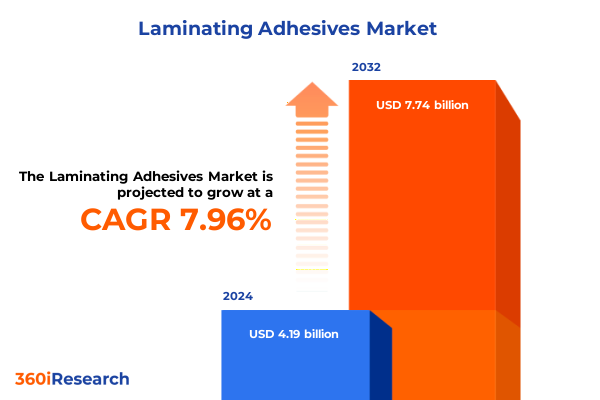

The Laminating Adhesives Market size was estimated at USD 4.53 billion in 2025 and expected to reach USD 4.86 billion in 2026, at a CAGR of 7.95% to reach USD 7.74 billion by 2032.

Exploring the Foundational Role of Laminating Adhesives in Unifying Materials and Boosting Product Durability Across Industries

The modern industrial landscape increasingly relies on advanced bonding solutions to unite diverse materials into cohesive products that meet rigorous performance standards. Laminating adhesives play a pivotal role in this process by enabling manufacturers to achieve lightweight, durable, and multifunctional assemblies across sectors ranging from flexible packaging to automotive interiors. Innovations in adhesive chemistry have expanded the boundaries of what is possible, integrating features like high heat resistance, chemical inertness, and tailored viscoelastic properties without compromising environmental compliance.

In recent years, the laminating adhesives domain has seen a convergence of performance enhancement and sustainability imperatives. Biobased polymers and low-VOC formulations now complement traditional hot melt, solvent-based, and water-based systems, reflecting evolving regulatory frameworks and consumer preferences for greener products. As digital printing and advanced coatings gain traction, adhesives must also adapt to novel substrates and processing speeds, ensuring seamless compatibility with high-throughput manufacturing environments.

This executive summary distills the critical insights derived from an extensive research initiative, providing stakeholders with a clear understanding of the current industry dynamics, emerging trends, and actionable intelligence. It serves as a concise guide for decision-makers to navigate the complexity of material choices, regulatory influences, and competitive pressures in the laminating adhesives market.

Examining the Major Technological and Regulatory Transformations Reshaping the Global Laminating Adhesives Market Landscape and Stakeholder Strategies

Over the past decade, the laminating adhesives landscape has undergone transformative shifts driven by technological advancements, regulatory mandates, and evolving end-market requirements. Sustainability has emerged as a central theme, with manufacturers accelerating the adoption of bio-based feedstocks and developing low-emission formulations that comply with stringent global air quality standards. This transition has been further catalyzed by consumer demand for eco-friendly packaging and product labeling, prompting suppliers to integrate life-cycle assessments and circular economy principles into their R&D pipelines.

Concurrently, digitalization and Industry 4.0 have introduced new paradigms in adhesive application processes. Automated dispensing systems, real-time quality monitoring, and predictive maintenance protocols now enhance production efficiency and reduce waste. The integration of UV-curable and pressure-sensitive adhesive technologies into inline processing has enabled shorter cycle times and greater design flexibility, accommodating complex substrate geometries and high-resolution laminations. As a result, manufacturers can deliver high-quality outputs while maintaining cost controls and minimizing downtime.

Regulatory environments across major jurisdictions have also evolved, with updated chemical registration requirements, restrictions on hazardous solvents, and incentives for green innovation shaping market entry strategies. This dynamic interplay between policy and technology underscores the importance of agile R&D capabilities, strategic partnerships, and robust supply chain management to capitalize on emerging growth opportunities in the laminating adhesives sector.

Analyzing the Aggregate Effects of 2025 United States Import Tariffs on Raw Materials and Supply Chain Resilience Within the Laminating Adhesives Sector

In 2025, new United States tariffs on critical adhesive raw materials exerted a cumulative effect on supply chain costs and strategic sourcing decisions. By targeting imported petrochemical intermediates and specialty polymers, these measures prompted a reevaluation of supplier contracts and inventory management practices across the laminating adhesives value chain. The immediate consequence was an upward pressure on resin and solvent prices, leading manufacturers to explore alternative chemistries and nearshoring to mitigate exposure to import duties.

The implementation of Section 301 and Section 232 tariffs also accelerated the development of domestic production capabilities. Research and pilot-scale facilities received renewed investment to produce key monomers and additives locally, reducing dependency on overseas suppliers. Meanwhile, global adhesive formulators adjusted pricing models to balance cost recovery with competitive positioning, often engaging in structured hedging arrangements and long-term purchase agreements to stabilize raw material expenses.

Longer-term, the tariffs reinforced the strategic importance of diversified sourcing networks and flexible formulation platforms. Producers expanded partnerships with regional distributors and embraced lean manufacturing techniques to optimize operational resilience. These adaptations not only cushioned the impact of trade policy shifts but also positioned the industry to respond more swiftly to future market disruptions, ensuring sustained innovation and customer satisfaction.

Uncovering Critical Type, Application, End-Use, and Technology Segments That Define Demand Patterns and Innovation Trajectories in the Laminating Adhesives Market

Insights into the laminating adhesives market reveal distinct performance profiles across the major adhesive types, including hot melt systems known for rapid bond strength, reactive technologies prized for chemical resistance, solvent-based formulations offering industrial-grade durability, UV-curable solutions enabling rapid curing under low heat, and water-based products valued for their environmental compliance. Each type commands attention for its unique blend of processing requirements and end-use performance, shaping buyer preferences and supplier innovation roadmaps.

Application-based segmentation underscores the breadth of market demand. Automotive interiors increasingly rely on high-performance laminating adhesives to bond multilayer substrates that enhance aesthetic appeal and interior comfort. Decorative laminates for furniture and architectural surfaces leverage adhesives that maintain clarity and resistance to wear. Flexible packaging applications span food, industrial, and pharmaceutical segments, where adhesives must meet stringent hygiene standards while ensuring strong seals under varying thermal and mechanical stresses. Graphic films and materials used in digital and screen printing demand adhesives that deliver precision registration and adhesion to engineered films, while labeling technologies such as in-mold labeling, self-adhesive, and shrink sleeve formats require formulations tailored for distinct surface energies and shrink characteristics.

From an end-use industry perspective, sectors like electronics and medical devices drive demand for adhesives with rigorous performance qualifications, including moisture barrier properties and biocompatibility. In construction and furniture, aesthetic durability and ease of processing are key. Packaging and textile applications continue to push the boundaries of lightweight, flexible laminations that maintain integrity under dynamic conditions. Underpinning these applications are advanced technologies-extrusion processes delivering uniform adhesive layers, heat-sealable systems enabling on-the-fly lamination in packaging lines, and pressure-sensitive platforms that offer peel-and-stick convenience-each contributing to optimized production workflows and end-product differentiation.

This comprehensive research report categorizes the Laminating Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End-Use Industry

- Technology

Evaluating Distinct Regional Dynamics Across the Americas, EMEA, and Asia-Pacific That Drive Laminating Adhesives Adoption and Competitive Positioning

Regional dynamics within the laminating adhesives market reflect a tapestry of economic maturity, regulatory frameworks, and industrial specialization. In the Americas, established manufacturing bases in North America focus on sustainable product development and lean production methodologies, supported by robust regulatory oversight and a sophisticated supplier network. Latin American markets demonstrate growing interest in cost-effective water-based and UV-curable formulations, driven by expanding food and consumer goods packaging industries seeking to meet both performance and environmental criteria.

Europe, the Middle East & Africa present a unique combination of stringent chemical regulations, sustainability incentives, and high-end application demand. European adhesive producers lead in developing bio-derived chemistries and zero-VOC products to comply with REACH and local air quality mandates, while Middle Eastern markets show potential for growth in construction laminates spurred by infrastructure investments. In Africa, limited domestic production capacity has fostered reliance on global suppliers, yet burgeoning packaging and textile sectors indicate an emerging opportunity for localized adhesive solutions.

Asia-Pacific remains the fastest-growing region for laminating adhesives due to surging demand from electronics assembly, automotive manufacturing, and flexible packaging. China and Southeast Asia invest heavily in capacity expansion and strategic joint ventures with international technology leaders. Japan and South Korea continue to set benchmarks in high-performance reactive and UV-curable systems for specialized industrial applications. The region’s diverse market needs and favorable investment climate ensure that it will remain a critical driver of global adhesive innovation and volume consumption.

This comprehensive research report examines key regions that drive the evolution of the Laminating Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants and Their Strategic Initiatives That Shape Market Competition and Growth in the Laminating Adhesives Domain

Leading companies in the laminating adhesives sector differentiate themselves through targeted R&D investments, strategic partnerships, and comprehensive portfolio offerings that address emergent industry needs. Some frontrunners have expanded their capabilities by acquiring specialty polymer producers to integrate upstream feedstock control with downstream formulation expertise, thereby enhancing supply stability and cost predictability.

Other key market participants prioritize sustainability credentials, collaborating with certification bodies to validate bio-based content and circularity metrics. These initiatives not only satisfy regulatory demands but also align with customer commitments to ESG principles, strengthening brand reputations. A number of companies have also embraced digital service models, offering technical support through virtual platforms and deploying sensor-enabled dispensing equipment to optimize adhesive usage and quality assurance in real time.

Across the competitive spectrum, alliances between material producers, equipment manufacturers, and end users have emerged as a critical mechanism for co-developing next-generation adhesive solutions. By leveraging cross-industry expertise, these collaborations accelerate time-to-market and foster the creation of application-specific formulations that address the nuanced requirements of sectors ranging from medical devices to flexible electronics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laminating Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Avery Dennison Corporation

- Bostik, Inc.

- Covestro AG

- DIC Corporation

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Flint Group

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- Paramelt B.V.

- Pidilite Industries Limited

- Sika AG

- Sun Chemical Corporation

- The Dow Chemical Company

- Toyo-Morton Co., Ltd.

- UFlex Limited

- Wacker Chemie AG

Formulating Strategic Initiatives for Industry Leaders to Accelerate Growth, Strengthen Supply Chains, and Drive Innovation in Laminating Adhesives

Industry leaders should prioritize the acceleration of sustainable adhesive technologies, investing in bio-based chemistries and low-emission processes to meet tightening regulatory standards and evolving customer expectations. By establishing clear roadmaps for product eco-design and collaborating with supply chain partners on circular economy programs, organizations can secure long-term competitive advantage while minimizing environmental impact.

Supply chain resilience is equally critical; manufacturers should diversify their raw material sources and explore nearshoring opportunities to reduce exposure to trade policy shifts and logistic disruptions. Developing strategic inventory buffers and leveraging advanced sourcing analytics will enhance agility in response to sudden cost fluctuations or supply constraints. Concurrently, the integration of digital manufacturing tools-such as automated applicators with real-time monitoring and predictive quality algorithms-can drive operational efficiencies and reduce waste, translating directly to improved margins.

Furthermore, fostering cross-sector collaboration through open innovation platforms will enable the co-creation of tailored adhesive solutions that address specific end-use challenges. Engaging in joint development agreements with equipment OEMs and end users ensures that formulation advancements are tightly aligned with production processes, while participation in industry consortia can provide early insights into regulatory changes and emerging market trends.

Detailing the Comprehensive Research Framework, Data Collection Processes, and Analytical Techniques Underpinning the Laminating Adhesives Market Report

The research methodology underpinning this laminating adhesives market report follows a rigorous, multi-phase approach designed to ensure accuracy, relevance, and depth of analysis. It commenced with an extensive secondary research phase, examining a wide range of publicly available sources such as trade publications, regulatory filings, patent databases, and corporate disclosures to establish baseline market intelligence and identify key industry players.

Primary research interviews with senior executives, technical specialists, and procurement managers across the adhesive value chain provided qualitative insights into formulation priorities, application challenges, and purchasing criteria. These discussions were complemented by quantitative surveys distributed to end users in automotive, packaging, electronics, and medical device sectors, enabling statistical validation of demand drivers and adoption rates across segments.

Data triangulation techniques were employed to reconcile primary feedback with secondary data, ensuring consistency across geographies and end-use industries. Advanced analytical tools facilitated regional and segmental breakdowns, while expert review panels and validation workshops ensured that final findings reflected real-world conditions and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laminating Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laminating Adhesives Market, by Type

- Laminating Adhesives Market, by Application

- Laminating Adhesives Market, by End-Use Industry

- Laminating Adhesives Market, by Technology

- Laminating Adhesives Market, by Region

- Laminating Adhesives Market, by Group

- Laminating Adhesives Market, by Country

- United States Laminating Adhesives Market

- China Laminating Adhesives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Core Findings and Strategic Implications for Stakeholders to Navigate the Evolving Laminating Adhesives Landscape with Confidence

The laminating adhesives market continues to evolve rapidly under the influence of sustainability mandates, technological innovation, and shifting trade policies. This report has highlighted the strategic importance of diversified formulation portfolios that balance performance requirements with environmental credentials. It has also underscored how digital manufacturing and automated application systems are enhancing production efficiency, quality control, and waste reduction across industries.

The imposition of new tariffs in 2025 has reinforced the need for resilient sourcing strategies and collaborative partnerships that can mitigate supply chain risk while fostering localized production capabilities. Regionally, the Americas, EMEA, and Asia-Pacific each present unique growth drivers and challenges, from regulatory complexity to infrastructure investments and evolving consumer preferences.

As stakeholders navigate this dynamic environment, the insights and recommendations presented herein provide a roadmap for making informed decisions about R&D priorities, operational investments, and strategic alliances. By embracing the coordinated adoption of sustainable practices, digital tools, and flexible supply networks, organizations can position themselves to capitalize on emerging opportunities and maintain competitive leadership.

Engage with Ketan Rohom to Access the Comprehensive Laminating Adhesives Market Research Report and Drive Strategic Advantage

Engage with Ketan Rohom (Associate Director, Sales & Marketing) to secure your access to the most comprehensive laminating adhesives market research report available today. By collaborating directly with Ketan, you gain personalized guidance on how the detailed insights within this study align with your strategic objectives and operational challenges, ensuring you extract maximum value from every page. This call will empower you with a clear roadmap for leveraging emerging opportunities and mitigating risks in an increasingly complex global environment. Reach out now to transform these actionable findings into measurable business outcomes and to position your organization at the forefront of innovation in the laminating adhesives sector.

- How big is the Laminating Adhesives Market?

- What is the Laminating Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?