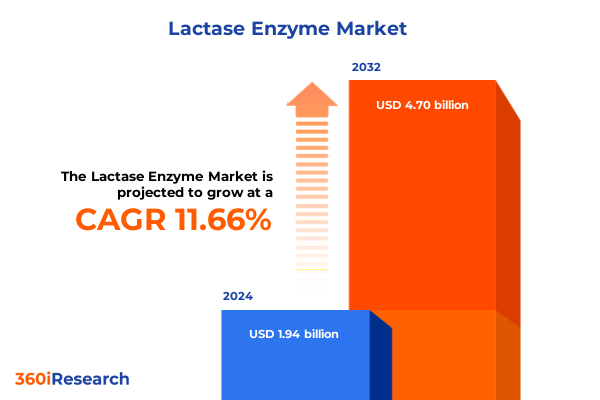

The Lactase Enzyme Market size was estimated at USD 2.17 billion in 2025 and expected to reach USD 2.38 billion in 2026, at a CAGR of 11.63% to reach USD 4.70 billion by 2032.

Exploring the Vital Role of Lactase Enzyme in Enhancing Digestive Health, Supporting Lactose-Free Product Innovation, and Fueling Industry Growth

The growing acknowledgment of lactose intolerance among consumers has catalyzed the critical role of lactase enzyme across diverse industry verticals. In the United States alone, approximately 36 percent of the population experiences varying degrees of lactose maldigestion, prompting dairy processors and dietary supplement manufacturers to integrate lactase solutions to meet evolving consumer needs. Globally, more than 65 percent of adults exhibit lactose malabsorption, particularly across Asian, African, and South American regions, underscoring universal demand for products enhanced with efficient lactase formulations.

As digestive health gains prominence among health-conscious consumers, lactase enzyme has transitioned from a niche supplement to a foundational ingredient in lactose-free dairy, infant nutrition, and functional beverage applications. This regulatory-sanctioned biocatalyst facilitates the breakdown of lactose into absorbable monomers, enabling producers to expand product offerings without compromising taste or nutritional profiles. Simultaneously, pharmaceutical and nutraceutical formulators are harnessing lactase’s biocompatibility in chewable tablets and liquid concentrates, catering to clinical and at-home therapeutic use cases.

Unveiling Revolutionary Shifts Reshaping Lactase Enzyme Production, Delivery, and Application Across Food, Beverage, and Pharmaceutical Sectors

Advancements in enzyme engineering and bioprocess optimization have fundamentally reshaped lactase production. Cutting-edge fermentation techniques, including high-cell-density cultivation of Aspergillus and recombinant yeast strains, now deliver yields markedly higher than legacy systems, while purification innovations such as membrane filtration and chromatography have elevated enzyme purity and stability. These technological shifts are enabling manufacturers to offer specialized lactase variants with enhanced pH tolerance and temperature resilience, broadening potential applications in high-volume dairy processing and infant formula manufacturing.

Concurrently, the market is witnessing a transition toward clean-label and non-GMO certified lactase enzymes. Driven by consumer and regulatory scrutiny, suppliers are investing in genetic marker-free production methods and transparent supply chain practices, reinforcing trust among B2C and B2B stakeholders alike. At the same time, the emergence of lactose biosensor test kits allows real-time monitoring of enzymatic activity during production and processing, heightening process control and reducing waste streams. Collectively, these transformative shifts are accelerating innovation cycles and redefining quality benchmarks across the lactase enzyme landscape.

Analyzing the Far-Reaching Consequences of 2025 United States Tariffs on Lactase Supply Chains, Cost Structures, and Industry Innovation

The 2025 United States tariffs on imported enzyme products have introduced significant recalibration within the lactase supply chain. Incremental duties elevated landed costs for manufacturers reliant on offshore fermentation capacities, prompting many to re-evaluate sourcing strategies and pivot toward domestic or nearshore suppliers to shield against further tariff volatility. This shift has accelerated capacity expansions among North American producers, enabling them to capture market share previously held by European and Asian exporters.

At the same time, the broader life sciences sector anticipates a period of short-term turbulence, as elevated input costs from approximately $200 billion in drug imports translate into billions of additional expenses annually under a 10 percent tariff scenario. Downstream users-including dairy processors, infant formula manufacturers, and pharmaceutical developers-face margin compression, driving an industry-wide emphasis on formulation optimization and dosage precision to sustain consumer price points without sacrificing product efficacy.

Moreover, reciprocal tariffs imposed by key trading partners have reverberated through global dairy flows, with U.S. lactose and whey exporters confronting punitive duties of up to 125 percent in China alone. These measures have redirected trade toward European and Oceania suppliers, risking domestic oversupply and downward pressure on farmgate prices. In response, leading enzyme firms are bolstering investments in high-activity lactase variants and agile procurement models, underscoring the strategic advantage of supplier diversification and innovation-focused resilience.

Illuminating Key Segmentation Insights Spanning Formulations, Biological Sources, Application Domains, Distribution Channels, and End Users

Formulation modalities represent a cornerstone of lactase enzyme market segmentation, spanning hard-shell and soft-gel capsules, macro- and microgranule variants, concentrated and solution-form liquids, freeze-dried and spray-dried powders, and both chewable and immediate-release tablets. Each delivery form addresses specific stability, dosage, and convenience requirements, with liquid concentrates becoming the preferred choice for high-throughput beverage processing lines, while freeze-dried powders maintain prominence in nutraceutical and infant formula applications.

Biological source differentiation further refines the competitive landscape, as animal-derived lactase from bovine and porcine origins competes with bacterial strains such as Escherichia coli and Lactobacillus, alongside fungal enzymes produced by Aspergillus oryzae and Kluyveromyces lactis. Yeast-derived variants currently dominate due to their balance of activity and production cost, while fungal lactases are emerging as the fastest-growing category supported by robust R&D investments in protein engineering and expression systems.

Application-based segmentation reveals the multifaceted use of lactase across animal feed for aquaculture, poultry, ruminants, and swine; food and beverage sectors covering dairy alternatives, functional foods and drinks, and infant formula; nutraceuticals categorized into functional ingredients and dietary supplements; and pharmaceuticals encompassing both over-the-counter and prescription products. The dairy processing sub-segment remains the largest demand driver, supported by expanding lactose-free portfolios across mainstream brands.

Distribution channel analysis highlights that offline pharmacy outlets, including direct sales operations and hospital pharmacies, continue to serve professional and clinical buyers, whereas company websites and e-commerce platforms are rapidly gaining traction for at-home supplement purchases. The online channel’s scalability and consumer convenience benefits are prompting formulators to adopt direct-to-consumer strategies, enhancing margins and fostering brand loyalty.

End-user segmentation spans clinical settings, home-care regimens, hospitals, and research institutes, each demanding distinct lactase presentations. In clinical laboratories and hospitals, precision-grade enzyme preparations ensure efficacy in diagnostic and therapeutic protocols, while home-care and outpatient scenarios drive demand for user-friendly tablets and liquid sachets. Research institutes leverage specialized lactase forms for biochemical assays and pilot-scale process development, underscoring the enzyme’s versatility across scientific and commercial environments.

This comprehensive research report categorizes the Lactase Enzyme market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Application

- Distribution Channel

- End User

Examining Distinct Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific to Unearth Growth Opportunities

In the Americas, mature dairy processing infrastructures and a high prevalence of lactose intolerance underpin sustained demand for advanced lactase solutions. North America alone accounted for more than one-third of global lactase revenues in 2024, driven by the dairy, infant nutrition, and dietary supplement sectors prioritizing lactose-free formulations to capture health-focused consumer segments. Simultaneously, Latin American markets are witnessing growing import reliance for high-purity enzymes as regional players seek to expand lactose-free product portfolios.

Europe, Middle East, and Africa (EMEA) benefit from a well-established enzyme manufacturing base and stringent regulatory frameworks that prioritize quality and traceability. Europe led global lactase revenues with nearly half of total share in 2019, buoyed by the presence of key industry incumbents and robust food safety regulations that favor premium enzyme grades. Emerging markets in the Middle East and Africa are also investing in on-shore enzyme processing facilities to reduce import dependencies and support local dairy and nutraceutical industries.

The Asia-Pacific region represents the fastest-growing lactase market segment, spurred by high lactose malabsorption rates-approaching 90 to 100 percent in parts of East Asia-and rapid expansion of dairy alternatives, functional beverage, and infant nutrition categories. Government initiatives promoting nutritional fortification and local enzyme biotechnology projects are reinforcing the region’s growth trajectory, with China and India emerging as focal points for production scale-up and innovation partnerships

This comprehensive research report examines key regions that drive the evolution of the Lactase Enzyme market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants and Their Strategic Initiatives Driving Competitive Advantage in the Lactase Enzyme Ecosystem

The competitive landscape of the lactase enzyme market is dominated by tier-one players that leverage scale and innovation to sustain leadership. Novozymes, DuPont/IFF, and DSM-Firmenich collectively command a significant portion of global revenues through extensive enzyme portfolios and long-standing partnerships with major food, beverage, and pharmaceutical manufacturers. Their strategic emphasis on customized enzyme solutions, coupled with continuous capacity expansions, has enabled robust market penetration across key geographies.

Meanwhile, niche and tier-two participants such as Chr. Hansen, Advanced Enzyme Technologies, Amano Enzyme, and Antozyme Biotech are differentiating through specialized product offerings and targeted market segments. Chr. Hansen’s focus on plant-based dairy alternatives and Advanced Enzyme Technologies’ enzymatic immobilization platforms exemplify the pursuit of specialized applications, while Amano Enzyme’s non-GMO certification and Antozyme’s boutique enzyme formulations address emerging clean-label and vegan-friendly demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lactase Enzyme market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Enzyme Technologies Ltd

- Amano Enzyme Inc.

- Antozyme Biotech Pvt Ltd

- Aumgene Biosciences

- Biocatalysts Ltd.

- Creative Enzymes

- DuPont de Nemours, Inc.

- Enzyme Development Corporation

- Jiangsu Boli Bioproducts Co., Ltd.

- Koninklijke DSM N.V.

- Maple Biotech Pvt. Ltd.

- Megazyme Ltd.

- Mitushi Biopharma

- Nature BioScience Pvt. Ltd.

- Novact Corporation

- Novozymes A/S

- SternEnzym GmbH & Co. KG

Delivering Strategic Recommendations for Industry Stakeholders to Navigate Market Disruptions and Capitalize on Emergent Lactase Enzyme Opportunities

To navigate ongoing trade uncertainties and supply-chain realignments, industry stakeholders should actively diversify procurement sources and forge strategic alliances with domestic and near-shore producers. Developing dual-sourcing frameworks that balance cost and reliability can safeguard operations against future tariff fluctuations and geopolitical disruptions. Additionally, investing in in-house enzyme formulation capabilities and modular bioprocess assets will empower organizations to scale production flexibly while maintaining quality control.

Furthermore, stakeholders are encouraged to accelerate R&D efforts focused on next-generation lactase variants with enhanced thermal stability and pH tolerance, as well as to optimize dosage matrices for specific applications. Embracing digital sales channels-particularly direct-to-consumer e-commerce and telehealth distribution-can unlock new demand pools and improve margin structures. Establishing collaborative R&D consortia with academic and research institutes will expedite innovation cycles and facilitate knowledge sharing, thereby reinforcing long-term competitiveness.

Outlining a Rigorous Research Methodology Combining Primary Expert Engagements and Secondary Data Analysis to Ensure Comprehensive Market Insights

This study employs a dual-phased research methodology that integrates primary engagements with enzyme producers, dairy processors, nutraceutical formulators, and regulatory experts. Semi-structured interviews provided qualitative insights into strategic procurement priorities, technology adoption hurdles, and emerging application trends, ensuring a nuanced understanding of stakeholder imperatives. Meanwhile, a targeted industry survey corroborated these findings through quantitative validation of pricing pressures, R&D investment shifts, and channel preferences.

Complementing primary research, the analysis synthesized secondary data from peer-reviewed journals, trade publications, patent filings, and government trade notifications to map regulatory frameworks and tariff developments. Data triangulation techniques were applied to reconcile market intelligence from proprietary sources with publicly available statistics on lactose intolerance prevalence, enzyme production capacities, and trade flows, delivering a robust, multi-dimensional perspective on market dynamics and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lactase Enzyme market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lactase Enzyme Market, by Form

- Lactase Enzyme Market, by Source

- Lactase Enzyme Market, by Application

- Lactase Enzyme Market, by Distribution Channel

- Lactase Enzyme Market, by End User

- Lactase Enzyme Market, by Region

- Lactase Enzyme Market, by Group

- Lactase Enzyme Market, by Country

- United States Lactase Enzyme Market

- China Lactase Enzyme Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing Core Findings on Lactase Enzyme Trends and Anticipating Future Trajectories in the Evolving Digestive Health Landscape

The lactase enzyme market continues to evolve under the influence of shifting consumer health priorities, technological advancements, and complex trade policies. Sustained investment in novel production methods and enhanced enzyme formulations will remain central to meeting the growing demand for lactose-free dairy, nutraceuticals, and pharmaceuticals. As industry participants realign procurement and R&D strategies, agility and supplier diversification will underpin resilience against external shocks such as tariffs and global supply disruptions.

Looking forward, the convergence of digital distribution models and bioprocess innovations is poised to unlock new growth avenues, particularly in emerging markets and direct-to-consumer channels. Stakeholders that proactively embrace collaborative R&D, invest in clean-label credentials, and optimize multi-channel go-to-market strategies will be best positioned to capture value and drive sustainable expansion in the dynamic lactase enzyme landscape.

Connect with Ketan Rohom to Unlock Comprehensive Lactase Enzyme Market Research Insights and Propel Your Strategic Decision-Making

The path to unlocking deep insights into the lactase enzyme market begins with a single step. Leverage the expertise of an industry specialist who can guide you through the complexities of supply chain shifts, segmentation nuances, and regional dynamics.

For a personalized consultation and to gain access to the complete market research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Each engagement is tailored to your unique strategic priorities, enabling faster, more informed decision-making and a competitive edge in the evolving lactase enzyme landscape.

- How big is the Lactase Enzyme Market?

- What is the Lactase Enzyme Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?