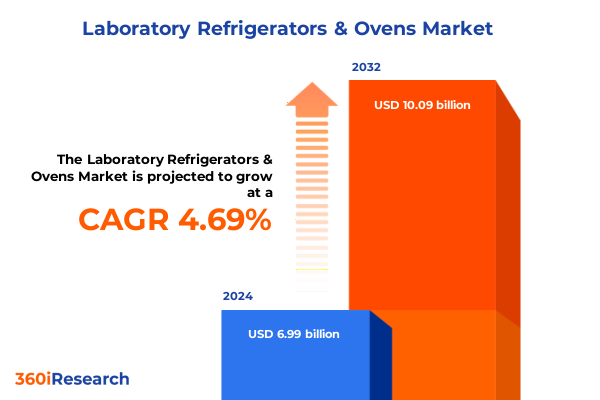

The Laboratory Refrigerators & Ovens Market size was estimated at USD 7.30 billion in 2025 and expected to reach USD 7.64 billion in 2026, at a CAGR of 4.71% to reach USD 10.09 billion by 2032.

Shaping the Future of Laboratory Refrigeration and Oven Technology to Support Cutting-Edge Research, Enhance Performance, and Accelerate Scientific Discoveries Worldwide

Laboratory refrigerators and ovens form the essential backbone of scientific investigation, clinical diagnostics, pharmaceutical development, and quality assurance across a wide array of industries. As research programs grow in complexity and scale, the requirements for reliable, precise, and versatile thermal management equipment have never been greater. Recent advances in materials science and engineering, coupled with emergent demands for digital monitoring and remote management, have propelled laboratory refrigeration and oven solutions into a new era of performance and connectivity.

Against this backdrop, this executive summary explores the critical dynamics shaping the laboratory refrigerator and oven ecosystem. It begins by articulating the pivotal role these instruments play in preserving sensitive biological samples, facilitating sterilization processes, and maintaining controlled environments for experimental protocols. From academic laboratories driving groundbreaking discoveries to high-stakes production processes in biotechnology and pharmaceutical settings, the evolution of equipment capabilities underpins broader scientific and commercial objectives.

Furthermore, this report emphasizes the confluence of factors-ranging from regulatory standards to sustainability imperatives-that are reshaping procurement priorities and operational practices. By examining the interplay among technological innovation, end-user requirements, and emerging market dynamics, readers will gain a foundational understanding of the pressures and opportunities compelling stakeholders to reimagine laboratory refrigeration and oven strategies for the next decade.

Unveiling the Transformative Shifts Redefining Laboratory Refrigerators and Ovens through Digitalization, Efficiency Imperatives, and Sustainability Drivers

Laboratory refrigeration and oven technologies are experiencing a metamorphosis driven by digital transformation, sustainability mandates, and heightened performance expectations. The advent of smart instrumentation, integrating sensors and IoT connectivity, empowers scientists and facility managers to monitor temperature fluctuations, energy consumption, and maintenance cycles in real time. Consequently, downtime is minimized and sample integrity is preserved through automated alerts and predictive diagnostics.

Simultaneously, energy efficiency has emerged as a top priority for institutions grappling with both budget constraints and environmental responsibilities. Manufacturers are responding with advanced compressor designs, improved insulation materials, and optimized airflow systems that reduce power consumption without compromising temperature uniformity. These enhancements not only address escalating energy costs but also align with corporate sustainability goals and regulatory programs targeting greenhouse gas emissions.

In parallel, the growing emphasis on traceability and compliance has prompted integration of secure data logging and audit trail features. Laboratories operating under stringent quality standards-such as those in pharmaceutical production or clinical research-now demand instruments capable of generating immutable records for regulatory authorities. This fusion of technology and compliance has reshaped procurement criteria, as buyers prioritize equipment that harmonizes operational excellence with governance requirements.

Looking ahead, sustainability-driven innovation and digitalization will continue to redefine performance benchmarks, driving a new generation of laboratory refrigerators and ovens that are both intelligent and environmentally responsible.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Laboratory Refrigerators and Ovens Supply Chains, Costs, and Strategic Sourcing Patterns

The unilateral imposition of additional duties in 2025 has significantly impacted the landscape for laboratory refrigerators and ovens sourced from key trading partners. Heightened tariffs have translated into escalated landed costs for equipment imported into the United States, placing pressure on procurement budgets and compelling institutions to reconsider sourcing strategies. Consequently, supply chain resilience has become paramount as organizations seek to mitigate exposure to cross-border cost volatility.

In response, original equipment manufacturers have diversified their manufacturing footprints by expanding assembly and production facilities within tariff-free regions. This nearshoring trend facilitates faster lead times and shields buyers from abrupt cost increases, while presenting opportunities for domestic suppliers to capture market share. Moreover, strategic partnerships with regional distributors and contract manufacturers have emerged as vital mechanisms to preserve supply continuity and ensure compliance with local content requirements.

Amid these shifts, careful inventory planning has gained priority in order to balance stockholding costs against the risk of tariff-induced delays. Institutions with critical storage requirements-such as those maintaining temperature-sensitive vaccines or reagents-have adopted hybrid purchasing models that combine standard lead-time orders with expedited domestic sourcing solutions. Ultimately, the cumulative impact of the 2025 tariff measures has underscored the necessity of flexible procurement frameworks to safeguard research and production workflows.

Key Insights into Product, End-User, Temperature, Distribution, and Technology Segments Shaping the Laboratory Refrigerator and Oven Ecosystem

A nuanced understanding of how product, end-user, temperature, distribution, and technology dimensions intersect is crucial for stakeholders seeking tailored solutions. Within the product type spectrum, ovens range from drying ovens engineered to remove moisture to sterilization units subdivided into gravity displacement and pre-vacuum models, and specialized vacuum ovens designed for delicate processes. Equally, laboratory refrigerators span compact units under 100 liters to mid-range capacities of 100 to 300 liters and larger systems exceeding 300 liters, each variant calibrated to specific storage requirements.

End-user segmentation reveals distinct procurement triggers across academic and research institutes, biotechnology companies, the food and beverage industry, hospitals, and the pharmaceutical sector. Academic settings prioritize flexibility and cost-effectiveness for diverse experimental needs, while biotech firms and pharmaceutical manufacturers demand robust compliance features and high-throughput capabilities. Meanwhile, quality assurance operations in food and beverage production focus on temperature uniformity for product safety, and clinical environments in hospitals emphasize rapid access and seamless integration with laboratory information systems.

Temperature range requirements further differentiate market expectations. Equipment designed for 0 to 10°C is ideal for reagent and sample storage, whereas units operating between 10 to 50°C suit routine processing tasks. High-temperature ovens up to 100°C enable drying and curing applications, while systems exceeding 100°C facilitate advanced sterilization. Specialized units catering to sub-zero environments maintain cryogenic-grade storage conditions for sensitive biomaterials.

In distribution channels, direct sales relationships foster collaborative product development and responsive service, whereas distributors and OEM partnerships extend geographic reach and customization options. Online retailing, though nascent in this segment, is gaining traction for standardized, low-volume orders. Finally, technological orientation spans conventional systems, energy-efficient configurations, and smart-enabled instruments that leverage connectivity to deliver real-time analytics and predictive maintenance.

This comprehensive research report categorizes the Laboratory Refrigerators & Ovens market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Temperature Range

- End User

- Distribution Channel

Examining Regional Dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific That Influence Demand for Laboratory Refrigerators and Ovens

Regional landscapes exert a profound influence on demand patterns and competitive dynamics. In the Americas, expanding research funding and strong biotech hubs in North America drive continued investment in laboratory refrigeration and oven infrastructure. Conversely, supply chain adjustments in response to tariffs have spurred growth of domestic manufacturing capabilities and strategic distributor networks across the region.

The Europe, Middle East & Africa corridor is characterized by diverse regulatory frameworks and sustainability mandates that elevate interest in energy-efficient and digitally connected solutions. European laboratories are early adopters of carbon-neutral laboratory initiatives, while Middle Eastern healthcare projects emphasize large-scale deployments. In Africa, improving research capacity at academic and governmental institutes underscores the need for reliable, low-maintenance equipment.

Asia-Pacific remains a powerhouse of production and innovation, with manufacturing centers in East Asia supplying a significant share of global exports. Regional demand is propelled by rapid expansion of pharmaceutical and food processing operations in emerging economies, complemented by government-led R&D programs. Manufacturers within the Asia-Pacific region are also investing in upgraded facilities to meet international compliance standards, thereby expanding their footprint in export markets.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Refrigerators & Ovens market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers Driving Innovation, Sustainability, and Strategic Partnerships in the Laboratory Refrigerator and Oven Market

A cadre of leading manufacturers is shaping the evolution of laboratory refrigerators and ovens through targeted investments in R&D, sustainability initiatives, and strategic partnerships. These organizations leverage extensive product portfolios that span conventional and advanced systems, enabling customers to align equipment capabilities with stringent operational requirements. Collaborative alliances with academic institutions and contract research organizations facilitate application-driven design enhancements, ensuring instruments address emerging scientific challenges.

Technology providers are also integrating proprietary software platforms to deliver unified dashboards that aggregate performance metrics, maintenance schedules, and compliance logs. This integrated approach streamlines facility management and provides end-users with actionable data insights that optimize uptime and sample integrity. Moreover, key players are prioritizing modular architectures that support upgrades and component-level servicing, extending instrument lifecycles and reducing total ownership costs.

Sustainability commitments have prompted manufacturers to pursue eco-label certifications and leverage renewable materials in product construction. By showcasing lower carbon footprints and offering energy management services, these companies differentiate themselves in markets where environmental stewardship is a critical procurement criterion. Amid rising competition, strategic acquisitions and joint ventures are expanding geographic reach and enabling tailored solutions for niche segments, reinforcing the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Refrigerators & Ovens market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B Medical Systems S.à r.l. by Azenta Life Sciences

- Binder GmbH

- Biorbyt Ltd.

- Carbolite Gero GmbH & Co. KG by Verder International B.V.

- Caron Products & Services, Inc.

- Chart Industries, Inc.

- Cole-Parmer Instrument Company, LLC

- Eppendorf AG

- Labconco Corporation

- Memmert GmbH + Co. KG

- NuAire, Inc.

- Panasonic Healthcare Co., Ltd.

- Qingdao Haier Biomedical Co., Ltd.

- Thermo Fisher Scientific Inc.

Actionable Recommendations for Industry Leaders to Optimize Supply Chains, Embrace Smart Technologies, and Navigate Regulatory and Tariff Challenges

Industry leaders can fortify their market positions by adopting a multi-pronged strategic approach that emphasizes supply chain diversification, technology integration, and sustainability alignment. First, cultivating partnerships with regional manufacturing and distribution entities mitigates exposure to tariff fluctuations and logistical disruptions. By establishing local assembly capabilities, organizations can reduce lead times while adhering to evolving trade policies.

Concurrently, investing in smart instrument platforms that offer predictive maintenance and remote diagnostics will distinguish value propositions. These digital enhancements not only elevate operational efficiency but also strengthen customer loyalty by minimizing downtime and delivering insights into long-term performance trends. Moreover, aligning product development roadmaps with emerging sustainability standards-such as energy consumption thresholds and carbon reporting frameworks-will resonate with customers prioritizing environmental accountability.

In addition, forging collaborative relationships with academic and research institutes can accelerate application-specific innovation. Co-development initiatives enable the rapid validation of novel design concepts and foster deep understanding of end-user challenges. Finally, a proactive approach to regulatory engagement-by tracking compliance updates and participating in standards committees-will ensure that product offerings remain ahead of certification requirements, safeguarding market access and reinforcing competitive advantage.

Outlining a Rigorous Research Methodology Combining Secondary and Primary Data to Validate Insights on Laboratory Refrigerators and Ovens

This report synthesizes insights derived from a rigorous, multi-stage methodology integrating both secondary and primary research. Initially, a comprehensive review of industry literature, technical journals, and regulatory publications established a contextual framework for understanding historical trends and technological milestones in laboratory refrigeration and oven design.

Subsequently, structured interviews and surveys were conducted with a cross-section of stakeholders, including laboratory managers, procurement officers, equipment engineers, and compliance specialists. These interactions provided granular perspectives on operational pain points, adoption drivers, and future requirements. Quantitative data from trade associations, customs databases, and industry consortiums were triangulated with interview findings to ensure the accuracy and reliability of conclusions.

Finally, the analysis was validated through consultations with subject-matter experts in thermal management, sustainability, and supply chain optimization. This iterative process of feedback and refinement underpins the credibility of the insights presented, furnishing decision-makers with a robust foundation for strategy formulation and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Refrigerators & Ovens market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Refrigerators & Ovens Market, by Product Type

- Laboratory Refrigerators & Ovens Market, by Temperature Range

- Laboratory Refrigerators & Ovens Market, by End User

- Laboratory Refrigerators & Ovens Market, by Distribution Channel

- Laboratory Refrigerators & Ovens Market, by Region

- Laboratory Refrigerators & Ovens Market, by Group

- Laboratory Refrigerators & Ovens Market, by Country

- United States Laboratory Refrigerators & Ovens Market

- China Laboratory Refrigerators & Ovens Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Evolving Laboratory Refrigerator and Oven Landscape and Implications for Future Research and Investment

As the scientific community’s demands continue to evolve, laboratory refrigerators and ovens will remain central to enabling advancements in life sciences, healthcare, and quality assurance. The confluence of digitalization, sustainability imperatives, and regulatory complexity presents both challenges and opportunities for equipment manufacturers and end users alike.

Navigating the implications of 2025 tariff measures, diversifying sourcing models, and embracing smart technologies will determine competitive differentiation. Meanwhile, segmentation across product types, end-user applications, and temperature specifications allows for tailored solutions that meet precise operational needs. Regional dynamics further shape strategic priorities, with each geography presenting unique regulatory landscapes and adoption drivers.

By leveraging the insights contained within this executive summary-underpinned by a stringent research methodology-industry stakeholders can anticipate shifts in demand, align product innovation with customer expectations, and make informed decisions that secure long-term success. This concluding perspective sets the stage for deeper exploration within the full report, where detailed analyses and case studies expand upon the themes outlined herein.

Take the Next Step with Ketan Rohom to Secure the Comprehensive Laboratory Refrigerator and Oven Market Research Report Tailored to Your Strategic Goals

Seize the opportunity to deepen your understanding of laboratory refrigeration and oven trends by reaching out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating complex market dynamics into strategic advantage will ensure you secure the comprehensive report that aligns with your organizational objectives. Take action today to equip your team with actionable insights that drive informed decisions and position your operations at the forefront of innovation.

- How big is the Laboratory Refrigerators & Ovens Market?

- What is the Laboratory Refrigerators & Ovens Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?