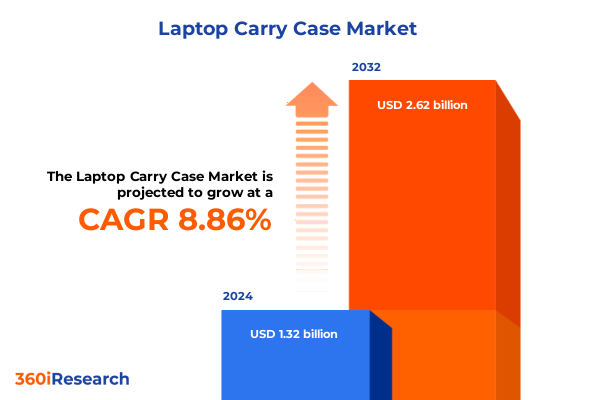

The Laptop Carry Case Market size was estimated at USD 1.44 billion in 2025 and expected to reach USD 1.57 billion in 2026, at a CAGR of 8.88% to reach USD 2.62 billion by 2032.

Exploring the Strategic Foundations and Emerging Dynamics of the Laptop Carry Case Market in a Rapidly Evolving Technological and Consumer Landscape

Exploring the Strategic Foundations and Emerging Dynamics of the Laptop Carry Case Market in a Rapidly Evolving Technological and Consumer Landscape

The modern laptop carry case market is defined by its fusion of functionality, style, and technological integration. As professional and personal workspaces converge, the demand for cases that safeguard premium devices while reflecting individual brand identities has intensified. Consumers increasingly view these accessories not merely as protection tools but as extensions of their lifestyles and professional personas.

Growth in mobile computing has been bolstered by the rise of remote work, digital nomadism, and hybrid office models. These trends have driven innovation in design, materials, and feature sets, compelling manufacturers to enhance durability, ergonomics, and environmental sustainability. Against this backdrop, stakeholders must understand shifting consumer expectations around portability, device compatibility, and aesthetic appeal.

Moreover, macroeconomic fluctuations, evolving trade policies, and raw material constraints have introduced both challenges and opportunities. As market participants strive to optimize supply chain efficiencies, they are also exploring alternative manufacturing hubs and strategic supplier partnerships. This introduction sets the stage for an in-depth examination of the forces reshaping the laptop carry case landscape, equipping decision-makers with a holistic view of current and future market imperatives.

Unveiling the Key Transformative Shifts Reshaping the Laptop Carry Case Landscape Amid Changing Consumer Preferences and Technological Innovation

Unveiling the Key Transformative Shifts Reshaping the Laptop Carry Case Landscape Amid Changing Consumer Preferences and Technological Innovation

The last several years have witnessed a dramatic pivot toward sustainable materials and ethical production practices. With consumers exhibiting heightened environmental consciousness, manufacturers are embracing plant-based textiles and recyclable polymers as viable alternatives to traditional leather and synthetic composites. Consequently, this shift has instigated collaborations between material science innovators and brand developers aimed at reducing carbon footprints and enhancing product life cycles.

In parallel, the emergence of smart features such as integrated power banks, device-tracking modules, and modular accessory attachments has elevated the carry case from a passive protector to an active technology companion. Such innovations cater to the needs of professionals and students who require on-the-go charging solutions and real-time asset management, thereby fostering deeper engagement with premium offerings.

Another transformative trend is the customization paradigm, wherein consumers demand tailored aesthetics, monogramming options, and configurable storage compartments. This movement has spawned direct-to-consumer platforms that streamline personalization processes and reinforce brand loyalty. Furthermore, omnichannel retail strategies-with seamless integration between online storefronts and physical showrooms-are redefining the purchase journey, enabling buyers to interact with products across multiple touchpoints before finalizing their decisions.

Together, these transformative shifts underscore the necessity for market players to anticipate evolving user preferences and to accelerate their innovation cycles, ensuring resilience in a competitive environment defined by speed, sustainability, and personalization.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on the Laptop Carry Case Supply Chain and Competitive Market Dynamics

Analyzing the Cumulative Impact of United States Tariffs in 2025 on the Laptop Carry Case Supply Chain and Competitive Market Dynamics

The introduction of new tariffs on key manufacturing inputs such as plastics, metals, and finished goods has reverberated throughout the laptop carry case supply chain. Companies reliant on imported components have encountered increased landed costs, compelling many to renegotiate agreements with existing suppliers and to explore alternative sourcing destinations. As a result, the emphasis on regional production near end markets has intensified, supporting faster turnaround times and reduced logistical exposure.

Import duties levied on leather skins and coated fabrics have driven raw material expenses higher, motivating brands to pioneer high-performance synthetic materials that match or surpass the durability of their traditional counterparts. This adaptation has spurred innovation in composite laminates and recycled textiles, which not only mitigate tariff impacts but also resonate with environmentally conscious consumers.

Moreover, higher import costs have influenced pricing strategies across distribution channels. Retailers have recalibrated margin structures, while premium segment offerings have incorporated value-added services-such as extended warranties and concierge-style repairs-to justify elevated price points. In parallel, some market participants have absorbed part of the tariff burden to maintain price competitiveness, inadvertently compressing profit margins.

Collectively, these trade policy dynamics underscore the imperative for supply chain flexibility, robust cost management practices, and strategic collaboration with logistics providers. By proactively addressing tariff-related challenges, industry players can safeguard their market positions and sustain growth amid evolving geopolitical landscapes.

Revealing Critical Segmentation Insights That Illuminate How Product Types, Materials, Channels, and User Profiles Drive Market Nuances

Revealing Critical Segmentation Insights That Illuminate How Product Types, Materials, Channels, and User Profiles Drive Market Nuances

Segmentation by product type unveils a diverse palette of offerings tailored to distinct user requirements and price sensitivities. Backpack sleeve solutions have surged in popularity among urban commuters seeking hands-free mobility and ergonomic distribution of weight, while hard cases-available as molded plastic and rigid shell variants-cater to professionals who prioritize maximum drop protection and structural integrity. Messenger bags occupy a niche where quick-access pockets and professional aesthetics intersect, and soft sleeves constructed from fabric and neoprene resonate with minimalist buyers desiring lightweight, compact solutions.

Material-based segmentation further highlights the interplay between tactile appeal and performance characteristics. Leather options, encompassing genuine and synthetic varieties, dominate the premium space with their blend of luxury and durability. Neoprene sleeves appeal to consumers valuing water resistance and shock absorption, whereas nylon and polyester variants offer cost-effective, abrasion-resistant alternatives that thrive in high-volume retail channels.

Distribution channel dynamics reveal that direct sales models foster deeper brand-to-customer relationships through proprietary online storefronts, enabling customization and personalized marketing campaigns. Mass retail partnerships amplify reach in big-box and specialty electronics outlets, while online retailers-spanning brand websites and third-party ecommerce platforms-deliver vast selection and convenient fulfillment options. Specialty stores, in turn, provide curated experiences that underscore product quality and specialized service.

End users bifurcate into business and consumer segments, each with distinct purchasing motivations. Corporate clients and educational institutions demand bulk procurement processes, standardized compliance with device compatibility protocols, and comprehensive after-sales support. In contrast, individual consumers base decisions on style, price point, and multifunctionality, fueling targeted marketing initiatives that speak directly to personal expression and day-to-day utility.

This comprehensive research report categorizes the Laptop Carry Case market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Distribution Channel

Highlighting Key Regional Perspectives Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Inform Strategic Growth Initiatives

Highlighting Key Regional Perspectives Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Inform Strategic Growth Initiatives

In the Americas, shifting workforce patterns and a strong emphasis on sustainability have fostered growth in premium and eco-friendly laptop carry case offerings. North American buyers increasingly gravitate toward recycled textiles and plant-based leathers, while Latin American markets exhibit robust demand for value-oriented options that balance durability with cost-effectiveness. Robust ecommerce infrastructure across the region supports rapid fulfillment and returns processes, setting high expectations for delivery speed and customer service quality.

Within Europe, Middle East & Africa, stringent environmental regulations and progressive urbanization trends drive preference for high-performance materials that comply with regional sustainability standards. Western European buyers often seek German-engineered hard cases or Italian-crafted leather designs, reflecting regional craftsmanship traditions. Meanwhile, Gulf Cooperation Council countries demonstrate appetite for luxury branded accessories, and African markets present untapped opportunities for competitively priced, durable product lines tailored to emerging middle-class segments.

The Asia-Pacific region serves as both a manufacturing powerhouse and a rapidly expanding consumer base. China and Vietnam lead in production volume, leveraging economies of scale to supply global markets. Simultaneously, domestic demand in India, Southeast Asia, and Australia is accelerating, buoyed by rising laptop penetration rates and a burgeoning remote work culture. Ecommerce platforms have revolutionized access to international brands, yet localized retail partnerships remain crucial in markets where trust and in-person evaluation influence purchase behavior.

Understanding these regional nuances enables market participants to tailor product portfolios, pricing models, and marketing narratives in alignment with diverse consumer preferences and regulatory environments, thereby enhancing competitiveness across global territories.

This comprehensive research report examines key regions that drive the evolution of the Laptop Carry Case market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Leading Company Strategies and Innovations Shaping the Competitive Trajectory of the Laptop Carry Case Market Worldwide

Uncovering Leading Company Strategies and Innovations Shaping the Competitive Trajectory of the Laptop Carry Case Market Worldwide

Industry frontrunners have distinguished themselves through bold investments in material science and product engineering. One leading luggage brand has introduced aerospace-grade composite cases that deliver unparalleled drop resistance, while another heritage leather specialist has transitioned to certified sustainable hides, securing new contracts with eco-conscious enterprise clients. This dual focus on performance and provenance underscores a broader pivot toward value-add differentiation.

Meanwhile, several technology accessory veterans have integrated wireless charging pads and Bluetooth-enabled tracking tags directly into carry case compartments, catering to users who demand seamless digital experiences. These integrated solutions not only elevate functionality but also foster recurring software service opportunities, creating additional revenue streams beyond one-time hardware sales.

Collaborative initiatives between device manufacturers and case providers have gained traction, resulting in co-branded offerings that guarantee precise device fit and style coherence. Such alliances leverage mutual brand equity to expand distribution reach and drive consumer trust. Furthermore, strategic acquisitions of niche startups specializing in 3D scanning and customization software have empowered incumbents to offer interactive online design studios, enabling buyers to visualize personalized configurations prior to purchase.

Lastly, an emerging subset of players is pursuing omnichannel disruption by blending digital showrooms with pop-up experiences in coworking spaces and premium retail corridors. This hybrid strategy bridges the gap between touch-and-feel authenticity and the convenience of ecommerce, reflecting a sophisticated understanding of modern buyer journeys.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laptop Carry Case market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Arctic Fox Co., Ltd.

- Belkin International, Inc.

- C.C. Filson Co.

- Case Logic Holdings, Inc.

- Dell Inc.

- DICOTA GmbH

- Fabrique Ltd.

- Golla Oy

- HP Inc.

- Inateck

- Incase Designs Corp.

- Lenovo Group Ltd.

- Norazza, Inc.

- Pelican Products, Inc.

- Razer Inc.

- Samsonite IP Holdings S.à r.l.

- Targus International, LLC

- Thule Sweden AB

- Timbuk2, Inc.

- Tumi, Inc.

- United States Luggage Co., LLC

- Victorinox AG

Formulating Actionable Recommendations to Enable Industry Leaders to Navigate Challenges and Capitalize on Emerging Opportunities in the Market

Formulating Actionable Recommendations to Enable Industry Leaders to Navigate Challenges and Capitalize on Emerging Opportunities in the Market

First, companies should accelerate the adoption of sustainable and recycled materials across their product portfolios to resonate with environmentally conscious consumers while mitigating regulatory risks. By establishing transparent supply chains and third-party certifications, they can reinforce brand credibility and command premium pricing.

Next, integrating smart functionalities-such as wireless charging, Bluetooth connectivity, and modular accessory attachments-will differentiate offerings in an increasingly crowded market. These enhancements not only increase perceived value but also open doors to subscription-based service models that can stabilize revenues.

Furthermore, optimizing supply chain resilience should be prioritized through diversified manufacturing footprints and strategic nearshoring partnerships. By balancing cost efficiencies with geographic agility, organizations can maintain service levels amid geopolitical uncertainty and tariff fluctuations.

In addition, enhancing omnichannel presence by synchronizing online customization tools with localized in-store experiences will foster deeper customer engagement. This approach should be complemented by data-driven marketing strategies that leverage CRM insights to deliver hyper-personalized communications and promotions.

Finally, expanding market penetration in underdeveloped regions-particularly within emerging Asia-Pacific and select EMEA corridors-through collaborations with local distributors and digital marketplaces will unlock new revenue streams. Tailored product lines and localized messaging will ensure relevance to diverse cultural and economic contexts.

Detailing the Comprehensive Research Methodology Employed to Ensure Data Integrity and Robust Analysis of the Laptop Carry Case Market

Detailing the Comprehensive Research Methodology Employed to Ensure Data Integrity and Robust Analysis of the Laptop Carry Case Market

This report is grounded in a rigorous dual-phase research approach that combines both primary and secondary data collection. Primary research encompassed in-depth interviews with executives from leading manufacturers, procurement specialists at Fortune 500 enterprises, and distribution channel partners. These conversations yielded firsthand perspectives on supply chain dynamics, pricing negotiations, and emerging feature demands.

Secondary research involved a thorough examination of industry publications, trade journals, regulatory filings, and publicly available financial disclosures. Proprietary procurement databases were also leveraged to track unit shipment trends and identify shifts in logistics routes. Where available, patent filings and material science white papers provided supplemental context on innovation pipelines and sustainability initiatives.

Data triangulation was achieved by cross-referencing insights from primary interviews with market intelligence from distribution analytics and case study evidence. All qualitative inputs underwent thematic coding to surface recurring trends, while quantitative data were normalized to account for regional exchange rate variations and tariff adjustments. A validation workshop with a panel of industry experts further refined the findings and ensured that the final analysis reflects the current market reality.

This methodological framework ensures that the conclusions and recommendations presented in the report rest on a foundation of reliable, convergent evidence, thereby equipping decision-makers with the confidence to act on strategic insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laptop Carry Case market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laptop Carry Case Market, by Product Type

- Laptop Carry Case Market, by Material

- Laptop Carry Case Market, by End User

- Laptop Carry Case Market, by Distribution Channel

- Laptop Carry Case Market, by Region

- Laptop Carry Case Market, by Group

- Laptop Carry Case Market, by Country

- United States Laptop Carry Case Market

- China Laptop Carry Case Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Insights That Synthesize Key Findings and Emphasize Strategic Imperatives for Sustained Growth in the Laptop Carry Case Sector

Concluding Insights That Synthesize Key Findings and Emphasize Strategic Imperatives for Sustained Growth in the Laptop Carry Case Sector

The laptop carry case market stands at a crossroads where innovation, sustainability, and strategic agility will define winners and laggards. Across product types-from hard cases engineered for maximum protection to sleek soft sleeves built for portability-the convergence of material advancements and smart integrations will shape consumer expectations. Regional nuances underscore the importance of tailoring portfolios to distinct economic and regulatory environments, while evolving tariff landscapes necessitate that supply chain fortification be top of mind.

Key segmentation insights affirm that the interplay between product format, material choice, distribution channel, and end-user profile continues to drive differentiated value propositions. Premium leather offerings coexist with budget-friendly polyester alternatives, and direct-to-consumer platforms complement traditional retail networks. Business buyers maintain rigorous compliance and standardization preferences, whereas individual consumers seek style-driven functionality.

Leading companies exemplify success through strategic alliances, targeted acquisitions, and hybrid go-to-market strategies that fuse digital convenience with tactile retail experiences. Actionable recommendations-including accelerated sustainability adoption, smart feature integration, supply chain diversification, and localized market expansion-provide a roadmap for industry leaders to navigate complexity and capture growth opportunities.

Ultimately, this report offers a holistic view of the forces at play in the laptop carry case market, empowering stakeholders to make informed decisions that balance innovation, resilience, and profitability.

Driving Next-Level Engagement and Report Acquisition with a Direct Call-to-Action Featuring Associate Director of Sales & Marketing Expertise

If you are seeking to capitalize on the latest strategic imperatives and secure a competitive advantage in the laptop carry case domain, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His insights and guidance will help you navigate market nuances and identify tailored research packages that align with your business objectives. Reach out today to discuss how this comprehensive report can inform your next steps and drive measurable results.

By partnering with an experienced industry authority, you can turn data insights into decisive action, ensuring that your organization remains at the forefront of innovation, quality, and customer satisfaction. Let Ketan Rohom help you transform research findings into strategic growth initiatives that deliver lasting impact.

- How big is the Laptop Carry Case Market?

- What is the Laptop Carry Case Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?