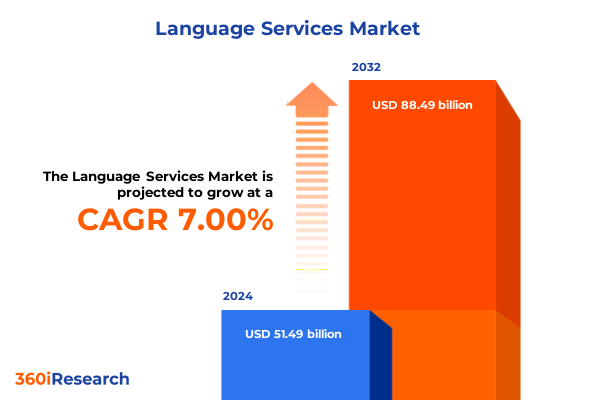

The Language Services Market size was estimated at USD 55.11 billion in 2025 and expected to reach USD 58.46 billion in 2026, at a CAGR of 6.99% to reach USD 88.49 billion by 2032.

Unveiling the Evolving Dynamics of the Language Services Industry to Illuminate Key Drivers and Emerging Strategic Opportunities

The global language services industry stands at a pivotal juncture, where evolving globalization patterns, rising consumer expectations and rapid technological progress converge to redefine traditional service paradigms. Across interpreting, translation, localization, transcription and machine translation, stakeholders are now challenged to deliver seamless multilingual experiences at speed and scale. With organizations expanding into new markets and digital channels proliferating, the pressure to provide culturally resonant, accurate content has never been greater.

This introduction outlines the fundamental market forces currently shaping the language services landscape. From the accelerated adoption of AI-driven tools to the resurgence of demand for high-touch interpreting and training solutions, industry players must balance innovation with quality control. The following sections dissect these transformative developments, illustrate the implications of recent policy shifts, and deliver strategic insights to guide decision-makers toward sustainable growth.

Examining Pivotal Technological Innovations and Market Disruptions Redefining the Competitive Landscape in Language Services

Significant disruption is underway as neural machine translation, speech recognition systems and advanced terminology management platforms gain maturity, prompting service providers to recalibrate their offerings. Simultaneously, the emergence of post-editing solutions and platform-as-a-service delivery models underscores a shift toward more integrated, end-to-end solutions. Legacy businesses are now grappling with the imperative to forge partnerships with technology vendors or invest in proprietary tools to maintain relevancy.

Beyond technological advancements, market volatility and shifting buyer preferences are reshaping competitive dynamics. Organizations increasingly seek flexible delivery modes that combine onsite and remote engagement, while also demanding transparent pricing and impeccable data security. Such paradigm shifts compel language service providers to enhance operational agility, deepen domain expertise and foster closer collaboration with end-user industries.

Assessing the Ramifications of 2025 Tariff Adjustments on United States Language Services and Supply Chain Continuity

In 2025, the United States implemented a renewed set of tariffs aimed at protecting domestic manufacturing and technology sectors, which inadvertently extended to software and digital content services. The language services realm, particularly providers reliant on international vendor networks for translation management systems or terminology databases, has felt the reverberations through increased import costs for specialized software licenses and hardware. These additional levies have strained operational budgets and prompted renegotiation of vendor contracts.

The cumulative impact of these tariff adjustments has also manifested in higher end-user pricing, as service providers pass through a portion of the added costs to maintain margins. Clients operating across multiple jurisdictions have begun to reassess their sourcing strategies, favoring local vendors or seeking hybrid delivery models that optimize onsite expertise with remote, cost-effective resources. Such supply chain realignments highlight the need for providers to adopt more diversified procurement approaches and invest in in-region infrastructure to mitigate future policy-driven risks.

Deriving Actionable Insights from a Multifaceted Segmentation Framework to Target Language Service Verticals Effectively

A nuanced segmentation framework reveals distinct growth vectors and service demands across the varied spectrum of language offerings. Based on service type, interpreters specializing in consecutive, remote and simultaneous modes are experiencing surges as multinational events resume in hybrid formats and regulatory compliance mandates increase. Language training, whether delivered through classroom environments, corporate workshops or online platforms, is witnessing renewed traction as organizations prioritize skills development amid talent shortages. Localization efforts span game, software and website contexts, each requiring specialized cultural adaptation and technical proficiency to resonate with target demographics. Meanwhile, machine translation solutions, encompassing standalone software, managed services models and post-editing workflows, continue to disrupt traditional translation by delivering rapid baseline content that human linguists refine. Subtitling and voice-over services remain critical for multimedia content, while transcription in business, legal and medical verticals underpins both accessibility and compliance. Document translation, software translation and website translation complete the ecosystem, illustrating the broad spectrum of text-based conversion services.

End-user industries further illuminate the demand landscape. Automotive manufacturers and BFSI institutions are investing heavily in technical translations and compliance documentation, while educational entities and government agencies seek interpreting and language training to meet inclusivity goals. Healthcare and life sciences players require meticulous accuracy for clinical trial materials and patient information, whereas IT and telecommunications firms demand rapid deployment of localized interfaces. Manufacturing operations leverage interpretation and translation for safety protocols, media and entertainment houses rely on high-quality subtitling, and retail and e-commerce platforms prioritize multilingual marketing content to engage diverse customer segments.

Delivery mode segmentation offers additional insight into operational preferences. Hybrid models that blend partial onsite with partial remote resources are lauded for balancing cost efficiency with contextual expertise. Fully onsite engagements remain vital for high-stakes assignments requiring nuanced cultural awareness, while pure remote options-whether over the phone or via video channels-cater to urgent, ad hoc needs and leaner budgets. Technology type differentiation underscores the growing importance of computer-assisted translation tools, machine translation, speech recognition systems, terminology management systems and translation management systems in delivering consistent, scalable quality. Finally, the business model layer highlights the competitive tension between freelance platforms offering flexible talent pools, in-house language service centers assuring dedicated quality control, and outsourced service providers delivering end-to-end management.

This comprehensive research report categorizes the Language Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology Type

- Business Model

- End-User

- Delivery Mode

Comparative Regional Dynamics Shaping Demand Patterns across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics illustrate varying adoption patterns and regulatory environments that influence growth and investment priorities in the language services market. In the Americas, particularly North America, robust enterprise demand for advanced translation management systems and machine translation solutions is driven by cross-border trade agreements and digital content proliferation. Latin American pockets demonstrate an uptick in interpreting services, fueled by expanding energy and infrastructure projects that require real-time language support.

In the Europe, Middle East & Africa sphere, stringent data privacy regulations have elevated the importance of secure, onshore data processing, prompting service providers to localize data centers and refine compliance protocols. Multilingual diversity in Europe sustains steady demand for translation and localization, while Middle Eastern markets leverage remote interpretation to bridge linguistic gaps during diplomatic and commercial negotiations. Africa’s burgeoning technology hubs are fostering opportunities for voice recognition and transcription services, albeit tempered by infrastructure and bandwidth constraints.

Asia-Pacific presents a dynamic tableau of rapid digital transformation, where e-commerce platforms, gaming companies and software developers invest heavily in localization to capture local audiences. Regional cloud adoption supports scalable remote delivery, and government initiatives around language preservation and digital inclusion are stimulating demand for subtitling, voice-over and language training programs. Together, these regional insights underscore the necessity for providers to tailor service portfolios and compliance measures in alignment with location-specific requirements.

This comprehensive research report examines key regions that drive the evolution of the Language Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Competitive Positioning of Leading Language Service Providers Driving Market Evolution

A review of leading market participants reveals a clear divergence between technology-centric and service-centric strategic approaches. Organizations emphasizing proprietary neural machine translation engines and integrated translation management platforms have carved out competitive moats through continuous algorithmic enhancements and robust terminology repositories. Conversely, service-centric providers have doubled down on domain expertise, assembling specialized linguist networks in legal, medical and technical fields, and investing in certification and quality assurance frameworks.

Partnerships between technology vendors and full-service language enterprises are also proliferating, as firms seek to offer bundled solutions combining software, human expertise and managed service models. This trend is catalyzing the emergence of hybrid business models that deliver rapid turnaround via machine translation with optional human post-editing. Additionally, companies investing in cloud-native infrastructures and microservice architectures are better positioned to scale globally and integrate with client systems through APIs, thereby enhancing client retention and operational resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Language Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acolad Group SAS

- Appen Ltd

- Certified Languages International Inc

- CyraCom International Inc

- GienTech Technology Corporation

- Global Talk Group Inc

- Hogarth Worldwide Ltd

- Honyaku Center Inc

- LanguageLine Solutions Inc

- LanguageWire AS

- LOGOS Group AG

- President Translation Service Group International Inc

- RWS Holdings plc

- STAR Group AG

- STAR7 Group SA

- Translated Srl

- Translation Bureau

- TransPerfect Global Inc

- Unbabel Inc

- Welocalize Inc

Formulating Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends and Enhance Operational Agility

To capitalize on these evolving trends, industry leaders should prioritize investments in modular technology stacks that facilitate seamless integration between machine translation, terminology management and translation management systems. By adopting a composable architecture, organizations can accelerate deployment cycles and offer clients customizable workflows that align with complex multilingual requirements.

Equally important is the cultivation of specialized talent pools through targeted recruitment, certification programs and incentive structures that reward linguistic excellence and cultural fluency. Firms can further differentiate by establishing centers of excellence in key industry verticals and partnering with academic institutions to develop emerging language technologists. Lastly, embedding data analytics capabilities and client dashboards into service offerings will enable real-time performance tracking, informed decision-making and deeper client engagement, all of which are essential for long-term differentiation.

Detailing a Robust Multistage Research Methodology Ensuring Data Accuracy, Reliability, and Comprehensive Market Insights

The findings summarized in this report stem from a rigorous, multi-phased research methodology integrating primary and secondary approaches. Initially, an extensive review of industry publications, white papers and regulatory documents provided foundational context and identified prevailing trends. This desk research informed the design of in-depth interviews and surveys conducted with C-level executives, sourcing managers and technical leads across a representative cross-section of global enterprises.

Quantitative data was corroborated through statistical analysis of procurement records, technology adoption metrics and vendor performance reports, while qualitative insights were gathered via expert roundtables and language industry forums. Throughout the process, data integrity was ensured through cross-validation protocols and adherence to established research ethics standards. This comprehensive methodology underpins the robustness and reliability of the strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Language Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Language Services Market, by Service Type

- Language Services Market, by Technology Type

- Language Services Market, by Business Model

- Language Services Market, by End-User

- Language Services Market, by Delivery Mode

- Language Services Market, by Region

- Language Services Market, by Group

- Language Services Market, by Country

- United States Language Services Market

- China Language Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings and Strategic Implications to Illuminate Pathways for Sustained Growth and Competitive Differentiation

In closing, the language services industry is navigating a period of profound transformation characterized by technological innovation, evolving buyer expectations and shifting regulatory landscapes. Providers that adeptly blend advanced machine translation capabilities with deep domain expertise, robust quality assurance mechanisms and agile delivery models will emerge as market leaders. Those that fail to adapt risk obsolescence in an arena defined by speed, precision and cultural relevance.

This summary distills the critical insights required for decision-makers to chart a clear path forward. By leveraging the segmentation and regional analyses, benchmarking competitive strategies and adhering to the articulated strategic imperatives, stakeholders can position themselves to capture emerging opportunities and mitigate policy-driven disruptions. The journey toward sustained growth and competitive differentiation begins with informed, strategic action based on comprehensive, data-driven intelligence.

Drive Strategic Advantage by Securing the Comprehensive Language Services Market Report through Direct Engagement with Ketan Rohom

To move from insight to action, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure the in-depth language services market report designed to empower your decision-making. Engage today to gain tailored executive briefings, exclusive data breakdowns, and strategic roadmaps that will reinforce your organization’s competitive edge. Connect directly with Ketan Rohom to discuss customized research packages, licensing options, or enterprise-wide access models and begin leveraging actionable intelligence immediately.

- How big is the Language Services Market?

- What is the Language Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?