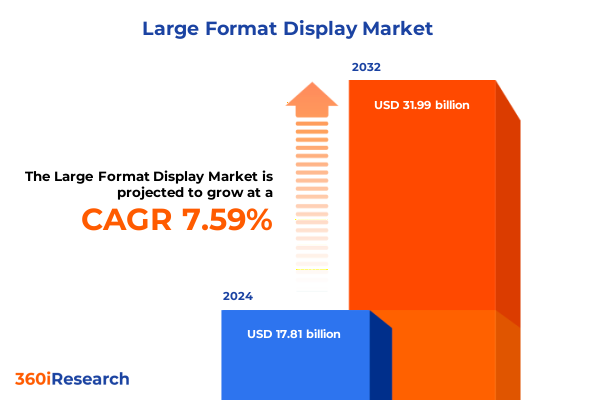

The Large Format Display Market size was estimated at USD 19.08 billion in 2025 and expected to reach USD 20.44 billion in 2026, at a CAGR of 7.66% to reach USD 31.99 billion by 2032.

Positioning Large Format Displays as a Cornerstone of Contemporary Visual Communication Strategies and Engagement in Complex Enterprise Environments

The large format display segment has emerged as an integral element of modern visual communication, underpinning how organizations convey information and engage audiences across diverse environments. As enterprises accelerate digital transformation, these expansive screens serve not only as dynamic canvases for branding but also as interactive touchpoints in retail, corporate, and public spaces. Over the past decade, advances in display resolution, processing power, and connectivity have unlocked novel applications-ranging from video walls in command centers to AI-driven digital signage in quick-service restaurants-each driving new value propositions and use cases.

Embracing Technological and Market Disruptions to Catalyze the Next Generation of Immersive Data-Driven Visual Communication Platforms

Artificial intelligence has rapidly evolved from a marketing buzzword to a foundational technology for large format displays, ushering in an era of personalized and adaptive content delivery. By harnessing machine learning algorithms and real-time data feeds, displays now analyze demographic and behavioral cues to tailor messaging on the fly. This capability not only enhances relevance and engagement but also fuels deeper analytics on dwell time and conversion outcomes, empowering operators to refine content strategies continuously.

Beyond AI-driven personalization, the integration of augmented and virtual reality into large format environments is redefining immersive experiences. Retail and hospitality venues are pioneering AR-enabled kiosks that overlay product information and virtual fitting rooms, while VR-powered installations transport users into fully simulated brand worlds. This convergence of display and immersive computing elevates customer journeys, blurring the lines between physical and virtual engagement and unlocking new narrative possibilities.

Navigating the Complex Aftermath of United States Trade Actions on Large Format Display Ecosystems and Supply Chain Dynamics

The reintroduction of reciprocal tariffs by the U.S. government in early 2025 has exerted immediate cost pressures across display hardware and critical subcomponents. Baseline duties of 10 percent on all imports, coupled with rates reaching as high as 34 percent on shipments from China and 46 percent on those from Vietnam, have elevated landed costs for LCD panels, semiconductors, and finished display units alike.

These duties have compelled many integrators and solution providers to reevaluate their supply chain footprints, shifting procurement to tariff-exempt or lower-rate jurisdictions such as Mexico, South Korea, and Japan. While this geographic diversification mitigates immediate trade risks, it introduces fresh logistics complexities and lead time variability. In parallel, some vendors have strategically pre-positioned inventory in domestic warehouses to buffer against future policy shifts, mirroring the tactical stockpiling observed during prior trade tensions.

Despite the short-term headwinds, the industry is witnessing a strategic pivot toward modular designs and component‐agnostic architectures that facilitate sourcing flexibility. As semiconductor tariffs loom on the horizon, ecosystem players are accelerating investments in configuration-driven hardware designs and near-shore manufacturing partnerships. This shift underscores a broader trend: treating tariff exposure as an operational variable to be managed rather than an unmitigated shock to the market.

Unveiling Core Segment Dynamics That Define Demand Patterns and Customization Requirements Across Display Types Technology and End Users

When examining demand drivers, display type remains a critical determinant of solution design and total cost of ownership. Interactive displays continue to gain traction in sectors valuing direct user engagement, such as retail showrooms and educational facilities, whereas non-interactive displays dominate static advertising and basic informational deployments. Standalone displays offer rapid roll-out capabilities for point-of-sale and wayfinding, while video wall configurations deliver high-impact visual canvases for control rooms and brand experiences in premium venues.

Equally vital to understanding market dynamics are technology preferences and end-user profiles. LCD displays maintain a strong presence due to their proven performance and cost-efficiency, even as LED panels and projection-based systems gain ground in applications demanding superior brightness or large-scale seamless imaging. Demand also varies by industry vertical: BFSI sectors prioritize security-hardened installations, corporate and government deployments emphasize collaboration ecosystems, education environments focus on interactive learning, entertainment venues seek immersive showpieces, healthcare facilities require compliance-driven reliability, retail and hospitality invest in experiential promotion, and transportation hubs leverage real-time information overlays to enhance passenger journeys.

This comprehensive research report categorizes the Large Format Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Type

- Technology

- Industry Vertical

Highlighting Regional Variations in Adoption Drivers and Regulatory Influences Across the Americas EMEA and Asia-Pacific Display Markets

In the Americas, the digital out-of-home landscape is characterized by high adoption in retail, quick-service restaurants, and smart city initiatives, buoyed by a regulatory focus on energy-efficient technologies. Federal incentives under the CHIPS and Science Act, alongside local sustainability mandates, have galvanized investments in low-power LED signage and cloud-based content architectures that deliver operational savings and environmental benefits. This regional push toward green displays not only aligns with corporate responsibility goals but also unlocks new funding streams for infrastructure upgrades and public sector roll-outs.

Across Europe, the Middle East, and Africa, demand is driven by a combination of digital transformation programs within enterprise and government bodies and burgeoning retail and transportation initiatives. Public sector projects in transit and education are increasingly specifying interactive and high-resolution video wall solutions, while sustainability regulations are prompting a shift to recyclable materials and e-paper signage solutions. Meanwhile, Asia-Pacific remains the principal manufacturing hub and innovation engine, with Chinese subsidy programs stimulating LCD panel production and Japanese and South Korean OEMs leading advancements in microLED and transparent OLED technologies. Rapid urbanization and major infrastructure investments continue to foster robust digital signage deployments, particularly in high-footfall environments such as airports and malls.

This comprehensive research report examines key regions that drive the evolution of the Large Format Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Display Manufacturers and Innovators Driving Competitive Differentiation and Technology Advancements in Large Format Ecosystems

Global OEMs continue to differentiate through breakthrough display technologies and ecosystems. Samsung’s microLED “The Wall” series has set the bar for modular, ultra-high-brightness installations that cater to luxury retail and corporate boardrooms, while LG’s OLED signage leverages borderless form factors and integrated AI analytics to elevate content interactivity. Sony’s Crystal LED line further enhances image fidelity for premium entertainment venues, and NEC’s interactive flat panels excel in education and government collaboration spaces. Each vendor reinforces its value proposition through software integration, security credentials, and service offerings tailored to enterprise needs.

Complementing these household names are specialist suppliers that address niche applications. Barco’s UniSee LED video walls deliver seamless tiled displays for command-and-control centers, Panasonic’s CS-Series outdoor solutions combine high luminance with rugged durability for transportation hubs, Planar’s modular walls enable rapid scalability in event and broadcast environments, and Christie’s projection and LED systems support immersive experiences in large-venue entertainment. Emerging challengers from Asia, including BOE and AU Optronics, are also gaining visibility through competitive pricing and enhanced panel quality, adding a new dimension to the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Large Format Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AOTO Electronics Co., Ltd.

- AU Optronics Corporation

- Barco NV

- BenQ Corporation

- BOE Technology Group Co., Ltd.

- Crestron Electronics, Inc.

- Crystal Display Systems Ltd

- Daktronics, Inc.

- Dell Technologies Inc.

- Delta Electronics, Inc.

- EIZO Corporation

- Koninklijke Philips N.V.

- LG Corporation

- Optoma Corporation

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Shenzhen Absen Optoelectronic Co.,Ltd.

- Sony Corporation

- Toshiba Corporation

Delivering Strategic Recommendations to Strengthen Resilience Scalability and Innovation in Display Deployment and Content Management Workflows

Industry leaders should diversify supply chains by incorporating near-shore manufacturing partners and leveraging modular, component-agnostic designs that enable dynamic sourcing adjustments. Maintaining strategic inventory buffers within domestic warehouses and negotiating tariff-pass-through structures with suppliers can provide resilience against abrupt policy changes. In parallel, procurement teams should engage in continuous risk monitoring to anticipate regulatory shifts and proactively recalibrate sourcing corridors, thus safeguarding project timelines and margin integrity.

To capitalize on evolving audience expectations, enterprises must invest in AI-enabled content management systems that deliver data-driven personalization at scale. This includes integrating machine learning engines that optimize content scheduling based on real-time environmental cues, deploying sustainable hardware options such as e-paper and low-power LED, and exploring AR/VR extensions for experiential engagement. Strategic partnerships with software and cloud platform providers will also be critical for achieving seamless omnichannel orchestration and unlocking advanced analytics capabilities.

Employing Rigorous Mixed-Method Research Practices to Ensure Credibility and Holistic Analysis in Display Market Studies

Our research methodology employed a rigorous mixed-method framework to ensure comprehensive and credible insights. Qualitative data were gathered through in-depth interviews with industry experts, integrators, and end-user stakeholders, while quantitative analysis synthesized trends from publicly available procurement data and published performance reports. This convergent parallel design facilitated cross-validation of findings, with pilot testing of interview guides and data collection instruments conducted to refine analytical rigor.

Ethical and practical considerations underpinned our approach, with informed consent obtained from all participants and transparency maintained regarding data usage and storage. To mitigate bias, we ensured representation across display type, technology, industry vertical, and geographic region. Triangulation techniques were deployed to integrate qualitative and quantitative strands meaningfully, thus providing additive insights rather than isolated data points. All conclusions were subjected to peer review and vendor briefings to confirm accuracy and relevance to current industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Large Format Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Large Format Display Market, by Display Type

- Large Format Display Market, by Technology

- Large Format Display Market, by Industry Vertical

- Large Format Display Market, by Region

- Large Format Display Market, by Group

- Large Format Display Market, by Country

- United States Large Format Display Market

- China Large Format Display Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing Key Findings to Illuminate Future Trajectories and Critical Considerations for Large Format Display Stakeholders

The comprehensive evaluation underscores a rapidly evolving landscape where AI, AR/VR, and sustainability converge to redefine large format display applications. Trade policy developments have introduced supply chain complexity, prompting a strategic shift toward modular designs and diversified sourcing that enhances operational resilience. Regional differences continue to shape adoption patterns, with energy efficiency driving projects in the Americas, interactive standards rising across EMEA, and Asia-Pacific solidifying its role as both a manufacturing hub and innovation catalyst. Leading vendors differentiate through technological leadership in microLED, OLED, and projection systems, while specialist suppliers fill niche performance requirements.

Secure In-Depth Insights on Large Format Display Innovations and Strategy Directly Through Our Comprehensive Market Research Purchase

If you’re ready to deepen your understanding of how technological innovation, trade policy, and evolving customer expectations are shaping the future of large format displays, contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through our comprehensive market research report that offers unparalleled insights on display types, supply chain strategies, regional dynamics, and competitive positioning. Secure your copy today to inform critical investment decisions and maintain a competitive edge in an increasingly complex visual communication ecosystem.

- How big is the Large Format Display Market?

- What is the Large Format Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?