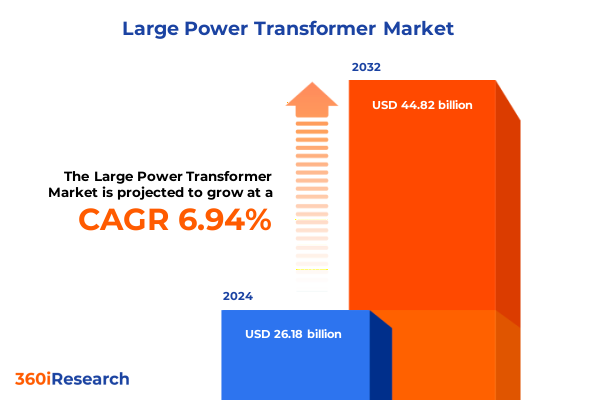

The Large Power Transformer Market size was estimated at USD 27.97 billion in 2025 and expected to reach USD 30.07 billion in 2026, at a CAGR of 6.96% to reach USD 44.82 billion by 2032.

Exploring the Critical Role Emerging Technologies and Strategic Importance of Large Power Transformers in Global Energy Infrastructure Transformation

Large power transformers have become indispensable components of modern electrical grids as utilities and industrial operators pursue unprecedented levels of reliability and flexibility. They serve as the backbone for voltage regulation, long-distance transmission, and efficient distribution of electric power across diverse terrains and climates. In an era defined by rapid renewable energy adoption and growing electrification of transportation and industrial processes, these transformers underpin the seamless integration of distributed energy resources into legacy infrastructure.

This section introduces the report’s scope, covering evolving technology trends, supply chain dynamics, and regulatory influences that have reshaped the large power transformer landscape. It sets the stage for deeper analysis of transformative shifts, segmentation insights, and strategic imperatives that will define competitive success. Recognizing the critical balance between operational performance, lifecycle costs, and environmental considerations, this overview highlights the role of rigorous analysis in equipping stakeholders with actionable intelligence to navigate market complexities.

Against a backdrop of intensifying demand for digital transformation in asset management and heightened scrutiny on sustainability metrics, stakeholders require a nuanced understanding of design innovations such as advanced core materials and eco-friendly dielectric fluids. Moreover, global trade tensions and evolving tariff regimes have introduced new variables into manufacturing and procurement strategies. Consequently, the insights synthesized here draw from extensive primary research and data-driven analysis, offering a comprehensive foundation for decision-makers seeking to optimize transformer deployment in diverse industrial and utility applications.

Uncovering the Transformative Shifts Redefining the Competitive Landscape of Large Power Transformers in a Rapidly Evolving Energy Sector

The large power transformer sector is undergoing seismic shifts as industry disruption accelerates innovation and redefines competitive parameters. Advanced digitalization initiatives, including the adoption of digital twin models, are enabling remote monitoring and predictive diagnostics to reduce unplanned outages and extend asset lifecycles. At the same time, material science breakthroughs are driving the development of ultra-low-loss magnetic cores and high-performance insulation systems, further improving efficiency and thermal management in high-capacity applications.

Meanwhile, the global push toward decarbonization is fostering demand for transformers optimized for renewable integration and microgrid support. Modular transformer designs are emerging to facilitate rapid deployment in remote and off-grid locations, while compact substations leverage prefabricated solutions to accelerate project timelines. Simultaneously, industry stakeholders are grappling with the complexities of a converging value chain, where electrical equipment manufacturers collaborate with software providers and service integrators to deliver end-to-end solutions encompassing commissioning, condition monitoring, and lifecycle management.

In this climate of rapid change, companies that can seamlessly integrate digital services with hardware offerings are poised to capture growing market share. Furthermore, strategic investments in sustainable dielectric fluids and automated manufacturing processes are differentiating leading players. This section delves into these transformative trends, illustrating how synergistic innovation across technology, operations, and business models is redefining the large power transformer landscape.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Supply Chains Costs and Strategic Sourcing in the Transformer Market

In 2025, newly imposed tariffs in the United States have reverberated across the large power transformer supply chain, altering cost structures and sourcing strategies. Increased duties on core steel laminations and copper conductors have prompted manufacturers to reassess procurement from traditional suppliers, accelerating efforts to establish domestic processing capacities. As a result, transformer OEMs are negotiating long-term contracts with U.S.-based steel mills and refining partnerships with North American copper fabricators to stabilize raw material costs and mitigate currency exposure.

Moreover, these tariff adjustments have triggered a recalibration of inventory management practices. Manufacturers and end users are implementing strategic stockpiling programs to hedge against fluctuating duty rates, while also exploring nearshoring alternatives in Mexico and Canada to circumvent higher import levies. Utilities, facing potential cost pass-throughs, are renegotiating service agreements and prioritizing retrofit activities that require minimal new material consumption. Consequently, project timelines have become more fluid, with phased commissioning approaches designed to leverage materials procured under lower duty structures prior to tariff escalations.

Despite these challenges, the enforced shift toward localized supply chains is generating opportunities for domestic value creation and job growth. Industry participants are accelerating investments in automated steel processing and advanced insulation manufacturing within U.S. borders, supported by government incentives aimed at enhancing critical infrastructure resilience. This section analyzes the cumulative impact of the 2025 tariff landscape, highlighting both the emergent pressures and strategic adaptations that will influence competitive positioning in the years to come.

Revealing Deep Segmentation Insights Across Cooling Methods Power and Voltage Ratings Installation Environments and Insulation Technologies

Segmentation analysis reveals nuanced performance drivers across the spectrum of transformer design and deployment criteria. Based on cooling methods, oil-immersed models featuring Onan configurations continue to dominate, while ester and silicone-based variants are gaining traction for their biodegradability and fire safety benefits. Natural and forced air-cooled alternatives are retaining a niche appeal in lower-capacity installations, but evolving sustainability regulations are gradually shifting preference toward closed-loop liquid cooling systems.

By power rating, the midrange segment between 50 and 100 MVA has experienced steady adoption in industrial and transmission networks due to balanced cost-to-performance ratios. Transformers exceeding 100 MVA are witnessing increased deployment in regional interconnect projects that demand ultra-high-capacity transmission, whereas sub-50 MVA units are typically applied in localized distribution networks and renewable integration points. These distinctions underscore the importance of aligning transformer sizing with specific project operational parameters.

Voltage-based differentiation further illustrates strategic variances, with 220 kV and 400 kV classes remaining the cornerstone of long-distance grid applications and bulk power transmission. Lower-voltage platforms at 132 kV serve sub-transmission corridors, while emerging projects utilizing voltages beyond 400 kV address growing interregional power flows. In parallel, the dichotomy between indoor and outdoor installation environments shapes design considerations for enclosure ratings, thermal management, and seismic resilience.

Insulation type segmentation highlights a surge in oil-filled designs-particularly those leveraging ester fluids and mineral oil-locally preferred for their dielectric stability and temperature tolerance. Dry-type and gas-insulated transformers sustain relevance in environments requiring minimal fire risk and compact footprints. Application-focused segmentation underscores robust demand across industrial manufacturing, central power grid infrastructure, and burgeoning renewable energy developments. Lastly, winding and core construction methods differentiate competitive offerings, with shell-type windings facilitating enhanced mechanical strength and step-lap core joints reducing magnetic losses when compared to traditional butt-lap designs.

This comprehensive research report categorizes the Large Power Transformer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cooling Method

- Power Rating

- Voltage Rating

- Installation

- Insulation Type

- Winding Type

- Core Construction

- Application

Highlighting Regional Divergence and Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Transformer Markets

Regional analysis uncovers pronounced divergence in growth trajectories and investment priorities across the Americas, Europe Middle East Africa, and Asia Pacific markets. In the Americas, a resurgence of grid modernization projects is underpinned by government funding and regulatory incentives aimed at enhancing resilience against extreme weather events. Renewables integration and smart grid deployments are driving demand for advanced monitoring solutions paired with high-capacity transformers capable of accommodating bidirectional power flows.

Across Europe Middle East and Africa, stringent environmental directives and carbon reduction targets are accelerating the adoption of eco-friendly dielectric fluids and low-loss core materials. Ambitious interconnection projects spanning the European supergrid and Middle East power pools are underpinning multi-voltage transmission expansions. Meanwhile, North African nations are leveraging large power transformers to facilitate cross-border energy exchanges and capitalize on burgeoning solar and wind generation capacities.

The Asia Pacific region remains the primary growth engine for the global transformer industry. Massive infrastructure investments in China and India to expand rural electrification, urban transmission upgrades, and high-voltage direct current corridors are fueling unprecedented capacity additions. In Southeast Asia and Australia, renewable energy mandates and decarbonization roadmaps are spurring a new wave of grid-scale transformer procurements. This section delves into these region-specific dynamics, illustrating how regulatory regimes, capital allocation patterns, and technological priorities are shaping divergent yet interconnected market ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Large Power Transformer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Visionary Industry Leaders and Strategic Initiatives Driving Competitive Excellence in the Large Power Transformer Sector

Leading transformer manufacturers are differentiating through targeted investments in digital service portfolios, advanced material research, and global manufacturing footprint optimization. Key players are augmenting their offerings by integrating Internet-of-Things sensors and cloud-based analytics platforms into traditional hardware, thereby enabling real-time condition monitoring and predictive maintenance frameworks that reduce downtime and lifecycle costs.

Parallel R&D initiatives are focused on breakthrough core-steel alloys with enhanced magnetic permeability and ultra-low hysteresis losses, alongside next-generation insulation compounds that combine thermal resilience with reduced environmental impact. Strategic partnerships with academic institutions and specialist material suppliers are accelerating these innovation pipelines. In addition, several tier-one vendors are executing select acquisitions to expand capacity in high-growth regions, particularly in North America and Southeast Asia, where proximity to end users offers competitive advantage under evolving trade policies.

Collaborations between transformer OEMs and utility operators are also on the rise, aiming to co-develop customized solutions for microgrid integration, grid edge applications, and rapid-deployment substations. These alliances underscore a shift from transactional equipment sales toward outcome-driven service contracts. Finally, sustainability commitments, including water usage reduction, recycled steel content targets, and lifecycle carbon footprint assessments, are becoming integral to corporate strategies, distinguishing forward-thinking organizations in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Large Power Transformer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions Limited

- China XD Group Co., Ltd

- Eaton Corporation plc

- Efacec Power Solutions S.A.

- General Electric Company

- Hitachi Energy Ltd

- Hyosung Heavy Industries Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- Mitsubishi Electric Corporation

- PROLEC-GE INTERNACIONAL S. DE R.L. DE C.V.

- SamYoung Electric Co., Ltd

- Schneider Electric SE

- Siemens Energy AG

- TBEA Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Virginia Transformer Corp

- WEG S.A.

- Wilson Power Solutions Ltd

Delivering Actionable Strategies for Industry Leaders to Navigate Supply Challenges Embrace Innovation and Maximize Operational Efficiency

Industry leaders must adopt a multifaceted approach to navigate escalating supply chain volatility and intensifying competitive pressures. Prioritizing vertical integration of critical inputs, such as core steel processing and transformer oil blending, can mitigate exposure to external tariffs and fluctuating commodity markets. Concurrently, embracing fully modular design principles enables accelerated production cycles and on-site scalability, which are essential for meeting demanding project timelines in remote or underdeveloped regions.

Advancing digital transformation through end-to-end IoT frameworks and artificial intelligence–driven analytics will unlock predictive maintenance capabilities and optimize asset utilization. This should be complemented by robust cybersecurity protocols to protect critical grid infrastructure from emerging cyber threats. Investment in advanced insulation systems and low-loss magnetic cores should continue as a strategic imperative, addressing both regulatory emissions targets and the operational imperative to minimize energy losses across transmission networks.

To foster sustainable growth, organizations should collaborate with policymakers to advocate for supportive regulations, incentives for eco-friendly dielectric fluid adoption, and infrastructure resilience programs. Cultivating cross-sector partnerships-with technology startups, research institutions, and utilities-can accelerate innovation cycles, while tailored after-sales service offerings will reinforce customer loyalty and generate recurring revenue streams. By executing these strategic measures in concert, industry stakeholders can transform market headwinds into competitive opportunities and secure leadership positions in the evolving transformer ecosystem.

Detailing Rigorous Research Methodology Integrating Primary Interviews Secondary Data Analysis and Expert Validation for Comprehensive Market Insights

This analysis is grounded in a rigorous multi-phase research methodology that integrates both primary and secondary data sources to ensure comprehensive market perspectives. In the primary research phase, in-depth interviews were conducted with senior executives from leading transformer OEMs, procurement managers at utility companies, and technical specialists at key component suppliers. Additionally, structured surveys captured quantitative insights on design preferences, procurement timelines, and service requirements across global regions.

Secondary research efforts encompassed a thorough review of corporate annual reports, regulatory filings, and technical papers published in peer-reviewed engineering journals. Industry association publications and white papers provided further validation of technology adoption trends and policy impacts. Data triangulation techniques were employed to reconcile divergent information streams, ensuring the reliability and accuracy of core findings.

Analytical frameworks such as Porter’s Five Forces and SWOT analysis were applied to assess competitive dynamics, while segmentation matrices facilitated in-depth exploration of product, application, and regional variations. Quality control measures, including peer review workshops and fact verification protocols, reinforced the credibility of the research outputs. This structured approach delivers a balanced synthesis of qualitative and quantitative insights, equipping stakeholders with actionable intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Large Power Transformer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Large Power Transformer Market, by Cooling Method

- Large Power Transformer Market, by Power Rating

- Large Power Transformer Market, by Voltage Rating

- Large Power Transformer Market, by Installation

- Large Power Transformer Market, by Insulation Type

- Large Power Transformer Market, by Winding Type

- Large Power Transformer Market, by Core Construction

- Large Power Transformer Market, by Application

- Large Power Transformer Market, by Region

- Large Power Transformer Market, by Group

- Large Power Transformer Market, by Country

- United States Large Power Transformer Market

- China Large Power Transformer Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing Essential Insights and Strategic Imperatives to Guide Stakeholders Through the Complexities of the Large Power Transformer Market

The landscape of large power transformers is being reshaped by converging forces of technological innovation, shifting trade policies, and evolving energy transition imperatives. Stakeholders must remain agile, leveraging in-depth segmentation insights to tailor product portfolios for diverse cooling methods, voltage classes, and application environments. Regional nuances, from North American tariff-led sourcing shifts to Asia Pacific’s infrastructure boom, underscore the importance of granular market understanding.

As digitalization and sustainability become non-negotiable drivers of competitive differentiation, companies must integrate advanced monitoring capabilities, eco-friendly insulation solutions, and modular designs into their core offerings. Strategic partnerships across the value chain, aligned with robust research and development investments, will be essential to navigate escalating complexity and deliver turnkey solutions. Moreover, effective stakeholder engagement and policy advocacy will enable the industry to shape favorable regulatory frameworks and access incentive programs.

In summary, this executive summary offers a cohesive blueprint for navigating the dynamic challenges and opportunities within the large power transformer market. The insights presented here provide a strategic foundation for informed decision-making, enabling industry participants to capitalize on emerging trends and secure sustained growth in an increasingly competitive environment.

Empower Decision Makers to Access Tailored Market Intelligence and Strategic Guidance by Engaging with the Associate Director of Sales & Marketing

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, empowers stakeholders to access a definitive resource tailored for strategic decision-making in the large power transformer domain. This report offers comprehensive analyses, detailed segmentation, and actionable recommendations designed to support procurement managers, project developers, and C-level executives. By initiating a conversation, organizations can secure expert guidance to align transformational grid upgrade initiatives with evolving regulatory and sustainability requirements.

Immediate engagement with the Associate Director facilitates customized briefings that address unique market challenges, including tariff-driven supply disruptions and emerging technology integrations. Prospective clients will benefit from exclusive insights into competitive positioning, enabling proactive identification of collaboration opportunities and investment priorities. To capitalize on early-mover advantages and safeguard operational continuity, this authoritative market intelligence must be secured through direct liaison. We invite decision-makers to connect promptly to transform market complexity into a clear, executable roadmap and to ensure their strategic imperatives are backed by robust data and industry expertise

- How big is the Large Power Transformer Market?

- What is the Large Power Transformer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?