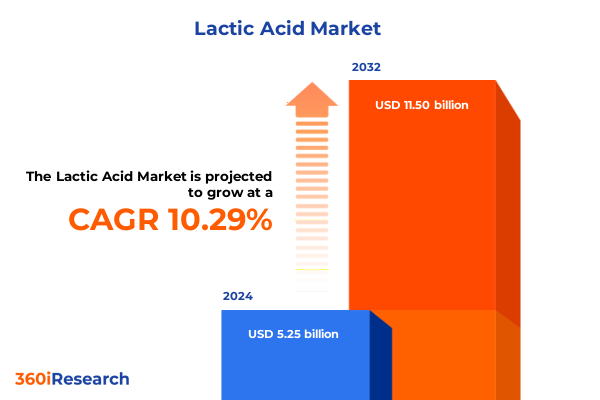

The Lactic Acid Market size was estimated at USD 5.77 billion in 2025 and expected to reach USD 6.34 billion in 2026, at a CAGR of 10.34% to reach USD 11.50 billion by 2032.

Discover the Essential Role and Multifaceted Applications of Lactic Acid Across Sustainable Industries and Innovative Bioprocesses

Lactic acid has evolved beyond its historic role as a simple fermentation byproduct to become a cornerstone of modern industrial applications, spanning food and beverage, pharmaceuticals, personal care, and biodegradable polymers. Produced primarily via microbial fermentation of renewable feedstocks, the compound’s inherent biodegradability and versatility have positioned it at the heart of global sustainability initiatives. Recent advances in metabolic engineering and adaptive evolution of microbial strains have significantly enhanced production efficiencies while improving optical purity, thereby broadening lactic acid’s commercial appeal.

Unveiling Technological Breakthroughs and Regulatory Drivers Reshaping Sustainable Lactic Acid Production and Application

The landscape of lactic acid production is undergoing transformative shifts driven by both technological breakthroughs and shifting regulatory imperatives. Innovations in fermentation technologies, such as integrated in-situ separation and continuous processing, have reduced energy consumption and improved yield, enabling producers to meet rising global demand with greater cost efficiency. Concurrently, metabolic engineering and adaptive laboratory evolution techniques are being deployed to develop robust microbial strains capable of tolerating high acid concentrations and low pH environments, further optimizing operational performance. On the regulatory front, an increasing number of jurisdictions are mandating single-use plastics reduction, directly fueling demand for polylactic acid (PLA) bioplastics as viable substitutes for petrochemical-based polymers. Together, these technological and policy drivers are redefining competitive dynamics and opening new avenues for innovation across the value chain.

Assessing the Cumulative Effects of 2025 U.S. Trade Measures on Lactic Acid Supply Chains, Pricing Pressures, and Procurement Strategies

In 2025, U.S. trade policy introduced a series of tariffs that have cumulatively reshaped the economics of lactic acid imports and domestic procurement. A 10% duty on Chinese-origin lactic acid, implemented February 1, 2025, significantly tightened supply chains and elevated procurement expenditure for buyers reliant on that market. Further escalation occurred following the April 2 executive order reinstating and raising tariffs on select Chinese chemical imports-among them lactic acid-with rates reaching as high as 145% for some industrial acids under Annex 2 of the USTR update. Despite subsequent legal challenges, an appeals court’s stay of lower-court decisions in June 2025 upheld these tariffs under the IEEPA, prolonging the uncertainty and cost pressures faced by downstream manufacturers. As a result, many end users have accelerated efforts to diversify sourcing strategies, including establishing new regional supply relationships and increasing investments in domestic fermentation capacity.

Exploring the Multidimensional Segmentation Framework That Defines Source, State, Grade, and Isomer Variants in the Lactic Acid Market

The lactic acid market is structured by multiple dimensions that collectively delineate its breadth and depth. Based on the source, participants navigate between natural and synthetic origins, with biological fermentation capturing sustainability credentials while chemical synthesis offers consistency. In terms of state, the liquid versus powder distinction affects logistics and dosing flexibility, as liquid grades facilitate continuous processing while powders enable extended shelf stability. Grade segmentation reveals a divide between food-grade and industrial-grade products, each tailored to distinct purity specifications and regulatory requirements. Further granularity emerges in form differentiation among D-, DL-, and L-lactic acid isomers; within each, application niches span food and beverages, cosmetics and personal care, pharmaceuticals, and industrial usage, demonstrating how molecular variant and downstream function converge to drive procurement and formulation decisions.

This comprehensive research report categorizes the Lactic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- State

- Grade

- Form

- Application

Understanding Regional Variations and Growth Drivers in the Americas, Europe, Middle East & Africa, and Asia-Pacific Lactic Acid Markets

Regional dynamics in the lactic acid domain reflect both mature demand centers and emerging growth corridors. In the Americas, established food and beverage, pharmaceutical, and personal care sectors continue to invest in high-performance lactic acid derivatives, supported by robust infrastructure and established biotech clusters. Within Europe, the Middle East & Africa, stringent environmental directives and extended producer responsibility schemes are accelerating PLA adoption and spurring product innovation, particularly in Western Europe. Meanwhile, the Asia-Pacific region has become a production powerhouse, leveraging abundant agricultural feedstocks and significant capacity expansions in China, Southeast Asia, and Australia to serve both domestic and export markets, though evolving trade policies demand agile supply chain optimization.

This comprehensive research report examines key regions that drive the evolution of the Lactic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants and Their Strategic Initiatives Shaping the Global Lactic Acid Ecosystem

Key industry participants demonstrate diverse strategies to capture value across the lactic acid value chain. Corbion, with its legacy in organic chemistry, leverages integrated fermentation and downstream purification systems to supply high-purity lactic acid and derivatives for food, pharmaceuticals, and specialty chemical applications. NatureWorks, a pioneer in biopolymer solutions, supports its Ingeo PLA business through backward-integrated lactic acid production at scale, complemented by advanced recycling capabilities that reclaim monomer via hydrolysis processes. Galactic has carved out a niche in natural antimicrobials and specialty esters, reinforcing its global footprint with R&D investment and capacity expansions, particularly in China and the United States. Alongside these leaders, innovative biotech entrants and specialty chemical players are introducing novel feedstock pathways and enzyme engineering platforms, intensifying competition and driving continuous product development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lactic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantor, Inc.

- BASF SE

- BOC Sciences

- Cargill, Incorporated

- Cellulac

- Chr. Hansen A/S by Novonesis Group

- Corbion N.V.

- DUBI CHEM MARINE INTERNATIONAL

- Ensince Industry Co., Ltd

- Foodchem International Corporation

- Fujifilm Holdings Corporation

- Galactic SA

- Hawkins, Inc.

- Henan Jindan Lactic Acid Technology Co., Ltd.

- Hydrite Chemical Co.

- Jiaan biotech Pvt.Ltd

- Jungbunzlauer Suisse AG

- Junsei Chemical Co.,Ltd.

- Kishida Chemical Co. Ltd.

- Koninklijke DSM N.V.

- LG Chem Ltd.

- Medix Biochemica USA ,Inc.

- Merck KGaA

- Mitushi Biopharma

- Musashino Chemical Laboratory, Ltd.

- Nacalai Tesque Inc.

- Teijin Limited

- The Archer-Daniels-Midland Company

- Thermo Fisher Scientific Inc.

- Vertec BioSolvents Inc.

- Vigon International, LLC by Azelis groupADM

- Vishnupriya Chemicals Pvt. Ltd.

Actionable Strategic Imperatives for Industry Leaders to Enhance Flexibility, Innovation, and Regulatory Engagement in Lactic Acid Production

Industry leaders should consider a multi-pronged approach to navigate evolving market conditions. Prioritizing agile production models that leverage alternative feedstocks-such as agricultural residues or methane-to-lactic acid bioconversion-can mitigate raw material constraints and reduce carbon footprints. Establishing strategic partnerships for regional fermentation capacities will help hedge against tariff and trade uncertainties, while co-innovation alliances with end-use customers can accelerate tailored product development in high-growth segments like PLA packaging and cosmeceuticals. Investment in advanced analytics to monitor global trade flows and price indicators will enable dynamic procurement adjustments and risk management. Furthermore, engaging proactively with regulatory bodies to influence emerging policy frameworks around compostability standards and chemical tariffs will secure competitive positioning and long-term market resilience.

Robust Research Design Combining Secondary Data, Primary Interviews, and Triangulated Analysis to Deliver Actionable Lactic Acid Market Insights

This research integrates comprehensive secondary and primary data sources to ensure analytical rigor. Secondary research encompassed peer-reviewed journals, patent filings, regulatory announcements, and trade data, while primary insights were obtained through in-depth interviews with C-suite executives, plant managers, and procurement specialists. The market segmentation framework was validated via a bottom-up approach, reconciling product-level intelligence with regional trade flows and publicly available customs statistics. Data triangulation was performed to confirm consistency across multiple sources, and qualitative assessments were incorporated to contextualize quantitative findings. Comparative analysis of historical trends and policy shifts underpins the report’s narrative, while ongoing consultation with industry experts ensures alignment with real-time developments and emerging market signals.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lactic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lactic Acid Market, by Source

- Lactic Acid Market, by State

- Lactic Acid Market, by Grade

- Lactic Acid Market, by Form

- Lactic Acid Market, by Application

- Lactic Acid Market, by Region

- Lactic Acid Market, by Group

- Lactic Acid Market, by Country

- United States Lactic Acid Market

- China Lactic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Converging Forces of Innovation, Policy and Market Dynamics Driving the Future of Lactic Acid

Lactic acid occupies a dynamic intersection of sustainability imperatives, technological innovation, and complex global trade environments. Its evolution from a commodity fermentation product to a multifunctional industrial precursor underscores its strategic importance across multiple sectors. The interplay of transformative bioprocess advancements, diversifying application portfolios, and regulatory pressures-particularly trade measures-establishes both challenges and opportunities. As the market continues to mature, stakeholders who adapt through agile supply chain tactics, differentiated product offerings, and strategic collaboration will be best positioned to capitalize on lactic acid’s expanding industrial prominence.

Unlock Critical Lactic Acid Market Intelligence with Expert Guidance from Associate Director Ketan Rohom at 360iResearch

To learn how our comprehensive market insights can guide your strategic initiatives and enhance profitability in the lactic acid sector, speak with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can provide tailored information on report scope, methodology, and deliverables, ensuring you acquire the precise intelligence needed to stay ahead of evolving market dynamics. Reach out today to secure your copy of the in-depth lactic acid market research report and unlock actionable insights that will drive growth and innovation within your organization.

- How big is the Lactic Acid Market?

- What is the Lactic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?