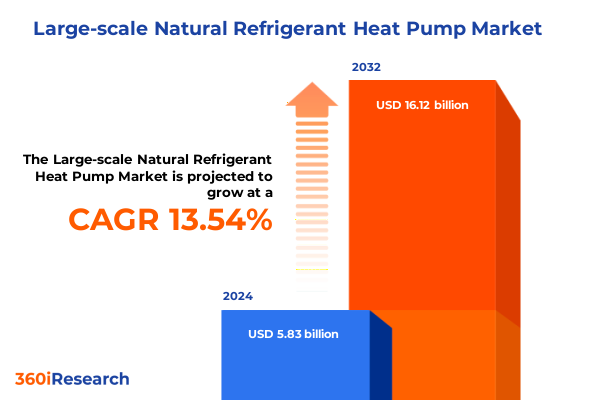

The Large-scale Natural Refrigerant Heat Pump Market size was estimated at USD 6.56 billion in 2025 and expected to reach USD 7.39 billion in 2026, at a CAGR of 13.69% to reach USD 16.12 billion by 2032.

Discover how natural refrigerant heat pumps are transforming energy efficiency and sustainability in large-scale industrial and commercial environments

The ongoing global push toward decarbonization has placed large-scale natural refrigerant heat pumps at the forefront of sustainable HVAC solutions. As organizations face increasingly stringent efficiency standards alongside ambitious carbon reduction targets, natural refrigerant systems present a compelling alternative to their high-global warming potential counterparts. By harnessing the superior thermodynamic properties of refrigerants like ammonia, carbon dioxide, and propane, these systems unlock higher coefficients of performance and substantially lower life-cycle emissions. Consequently, they align seamlessly with corporate environmental, social, and governance objectives while addressing the dual challenge of energy cost management and carbon footprint reduction.

In large-scale settings such as hospitals, data centers, chemical processing plants, and district cooling networks, operational reliability and year-round performance are non-negotiable. Natural refrigerant heat pumps excel in this arena due to their robust safety profiles, adaptability across diverse heat source environments, and compatibility with legacy infrastructure. As a result, stakeholders are increasingly prioritizing these systems in retrofit projects and new builds alike. This introduction lays the foundation for understanding why natural refrigerant heat pumps have transitioned from niche applications to mainstream adoption, setting the stage for deeper analysis into the transformative shifts, regulatory impacts, segmentation nuances, regional dynamics, and strategic imperatives that define the market today.

Explore the pivotal technological advances and policy transformations reshaping the landscape of large-scale natural refrigerant heat pump applications

In recent years, breakthrough innovations and policy realignments have reconfigured the landscape for large-scale natural refrigerant heat pump deployment. Technological advancements such as enhanced oil-free screw compressors and high-pressure centrifugal units have improved system reliability and lowered maintenance requirements. Concurrently, the refinement of subcritical and transcritical carbon dioxide cycles has broadened operational windows, enabling consistent performance in extreme climates and reducing reliance on synthetic refrigerants.

On the regulatory front, transatlantic momentum toward phasing down hydrofluorocarbons has accelerated industry adoption of low-GWP refrigerants. The European Union’s F-Gas Regulation revision and recent Environmental Protection Agency rules in the United States have created a clear compliance roadmap for end users, stimulating capital investment in natural refrigerant solutions. Regional incentive programs tied to carbon pricing and energy efficiency standards further amplify technology adoption, driving economies of scale and lowering total cost of ownership over the asset lifecycle. As a result, the market is witnessing a convergence of technical maturity and regulatory certainty, catalyzing a new era of sustainable large-scale heating and cooling.

Understand how recent tariff implementations in the United States are cumulatively impacting the deployment and cost dynamics of natural refrigerant heat pump systems in 2025

Since the early 2025 adjustments to U.S. tariff policies, end-users and manufacturers of natural refrigerant heat pumps have navigated a more complex cost structure for imported components. Steel and aluminum levies enacted under Section 232 continue to influence chiller frame and heat exchanger prices, while the lingering 25 percent duties on selected Chinese imports under Section 301 affect specialized compressor parts and controls. These combined duties have incrementally increased capital expenditures, prompting procurement teams to renegotiate supply contracts and explore alternative sourcing strategies.

In response to tariff-driven cost pressures, several heat pump OEMs have shifted to regionalized manufacturing footprints, establishing assembly and compressor modularization hubs in North America. This strategic realignment mitigates cross-border duties and expedites lead times. Moreover, domestic content provisions under emerging climate legislation incentivize local production of ammonia- and carbon dioxide-based systems, partially offsetting tariff burdens. Although short-term price adjustments remain a consideration for project planners, the cumulative effect of policy-induced supply chain realignment is fostering greater resilience and ensuring more predictable total cost of ownership for large-scale installations in 2025 and beyond.

Unlock segmentation insights showing how applications, refrigerants, sources, compressors, capacities, configurations, and channels shape natural refrigerant heat pump markets

A nuanced understanding of market segmentation reveals critical pathways to value creation and risk mitigation across the natural refrigerant heat pump ecosystem. When considering applications, decision-makers evaluate commercial deployments-such as data centers requiring precision cooling, district cooling networks prioritizing centralized efficiency, hospitals demanding redundancy, and hospitality facilities seeking guest comfort-alongside industrial uses in chemical and petrochemical processing where corrosion resistance is paramount, food and beverage operations requiring hygienic conditions, and pharmaceutical plants needing sterile temperature control. Each application category imposes unique performance, safety, and maintenance requirements that inform refrigerant selection and system design.

Refrigerant type segmentation underscores the importance of aligning thermophysical properties with operational imperatives. Ammonia’s high latent heat of evaporation suits large chillers, whereas carbon dioxide’s non-flammability and compact heat exchanger design make it ideal for urban installations; within this category, subcritical and transcritical cycles offer trade-offs between capital cost and seasonal efficiency. Propane systems deliver a balance of low GWP and established component availability, catering to mid-range capacities.

Heat source dynamics further differentiate market strategies. Air source configurations benefit from lower upfront costs but face efficiency degradation in subzero climates. Ground source deployments-whether leveraging vertical borehole arrays or horizontal collector loops-offer stable temperature baselines at higher capital outlays. Water source solutions tapping cooling tower circuits or river water intakes deliver optimal performance in regions with ample water access but require additional corrosion management protocols.

The choice of compressor technology-from centrifugal units suited to very high capacities and continuous operation, to reciprocating compressors for intermittent load profiles, and screw compressors available in oil-free or oil-injected variants-drives system efficiency and lifecycle costs. Equipment sizing within capacity thresholds, whether below 500 kilowatts for smaller plants, 500–1000 kilowatts for mid-sized installations, or above 1000 kilowatts for hyperscale applications, allocates capital and operational budgets accordingly. Configuration options, including single-stage and two-stage designs, offer flexibility in matching supply temperatures and load variations. Finally, distribution strategies through aftermarket channels emphasize service, maintenance, and spare parts readiness, while original equipment manufacturers-encompassing chiller fabricators and turnkey solution providers-bundle systems with engineering, procurement, and construction expertise. By mapping these interdependent segments, stakeholders can identify tailored entry points and optimized value chains.

This comprehensive research report categorizes the Large-scale Natural Refrigerant Heat Pump market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Refrigerant Type

- Heat Source

- Compressor Type

- Capacity Range

- Configuration

- Application

- Distribution Channel

Explore the regional nuances and growth trajectories of natural refrigerant heat pump adoption across the Americas, Europe Middle East & Africa, and Asia-Pacific regions

Regional dynamics in the Americas are shaped by a blend of mature infrastructure and emerging policy incentives. In North America, evolving efficiency standards under the Department of Energy and tax credits tied to low-carbon technologies have strengthened the business case for ammonia and carbon dioxide heat pumps in commercial real estate and data center applications. Latin American markets, driven by urbanization and industrial expansion, are increasingly receptive to natural refrigerant solutions, particularly for district cooling and beverage processing operations.

Within Europe, Middle East & Africa, the European Union leads with the world’s most stringent F-Gas regulations, propelling widespread adoption of propane and carbon dioxide systems for both retrofit and greenfield projects. Stringent energy labeling requirements and carbon border adjustment mechanisms further accelerate demand for best-in-class COP ratings. Meanwhile, the Middle East’s investment in mega-projects and smart city initiatives is creating niche opportunities for water-source and high-capacity centrifugal applications, while select African nations explore thermal storage-integrated heat pump systems to overcome grid reliability challenges.

Asia-Pacific continues to command a leadership role in manufacturing and innovation. China’s commitment to carbon peaking by 2030 has institutionalized incentives for large-scale industrial heat pump deployments, particularly in chemical, textile, and pharmaceutical sectors. Japan’s rigorous safety standards underpin a robust market for ammonia-based chillers in cold storage and process cooling. Australia’s focus on energy resilience and extreme climate performance is driving interest in ground-source hybrid systems. Across the region, strategic partnerships between global OEMs and local integrators are unlocking customized solutions that marry regulatory compliance with operational excellence.

This comprehensive research report examines key regions that drive the evolution of the Large-scale Natural Refrigerant Heat Pump market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze leading enterprises driving innovation, strategic partnerships, and competitive dynamics within the large-scale natural refrigerant heat pump industry landscape

Leading enterprises are shaping the trajectory of the natural refrigerant heat pump domain through a combination of technological innovation, strategic acquisitions, and collaborative partnerships. Global HVAC giants have introduced advanced ammonia and transcritical carbon dioxide product lines featuring integrated digital controls, predictive maintenance analytics, and modular architectures for rapid field servicing. At the same time, specialized firms have carved out expertise in oil-free screw compressors and high-efficiency subcritical carbon dioxide sub-systems, enabling niche performance advantages in critical infrastructure environments.

Strategic alliances between component suppliers and system integrators are optimizing the bill of materials, reducing installation complexity, and enhancing lifecycle reliability. Several prominent manufacturers have also invested in regional manufacturing hubs to mitigate tariff exposures and improve after-sales service responsiveness. Meanwhile, collaborative research consortia encompassing equipment vendors, research institutes, and utility partners are driving next-generation refrigerant formulations and enhanced heat exchanger coatings that promise further gains in COP and equipment longevity.

Competitive dynamics reflect a shift from purely price-driven procurement toward value-based selection criteria incorporating total cost of ownership, carbon abatement potential, and system interoperability. As a result, established market leaders are reinforcing their portfolios with turnkey solutions and digital service subscriptions, while emerging challengers focus on specialized applications such as high-purity pharmaceutical cooling and hyperscale data center thermal management. This diversified competitive landscape empowers end users to select solutions that precisely align with their operational priorities and sustainability targets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Large-scale Natural Refrigerant Heat Pump market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- ARANER

- Bitzer SE

- Bosch Thermotechnik GmbH

- Carrier Global Corporation

- Clade Engineering Systems Ltd.

- Daikin Industries, Ltd.

- Danfoss A/S

- Emerson Electric Co.

- Emicon AC S.p.A.

- FENAGY A/S

- GEA Group Aktiengesellschaft

- Guangdong PHNIX Eco-energy Solution Ltd.

- Johnson Controls International plc

- Linc Limited

- MAN Energy Solutions SE

- Mayekawa Mfg. Co., Ltd.

- Mitsubishi Electric Corporation

- Pure Thermal

- Siemens Energy AG

- Skadec GmbH

- Star Refrigeration Ltd.

- Thermax Limited

- Trane Technologies PLC

- Viessmann Werke GmbH & Co. KG

Uncover actionable recommendations empowering industry leaders to capitalize on natural refrigerant heat pump opportunities, mitigate risks, and accelerate sustainable growth

Organizations poised to capitalize on the natural refrigerant heat pump revolution should prioritize investments in integrated system design and lifecycle service models. By collaborating early with suppliers on modularized compressor and heat exchanger packages, project teams can reduce installation timelines and secure predictable performance metrics under varying load profiles. In parallel, engaging in joint pilot programs with technology providers will validate performance data and de-risk full-scale rollouts, especially for novel transcritical carbon dioxide and ammonia configurations.

To navigate the evolving tariff environment, industry leaders must diversify their sourcing strategies and consider localized manufacturing partnerships to mitigate duties and improve responsiveness. Strategic alliances with component fabricators can unlock preferential access to critical parts and enable co-development of oil-free and high-temperature compressor technologies. Additionally, adopting digital twin simulations and advanced control algorithms will optimize system operations, balancing efficiency gains against maintenance schedules to minimize unplanned downtime.

Finally, fostering end-user education through workshops and cross-sector knowledge exchanges will accelerate market acceptance and standardize safety protocols for handling natural refrigerants. By championing comprehensive training programs for installation crews and facility managers, organizations can ensure adherence to best practices and unlock the full sustainability potential of large-scale natural refrigerant heat pump deployments.

Delve into the rigorous research methodology blending primary insights and secondary intelligence shaping the comprehensive analysis of natural refrigerant heat pumps

This analysis integrates primary stakeholder insights with extensive secondary research to deliver a rigorous assessment of large-scale natural refrigerant heat pumps. Primary research included one-on-one interviews with engineering heads, facility managers, OEM executives, and regulatory specialists across North America, Europe, Middle East & Africa, and Asia-Pacific. These discussions provided firsthand perspectives on deployment challenges, performance benchmarks, and cost drivers, enabling a comprehensive understanding of end-user priorities.

Secondary research encompassed review of publicly available government regulations, industry association white papers, technical journals, and tariff schedules. Data triangulation techniques were applied to reconcile potential discrepancies between interview feedback and documented sources, ensuring the analysis reflects both market realities and emerging policy landscapes. Capacity design criteria, refrigerant emission factors, and operational case studies were benchmarked against peer-reviewed literature to validate performance claims.

The combined methodological rigor ensures that findings are grounded in quantitative metrics and qualitative insights, offering decision-makers a robust foundation for strategic planning without relying on speculative forecasting models.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Large-scale Natural Refrigerant Heat Pump market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Large-scale Natural Refrigerant Heat Pump Market, by Refrigerant Type

- Large-scale Natural Refrigerant Heat Pump Market, by Heat Source

- Large-scale Natural Refrigerant Heat Pump Market, by Compressor Type

- Large-scale Natural Refrigerant Heat Pump Market, by Capacity Range

- Large-scale Natural Refrigerant Heat Pump Market, by Configuration

- Large-scale Natural Refrigerant Heat Pump Market, by Application

- Large-scale Natural Refrigerant Heat Pump Market, by Distribution Channel

- Large-scale Natural Refrigerant Heat Pump Market, by Region

- Large-scale Natural Refrigerant Heat Pump Market, by Group

- Large-scale Natural Refrigerant Heat Pump Market, by Country

- United States Large-scale Natural Refrigerant Heat Pump Market

- China Large-scale Natural Refrigerant Heat Pump Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesize the key findings and strategic implications of the natural refrigerant heat pump study to inform future decision-making and sustainable development

The cumulative analysis underscores that natural refrigerant heat pumps represent a transformative pathway for large-scale heating and cooling applications. Key findings highlight that aligning system configuration with specific application requirements and regulatory drivers unlocks superior energy efficiency and carbon reduction benefits. Segmentation insights clarify how choices in refrigerant type, heat source, compressor technology, capacity tier, configuration stage, and distribution channel converge to influence total cost of ownership and operational resilience.

Regional dynamics reveal a mosaic of adoption rates driven by policy incentives, infrastructure maturity, and industrial demand profiles. Leading companies have responded by refining their product portfolios and forging strategic alliances, while forward-looking organizations should adopt agile sourcing, digital optimization, and stakeholder education to fully leverage market opportunities.

In conclusion, stakeholders equipped with these insights can confidently navigate the complexities of tariffs, regulatory landscapes, and technological options, positioning themselves to lead in the next generation of sustainable large-scale heating and cooling.

Take immediate action: connect with Ketan Rohom for exclusive access to the definitive natural refrigerant heat pump market research report and elevate your strategic roadmap

To secure a competitive edge in the evolving natural refrigerant heat pump landscape, take the next step by engaging with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the comprehensive research, ensuring tailored insights that align with your strategic objectives. Don’t miss the opportunity to leverage this definitive analysis to elevate your market positioning and drive sustainable growth.

- How big is the Large-scale Natural Refrigerant Heat Pump Market?

- What is the Large-scale Natural Refrigerant Heat Pump Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?