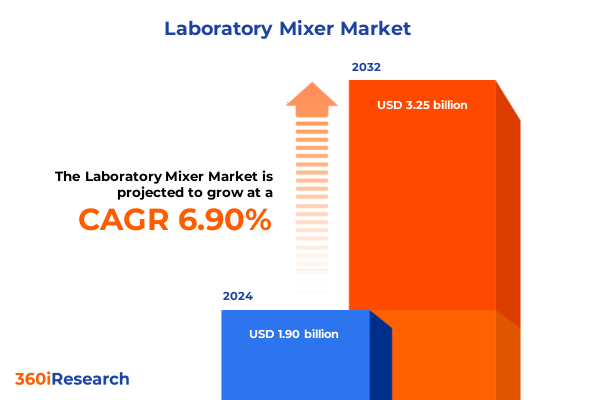

The Laboratory Mixer Market size was estimated at USD 2.02 billion in 2025 and expected to reach USD 2.14 billion in 2026, at a CAGR of 7.02% to reach USD 3.25 billion by 2032.

Navigating the Evolving Laboratory Mixer Market Landscape: Key Drivers, Innovations, and Strategic Imperatives for Stakeholders

Laboratory mixers serve as the backbone of processes spanning pharmaceutical development, chemical synthesis, cosmetics formulation, and food research. By facilitating precise blending, homogenization, and particle dispersion, these instruments play a pivotal role in driving innovation and ensuring reproducibility in experimental workflows. Recent advances in mixer technology have enhanced operational efficiency, minimized cross-contamination risks, and expanded application versatility across diverse scientific and industrial domains. As organizations prioritize accelerated time to insight and cost-effective scale-up, the strategic selection and deployment of mixer platforms have never been more critical to competitive performance.

This executive summary presents an integrated overview of the laboratory mixer market, highlighting fundamental drivers and emergent trends shaping industry dynamics. Readers will gain clarity on transformative shifts in equipment design and digital integration, the cumulative effects of new United States tariff measures in 2025 on sourcing and production, and nuanced segmentation insights across mixer typologies, performance metrics, and end-user profiles. Additionally, the summary offers regional perspectives, competitive company analyses, targeted recommendations for market leaders, methodological transparency, and concluding strategic imperatives essential for informed decision-making.

Identifying the Major Technological and Operational Transformations Redefining the Laboratory Mixer Industry Landscape in 2025

Over the past decade, the laboratory mixer sector has witnessed a profound convergence of technological and operational advancements. Automation has emerged as a cornerstone, driving repeatable workflows and integrating seamlessly with laboratory information management systems. Simultaneously, the adoption of digital monitoring-featuring real-time torque and temperature analytics-has empowered teams to optimize process parameters and ensure batch consistency. Meanwhile, the demand for modular, bench-scale systems with plug-and-play capabilities has spurred manufacturers to prioritize user-centric design, enabling rapid reconfiguration between research and pilot-scale applications.

Sustainability and miniaturization have also reshaped product roadmaps, with the introduction of energy-efficient motors, solvent-resistant materials, and disposable mixing components. As laboratories confront tighter environmental regulations and heightened safety mandates, equipment with reduced power consumption and minimal cleaning requirements has gained traction. Furthermore, the rise of intelligent mixing platforms-featuring closed-loop feedback, predictive maintenance alerts, and remote operation-underscores the industry’s commitment to Industry 4.0 integration, ultimately enhancing throughput and driving down total cost of ownership.

Assessing the Comprehensive Effects of United States 2025 Tariff Measures on Supply Chains, Manufacturing Costs, and Strategic Sourcing Decisions

Beginning in early 2025, new United States tariff measures imposed on imported components-particularly precision steel parts and electronic modules-have introduced pronounced cost pressures across the laboratory mixer supply chain. Manufacturers reliant on Asian-formatted drives and European-sourced sensors have faced incremental duty rates, prompting material cost uplifts of up to 15 percent in certain product lines. To mitigate these headwinds, several producers have expedited regionalization strategies, establishing assembly hubs closer to end-market geographies to redistribute inbound duties and shorten lead times.

These collective adjustments have rippled through procurement, product pricing, and partner negotiations. Organizations have renegotiated vendor contracts to include duty-pass-through clauses, while exploring alternative alloys and domestic component suppliers to preserve margin stability. In parallel, manufacturers are revising their product roadmaps to prioritize platforms with standardized, duty-exempt parts and enhanced modularity. Consequently, the tariff landscape in 2025 has not only elevated cost management imperatives but has also catalyzed more resilient and agile sourcing models.

Delving into Critical Segmentation Factors Shaping User Requirements Across Mixer Type, Speed, Capacity, Application, and End User Profiles

Segmentation analysis reveals how laboratory mixer demand and user preferences align with specific performance and application criteria. Across mixer types-such as high shear mixers, homogenizers, magnetic laboratory mixers, overhead mixers, ultrasonic units, and vortex mixers-overhead configurations have seen particular adoption, with air-driven models differentiated into diaphragm and piston designs, magnetic-coupled variants available as single or double couplings, and mechanical drives offered in belt-driven, direct-drive, and gear-driven formats. These distinctions influence shear profile, maintenance cycles, and capital outlay, guiding selection based on viscosity range and throughput requirements.

Performance speed further nuances market positioning, as high-speed mixers excel in fine emulsion formation, medium-speed platforms strike a balance between shear and gentle blending, and low-speed units support volume scaling and temperature-sensitive formulations. Capacity tiers-from sub-1-liter vessels and 1 to 5 liters to larger bench-scale carboys-cater to research, process development, and small-batch manufacturing stages. Application-based segmentation spans academic research, chemical synthesis, cosmetics formulation, food and beverage testing, and pharmaceutical development, with distinct regulatory and hygiene protocols for each domain. End users, including academia, biotechnology firms, chemical producers, cosmetic houses, food and beverage manufacturers, and pharmaceutical organizations, prioritize mixer configurations that align with laboratory layout constraints, solvent compatibility, validation requirements, and after-sales support structures.

This comprehensive research report categorizes the Laboratory Mixer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mixer Type

- Speed

- Capacity

- Application

- End User

Highlighting Regional Dynamics and Growth Trajectories in the Laboratory Mixer Market Across Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics in the laboratory mixer domain reflect both established markets and emerging growth corridors. In the Americas, sustained investment in pharmaceutical R&D, biotechnology innovation, and petrochemical processing has underpinned consistent demand for advanced mixing platforms. North American laboratories continue to prioritize high-throughput and automation-ready equipment to accelerate drug discovery pipelines, while Latin American academic and food testing institutions are gradually upgrading infrastructure, driven by government funding and evolving quality standards.

The Europe, Middle East & Africa region combines mature industrial hubs in Western Europe-characterized by stringent regulatory compliance and a focus on green chemistry-with rapid expansion in the Middle East’s petrochemical sector and Africa’s agricultural research initiatives. Laboratory mixers in these markets must balance energy efficiency, materials compatibility, and localized service networks. Meanwhile, Asia-Pacific leads as the fastest-growing region, propelled by China’s pharmaceutical manufacturing boom, India’s contract research organization sector, and Japan’s precision instrumentation legacy. Investment incentives, public–private partnerships, and domestic manufacturing incentives have attracted global mixer producers to establish R&D and assembly facilities across the region.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Mixer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Strategies and Innovation Pipelines of Leading Industry Players Driving the Laboratory Mixer Market Forward

Leading participants in the laboratory mixer space are advancing competitive differentiation through innovation, channel expansion, and strategic alliances. Firms such as IKA Works leverage modular architectures and digital integration to support multi-scale mixing, while Silverson emphasizes patented rotor-stator designs that deliver consistent shear profiles. Heidolph instruments focus on ergonomic, small-footprint overhead mixers, and Thermo Fisher Scientific integrates mixing systems with broader laboratory automation portfolios to address end-to-end workflows. Additionally, Mettler Toledo combines high-precision weighing with mixing control to optimize formulations and validate critical quality attributes.

Emerging players and niche providers are also shaping the competitive landscape. Yamato Scientific offers bespoke ultrasonic mixers tailored for nanoparticle dispersion, while Cole-Parmer’s comprehensive fluid handling suite strengthens its position in academic and research markets. Partnerships between instrumentation vendors and consumable manufacturers have further enriched aftermarket ecosystems, ensuring reagent and accessory compatibility. Across this competitive set, success hinges on rapid product iteration, robust service infrastructures, and digital enhancements that deliver actionable process insights.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Mixer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantor, Inc.

- Benchmark Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Eppendorf AG

- FrymaKoruma

- GEA Group AG

- Gebr. NETZSCH GmbH & Co. Holding KG

- Grandpackmachine

- Heidolph Instruments GmbH & Co. KG

- IKA-Werke GmbH & Co. KG

- Labstac Ltd

- LIENM

- Merck KGaA

- REMI GROUP

- Ross Engineering Co.

- SARSTEDT AG & Co. KG

- Sartorius AG

- Shuanglong Group Co. Ltd.

- Silverson

- SP Industries, Inc.

- SPX FLOW, Inc.

- Thermo Fisher Scientific Inc.

Strategic Imperatives and Operational Recommendations for Industry Leaders to Thrive Amid Evolving Market Conditions in Laboratory Mixing Segment

Industry leaders are advised to prioritize digital enhancement of mixing platforms by integrating advanced sensors and IoT connectivity, enabling closed-loop process control and remote monitoring capabilities. Establishing regional assembly and service centers can mitigate tariff impacts and reduce lead times, while strategic partnerships with local component suppliers will foster supply chain resilience. Manufacturers should also explore sustainable materials and energy-efficient drive options to meet evolving regulatory requirements and customer expectations around environmental stewardship.

Furthermore, investing in modular, upgradeable mixer architectures will allow end users to scale seamlessly from R&D to pilot-scale operations, driving customer loyalty and recurring revenue streams. Strengthening after-sales service-through predictive maintenance programs, virtual training, and rapid spare parts distribution-will differentiate offerings in a competitive market. Lastly, cultivating collaborations with academic institutions and industry consortia can accelerate next-generation mixing innovation, ensuring long-term relevance and market leadership.

Outlining Rigorous Research Protocols and Analytical Techniques Employed to Ensure Data Integrity and Insight Accuracy in This Study

This analysis is underpinned by a rigorous two-fold research methodology designed to ensure comprehensive coverage and data integrity. Secondary data collection involved an extensive review of scientific publications, patent filings, regulatory filings, corporate disclosures, and industry white papers to map technological trends, product launches, and tariff developments. These insights were triangulated against trade data and customs records to quantify the impact of tariff measures on component imports and equipment distribution.

Primary research comprised structured interviews with supply chain managers, R&D directors, and laboratory operations specialists across key geographic markets, supplemented by surveys that captured real-world equipment performance feedback and purchasing criteria. Qualitative findings were validated through peer review by subject-matter experts, and statistical techniques were applied to extrapolate broader market behaviors. All research inputs were subjected to consistency checks and cross-verified to mitigate biases, ensuring that the conclusions and recommendations presented herein are both reliable and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Mixer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Mixer Market, by Mixer Type

- Laboratory Mixer Market, by Speed

- Laboratory Mixer Market, by Capacity

- Laboratory Mixer Market, by Application

- Laboratory Mixer Market, by End User

- Laboratory Mixer Market, by Region

- Laboratory Mixer Market, by Group

- Laboratory Mixer Market, by Country

- United States Laboratory Mixer Market

- China Laboratory Mixer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Key Insights and Strategic Implications to Equip Decision Makers with a Clear Path Forward in the Laboratory Mixer Market Ecosystem

In closing, the laboratory mixer market in 2025 presents a dynamic convergence of technological sophistication, supply chain realignment, and diverse end-user demands. Organizations that embrace digital transformation, modularity, and sustainability will be best positioned to capitalize on efficiency gains and regulatory compliance mandates. Simultaneously, businesses must remain vigilant of geopolitical shifts-such as tariff regimes-and refine sourcing strategies to maintain cost competitiveness and minimize operational disruptions.

The intersection of advanced mixer architectures, real-time analytics, and regional market nuances underscores the importance of a nuanced, multi-dimensional approach to strategic planning. By leveraging the segmentation, regional, and competitive insights outlined in this executive summary, decision makers can chart a clear path forward-balancing innovation investments with pragmatic operational controls to secure long-term growth and leadership in an increasingly complex global marketplace.

Engage Ketan Rohom Associate Director Sales & Marketing at 360iResearch to Secure Your Comprehensive Laboratory Mixer Market Research Report Today

To access in-depth analysis and actionable insights tailored to your strategic objectives, engage Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your comprehensive laboratory mixer market research report. His expertise ensures you receive personalized guidance on leveraging transformative trends, understanding tariff impacts, and identifying growth opportunities. Reach out today to obtain detailed data, segmentation breakdowns, and forward-looking recommendations that empower your organization to stay ahead in a rapidly evolving market landscape.

- How big is the Laboratory Mixer Market?

- What is the Laboratory Mixer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?