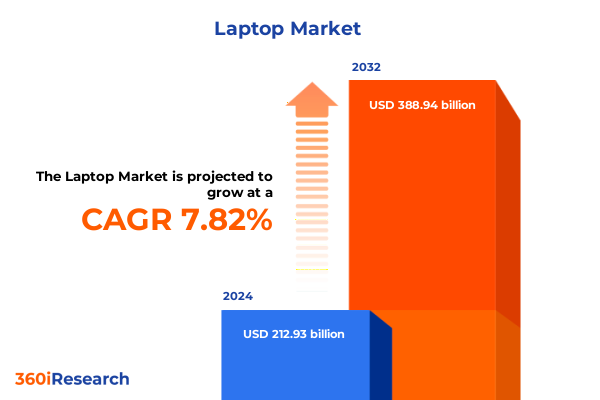

The Laptop Market size was estimated at USD 228.71 billion in 2025 and expected to reach USD 245.82 billion in 2026, at a CAGR of 7.88% to reach USD 388.94 billion by 2032.

Setting the Stage for Laptop Innovation and Market Evolution in the Wake of Technological Convergence and Consumer Demand Dynamics

Amid unprecedented digital transformation and an accelerating pace of innovation, the laptop market has emerged as a cornerstone of global productivity and creativity. The confluence of remote work mandates, e-learning expansion, and immersive entertainment demands has elevated laptops from mere computing devices to critical lifelines for professionals, students, and creative enthusiasts alike. As organizations pursue digital-first strategies, the need for flexible, high-performance, and energy-efficient machines has never been more pronounced. This introduction sets the stage for a comprehensive exploration of how technological convergence, shifting consumer behaviors, and supply chain complexities are converging to redefine the laptop market landscape.

Looking ahead, stakeholders must anticipate evolving expectations surrounding portability, battery longevity, and integrated security features, all while balancing sustainability imperatives and cost efficiency. Pressures from geopolitical developments and component shortages further accentuate the importance of resilience and agility in supply network design. In this context, the insights that follow are designed to equip decision makers with a clear understanding of key inflection points, enabling strategic investments that capitalize on emerging opportunities and mitigate potential disruptions.

Unpacking the Pivotal Technological Consumer Behavior and Supply Chain Shifts Redefining the Global Laptop Market Ecosystem

Unpacking the dynamics of the laptop market reveals a tapestry of transformative shifts that span technological breakthroughs, consumer preferences, and global supply infrastructures. At the technological forefront, advances in processor architectures and integrated AI accelerators are pushing performance boundaries while driving a surge in power-efficient chip designs. These improvements enable sleeker form factors without compromising computational capabilities, thereby fuelling demand for ultralight notebooks and convertible formats. Concurrently, rapid refinement of display technologies, including variable refresh rates and adaptive power management, is redefining the user experience across productivity and gaming segments.

Moreover, shifting consumer behavior toward hybrid lifestyles is propelling demand for versatile devices capable of seamless transitions between personal, professional, and entertainment contexts. This has galvanized manufacturers to invest in enhanced connectivity options such as 5G integration and expanded IoT compatibility, ensuring uninterrupted workflows and enriched content consumption. At the same time, disruptions in global supply chains-rooted in component shortages and geopolitical tensions-are driving regional diversification strategies and long-term supplier partnerships. Stakeholders are increasingly focused on fortifying logistics networks to maintain inventory fluidity and minimize lead times. Together, these shifts underscore the intricate, interdependent nature of modern laptop market forces, setting the stage for a period of rapid evolution and competitive realignment.

Exploring How the 2025 United States Tariff Adjustments Are Reshaping Cost Structures and Competitive Dynamics in Laptop Production

The 2025 adjustments to United States tariffs on imported computing components and finished devices have cascading effects across cost structures, pricing strategies, and competitive dynamics. Manufacturers that rely heavily on international supply sources have witnessed material cost upticks, necessitating recalibrations in procurement policies and inventory management tactics. These cost pressures are further exacerbated by fluctuating currency exchange rates, compelling firms to explore alternative sourcing geographies to preserve margin targets without compromising on component quality or innovation roadmaps.

In response, some industry players are accelerating investments in localized manufacturing hubs and assembly facilities, aiming to mitigate exposure to tariff-driven volatility. This strategic pivot not only improves supply chain resilience but also unlocks opportunities to tailor products to regional preferences, tapping into localized feature sets and service ecosystems. From a competitive standpoint, companies with vertically integrated operations and robust R&D pipelines are better positioned to absorb tariff shocks and maintain price competitiveness. Meanwhile, smaller entrants face heightened barriers to entry as capital and operational leeway narrow, potentially fueling consolidation or strategic alliances. As such, the cumulative impact of the 2025 tariff landscape extends beyond immediate cost implications, reshaping the broader strategic calculus and reinforcing the imperative for agile, diversified supply architectures.

Intriguing Insights into Product Type Operating System Screen Size RAM and End User Segmentation that Illuminate Market Nuances

An in-depth segmentation analysis illuminates nuanced demand patterns and growth drivers across diverse user cohorts and product configurations. Insights drawn from the product type segmentation reveal that convertible laptops designed for seamless mode-switching are surging in popularity among professionals seeking versatile hybrid workstations, while dedicated gaming laptops-with their high-refresh-rate displays and advanced cooling solutions-continue to capture the attention of esports enthusiasts and content creators. Meanwhile, rugged laptops engineered for harsh environments are carving out a stable niche within industrial and field operations, even as ultrabooks and traditional clamshell designs maintain broad appeal thanks to their balanced performance-to-portability ratios. High-end workstation laptops, tailored for complex computational workloads, reaffirm their critical role in engineering, design, and data science applications.

Operating system segmentation further delineates distinct user preferences that inform platform development strategies. Windows remains the incumbent for enterprise deployments and software compatibility, while Chrome OS’s cloud-centric simplicity resonates within education and light productivity segments. MacOS sustains its premium positioning among creative professionals, and Linux distributions offer customizable environments for developers and research institutions. Screen size considerations underscore the significance of both compact form factors under 12 inches-favored for ultimate portability-and larger screens above 18 inches deployed in immersive gaming and multimedia editing contexts. The mid-range 12-14 inch and 15-18 inch categories continue to dominate mainstream usage, balancing usability with ergonomic viewing experiences.

Analyzing RAM size preferences uncovers a bifurcation between entry-level configurations with 4GB-8GB of memory for basic tasks and power-user segments gravitating toward 8GB-16GB or above 16GB for multitasking and virtualization workloads. End-user segmentation paints a layered portrait of market dynamics: enterprise and public sector clients drive demand for secure, high-performance rigs, with large organizations prioritizing managed deployments and small-to-medium businesses seeking cost-effective scalability. Among individuals, freelancers value portability and battery endurance, home users demand affordability and family-friendly platforms, and students pursue value-driven devices that support education-centric software ecosystems. Distribution channel insights reveal parallel growth trajectories: offline specialty retailers leverage hands-on demonstrations at electronics stores and hypermarkets, while online retailers-including both direct-to-consumer websites and third-party e-commerce platforms-capitalize on digital marketing and streamlined fulfillment models. These segmentation revelations equip stakeholders with a granular understanding of evolving requirements, informing product innovation, targeted marketing, and channel optimization strategies.

This comprehensive research report categorizes the Laptop market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Operating System

- Screen Size

- RAM Size

- End-User

- Distribution Channel

Unveiling Panoramic Distinct Market Characteristics across the Americas Europe the Middle East Africa and Asia Pacific Regions

Regional dynamics within the laptop market underscore how cultural, economic, and regulatory factors shape unique competitive landscapes and consumer behaviors. In the Americas, market momentum is driven by early adopter culture and robust commercial investments in digital transformation, with North American enterprises and educational institutions at the forefront of device upgrades. Latin America exhibits an appetite for mid-range laptops that deliver reliable performance at accessible price points, tethered to the rise of remote work solutions and digital skills initiatives.

Across Europe, the Middle East, and Africa, regulatory frameworks surrounding data security and environmental impact are reshaping procurement criteria, prompting vendors to emphasize eco-friendly materials and circular economy programs. Western Europe’s mature markets emphasize premium ultrabooks with advanced security features, whereas Central and Eastern European economies prioritize value-conscious offerings. In the Middle East and Africa, emerging urban centers are catalyzing demand for both rugged and convertible laptops, bolstered by infrastructure investments and youth-driven entrepreneurship.

Asia-Pacific remains a dynamic epicenter of production innovation and consumption. In East Asia, leading manufacturers continue to refine flagship models and integrate cutting-edge technologies such as mini-LED displays and 5G connectivity. Southeast Asian markets exhibit rapid adoption of cloud-based operating systems and hybrid work ecosystems, fueled by growing tech talent pools and government digitization agendas. South Asia’s cost-sensitive consumer base drives strong growth in budget-friendly notebooks, while Oceania’s appetite for premium designs aligns with a mature corporate sector demanding high security and streamlined device management solutions. These regional insights highlight the critical importance of tailoring value propositions to distinct market characteristics and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Laptop market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives Innovation Partnerships and Competitive Postures of Leading Laptop Manufacturers and Brands

Leading laptop manufacturers and brand portfolios are distinguished by their strategic investments in innovation, partnerships, and operational excellence. Key players with vertically integrated manufacturing operations continue to leverage economies of scale and rapid iteration cycles to introduce next-generation processors, advanced thermal management systems, and proprietary software enhancements. Strategic collaborations between component suppliers and OEMs are accelerating the deployment of AI-enabled features, from real-time performance optimization to predictive maintenance alerts that enhance device longevity.

Meanwhile, brands that prioritize ecosystem playbooks-integrating laptops with complementary peripherals, cloud services, and subscription-based software-are deepening customer engagement and driving recurring revenue streams. Competitive postures are further characterized by bold sustainability pledges, as leading vendors set ambitious carbon neutrality targets and embrace closed-loop recycling initiatives. In contrast, emerging challengers are carving out market share through differentiated design languages, localized service offerings, and disruptive pricing models that undercut incumbent margins without compromising on core functionality.

Organizations at the forefront of the market are also investing heavily in user experience innovations such as advanced biometric security, zero-touch deployment tools, and immersive multimedia platforms. By aligning R&D roadmaps with these strategic imperatives, top-tier companies are not only defending existing segments but also cultivating new growth pathways in adjacent markets like edge computing and cloud-native device management. Altogether, these corporate maneuvers underscore a landscape defined by both cooperative alliances and intense competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laptop market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Chuwi Innovation Limited

- Clevo Computer

- Dell Technologies Inc.

- Eluktronics

- Eurocom Corporation

- Framework Computer Inc.

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Haier Group

- Hasee Computer Co., Ltd.

- Hewlett-Packard Company

- HONOR Device Co., Ltd.

- HP Inc

- Huawei Technologies Co., Ltd.

- Lava International Limited

- Lenovo Group Limited

- LG Electronics Inc.

- Medion AG

- Micro-Star INT'L CO., LTD.

- Microsoft Corporation

- Panasonic Life Solutions India Private Limited

- Purism SPC

- Quanta Computer Inc.

- Razer Inc.

- Samsung Electronics Co., Ltd.

- Schenker Technologies

- Sony Group Corporation

- System76, Inc.

- Teclast Technology Co., Ltd.

- Toshiba Corporation

- TUXEDO Computers GmbH

- VAIO Corporation

- Wistron Corporation

- Xiaomi Corporation

Implementing Proactive Strategies and Tactical Roadmaps to Capitalize on Emerging Opportunities in the Dynamic Laptop Market

To thrive amid accelerating market complexity, industry leaders must adopt proactive strategies that capitalize on emerging trends and fortify their competitive positioning. Embracing modular design architectures and open hardware standards can dramatically shorten development cycles, enabling faster rollouts of tailored configurations for enterprise, education, and gaming segments. Aligning supply chain strategies with advanced analytics and scenario modeling tools will empower organizations to anticipate disruptions, optimize inventory buffers, and reduce lead times without resorting to excessive safety stock.

In parallel, cultivating close partnerships with cloud and software ecosystem providers can unlock new service-based revenue opportunities. By bundling device offerings with subscription services such as device management platforms, cybersecurity suites, and productivity software, companies can transform one-time hardware sales into long-term client relationships. Excellence in after-sales support and warranty services should be elevated as a differentiator, leveraging AI-driven helpdesk solutions and remote diagnostic capabilities to minimize downtime and enhance user satisfaction.

Sustainability must be integrated as a central tenet of product and operational strategies. Firms that adopt circular economy principles-such as component reuse, remanufacturing, and take-back programs-will not only comply with tightening regulations but also resonate with environmentally conscious buyers. Lastly, investing in continuous workforce upskilling initiatives ensures that sales, technical support, and R&D teams remain aligned with evolving customer requirements and technological innovations. By executing on these actionable recommendations, leaders can secure their positions and pave the way for sustained growth in an ever-evolving competitive environment.

Detailing the Rigorous Data Collection Analytical Framework and Validation Processes Underpinning the Comprehensive Laptop Market Study

This analysis is underpinned by a multi-stage research methodology designed to ensure rigor, reliability, and relevance. Primary data was collected through structured interviews and surveys with senior stakeholders spanning OEMs, channel partners, and enterprise IT buyers, thereby capturing firsthand perspectives on purchase criteria, technology preferences, and procurement challenges. These qualitative insights were complemented by quantitative data gathered from proprietary databases, financial disclosures, and industry consortium reports, enabling a comprehensive triangulation of market dynamics.

The analytical framework integrates cross-sectional segmentation analysis, competitive benchmarking, and supply chain mapping to reveal interdependencies and growth catalysts. Scenario planning exercises were employed to model the impacts of external variables-including tariff alterations, component supply constraints, and emerging technology adoption-on cost structures and deployment timelines. Moreover, a rigorous validation process involved peer reviews by independent domain experts and corroboration against public policy announcements, regulatory filings, and sustainability indices. Data integrity was further reinforced through consistency checks, outlier analyses, and continuous updates throughout the research lifecycle.

This robust methodology ensures that the findings presented herein reflect an authoritative, balanced perspective-equipping decision makers with the clarity needed to navigate an increasingly complex and opportunity-rich laptop market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laptop market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laptop Market, by Product Type

- Laptop Market, by Operating System

- Laptop Market, by Screen Size

- Laptop Market, by RAM Size

- Laptop Market, by End-User

- Laptop Market, by Distribution Channel

- Laptop Market, by Region

- Laptop Market, by Group

- Laptop Market, by Country

- United States Laptop Market

- China Laptop Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Insights Underscoring Key Trends Strategic Implications and Future Trajectories in the Evolving Laptop Market Landscape

The synthesis of our research highlights a market in marked transition, driven by intertwined forces of technological innovation, evolving user expectations, and geopolitical complexities. Key trends encompass the rise of AI-enabled performance enhancements, a growing emphasis on sustainability and circular economy practices, and the imperative for adaptive supply chain architectures that can withstand tariff-induced shocks. These dynamics collectively underscore a shift towards more modular, service-centric business models and localized production strategies.

Strategic implications for stakeholders include the need to balance cost efficiency with innovation velocity, to cultivate partnerships that extend beyond component supply, and to embed environmental considerations as a core value proposition. Companies that succeed will be those that align R&D investments with emerging consumer and enterprise applications, leverage data-driven insights to anticipate market inflections, and uphold agile manufacturing and distribution capabilities. Ultimately, the future trajectory of the laptop market will be defined by the ability to integrate advanced technologies-such as on-device AI and immersive interfaces-with holistic support ecosystems that enrich user experiences.

Looking forward, the convergence of cloud-native computing paradigms and edge intelligence promises to unlock new device categories and service offerings, while regulatory trends around data security and sustainability will continue to shape competitive landscapes. This conclusion reaffirms the necessity for continuous innovation and strategic foresight as the laptop market evolves into a more dynamic, interconnected ecosystem.

Secure Exclusive Access to In-Depth Laptop Market Intelligence by Connecting with the Associate Director of Sales and Marketing Today

To gain unparalleled insights and strategic clarity, engage directly with Ketan Rohom, the Associate Director of Sales & Marketing. His expertise bridges market intelligence with actionable business outcomes tailored to organizational priorities. By connecting with Ketan Rohom, stakeholders secure a detailed consultation to navigate the complexities of the evolving laptop sector, ensuring alignment with technological innovations and shifting consumer expectations. Take the next step toward competitive differentiation and sustained growth by reaching out for your fully customized market research report today

- How big is the Laptop Market?

- What is the Laptop Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?