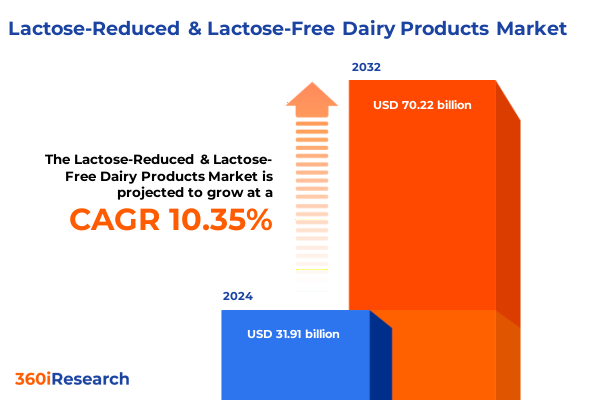

The Lactose-Reduced & Lactose-Free Dairy Products Market size was estimated at USD 35.29 billion in 2025 and expected to reach USD 38.63 billion in 2026, at a CAGR of 10.32% to reach USD 70.22 billion by 2032.

Lactose-Reduced and Lactose-Free Dairy Products Unveiled: Consumer Health Trends, Industry Evolution, and Emerging Market Dynamics

Dairy consumption is undergoing a profound transformation as millions of consumers worldwide grapple with lactose malabsorption and gastrointestinal sensitivities. While most infants can digest lactose, studies indicate that roughly 68 percent of the global population experiences reduced lactase enzyme activity after infancy, and approximately 36 percent of Americans develop some degree of lactose malabsorption in adulthood. As awareness of lactose intolerance rises, demand for lactose-reduced and lactose-free dairy products has surged, offering individuals the opportunity to enjoy the nutritional benefits of milk, cheese, yogurt, and other dairy staples without discomfort.

Moreover, the evolution of enzymatic hydrolysis and ultra-filtration technologies has enabled manufacturers to deliver smooth, flavorful dairy options that break down lactose into readily digestible sugars. This technological enablement, combined with a growing focus on gut health and functional nutrition, has positioned lactose-free offerings as a mainstream alternative rather than a niche specialty. By meeting consumer expectations for taste, texture, and nutritional value, producers have accelerated the renaissance of dairy consumption among health-conscious demographics.

Shifting Paradigms in Dairy Consumption: How Health Consciousness, Technological Innovation, and Sustainability Are Redefining Lactose-Reduced Market

The driving forces underpinning the lactose-reduced dairy renaissance reflect sweeping shifts in consumer priorities, technological innovation, and sustainability commitments. A pronounced rise in health consciousness has led buyers to scrutinize ingredient lists and seek products that deliver digestive comfort alongside core nutritional benefits. As research highlights the importance of calcium, protein, and probiotics for long-term well-being, lactose-free dairy formulations have been positioned as functional foods that align with preventive health objectives.

Simultaneously, food technology breakthroughs have reshaped production paradigms. Precision fermentation platforms now produce whey protein identical to that from cow’s milk without the lactose, cholesterol, or environmental footprint of traditional methods, reducing greenhouse gas emissions by up to 97 percent and water usage by 99 percent compared to legacy dairy processes. Likewise, high-pressure processing techniques preserve essential micronutrients and flavor profiles while extending shelf life, ensuring that lactose-free beverages and yogurts remain fresh longer without thermal degradation of sensitive compounds.

Beyond product innovation, sustainability has become integral to strategic planning. Major players have pledged carbon neutrality goals, invested in renewable energy, and adopted closed‐loop packaging systems. This alignment of consumer health expectations with environmental stewardship has propelled lactose-reduced dairy into a leadership position within the broader dairy sector.

Assessing the Ripple Effects of 2025 US Tariffs on Lactose-Reduced and Lactose-Free Dairy: Supply Chain Pressures, Pricing Strategy, and Trade Dynamics

The introduction of new tariffs by the United States in early 2025 has reverberated across the lactose-reduced dairy value chain, heightening cost volatility and precipitating strategic recalibrations. When Washington imposed levies on imports from Canada, Mexico, and China, these partners swiftly reciprocated with measures affecting key dairy exports, including whey, lactose, and specialized milk powders. Such tit-for-tat duties have disrupted established trade flows, compelling manufacturers and traders to identify alternative sourcing strategies and renegotiate long-standing contracts.

Furthermore, the specter of punitive retaliatory tariffs-exceeding 80 percent on certain whey and lactose products bound for China-has accelerated adaptations in global logistics and product portfolio management. Analysts note that while commodity prices have softened under the weight of anticipated duties, margins for U.S. producers and exporters have narrowed, particularly in segments reliant on high-value protein ingredients. The inherent uncertainty surrounding tariff duration and scope continues to discourage speculative buying, leading both domestic and international buyers to adopt more cautious procurement practices. As a result, the cumulative impact of U.S. tariffs in 2025 underscores the imperative for agile supply chain resilience and proactive policy engagement.

Unlocking Growth Through Consumer and Channel Segmentation: Product Types, Distribution Pathways, User Demographics, and Packaging Preferences Driving Innovation

Segmenting the lactose-reduced dairy market by product type, distribution channel, end user, and packaging format reveals differentiated growth pathways and consumer touchpoints. When examining the assortment of butter, cheese, ice cream, infant formula, milk, and yogurt, it becomes evident that milk and yogurt variants command everyday consumption, positioning them as foundational offerings for mainstream audiences. In contrast, specialty segments such as lactose-free ice cream and infant formula serve niche needs, with product developers tailoring formulations to texture and nutritional specifications that cater to sensitive demographics.

From a distribution perspective, offline retail channels-comprising supermarkets and hypermarkets alongside convenience locations, pharmacies, and specialty retailers-continue to underpin broad accessibility and brand discovery. Yet the surge in online grocery and direct-to-consumer platforms has unlocked new avenues for personalized product bundling and subscription models that appeal to time-starved adults and tech-savvy households. In addition, the delineation between multi-serve packaging, favored by families seeking value and eco-efficiency, and single-serve formats, embraced by on-the-go professionals and elderly consumers requiring portion control, underscores the importance of aligning packaging solutions with usage occasions.

Moreover, end-user segmentation across adults managing intolerance symptoms, elderly consumers prioritizing bone health and digestive comfort, and infants requiring precise nutritional formulations illuminates the necessity for targeted R&D and communication strategies. This multidimensional lens on segmentation affords manufacturers the clarity to refine product roadmaps, optimize channel investments, and craft resonate marketing narratives that address distinct consumer motivations.

This comprehensive research report categorizes the Lactose-Reduced & Lactose-Free Dairy Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- End User

- Packaging Type

Regional Dynamics Shaping the Lactose-Reduced Dairy Market: Comparative Analysis of Consumer Adoption, Policy Environments, and Innovation Across Key Geographies

Regional disparities in lactose-reduced dairy adoption reflect a complex mosaic of cultural traditions, regulatory frameworks, and competitive landscapes. In the Americas, robust consumption of lactose-free milk and yogurt is bolstered by heightened public awareness of digestive health, supported by nutrition education campaigns and school-based pilot programs that integrate lactose-free options into meal planning. This North American momentum has encouraged domestic producers to expand capacity and introduce innovative flavor profiles tailored to multicultural palates.

Across Europe, the Middle East, and Africa, the lactose-reduced sector benefits from established traditions in cheese production and premium yogurt consumption. Regulatory recognition of lactose-reduced and lactose-free labeling standards has instilled consumer confidence, while leading dairy federations collaborate with national authorities to harmonize quality specifications. Meanwhile, accelerating wealth in select MENA markets is broadening consumer access, with localized product launches that address regional taste preferences and climate-driven packaging innovations.

In the Asia-Pacific region, rising disposable incomes and urbanization have catalyzed demand for functional dairy solutions, prompting global dairy brands to forge joint ventures with local players. Given the high prevalence of lactose malabsorption in many APAC populations, lactose-free infant formula and UHT milk variants have emerged as priority segments. Concurrently, e-commerce penetration and modern retail expansion have facilitated rapid distribution, allowing niche brands to scale with minimal capital outlay.

This comprehensive research report examines key regions that drive the evolution of the Lactose-Reduced & Lactose-Free Dairy Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves by Leading Dairy Innovators: Partnership Models, Product Launches, and Sustainability Initiatives Steering Competitive Advantage

Leading dairy companies are making bold moves to capture market share in the lactose-reduced arena, demonstrating diversified strategies that blend product innovation, brand building, and strategic partnerships. Fairlife, recognized for its ultra-filtered milk with enhanced protein and reduced sugar, has leveraged premium positioning to command shelf presence in major retail chains, while driving consumer trial through sports nutrition and meal-replacement channels. Its collaboration with national dairy cooperatives has also enabled efficient raw milk sourcing and scale advantages.

Meanwhile, Lactaid continues to reinforce its heritage as a first-mover by extending its portfolio beyond fluid milk to encompass creamers and ice cream novelties, supported by targeted marketing campaigns that underscore digestive relief and authentic dairy taste. Danone has likewise expanded its flagship Activia line into lactose-free territories, launching Activia Sin in Europe to marry probiotics with enzyme-treated yogurt, and adapting product formulations to local dietary guidelines. Arla has taken a multimedia approach for its LactoFREE brand, deploying innovative out-of-home activations and neurodiversity-inclusive digital campaigns to amplify brand resonance across diverse demographic groups.

Emerging players specializing in precision fermentation are also attracting strategic investments, signalling potential collaboration opportunities for incumbents seeking alternative protein inputs. This competitive landscape underscores the imperative for agility in forging co-development alliances and leveraging proprietary technologies to sustain differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lactose-Reduced & Lactose-Free Dairy Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amul

- Arla Foods

- Cabot Creamery Cooperative Inc.

- Dairy Farmers of America, Inc.

- Danone S.A.

- Fairlife

- General Mills Inc.

- Green Valley Creamery

- Hiland Dairy

- Lactalis Group

- Lifeway Foods Inc.

- Müller Holding GmbH & Co. KG

- Nestlé S.A.

- Organic Valley

- Parmalat S.p.A.

- Royal FrieslandCampina N.V.

- Saputo Inc.

- The Kraft Heinz Company

- The Kroger Company

- Valio Ltd.

Action-Oriented Strategies for Dairy Industry Leaders: Leveraging Consumer Insights, Supply Chain Optimization, and Collaborative Innovation to Stay Ahead

To navigate evolving consumer preferences, trade uncertainties, and intensifying competition, industry leaders should pursue a multipronged strategy that aligns innovation with operational resilience. First, prioritizing R&D investments in advanced enzyme and fermentation technologies will enable the development of next-generation lactose-free formulations with improved nutritional profiles and lower carbon footprints. Engaging in pre-competitive partnerships with biotech startups can expedite time-to-market and foster shared risk models.

Second, optimizing supply chain agility through diversified sourcing networks and flexible manufacturing configurations can mitigate tariff shocks and minimize inventory obsolescence. Establishing regional production hubs that leverage local milk supplies will reduce exposure to cross-border levies and accelerate responsiveness to market fluctuations. At the same time, implementing real-time analytics for demand forecasting and dynamic pricing will strengthen margin management under volatile cost conditions.

Third, deepening consumer engagement with tailored marketing that highlights the functional benefits of lactose-free products-such as digestive comfort, bone health, and high protein content-will reinforce brand loyalty. Investing in digital platforms for personalized recipe recommendations and interactive education on lactose management will cultivate community advocates. Additionally, demonstrating tangible sustainability commitments through transparent reporting and eco-friendly packaging designs will resonate with the growing cohort of environmentally conscious buyers.

Robust Research Framework Illuminating the Lactose-Reduced Dairy Landscape: Integrating Qualitative Interviews, Data Analytics, and Market Intelligence for Credible Insights

This analysis is underpinned by a rigorous research framework that integrates primary and secondary methodologies to ensure credibility and relevance. In the primary phase, qualitative interviews were conducted with executives, R&D specialists, and procurement leaders across leading dairy companies, ingredient suppliers, and retail chains. These conversations provided direct insights into emerging product priorities, operational challenges, and competitive dynamics.

Secondary research encompassed an extensive review of industry publications, government databases, trade association reports, scientific journals, and reputable news outlets. Sources included regulatory filings, press releases from leading dairy federations, and peer-reviewed studies on lactase enzyme technologies and high-pressure processing. Data triangulation techniques were applied to reconcile divergent perspectives and validate qualitative findings.

The analytical approach employed thematic coding to identify cross-cutting trends, while benchmarking exercises compared strategic initiatives among top performers. A sector mapping exercise distilled the impact of U.S. tariff measures enacted in 2025 through the synthesis of trade data and economic commentary. Throughout the process, strict quality assurance protocols-including source verification and expert reviews-ensured the robustness of conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lactose-Reduced & Lactose-Free Dairy Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lactose-Reduced & Lactose-Free Dairy Products Market, by Product Type

- Lactose-Reduced & Lactose-Free Dairy Products Market, by Distribution Channel

- Lactose-Reduced & Lactose-Free Dairy Products Market, by End User

- Lactose-Reduced & Lactose-Free Dairy Products Market, by Packaging Type

- Lactose-Reduced & Lactose-Free Dairy Products Market, by Region

- Lactose-Reduced & Lactose-Free Dairy Products Market, by Group

- Lactose-Reduced & Lactose-Free Dairy Products Market, by Country

- United States Lactose-Reduced & Lactose-Free Dairy Products Market

- China Lactose-Reduced & Lactose-Free Dairy Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Key Trends and Strategic Imperatives: Embracing Innovation, Navigating Trade Challenges, and Aligning with Consumer Health Priorities in Dairy

The lactose-reduced and lactose-free dairy sector is poised for continued expansion, driven by an accelerating confluence of health-conscious consumer behavior, disruptive food technologies, and evolving policy landscapes. As digestive comfort and functional nutrition become central to dietary decision-making, lactose-free milk, yogurt, cheese, and specialty products will increasingly occupy mainstream retail and institutional channels. Concurrently, the enduring impact of 2025 tariff adjustments underscores the necessity for supply chain flexibility and strategic sourcing to preserve margin stability.

Differentiation through segmentation-tailoring formulations for adults managing intolerance, elderly demographics seeking nutrient-dense options, and infants requiring precise nutritional care-will be critical to retaining consumer relevance. Regional market dynamics, from North America’s robust consumption to Europe’s regulatory sophistication and Asia-Pacific’s rapid adoption, present a mosaic of opportunities best addressed through customized go-to-market strategies.

Ultimately, companies that embed sustainability commitments, leverage collaborative innovation with biotech partners, and harness digital channels for consumer engagement will unlock competitive advantage. By aligning product portfolios with evolving dietary trends and operational contingencies, industry players can navigate the complexities of trade environments and solidify their positions as leaders in the lactose-reduced dairy revolution.

Secure Comprehensive Market Intelligence Today by Connecting with Ketan Rohom to Propel Your Lactose-Reduced Dairy Strategy

Elevate your strategic planning with authoritative insights and practical guidance tailored to the dynamic lactose-reduced and lactose-free dairy sector. To gain full access to in-depth analysis across consumer trends, technological breakthroughs, tariff impacts, segmentation nuances, regional dynamics, and competitive intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Embark on a partnership that equips your team with the data-driven perspective required to navigate regulatory shifts, optimize product portfolios, and seize emerging opportunities in a rapidly evolving market. Secure your copy of the comprehensive market research report today and empower your organization to make informed, forward-looking decisions that drive growth and resilience.

- How big is the Lactose-Reduced & Lactose-Free Dairy Products Market?

- What is the Lactose-Reduced & Lactose-Free Dairy Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?