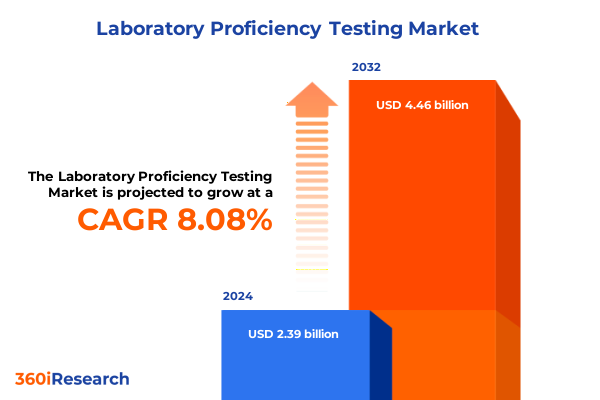

The Laboratory Proficiency Testing Market size was estimated at USD 2.59 billion in 2025 and expected to reach USD 2.80 billion in 2026, at a CAGR of 8.42% to reach USD 4.56 billion by 2032.

Setting the Stage for Laboratory Excellence with Insightful Context on the Evolution and Significance of Proficiency Testing in Modern Analytical Practices

Introduction

Laboratory proficiency testing has emerged as a foundational element in ensuring the credibility and reliability of analytical results across diverse sectors. As laboratories strive to meet stringent quality assurance benchmarks, proficiency testing programs provide an objective mechanism to assess technical competence, identify areas for methodological improvement, and benchmark performance against peer institutions. In today’s environment of heightened regulatory scrutiny and evolving scientific standards, proficiency testing extends beyond compliance-it serves as a catalyst for continuous enhancement of laboratory processes and fosters confidence among stakeholders ranging from regulatory bodies to end-user clients.

By participating in proficiency testing schemes, laboratories gain actionable insights into the robustness of their analytical workflows, from sample preparation nuances to data interpretation protocols. These structured comparative evaluations not only spotlight deviations in assay performance but also drive standardization and harmonization across multi-site networks and decentralized operations. Moreover, proficiency testing cultivates a culture of accountability and transparency, empowering laboratories to proactively address root causes of variability before they translate into non-conformities or process deviations. As the sophistication of analytical methodologies continues to ascend-spanning molecular diagnostics, elemental analysis, and advanced microbiological assays-the strategic relevance of proficiency testing becomes all the more pronounced.

Exploring Transformative Shifts Reshaping the Laboratory Proficiency Testing Landscape Amidst Technological Innovation Regulatory Evolution and Collaboration

Transformative Shifts in the Proficiency Testing Landscape

The laboratory proficiency testing landscape is being redefined by a suite of technological advancements that are accelerating data throughput, refining analytical precision, and enhancing inter-laboratory connectivity. Automation platforms equipped with robotics and high-throughput sample handling have streamlined routine assays, reducing manual intervention and the potential for human error. Concurrently, digital data management systems and cloud-based portals facilitate real-time result submission, trend monitoring, and interactive feedback loops between providers and participants. These digital transformations have catalyzed a shift from periodic static reporting toward dynamic continuous quality monitoring, enabling laboratories to identify performance drifts as they emerge rather than after the fact.

Regulatory frameworks have similarly evolved to accommodate emerging challenges, incorporating risk-based approaches and mandating more frequent proficiency assessments for high-impact analytical domains such as clinical diagnostics and environmental testing. In response, proficiency testing providers are expanding their offerings to include hybrid models that blend in-person sample distribution with virtual assessments and e-learning modules. Collaboration between organizations, industry consortia, and accreditation bodies has further accelerated the development of consensus standards and best practices. Through collaborative ring trials and inter-laboratory studies, participants can validate novel methods, benchmark emerging instrumentation, and align with international quality directives, ensuring greater harmonization of analytical outputs on a global scale.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Laboratory Proficiency Testing Stakeholders Supply Chains and Quality Assurance Dynamics

Assessing the Impact of 2025 United States Tariffs on Laboratory Quality Assurance

In 2025, a series of tariff measures imposed on imported analytical reagents, precision instruments, and calibration standards reshaped supply-chain economics for proficiency testing providers and laboratories alike. The additional levies on glassware, specialty chemicals, and mass spectrometers significantly increased procurement costs, prompting many organizations to reevaluate sourcing strategies and inventory management practices. For laboratories dependent on critical imported components-such as certified reference materials for trace elemental analysis or specialized immunoassay kits-these tariffs have translated into extended lead times and elevated operational budgets.

Quality assurance teams have responded by forging closer relationships with domestic manufacturers and local distributors to mitigate tariff-related disruptions. Some proficiency testing providers have diversified sample matrices to include more locally-procured standard materials, thereby insulating participants from geopolitical supply shocks. In parallel, laboratories have accelerated validation protocols for alternative reagent formulations and sought to harmonize equivalency data across multiple product lines. While these adaptations have bolstered resilience, they have also underscored the importance of strategic inventory forecasting and agile supplier networks. By leveraging data analytics to anticipate price fluctuations and implementing flexible procurement frameworks, laboratories can safeguard continuity of proficiency assessments and maintain the integrity of their quality assurance regimens.

Unlocking Deep Market Insights through Multifaceted Segmentation Covering Categories Applications End Users and Distribution Channels

Key Segmentation Insights That Drive Proficiency Testing Strategies

Segmenting the proficiency testing market by analytical category reveals distinct growth trajectories and evolving client needs. In biological analysis, the rapid expansion of molecular techniques such as PCR-based assays and next-generation sequencing has fueled heightened demand for specialized proficiency schemes focused on molecular analysis, immunoassays, and enzyme kinetics. Chemical analysis remains a cornerstone of quality assurance, with inorganic chemical testing continuing to support environmental compliance while organic chemical protocols advance to address emerging contaminants and pharmaceutical impurities. Microbiology analysis has witnessed renewed emphasis on virology panels and fungal identification, driven by public health priorities and food safety imperatives. By tailoring proficiency challenges to these subcategories, providers can align program complexity with the technical maturity of participating laboratories.

Application-based segmentation offers further clarity on sector-specific proficiency requirements. Environmental testing labs are increasingly prioritizing water and soil matrices to accommodate regulatory directives on water quality and soil remediation. Food and beverage entities are intensifying bakery, dairy, and meat assessments to uphold safety standards and brand integrity in a competitive marketplace. Healthcare and diagnostic laboratories are gravitating toward clinical chemistry and hematology schemes, reflecting both regulatory mandates and evolving patient care protocols. Pharmaceutical companies demand rigorous proficiency frameworks across drug development and GMP compliance, while tobacco testing remains focused on nicotine quantification and quality control. This multi-dimensional segmentation model enables providers to fine-tune sample design, performance criteria, and reporting formats for each application niche.

End-user segmentation underscores the diverse constituencies served by proficiency testing programs. Diagnostic laboratories-ranging from hospital-based to independent specialty facilities-seek rapid turnaround, robust data analytics, and peer benchmarking. Environmental testing entities in both public and private sectors require validated proficiency samples that mirror complex real-world matrices. Food and beverage manufacturers prioritize batch-to-batch consistency, and regulatory agencies demand transparent performance data to inform policy decisions. Pharmaceutical companies, from biotech startups to large-scale manufacturers, rely on proficiency outcomes to substantiate analytical method robustness and regulatory submissions. Distribution channel nuances further shape market dynamics: direct sales of high-value instrument-based challenges coexist with distributor networks supplying standard consumable kits, while online platforms accelerate access to digital proficiency modules and e-learning assets. Understanding these layered segmentation insights is crucial for designing proficiency offerings that resonate with each stakeholder group.

This comprehensive research report categorizes the Laboratory Proficiency Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Category

- Distribution Channel

- Application

- End User

Revealing Key Regional Trends and Dynamics Shaping Laboratory Proficiency Testing across the Americas Europe Middle East Africa and Asia Pacific Ecosystems

Key Regional Insights Spotlighting Global Proficiency Testing Dynamics

Regional dynamics exert a profound influence on the design, delivery, and uptake of proficiency testing services. In the Americas, the United States leads with well-established accreditation frameworks and a proactive regulatory environment, compelling laboratories to engage in frequent comparative assessments to maintain compliance and market access. Canadian laboratories benefit from harmonized North American standards, leveraging cross-border collaboration to optimize proficiency offerings and expand program participation. Latin American markets are emerging rapidly, with localized providers adapting proficiency protocols to reflect regional analyte profiles and logistical realities.

Europe, the Middle East, and Africa present a tapestry of regulatory landscapes and infrastructural maturity levels. Within the European Union, unified directives and the CE-marking system drive consistent proficiency testing requirements across member states, while the Middle East is witnessing accelerated investment in healthcare and environmental testing infrastructure. In Africa, nascent accreditation bodies are partnering with international organizations to establish baseline proficiency frameworks, fostering capacity building and enhancing analytical rigor across public health and agricultural sectors.

The Asia-Pacific region is characterized by dynamic growth and strategic diversification. China’s domestic proficiency providers have scaled capacity rapidly, integrating digital result platforms and remote assessment capabilities to serve a vast and dispersed laboratory network. India’s emphasis on quality enhancement in diagnostic and pharmaceutical testing has led to the roll-out of specialized proficiency modules and expanded outreach initiatives. Australia and neighboring economies leverage strong environmental testing mandates to pilot advanced proficiency schemes, often in collaboration with academic institutions. These regional distinctions underscore the importance of customizing proficiency testing strategies to align with local regulatory expectations, technical maturity, and market drivers.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Proficiency Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Driving Forces and Strategic Approaches of Leading Companies in Laboratory Proficiency Testing with Innovation Partnerships and Market

Key Company Strategies Fueling Innovation and Market Leadership

Leading proficiency testing providers are distinguished by their commitment to innovation, strategic partnerships, and customer-centric service models. Some organizations have pioneered digital platforms that integrate advanced analytics and visualization dashboards, enabling laboratories to track performance trends over time, benchmark against peer cohorts, and generate tailored corrective action plans. These end-to-end digital ecosystems not only streamline result submission but also incorporate knowledge repositories and e-learning modules, fostering continuous professional development among laboratory personnel.

Strategic alliances with instrument manufacturers and reagent suppliers have emerged as another differentiator. By co-developing proficiency materials calibrated to specific platforms, providers can ensure compatibility, enhance analytical precision, and minimize the validation burden for participating laboratories. Collaborative research agreements with academic institutions and regulatory agencies further enhance program credibility, enabling the co-creation of consensus standards and the rapid incorporation of new analyte challenges into proficiency schemes.

Supply chain resilience has become a focal point for market leaders, with investments in regional production facilities and diversified distributor networks mitigating the impact of geopolitical disruptions and tariff fluctuations. Additionally, a growing number of providers are establishing specialized business units dedicated to high-impact sectors such as clinical microbiology, environmental toxicology, and pharmaceutical manufacturing. These sector-focused teams bring domain expertise, regulatory acumen, and tailored sample matrices, ensuring that proficiency challenges remain both scientifically rigorous and operationally relevant for key industry stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Proficiency Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Absolute Standards, Inc.

- American Proficiency Institute

- AOAC INTERNATIONAL

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Fera Science Limited

- INSTAND e.V.

- LGC Limited

- Merck KGaA

- NSI Lab Solutions

- Proficiency Testing Australia

- QACS Labs

- Randox Laboratories Ltd.

- Thermo Fisher Scientific Inc.

- Trilogy Analytical Laboratory

- Waters Corporation

- Weqas

Strategic Actionable Recommendations to Empower Industry Leaders in Enhancing Proficiency Testing Outcomes Through Operational Excellence and Collaboration

Actionable Recommendations to Elevate Proficiency Testing Outcomes

Laboratory leaders can achieve significant gains in analytical performance and quality assurance by embracing a strategic roadmap centered on digital transformation and cross-sector collaboration. Investing in integrated data management platforms that support real-time result submission, automated trend analysis, and interactive feedback loops will enhance the visibility of performance drifts and expedite corrective actions. These platforms should be interoperable with existing laboratory information management systems to reduce manual data entry and minimize transcription errors.

Strengthening domestic supply chains is critical to buffering against international tariff volatility and geopolitical disruptions. Engaging local manufacturers and validated distributors for core reagents, certified reference materials, and consumables not only reduces lead times but also fosters transparency in quality control processes. Joint development agreements with equipment suppliers can further optimize method compatibility and simplify the validation of alternative reagent sources.

Fostering collaborative networks through ring trials, consortia, and public-private partnerships will expand the scope of proficiency challenges and accelerate the adoption of emerging analytical methodologies. Cross-disciplinary working groups encompassing regulatory representatives, academic researchers, and industry practitioners can co-design novel proficiency modules tailored to high-impact sectors. Finally, prioritizing workforce development through targeted training programs, e-learning resources, and on-site workshops will empower laboratory professionals to interpret proficiency results effectively and implement continuous improvement initiatives.

Employing Robust Research Methodologies and Data Collection Techniques to Ensure Comprehensive and Reliable Insights in Laboratory Proficiency Testing Analysis

Comprehensive Research Methodology Underpinning Market Intelligence

The findings presented in this report are grounded in a rigorous blend of secondary and primary research methodologies designed to ensure accuracy, relevance, and depth of insight. The secondary research phase involved extensive review of peer-reviewed publications, regulatory guidelines, and technical white papers, complemented by an analysis of scientific conference proceedings and industry presentations. This foundational research established the macro-context for proficiency testing landscapes, including regulatory frameworks, technological evolutions, and geopolitical influences.

Primary data collection was conducted through structured interviews with senior quality assurance managers, laboratory directors, and proficiency testing coordinators across diverse geographic regions and end-user segments. In addition, a series of web-based surveys supplemented qualitative insights with quantitative perspectives on program adoption rates, perceived challenges, and emerging requirements. Data triangulation ensured that insights were validated against multiple sources, enhancing the credibility of thematic conclusions.

Segmentation frameworks were developed by mapping category, application, end user, and distribution channel attributes to industry use cases and regulatory mandates. Regional classifications adhered to standard geographic groupings, with adjustments to reflect the nuances of market maturity and infrastructural capacity. All data points underwent a multi-tier validation process involving cross-verification by subject matter experts and iterative reviews to confirm consistency and factual integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Proficiency Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Proficiency Testing Market, by Category

- Laboratory Proficiency Testing Market, by Distribution Channel

- Laboratory Proficiency Testing Market, by Application

- Laboratory Proficiency Testing Market, by End User

- Laboratory Proficiency Testing Market, by Region

- Laboratory Proficiency Testing Market, by Group

- Laboratory Proficiency Testing Market, by Country

- United States Laboratory Proficiency Testing Market

- China Laboratory Proficiency Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Reflections on the Significance and Future Implications of Laboratory Proficiency Testing for Quality Assurance Regulatory Compliance and

Conclusion

Laboratory proficiency testing stands at the nexus of quality assurance, regulatory compliance, and operational excellence. As analytical technologies evolve and regulatory landscapes shift, proficiency testing has transcended its historical role as a compliance checkpoint to become a strategic enabler of continuous performance improvement. The transformative impact of digital platforms, the challenges posed by tariff-induced supply-chain disruptions, and the nuanced demands of segmented markets underscore the complexity of contemporary proficiency testing ecosystems.

Segmentation insights reveal that one-size-fits-all approaches no longer suffice. Providers and laboratories must tailor proficiency schemes to distinct analytical categories, sector-specific applications, and end-user requirements, while adopting flexible distribution channels that cater to diverse operational models. Regional variations in regulatory rigor and infrastructural development further emphasize the need for localized proficiency strategies that resonate with market realities.

Leading organizations are responding with innovative digital solutions, strategic partnerships, and resilient supply-chain frameworks. By embracing these best practices and pursuing collaborative initiatives-such as ring trials, consortium-driven standardization, and targeted training programs-laboratories can optimize analytical accuracy, drive methodological harmonization, and safeguard stakeholder confidence. The future of proficiency testing lies in its capacity to integrate technological innovation with strategic foresight, ensuring that laboratories remain at the forefront of scientific reliability and quality assurance.

Empowering Decision Makers with Strategic Guidance to Secure the Laboratory Proficiency Testing Market Research Report from the Associate Director of Sales

Organizations seeking in-depth insights and practical strategic guidance are encouraged to secure the Laboratory Proficiency Testing market research report through direct engagement with Ketan Rohom, Associate Director of Sales. With a deep understanding of industry dynamics and a commitment to client success, Ketan Rohom can tailor a consultation to address specific organizational objectives, highlight critical findings, and guide the seamless acquisition process. By partnering with this expert, decision-makers will gain privileged access to granular analyses, comprehensive segmentation intelligence, and actionable recommendations designed to optimize proficiency testing frameworks and elevate quality assurance standards within their operations. Don’t miss this opportunity to leverage authoritative research and empower your laboratory processes with robust, evidence-backed strategies by reaching out today to the Associate Director of Sales for immediate support and purchase facilitation

- How big is the Laboratory Proficiency Testing Market?

- What is the Laboratory Proficiency Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?