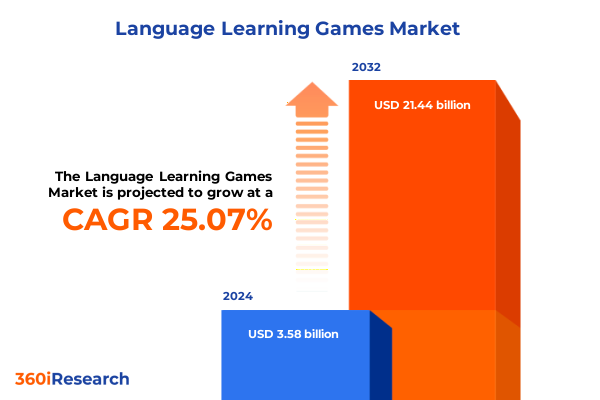

The Language Learning Games Market size was estimated at USD 4.45 billion in 2025 and expected to reach USD 5.55 billion in 2026, at a CAGR of 25.15% to reach USD 21.44 billion by 2032.

Unveiling the Ascendant Realm of Language Learning Games That Revolutionize Engagement and Accelerate Fluency Through Immersive Play Experiences

The world of language education has undergone a profound transformation as digital technologies converge with pedagogical best practices to create highly engaging, game-based learning environments. In the wake of accelerating global connectivity and evolving consumer expectations, learners increasingly seek interactive experiences that go beyond traditional flashcards and rote memorization. These gamified solutions harness principles of motivation and reward to encourage consistent practice, thereby fostering greater retention and real-world conversational confidence. Moreover, learning games have demonstrated the capacity to adapt dynamically to each individual’s pace and proficiency, creating personalized pathways that keep engagement levels high over extended periods.

Against this backdrop, the language learning games arena has become a catalyst for innovation, drawing investment from educational technology ventures, console studios, and mobile developers alike. Established edtech companies are collaborating with creative studios to integrate rich narratives and real-time feedback loops, while new market entrants employ cutting-edge artificial intelligence to simulate lifelike dialogues. At the same time, educators and corporate training programs are integrating these platforms to streamline multilingual onboarding and cross-cultural communication training. Consequently, the market is characterized by rapid iteration cycles, intense competition, and an unrelenting drive to deepen immersion through audiovisual and haptic feedback.

This executive summary distills the most salient insights gathered through a rigorous, multilayered research process. The analysis unpacks paradigm-shifting trends, assesses the cumulative impact of fiscal policies on cross-border distribution, breaks down critical segmentation dimensions, highlights regional nuances, profiles leading innovators, and culminates in strategic recommendations for industry leaders. Designed for decision-makers and subject-matter experts, this report provides an authoritative foundation for navigating the evolving language learning games ecosystem with confidence and clarity.

Tracing the Paradigm Shift Reshaping the Language Learning Landscape Through AI, AR, VR, and Rapidly Evolving User Expectations Driving Innovation

The language learning games industry is experiencing transformative shifts that are redefining how learners interact with new languages. At the forefront is the proliferation of artificial intelligence tutors, which deploy natural language processing to engage users in real-time conversational practice. These AI-powered tools not only evaluate pronunciation with granular precision but also adapt dialogue complexity to match evolving proficiency levels. Meanwhile, augmented and virtual reality applications have transitioned from proof-of-concept demos to fully integrated modules, immersing users in contextualized scenarios such as virtual marketplaces or historical reenactments. This emphasis on experiential immersion is unlocking greater cognitive association between vocabulary and real-world usage.

Concurrently, consumer expectations are evolving from passive content consumption to interactive, social learning experiences. Developers are introducing multiplayer capabilities that enable real-time collaboration and competition among peers, fostering a sense of community and collective progress. The emergence of cross-platform progression means that a learner can begin a session on a smartphone during a commute and seamlessly continue on a console or desktop environment, preserving achievements and personalized avatars. This fluidity in user experience underscores the necessity for cohesive ecosystems that bridge hardware boundaries.

Furthermore, an accelerated pace of content localization has emerged in response to a diversified global user base. Language learning games now incorporate culturally relevant narratives, dialect variations, and region-specific idioms to enhance relatability. As a result, platforms are striking a balance between scalable template-driven courses and bespoke modules tailored to niche learner segments. Taken together, these shifts underscore a market trajectory that prizes hyper-personalization, immersive interactivity, and seamless cross-device integration.

Assessing the Ongoing Ripple Effects of United States Tariffs Enacted in 2025 on Cross-Border Distribution and Hardware Accessibility for Language Learning Games

In 2025, the United States enacted a series of tariffs targeting imported electronics and gaming hardware, a move designed to bolster domestic manufacturing but one that has reverberated throughout the language learning games ecosystem. The incremental duties on gaming consoles and tablets have driven up unit costs for both consumer hardware bundles and educational kits that pair peripherals with software. Consequently, developers reliant on subsidized hardware pricing have faced margin compression, prompting many to reassess distribution partnerships and explore direct-to-consumer digital-only delivery models.

Moreover, the tariffs have impacted supply chain lead times and inventory management strategies. Companies that previously imported components from multiple Southeast Asian suppliers now confront longer procurement cycles and heightened logistics expenses. These additional overheads have, in turn, influenced pricing strategies, with some providers instituting tiered subscription models to offset one-time revenue shortfalls. At the same time, smaller developers without diversified vendor networks have experienced disproportionate disruptions, intensifying consolidation pressures as they seek scale efficiencies to weather the new fiscal environment.

Nevertheless, these challenges have catalyzed novel approaches to mitigate cost headwinds. Some industry players are accelerating the adoption of cloud-streaming solutions that reduce reliance on local hardware, while others are forging alliances with domestic assembly firms to qualify for tariff exemptions. Meanwhile, educational institutions and corporate training buyers are renegotiating procurement terms to secure bundled offerings at negotiated rates. As the market adapts, the cumulative impact of these tariffs underscores the importance of flexible supply chains, diversified go-to-market strategies, and an unwavering focus on delivering value that transcends hardware constraints.

Revealing Critical Segmentation Insights Across Platform Preferences, Technological Innovations, and Learning Modalities Driving Market Strategies

The language learning games market is defined by a multifaceted segmentation framework that reveals nuanced consumer behaviors and preferences. When viewed through the lens of platform, console systems deliver high-fidelity audio and controller-driven interactions favored by dedicated learners, whereas mobile experiences split into smartphone-centric micro-lessons for on-the-go practice and tablet-driven immersive scenarios that capitalize on larger displays. Parallel to this, personal computers are bifurcated into MacOS environments that attract creative professionals seeking design-rich interfaces and Windows configurations that dominate institutional deployments due to legacy compatibility.

Equally critical is the technological dimension, which categorizes solutions according to AI-powered tutors that offer chatbot-based dialogues and voice-recognition feedback, augmented reality overlays that contextualize vocabulary in real-world settings, traditional software encompassing both desktop applications and web-based platforms, and virtual reality modules that simulate fully immersive language environments. This taxonomy underscores the spectrum from low-barrier-to-entry tools to advanced, hardware-intensive experiences, guiding decisions around research and development investments and partnership ecosystems.

The final axis of segmentation centers on learning mode, ranging from conversational practice delivered via chatbot simulations and live chat games to cultural immersion scenarios that foster contextual understanding, grammar training modules that reinforce structural accuracy, and vocabulary practice games divided between flashcard-style recall drills and matching-puzzle mechanics. By cross-analyzing these dimensions, stakeholders can identify under-served combinations-such as VR-enabled cultural immersion or voice-recognition grammar training-and tailor offerings to capture incremental growth opportunities within distinct learner cohorts.

This comprehensive research report categorizes the Language Learning Games market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Technology

- Learning Mode

Illuminating Regional Variances and Emerging Growth Drivers Spanning the Americas, EMEA, and Asia-Pacific Language Learning Game Ecosystems

Regional dynamics in the language learning games market illustrate how geographic factors shape user adoption patterns and platform evolution. In the Americas, strong consumer appetite for casual mobile gaming and established console ecosystems has driven rapid uptake of smartphone-based micro-lesson apps, especially among young professionals seeking flexible, anytime-anywhere learning options. Meanwhile, educational institutions in North America are integrating immersive VR modules into language curriculums to simulate study-abroad environments without physical travel, reflecting a broader emphasis on experiential pedagogy.

Across Europe, the Middle East, and Africa, the market is shaped by linguistic diversity and regulatory considerations that encourage content localization and multilingual support. European markets, in particular, have seen growth in AI-powered voice tutors that address the demand for accent training and fine-tuned pronunciation, whereas EMEA’s varied infrastructure conditions have led to hybrid deployment models that blend offline desktop applications with periodic online synchronization. Moreover, government initiatives promoting digital literacy are increasingly subsidizing language learning technology for under-represented communities.

In the Asia-Pacific region, fierce competition among local and global providers has elevated standards for user engagement and platform sophistication. High mobile penetration rates in Southeast Asia underpin the popularity of conversational practice games, while mature markets such as Japan and South Korea prioritize advanced AR overlays and VR simulations to deepen contextual immersion. Furthermore, regional e-commerce partnerships have enabled subscription bundling with popular lifestyle apps, fostering cross-sector synergies and accelerating growth in subscription-based language learning games.

This comprehensive research report examines key regions that drive the evolution of the Language Learning Games market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Challengers Who Are Defining the Future of Interactive Language Learning Experiences

The competitive landscape is characterized by established education technology companies, specialist gaming studios, and emergent startups vying for learner loyalty. Leading innovators have distinguished themselves through proprietary AI engines that deliver real-time feedback with pronounced accuracy, integrated social features that foster collaborative study, and expansive content libraries spanning dozens of language pairs. At the same time, challenger brands are carving out niches by focusing on underserved language segments, embedding culturally authentic narratives, and adopting freemium models that lower barriers to entry.

Strategic partnerships between software developers and hardware manufacturers are redefining the distribution paradigm. Console producers have begun offering bundled language learning game packages, while wearable technology firms are exploring haptic feedback integrations to reinforce pronunciation through subtle tactile cues. Concurrently, mobile platform operators are leveraging their distribution networks to introduce pre-installed learning game apps, accelerating user acquisition rates and enabling data-driven personalization at scale.

Investment patterns further illuminate emerging frontrunners and potential disruptors. Series funding rounds concentrated on AI and AR innovations have propelled several startups to unicorn status, while acquisitions by larger edtech conglomerates have consolidated gaps in content specialization and technological expertise. Companies that demonstrate agility in iterating product roadmaps and depth in pedagogical content development are best positioned to maintain momentum as consumer expectations evolve.

This comprehensive research report delivers an in-depth overview of the principal market players in the Language Learning Games market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ATi Studios SRL

- Busuu Limited

- Drops Learning Ltd.

- Duolingo, Inc.

- HelloTalk Inc.

- Lesson Nine GmbH

- Lingokids Inc.

- Memrise Ltd.

- Rosetta Stone Inc.

- Tripod Technology GmbH

Delivering Actionable Strategic Imperatives for Industry Leaders to Capitalize on Technological Advances and Evolving Consumer Demand in Language Learning Games

Industry leaders must prioritize the integration of adaptive AI tutors into modular frameworks that allow seamless integration with third-party content and analytics platforms. By deploying machine learning algorithms that continuously refine difficulty levels and personalize learning paths, organizations can enhance retention and foster deeper user engagement. In addition, expanding cross-device continuity-through cloud-based save states and unified progress tracking-will be crucial to accommodate learners who transition between smartphones, tablets, and gaming consoles throughout their day.

Moreover, forging strategic alliances with hardware manufacturers and infrastructure providers can mitigate the impact of shifting tariff regimes. Joint ventures aimed at local assembly, cloud gaming streaming partnerships to circumvent hardware cost escalations, and co-marketing initiatives with mobile carriers can unlock new distribution channels and broaden market access. At the same time, cultivating strong relationships with educational institutions and corporate clients will drive recurring revenue streams and create opportunities for co-development of bespoke training modules.

Finally, industry leaders should invest in rigorous localization approaches that extend beyond mere translation to incorporate regionally specific idioms, cultural narratives, and dialectal variations. Combining user-generated content frameworks with expert-curated course material can satisfy diverse learner cohorts and accelerate community-driven innovation. By maintaining a relentless focus on personalization, seamless experience orchestration, and ecosystem partnerships, organizations can secure a sustainable competitive advantage in the evolving language learning games market.

Outlining a Robust Multilayered Research Methodology Integrating Quantitative Surveys, Expert Interviews, and Data Triangulation Processes

This research synthesizes insights from a meticulously designed mixed-methods approach, beginning with primary interviews conducted with senior executives at leading language learning and gaming companies. Detailed conversations provided qualitative perspectives on strategic priorities, technology roadmaps, and market positioning. Complementing these interviews, an extensive quantitative survey of end-users spanning diverse demographic cohorts captured data on usage patterns, platform preferences, and feature importance, ensuring that the analysis reflects real-world behaviors and unmet needs.

Secondary research constituted a thorough review of publicly available financial statements, patent filings, industry white papers, and academic journals to trace historical innovation cycles and competitive dynamics. Data triangulation techniques reconciled disparate sources, enabling cross-validation of key findings and minimizing potential biases. In parallel, a dedicated expert panel comprising linguists, game designers, and artificial intelligence specialists convened to evaluate emerging trends and stress-test hypotheses, adding a layer of domain-specific rigor to the research.

Finally, the methodological framework incorporates iterative validation exercises, where preliminary insights were presented to a cross-section of stakeholders for feedback. This cyclical refinement process not only enhanced the accuracy of the resultant analysis but also uncovered latent market signals that informed the strategic recommendations. By blending quantitative robustness with qualitative depth, the study delivers a comprehensive, actionable view of the language learning games ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Language Learning Games market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Language Learning Games Market, by Platform

- Language Learning Games Market, by Technology

- Language Learning Games Market, by Learning Mode

- Language Learning Games Market, by Region

- Language Learning Games Market, by Group

- Language Learning Games Market, by Country

- United States Language Learning Games Market

- China Language Learning Games Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesizing Key Discoveries to Provide a Definitive Overview of the Language Learning Games Market’s Current State and Forward-Looking Trajectory

Through a holistic examination of technological innovations, fiscal policy impacts, segmentation dynamics, and regional nuances, this report offers a comprehensive portrait of the language learning games market as it stands in mid-2025. The convergence of AI-driven tutors, immersive AR and VR modules, and adaptive learning modalities has redefined expectations for engagement and efficacy. Meanwhile, macroeconomic measures such as newly imposed tariffs have underscored the importance of agile supply chains and alternative distribution strategies.

Critical segmentation insights reveal that opportunities lie at the intersections of platform capabilities, technological sophistication, and personalized learning modes-particularly in under-penetrated combinations like voice-enabled grammar training and VR-based cultural immersion. Regional analysis highlights how disparate infrastructure landscapes and regulatory frameworks shape consumer adoption, underscoring the need for localized go-to-market strategies. Additionally, the competitive landscape continues to evolve, with both incumbents and agile startups driving continuous innovation in content, features, and pricing models.

Taken together, the findings point to a market poised for further disruption, where success will hinge on the ability to orchestrate seamless, cross-device experiences, leverage advanced personalization engines, and cultivate strategic partnerships that transcend hardware and geographic boundaries. Organizations that embrace these imperatives will be well positioned to capture new growth opportunities and deliver transformative learning outcomes.

Seize the Opportunity to Engage with Ketan Rohom and Secure the Definitive Comprehensive Market Research Report on Language Learning Games

To explore how your organization can leverage these insights and gain a competitive edge in the rapidly evolving language learning games market, contact Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s strategic expertise will guide your team through the nuances of market positioning, product enhancement, and partnership opportunities that align with the findings presented in this comprehensive report. Engaging with an expert who understands both the technical innovation landscape and end-user dynamics ensures that your investment in market intelligence will translate into actionable strategies and measurable outcomes. Reach out today to secure exclusive access to detailed datasets, in-depth analyses, and tailored recommendations designed to accelerate your success in this dynamic sector.

- How big is the Language Learning Games Market?

- What is the Language Learning Games Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?