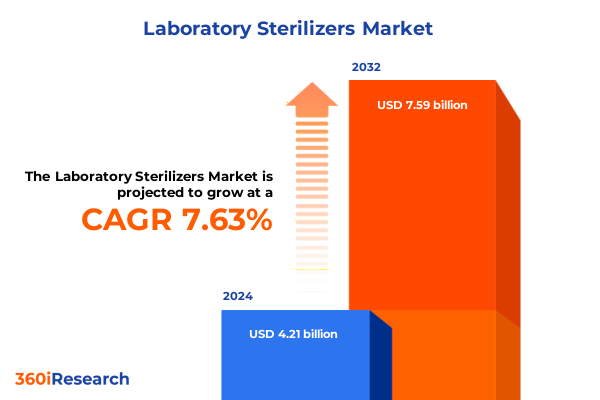

The Laboratory Sterilizers Market size was estimated at USD 4.52 billion in 2025 and expected to reach USD 4.86 billion in 2026, at a CAGR of 7.66% to reach USD 7.59 billion by 2032.

Pioneering the Next Wave of Sterilization Innovation Driven by Precision, Safety, and Regulatory Compliance in Modern Laboratory Environments

Laboratory sterilization stands at the forefront of ensuring procedural integrity, operational excellence, and compliance in critical scientific environments. From academic research facilities to high-throughput clinical diagnostics laboratories, the demand for sterilizers that deliver both uncompromised efficacy and seamless workflow integration has never been more intense. As emerging biological threats, stringent regulatory frameworks, and growing sustainability mandates converge, modern laboratory operations require sterilization solutions that not only eradicate microbial contaminants but also adapt to rapidly evolving protocols and data management requirements.

The evolution of sterilization technologies has spanned steam, dry heat, ethylene oxide, hydrogen peroxide gas plasma, gamma irradiation, and increasingly sophisticated hybrid modalities. Steam autoclaves remain the gold standard for heat-tolerant instruments due to their proven efficacy and alignment with CDC recommendations for sterilizing critical medical devices. At the same time, low-temperature sterilization methods have gained traction in reprocessing heat-sensitive labware, supporting stringent material compatibility and accelerated throughput demands.

Against this backdrop, regulatory bodies such as the U.S. Food and Drug Administration, the Centers for Disease Control and Prevention, ISO, and the World Health Organization continually refine best practices to mitigate healthcare-associated infections and safeguard laboratory personnel. This executive summary synthesizes the transformative shifts reshaping the laboratory sterilizers market, examines the cumulative effects of U.S. tariffs introduced in 2025, and delivers strategic segmentation, regional, and competitive insights designed to empower decision-makers as they navigate the complex landscape of sterilization solutions.

Examining the Critical Technological and Operational Paradigm Shifts Reshaping Laboratory Sterilization and Ensuring Future-Proofed Processes

The laboratory sterilization landscape is undergoing a profound transformation driven by digitalization, automation, and intelligent systems that converge to elevate process reliability and data integrity. Leading laboratories now embed Internet of Things sensors within sterilizers, enabling real-time performance monitoring, predictive maintenance alerts, and seamless integration with Laboratory Information Management Systems. These advancements are underpinned by artificial intelligence and machine learning algorithms that analyze cycle data to optimize operating parameters, reduce downtime, and ensure consistent sterilization efficacy across variable load configurations.

Simultaneously, intelligent lab automation is reshaping pre- and post-sterilization workflows. High-precision robotics augment manual tasks such as instrument loading, unloading, and cycle verification, mitigating human error and increasing throughput capacity. Miniaturized sterilization modules and compact benchtop units now offer high-throughput capabilities previously reserved for floor-standing systems, supporting point-of-care diagnostics and decentralized research environments. This shift toward scale-agile platforms has accelerated adoption in clinical labs and small-scale research facilities, where footprint and flexibility are essential.

Environmental sustainability has emerged as a pivotal criterion in sterilizer procurement and design. The incorporation of energy-efficient vacuum pumps, water recirculation systems, and advanced insulation materials has reduced water consumption by up to 75% and lowered energy usage per cycle, reflecting a broader industry commitment to green laboratory operations. Moreover, emerging sterilization modalities such as electron beam and supercritical carbon dioxide offer reduced chemical residues and waste, aligning both operational and environmental objectives. These technological and operational paradigm shifts are setting a new standard for reliability, efficiency, and sustainability in laboratory sterilization.

Assessing the Cumulative Impact of 2025 United States Tariffs on Laboratory Sterilizers Supply Chains, Cost Structures, and Strategic Sourcing Decisions

In 2025, U.S. import tariff policies introduced significant cost pressures on laboratory sterilization equipment, reshaping procurement strategies and supply chain configurations. At the base level, the Most-Favored-Nation tariff rate applies a de minimis duty range of 0–7% on WTO members, while a 10% reciprocal tariff layer covers all imports under a temporary pause that extends through July 9, 2025. For machinery whose essential character derives from steel or aluminum, Section 232 duties impose an additional 50% duty (25% for UK origin), potentially elevating landed costs on sterilizer components such as pressure vessels and vacuum systems.

The cumulative China-only stack amplifies the impact for sterilizers and spare parts manufactured in the People’s Republic of China. A 20% fentanyl-related penalty tariff, alongside the 25% Section 301 duties on covered goods, pushes effective Chinese import duties to 55% (or 70% where Section 232 applies to steel-dominant products), fundamentally altering cost structures for labs reliant on China-sourced equipment. Although 178 HTS subheadings benefit from Section 301 exclusions until August 31, 2025, sterilization machinery under Chapters 84 and 85 remains largely exposed unless specific exclusion requests are granted.

To mitigate these tariff burdens, laboratories and OEMs are pursuing strategic sourcing initiatives, including diversification to non-China suppliers, increased domestic manufacturing capacity, and utilization of the new USTR machinery exclusion process. This realignment of supply chains not only addresses immediate cost headwinds but also enhances long-term resilience against future trade policy shifts. Going forward, procurement teams must closely monitor tariff exclusion expiration dates and proactively engage in exclusion petitions to preserve cost competitiveness and ensure continuity of equipment deployment.

Unraveling Market Segmentation Insights Across Product Type, Sterilization Method, Capacity, End Users, and Distribution Channels to Reveal Growth Drivers

A granular understanding of market segmentation reveals the nuanced drivers that underpin sterilizer selection and deployment across diverse laboratory environments. In terms of product type, benchtop sterilizers cater to laboratories requiring compact footprints, rapid cycle times, and minimal installation complexity, making them ideal for outpatient clinics and specialized research settings. Conversely, floor-standing sterilizers deliver large chamber volumes, higher throughput capacity, and robust cycle versatility, aligning with the demands of central sterile processing departments in general hospitals and large biotechnology production facilities.

Segmentation by sterilization method underscores distinct value propositions. Steam remains the predominant choice for critical instrument sterilization, prized for its rapid cycle and validated microbial lethality. Dry heat sterilization addresses materials intolerant to moisture, such as glassware and powders, while chemical liquid methods using agents like ethylene oxide and peracetic acid ensure low-temperature sterilization of heat- and moisture-sensitive equipment. Radiation modalities, including gamma and electron beam, are gaining traction in contract sterilization services, offering high throughput and penetration depth for sealed medical supplies and disposable labware.

Capacity segmentation further differentiates user needs. Large-capacity units support pharmaceutical manufacturing and biopharmaceutical development workflows, where batch consistency and regulatory traceability are paramount. Medium-capacity sterilizers strike a balance between flexibility and volume, often deployed in specialty hospital departments and multi-disciplinary research institutes. Small-capacity models suit low-volume applications in clinics and small labs, where speed and footprint optimization take precedence. End-user segmentation delineates clinics, hospitals, pharmaceutical and biotechnology (with subsectors spanning biopharmaceutical development, biotechnology research, and pharmaceutical manufacturing), and research laboratories, each exhibiting unique sterilization protocols, validation requirements, and distribution channel preferences between direct OEM sales and distributor networks.

This comprehensive research report categorizes the Laboratory Sterilizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sterilization Method

- Capacity

- End User

- Distribution Channel

Mapping Regional Dynamics Across the Americas, EMEA, and Asia-Pacific to Highlight Distinct Drivers and Barriers in Laboratory Sterilization Adoption

In the Americas, the United States sets a high bar for sterilization process validation and record-keeping, with the CDC’s Guidelines for Disinfection and Sterilization mandating steam as the preferred sterilant for critical items and specifying low-temperature methods for heat-sensitive devices. The combination of Section 301 tariff exposures and robust domestic manufacturing capabilities has spurred a resurgence in U.S.-based production, while service contractors and OEMs expand preventative maintenance offerings to counteract higher replacement costs and boost equipment uptime. Canada parallels these trends, leveraging cooperative purchasing in public health networks to procure sterilizers at scale.

Europe, the Middle East, and Africa navigate a multifaceted regulatory ecosystem shaped by the EU Medical Device Regulation (MDR) 2017/745, which enforces Unique Device Identification requirements for reusable devices by May 26, 2025, and delineates strict reprocessing responsibilities across member states. National health authorities in Germany, the U.K., and the Gulf Cooperation Council further layer local reprocessing rules, driving demand for validated sterilization services and certification scopes, as evidenced by recent ISO and EN standard extensions in Belgium, Hungary, and Azerbaijan.

Asia-Pacific leads in growth momentum, underpinned by government-led biomanufacturing investments and infrastructure expansions. China’s Ministry of Industry and Information Technology announced aggressive support for biomanufacturing through the establishment of pilot-scale facilities and financial incentives in 2025, reinforcing the demand for compliant sterilization systems in domestic and export markets. Simultaneously, India’s BioE3 policy and significant investments from global pharmaceutical players strengthen the region’s capacity for instrument sterilization, accelerating adoption across emerging healthcare and research ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Sterilizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Innovations That Are Shaping the Competitive Landscape of Laboratory Sterilization Solutions

Leading industry players are deploying strategic innovations to capture market share and enhance value propositions in the laboratory sterilizers segment. STERIS plc, a pioneer in infection prevention, has advanced its digital service ecosystem with the ConnectCare℠ platform, offering cloud-based equipment monitoring, remote diagnostics, and predictive maintenance capabilities that reduce downtime and optimize field service resources. By integrating real-time cycle data and automated alerts, STERIS enables laboratories to maintain continuous compliance with sterilization cycles and calibration standards.

Getinge AB and Belimed AG emphasize sustainable sterilization technologies, incorporating electric vacuum pumps, water recirculation, and low-temperature sterilant options in their latest steam autoclave models. These enhancements not only reduce water usage by up to 75% but also lower energy consumption per cycle, aligning with global green lab initiatives. Both companies have forged partnerships with leading research institutions to validate novel sterilization protocols for sensitive instruments, expanding their installed base in academic and pharmaceutical sectors.

Regional and niche specialists such as Tuttnauer, Astell Scientific, and Matachana Group differentiate through modular design, customization services, and comprehensive training programs. These firms leverage extensive distributor networks and flexible financing schemes to penetrate underserved markets, from outpatient clinics to contract sterilization service providers. Their focus on rapid implementation, localized technical support, and compliance training strengthens customer loyalty and positions them as agile alternatives to the global OEMs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Sterilizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Sterilization Products, Inc.

- Andersen Products, Inc.

- Astell Scientific Ltd.

- Belimed AG

- Cisa Production S.r.l.

- Consolidated Sterilizer Systems, Inc.

- Fedegari Autoclavi S.p.A.

- Getinge AB

- Laoken Medical Technology Co., Ltd.

- LTE Scientific Ltd.

- Matachana Group S.L.

- MELAG Medizintechnik GmbH & Co. KG

- MMM Group GmbH

- Noxilizer, Inc.

- Priorclave Ltd.

- Sakura Seiki Co., Ltd.

- Shinva Medical Instrument Co., Ltd.

- Steelco S.p.A.

- STERIS plc

- Systec GmbH

- TSO3, Inc.

- Tuttnauer Europe B.V.

- Yamato Scientific Co., Ltd.

- Zirbus Technology GmbH

Actionable Strategic Imperatives for Industry Leaders to Capitalize on Emerging Sterilization Technologies, Supply Chain Resilience, and Regulatory Compliance

Industry leaders should prioritize investment in digital integration by embedding IoT sensors and analytics engines within sterilization equipment to enable predictive maintenance, remote troubleshooting, and closed-loop quality control. By adopting AI-driven cycle optimization, laboratories can reduce cycle durations without compromising efficacy, freeing up capacity for mission-critical workflows while maintaining compliance with regulatory standards. Strategic partnerships with LIMS and MES providers will ensure seamless data exchange and centralized oversight of sterilization records.

To navigate the continuing tariff environment, procurement teams must diversify supplier portfolios by qualifying alternative non-China sources, leveraging USTR machinery exclusion processes, and exploring opportunities for localized manufacturing or assembly. Securing long-term agreements with clustered contract sterilization providers and exploring reshoring incentives can mitigate exposure to further duty increases and safeguard supply continuity. Additionally, labs should collaborate with trade advisors to file and track exclusion requests before expiration deadlines, preserving cost advantages where possible.

Sustainability and regulatory compliance are inextricably linked; upgrading to energy-efficient vacuum systems, water recovery modules, and validated low-temperature sterilization options can lower operational costs and reduce environmental impact. Leadership teams must also invest in comprehensive training programs and change management initiatives, ensuring end-users are proficient in new workflows and that sterilization personnel remain current with evolving standards. By aligning technology roadmaps with sustainability goals and compliance requirements, industry leaders will secure a competitive edge and foster long-term resilience.

Illuminating the Rigorous Primary and Secondary Research Methodology Underpinning Credible Insights into the Laboratory Sterilizers Market

The research methodology underpinning these insights blends rigorous primary and secondary approaches to ensure robust, actionable findings. Secondary research encompassed exhaustive reviews of regulatory frameworks, including FDA and CDC guidelines, EU MDR texts, USTR tariff notices, and ISO standards documentation. Publicly accessible company disclosures, industry white papers, and technology platform releases were systematically analyzed to map competitive landscapes and innovation trajectories.

Primary research involved structured interviews and surveys with key stakeholders, including laboratory directors, sterilization service managers, OEM technical leads, and procurement specialists. These engagements provided qualitative validation of emerging trends, pain points, and adoption barriers. Expert panels comprised of microbiologists, biomedical engineers, and regulatory affairs professionals further refined the interpretation of data, ensuring insights resonate with frontline operational realities.

Data triangulation was achieved by cross-referencing quantitative inputs-such as import duty schedules, equipment performance benchmarks, and sustainability metrics-with qualitative feedback from industry practitioners. A multi-stage validation process, incorporating iterative feedback from advisory board members, guaranteed the credibility and relevance of conclusions. Limitations, such as potential changes in trade policy timelines or emerging regulatory updates, have been explicitly noted to guide readers in contextualizing the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Sterilizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Sterilizers Market, by Product Type

- Laboratory Sterilizers Market, by Sterilization Method

- Laboratory Sterilizers Market, by Capacity

- Laboratory Sterilizers Market, by End User

- Laboratory Sterilizers Market, by Distribution Channel

- Laboratory Sterilizers Market, by Region

- Laboratory Sterilizers Market, by Group

- Laboratory Sterilizers Market, by Country

- United States Laboratory Sterilizers Market

- China Laboratory Sterilizers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights and Forward-Looking Perspectives to Inform Strategic Decision-Making in the Laboratory Sterilizers Landscape

This executive summary has detailed the convergence of digital innovation, regulatory mandates, tariff dynamics, and sustainability imperatives that are redefining the laboratory sterilizers market. The integration of IoT, AI-driven analytics, and advanced robotics is elevating sterilization reliability while streamlining operational workflows. Concurrently, the layered U.S. tariff landscape and evolving global trade policies necessitate proactive supply chain strategies to control costs and secure equipment availability.

Segment-specific analysis reveals that product type, sterilization method, capacity, and end-user nuances critically inform procurement decisions, underscoring the need for tailored solutions across disparate laboratory environments. Regional assessments highlight divergent regulatory drivers-from CDC guidelines in the Americas to EU MDR compliance in EMEA and biomanufacturing investments in Asia-Pacific-each presenting distinct opportunities and challenges. Leading OEMs and specialized providers are navigating these complexities through digital service platforms, sustainable design enhancements, and modular architectures.

Looking ahead, laboratories that embrace agile technology adoption, leverage tariff exclusion mechanisms, and align procurement with environmental stewardship will outperform peers. The strategic recommendations offered herein serve as a roadmap for decision-makers to harness market dynamics, optimize capital deployment, and fortify operational resilience. Armed with these insights, stakeholders can confidently chart a path toward sustainable growth and competitive differentiation in the evolving laboratory sterilizers landscape.

Connect with Ketan Rohom to Secure Comprehensive Laboratory Sterilizers Market Insights and Drive Informed Strategic Investments in Your Organization

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to unlock unparalleled access to the full laboratory sterilizers market research report and accelerate your strategic initiatives. By partnering with Ketan, you will secure a tailored briefing that aligns with your organization’s unique objectives and gain deep visibility into the evolving sterilization landscape. Confidential consultations will equip you with the actionable insights needed to optimize procurement strategies, refine technology roadmaps, and strengthen competitive positioning.

Reach out to Ketan Rohom today to discuss customized licensing options or enterprise-wide access packages and ensure your teams have the intelligence they need to make data-driven decisions. Don’t miss this opportunity to transform market intelligence into tangible business outcomes and drive sustainable growth in the laboratory sterilizers sector.

- How big is the Laboratory Sterilizers Market?

- What is the Laboratory Sterilizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?