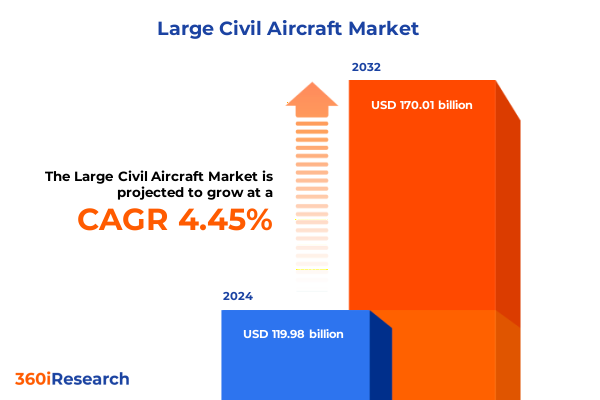

The Large Civil Aircraft Market size was estimated at USD 139.87 billion in 2025 and expected to reach USD 149.39 billion in 2026, at a CAGR of 6.67% to reach USD 219.87 billion by 2032.

Charting the Resilient Path of the Large Civil Aircraft Sector Through Post-Pandemic Recovery and Sustainable Innovation

The large civil aircraft sector navigates a period of heightened complexity as post-pandemic travel recovery collides with persistent delivery backlogs and cost pressures. While passenger demand has rebounded strongly in major markets, airlines continue to grapple with constrained manufacturing capacity and protracted wait times for new aircraft. This confluence of demand resurgence and production challenges has contributed to sustained pressure on airfares, as carriers balance revenue objectives with capacity limitations and evolving consumer expectations.

Simultaneously, the industry is accelerating its commitment to sustainability, with stakeholders recognizing the imperative to decarbonize operations. Sustainable aviation fuel production is projected to double to approximately two million tonnes in 2025, though it still represents less than one percent of total fuel consumption. This modest growth underscores the urgent need for long-term supply agreements and supportive policy frameworks to scale production and achieve emissions targets.

Amid these dynamics, original equipment manufacturers and tier-one suppliers are prioritizing digital transformation and supply chain resilience. Innovations such as digital twins, predictive maintenance, and advanced analytics are being integrated to enhance production throughput, reduce operational risk, and optimize lifecycle costs. Near-term competitive pressures are also intensified by emerging entrants from Asia, adding further impetus for incumbents to refine product portfolios and operational models.

Embracing Digitalization Decarbonization and Supply Chain Resilience to Redefine the Large Civil Aircraft Market’s Future Landscape

The landscape of large civil aviation is being reshaped by rapid digitalization, as manufacturers and operators leverage digital twins and predictive analytics to streamline design, production, and maintenance processes. By virtually simulating aircraft systems and assembly workflows, stakeholders can anticipate and mitigate disruptions, reducing lead times and improving overall program reliability. This digital acceleration is evident in the aerospace and defense sector’s projected expansion of the global digital twin market to over $50 billion by 2034, driven by a compound annual growth rate exceeding 37 percent.

In parallel, the drive toward decarbonization has galvanized investment in sustainable aviation fuels and next-generation propulsion systems. Regulatory mandates under CORSIA and nascent SAF requirements in Europe and North America are fostering collaboration across the value chain, from feedstock producers to airlines. Despite the slow ramp-up of capacity and heightened costs associated with mandates, industry leaders are forging strategic alliances to secure long-term supply and develop advanced pathways such as alcohol-to-jet and e-SAF.

Beyond fuel and data technologies, companies are fortifying supply chain resilience in response to geopolitical tensions and trade volatility. Nearshoring critical component production and diversifying supplier bases have become essential strategies to mitigate the impact of material shortages and protectionist measures. As a result, large civil aviation is entering an era defined by integrated digital capabilities, sustainability imperatives, and agile sourcing models that together will redefine competitive advantage.

Analyzing the Ripple Effects of 2025 U.S. Trade Measures on Commercial Aircraft Costs Supply Chains and Delivery Schedules

In early 2025, the U.S. government enacted a 25% tariff on steel and aluminum imports to support domestic producers, directly elevating raw material costs for aircraft manufacturers. These duties compound existing cost pressures from production backlogs, threatening to increase aircraft build expenses by up to ten percent and extend delivery timelines further.

Airbus faces unique exposure due to its European final assembly of widebody jets. While its U.S. facilities in Alabama and Mississippi mitigate part of the impact for narrowbody platforms, flagship programs such as the A350 and A330neo remain vulnerable to tariff-induced price escalations. With unfilled orders from U.S. carriers accounting for over eight percent of Airbus’s backlog, deferred deliveries by Delta and other operators underscore the potential for order rescheduling and contractual renegotiations if tariffs persist.

For Boeing, which sources thousands of components from global suppliers, tariffs on raw materials and intermediate goods threaten to erode profit margins or be passed on to customers through higher list prices. Boeing’s CEO has warned that supply chain disruptions could further strain delivery performance, hampering the company’s efforts to clear its substantial backlog and sustain post-pandemic recovery momentum.

In response, OEMs and airlines are deploying mitigation strategies including stockpiling critical parts ahead of tariff implementation, reshoring production of high-value subassemblies, and engaging in “tariff engineering” to reconfigure import pathways. Meanwhile, industry associations are lobbying for targeted exemptions and reversion to duty-free frameworks to preserve competitiveness and avert a tit-for-tat escalation in aerospace trade relations.

Uncovering Segment-Specific Dynamics Across Aircraft Type Seating Capacity Range Engine Technology and End Users in the Civil Aviation Market

The civil aircraft market demonstrates nuanced performance when divided by aircraft type, as narrowbody jets continue to secure the largest share of new orders driven by the proliferation of low-cost carriers and point-to-point services. In contrast, widebody platforms are strategically focused on ultra-long-haul connectivity, catering to premium traffic flows and transoceanic routes. Regional jets remain essential for feeding major hubs and unlocking thin-route markets, underpinned by evolving pilot shortage mitigation and airport slot constraints.

Across seating capacity segments, modern fleets are calibrated to maximize operating efficiency. Aircraft with up to 150 seats address regional and short-haul demands, enabling flexible scheduling and reduced trip costs. The 151–300 seating bracket represents the workhorse category for medium-haul networks and high-frequency domestic services, balancing unit economics with network reach. Above 300 seats, very large aircraft support peak-volume trunk routes, where airlines can leverage economies of scale and premium cabin differentiation to optimize yield.

Range segmentation reveals the importance of matching aircraft performance to route profiles. Short-haul types excel in high-frequency feeder missions, while medium-haul jets service gateway markets. Long-haul and ultra-long-haul aircraft are increasingly required to deliver extended nonstop operations, flying up to 9,700 nautical miles without payload restriction, reinforcing the premium value proposition.

Engine type selection further differentiates product offerings. Turbofan powerplants dominate narrowbody and widebody segments, driven by ongoing enhancements in bypass ratios and composite materials. Turboprop aircraft serve niche regional markets with lower fuel burn at sub-500-mile sectors. Electric and hybrid-electric propulsion technologies are emerging in commuter aircraft, with battery electric systems and hybrid architectures under development to reduce emissions in short-range applications.

Finally, end users diverge based on fleet ownership models. Airlines pursue tailored aircraft specifications to align with network strategies, whereas leasing companies emphasize asset flexibility and residual value considerations. This dichotomy influences contractual frameworks, maintenance planning, and aftermarket support agreements, shaping how aircraft are designed, financed, and deployed in service.

This comprehensive research report categorizes the Large Civil Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Seating Capacity

- Range

- Engine Type

- End User

Delineating Regional Differentiators Impacting Demand Growth Supply Chain Strategies and Sustainability Adoption in Americas EMEA and Asia-Pacific Markets

The Americas region is characterized by mature air travel markets with significant backlog of narrowbody and regional jet orders. Strong low-cost carrier growth across North and Latin America drives sustained narrowbody demand, while environmental regulations in California and Canada spur the introduction of advanced turbofan and regional hybrid-electric programs. Trade agreements within USMCA also influence sourcing decisions and supply chain alignment across the continent.

Europe, the Middle East, and Africa feature a diverse market landscape, where legacy flag carriers and ultra-low-cost airlines coexist. Safety regulations, airport slot restrictions, and aggressive sustainability mandates have accelerated the adoption of fuel-efficient widebody variants and SAF blends. Meanwhile, geopolitical factors in the Middle East present both development opportunities through burgeoning hub expansions and potential supply chain exposure to sanctions and regional trade policies.

Asia-Pacific remains the fastest-growing region for civil aviation, driven by robust passenger traffic growth in China, India, Southeast Asia, and Australasia. Government infrastructure investments in new airports and strategic carrier partnerships have underpinned record-setting fleet expansion plans. Local OEMs, such as COMAC and Mitsubishi, are increasingly competing for order placements alongside legacy manufacturers. Simultaneously, airlines are pursuing technology transfer agreements and regional assembly investments to localize production and reduce exposure to trade disruptions.

This comprehensive research report examines key regions that drive the evolution of the Large Civil Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Analysis of Major OEMs and Powerplant Suppliers Shaping Market Competitiveness Through Innovation Alliances and Operational Excellence

Boeing continues to leverage its status as the largest U.S. exporter, securing trade agreements with strategic partners and anchoring its recovery on the 737 MAX and 787 Dreamliner programs. Despite lingering regulatory scrutiny and quality control enhancements, Boeing’s expansive service network and aftermarket ecosystem remain pivotal to its competitive position.

Airbus is focused on ramping up A320neo family deliveries while integrating advanced supply chain digitalization and lean manufacturing methodologies at its assembly sites in Europe and North America. The company’s investment in production scalability and modular assembly processes underscores its ambition to reclaim market balance in both narrowbody and widebody segments.

Embraer and Mitsubishi Aircraft are expanding their regional jet portfolios, incorporating cutting-edge turbofan and hybrid-electric powerplants to address evolving short-haul market requirements. These OEMs emphasize versatile aircraft platforms that cater to emerging connectivity corridors and secondary city pairs.

Engine manufacturers are advancing powerplant innovations to meet dual objectives of performance and sustainability. Pratt & Whitney’s geared turbofan continues to achieve incremental fuel burn reductions, while Rolls-Royce’s hybrid-electric research at CHESCO in Germany targets significant lifecycle emissions cuts for commuter aircraft.

Simultaneously, leading tier-one suppliers are forging partnerships to co-develop next-generation materials, avionics architectures, and digital maintenance solutions, highlighting the collaborative nature of innovation in the large civil aircraft ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Large Civil Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aero Transfer Réunion GIE

- Airbus SE

- Antonov State Company

- Avions de Transport Régional SAS

- Bombardier Inc.

- COMAC subsidiary Shanghai Aircraft Manufacturing Company

- Commercial Aircraft Corporation of China, Ltd.

- Dassault Aviation

- De Havilland Aircraft of Canada Limited

- Embraer S.A.

- Gulfstream

- Hindustan Aeronautics Limited

- Let Kunovice

- Lockheed Martin Corporation

- Mitsubishi Aircraft Corporation

- Northrop Grumman

- Piaggio Aerospace

- Pilatus Aircraft Ltd.

- Public Joint Stock Company United Aircraft Corporation

- State Enterprise Antonov

- Sukhoi Civil Aircraft Company

- Textron Aviation Inc.

- The Boeing Company

- United Aircraft Corporation

- Viking Air Ltd.

Formulating Strategic Imperatives for Industry Leaders to Navigate Tariffs Sustainability Pressures Digital Disruption and Supply Chain Volatility

Industry leaders should prioritize end-to-end digital integration, extending beyond design and manufacturing into predictive maintenance and in-service data analytics. By deploying interoperable platforms and strengthening cybersecurity protocols, stakeholders can achieve faster decision cycles, reduce unplanned downtime, and optimize total cost of ownership across fleets.

To mitigate trade volatility and raw material uncertainties, companies must diversify geographic sourcing and strategically localize production of critical components. Engaging with governmental bodies to advocate for targeted tariff exemptions and reestablishment of duty-free frameworks will be key to preserving cost competitiveness.

Accelerating decarbonization requires forging enduring partnerships with SAF producers and feedstock suppliers. Long-term offtake agreements and investment in sustainable feedstock projects will be instrumental in enhancing supply security and driving down lifecycle emissions. Concurrently, advancing hybrid and electric propulsion demos through collaborative R&D consortia will build the foundation for next-generation regional mobility.

Finally, organizations should integrate resilience planning into strategic roadmaps, conducting scenario analysis around regulatory shifts, geopolitical events, and supply chain shocks. Establishing flexible capacity buffers and dynamic procurement models will enable the large civil aircraft ecosystem to adapt rapidly to disruption and capitalize on emergent growth opportunities.

Overview of Robust Mixed-Method Research Techniques Employed to Ensure Data Integrity Industry Validation and Comprehensive Trend Analysis in Aircraft Studies

This research employs a structured mixed-method approach, leveraging extensive secondary data from public filings, regulatory disclosures, trade association reports, and proprietary aviation databases. Rigorous triangulation ensures consistency across multiple sources and enhances data integrity.

Primary insights were obtained through in-depth interviews with C-level executives, supply chain directors, airline fleet planners, and policy analysts. These qualitative discussions provided contextual understanding of strategic priorities, operational constraints, and innovation roadmaps.

Analytical models were developed to map segment-specific dynamics, incorporating variables such as aircraft performance parameters, fuel cost trajectories, regulatory scenarios, and regional market trends. These models underwent validation with industry experts to confirm assumptions and refine key drivers.

Scenario analysis around tariff regimes, sustainability policy shifts, and technology adoption pathways was conducted to identify potential inflection points. The methodology emphasizes transparency, with clearly documented assumptions and sensitivity testing to gauge the robustness of findings across divergent market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Large Civil Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Large Civil Aircraft Market, by Aircraft Type

- Large Civil Aircraft Market, by Seating Capacity

- Large Civil Aircraft Market, by Range

- Large Civil Aircraft Market, by Engine Type

- Large Civil Aircraft Market, by End User

- Large Civil Aircraft Market, by Region

- Large Civil Aircraft Market, by Group

- Large Civil Aircraft Market, by Country

- United States Large Civil Aircraft Market

- China Large Civil Aircraft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis of Core Findings Highlighting Emerging Opportunities and Persistent Challenges in the Large Civil Aircraft Landscape for Strategic Decision Making

The large civil aircraft market is at a pivotal juncture, balancing the dual imperatives of operational recovery and sustainable advancement. The confluence of digital innovation, decarbonization efforts, and trade policy fluctuations underscores the importance of strategic agility and informed decision-making.

Segmentation analysis reveals nuanced opportunities across aircraft types, seating capacities, route lengths, propulsion systems, and end-user models. Regional insights highlight the need for tailored approaches in the Americas, EMEA, and Asia-Pacific, where regulatory landscapes and market maturities diverge.

Tariff developments in 2025 have injected complexity into supply chain management and cost structures, prompting proactive mitigation through reshoring, tariff engineering, and advocacy. Concurrently, OEMs and suppliers are realigning portfolios and forging collaborative partnerships to drive performance, efficiency, and environmental stewardship.

Collectively, these dynamics present a tapestry of challenges and growth vectors. Stakeholders who integrate advanced digital solutions, cultivate resilient supply networks, and champion sustainable fuel and propulsion innovations will be poised to lead the next phase of civil aviation evolution.

Connect Directly with Ketan Rohom to Secure Comprehensive Large Civil Aircraft Market Intelligence and Propel Strategic Growth with Informed Insights

To acquire the full scope of strategic insights and data-driven analysis on the large civil aircraft market, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through tailored solutions that align with your organization’s growth objectives and ensure you have the intelligence you need to navigate competitive pressures, regulatory shifts, and technological disruptions. Unlock unparalleled market visibility, benefit from deep-dive segment analyses, and leverage expert recommendations to inform your capital investments, supply chain strategies, and product development roadmaps. Connect now to secure your comprehensive report and catalyze informed decision-making for sustained success in the dynamic aviation landscape

- How big is the Large Civil Aircraft Market?

- What is the Large Civil Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?