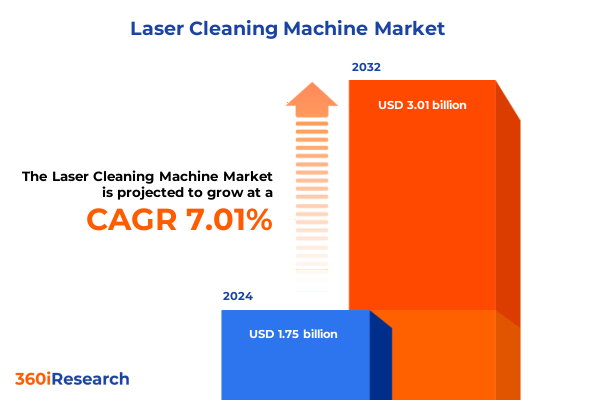

The Laser Cleaning Machine Market size was estimated at USD 1.85 billion in 2025 and expected to reach USD 1.99 billion in 2026, at a CAGR of 7.17% to reach USD 3.01 billion by 2032.

Revolutionary Laser Cleaning Technologies are Redefining Industrial Surface Treatment and Operational Efficiency Across Diverse Manufacturing Environments

Laser cleaning machines are transforming industrial surface treatment by integrating high-precision, non-abrasive processes into manufacturing and maintenance workflows. By harnessing focused laser beams, these systems selectively remove contaminants, coatings, oxides, and residues without the need for chemicals or media blasting. This capability not only enhances operational efficiency but also aligns with broader sustainability goals by eliminating secondary waste streams. As industries worldwide contend with stringent environmental regulations and mounting pressure to optimize asset lifecycles, laser cleaning solutions offer a compelling combination of speed, repeatability, and environmental stewardship.

Moreover, the advent of advanced laser sources and beam delivery systems has expanded the application scope beyond simple cleaning tasks. Through proper selection of wavelength and pulse parameters, modern equipment can address complex substrates, from delicate composites to heavy-duty alloys. This versatility is driving adoption across sectors such as aerospace maintenance, precision electronics fabrication, and heavy machinery refurbishment. In addition, built-in automation and sensor integration allow for consistent process control, reducing operator variability and ensuring high-quality results under demanding production schedules. As a result, laser cleaning is emerging as a cornerstone technology for manufacturers seeking to boost throughput, minimize downtime, and elevate product integrity.

Emerging Trends and Disruptive Innovations are Shaping the Future of Laser Cleaning Solutions with Unprecedented Precision and Sustainable Performance Gains

The laser cleaning industry is undergoing a period of rapid transformation as innovations in materials science, digital technologies, and process integration converge to redefine surface treatment workflows. Smart control systems equipped with real-time monitoring are now embedded within laser cleaning platforms, enabling operators to adjust parameters on the fly based on feedback from high-speed cameras and spectral sensors. This closed-loop approach not only optimizes cleaning efficacy but also prevents potential substrate damage by adapting beam intensity and scanning patterns to varying surface conditions.

Concurrently, advancements in laser source technology are driving down the total cost of ownership. Diode-pumped solid-state and fiber laser architectures are achieving higher wall-plug efficiencies, smaller form factors, and reduced maintenance requirements compared to their predecessors. These developments are paving the way for portable, handheld units that can address field maintenance applications previously inaccessible to bulkier, stationary systems. At the same time, integration with robotics and automated guided vehicles is becoming more commonplace, creating fully automated cleaning cells capable of operating in hazardous or hard-to-reach environments. These transformative shifts are expanding the addressable market and positioning laser cleaning as a next-generation solution for sustainable manufacturing and maintenance operations.

Evaluating the Deep and Multifaceted Effects of 2025 United States Tariffs on Laser Cleaning Equipment Supply Chains and Cost Structures

In 2025 the introduction of revised United States tariff schedules on imported laser equipment components is exerting significant influence on the global supply chain for laser cleaning systems. These tariffs, which target key subassemblies such as high-power laser diodes, fiber optic delivery modules, and precision galvanometer scanners, have prompted original equipment manufacturers and their suppliers to reevaluate procurement strategies. Consequently, some vendors are relocating component manufacturing to tariff-exempt regions, while others are renegotiating contracts to absorb additional levies without transferring the full burden to end users.

As a result, the cumulative cost impact is being mitigated through diversified sourcing and localized assembly. Several laser cleaning system providers have established regional hubs in Mexico and Southeast Asia to circumvent the most onerous duties, thereby preserving competitive pricing for North American customers. Moreover, service organizations are offering extended maintenance plans and consumable bundles to stabilize aftermarket revenue streams in the face of rising import costs. For enterprises that rely on laser cleaning for critical operations, the key is to partner with suppliers demonstrating transparent tariff management strategies and a commitment to supply chain resilience. In this evolving environment, proactive engagement with tariff specialists and close collaboration with vendors will remain essential to minimize disruptions.

Comprehensive Segmentation Analysis Reveals Market Dynamics Shaped by Laser Types Industry Verticals Applications Power Profiles and Sales Frameworks

A detailed examination of the market reveals that fiber lasers have solidified their position as the technology of choice for high-precision cleaning tasks, particularly where minimal substrate impact is critical. Parallel to this trend, CO₂ lasers continue to be favored for large-scale rust removal and heavy oxide stripping due to their cost advantages and broad beam profiles. Meanwhile, diode laser units are gaining traction in portable configurations, delivering lower power consumption and reduced maintenance in field operations. Nd:YAG systems maintain a niche role for specialty applications where pulsed beam characteristics offer unique cleaning dynamics.

Turning to end user industry dynamics, aerospace operators emphasize maintenance, repair, and overhaul functions, leveraging laser cleaning to prolong component life while meeting strict regulatory standards. Original equipment manufacturers in the automotive sector are integrating cleaning modules into production lines to ensure weld beds and paint surfaces meet exacting quality thresholds. Electronics fabricators apply laser cleaning to remove microscopic particulates without altering conductive traces, while metal fabrication shops deploy these systems to prepare complex geometries for subsequent coating applications. Shipbuilding yards, both commercial and military, increasingly adopt laser solutions to streamline hull refurbishment and signature reduction efforts.

Application area segmentation highlights that surface preparation remains the cornerstone use case, with automated cleaning arrays mounted on robotic arms to achieve consistent results. Paint stripping and rust removal continue to grow as operators seek chemical-free methods, whereas weld cleaning garners interest for its capacity to eliminate spatter without mechanical abrasion. Power rating analysis shows midrange 100 to 500 W systems dominating general industry use, while higher-power configurations above 500 W are reserved for heavy duty continuous processing. Conversely, under 100 W units are carving out a role in precision electronics and ARTEM-based micro-cleaning tasks. Finally, portable systems appeal to maintenance crews requiring flexibility, whereas stationary platforms are the workhorses in centralized production facilities. Sales channel trends indicate that direct sales relationships persist for large capital investments, distributors support regional service delivery, and online channels are emerging for entry-level and refurbished systems.

This comprehensive research report categorizes the Laser Cleaning Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Laser Type

- Power Rating

- System Type

- End User Industry

- Application Area

- Sales Channel

Regional Analysis Highlights Distinct Growth Drivers Challenges and Adoption Patterns in Americas Europe Middle East and Africa and Asia-Pacific Markets

Across the Americas the United States remains at the forefront of laser cleaning adoption, driven by robust demand in aerospace maintenance and heavy manufacturing. Canadian facilities are increasingly deploying laser systems in oil sands maintenance programs to reduce downtime and environmental impact, while Brazil’s growing automotive sector is testing handheld units for factory floor cleaning tasks. Mexico serves as both an assembly hub and a gateway for North American distribution, leveraging proximity to end users to minimize lead times and service costs.

In Europe Middle East and Africa, Germany and France lead the continental charge, supporting advanced manufacturing clusters with integrated laser and robotic cleaning cells. The Middle East’s petrochemical and shipbuilding sectors are embracing laser solutions to expedite turnaround in megashipyards, and select African nations are piloting programs for bridge restoration and heritage conservation. Regulatory frameworks in the European Union that prioritize chemical-free processes have further accelerated uptake, prompting local system integrators to develop turnkey laser cleaning solutions tailored to regional compliance requirements.

The Asia-Pacific region demonstrates dynamic growth underpinned by China’s expansive shipbuilding and automotive ecosystems, which demand high-throughput cleaning technologies. Japan and South Korea continue to innovate at the high-end segment, focusing on ultra-precision cleaning for semiconductor and electronics manufacturing. Meanwhile, Southeast Asian markets such as Vietnam and Thailand are emerging as service hubs, offering cost-effective maintenance and refurbishment services that cater to multinational OEMs. Across all subregions, government incentives for digitalization and smart factory initiatives are reinforcing the case for laser cleaning as an enabling technology within broader Industry 4.0 roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Laser Cleaning Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Technological Advancements and Competitive Differentiation in the Laser Cleaning Equipment Market

Leading technology providers are differentiating through focused investment in R&D to expand laser source efficiencies and beam delivery innovations. One prominent manufacturer has introduced modular fiber laser heads with adaptive focusing mechanisms that automatically adjust spot size based on surface topography. Another global player has forged partnerships with robotic arm suppliers to deliver fully integrated cleaning cells equipped with advanced vision systems for precision targeting. These alliances underscore a trend toward ecosystem play, where comprehensive solutions are prioritized over standalone laser modules.

Simultaneously, several mid-tier companies are carving out niches by offering specialized coatings removal packages that combine pre-treatment analysis with tailored pulse sequences. In parallel, service-oriented firms are establishing regional maintenance networks to guarantee rapid response times and consumable availability, positioning aftermarket support as a competitive differentiator. Strategic acquisitions have further reshaped the landscape, with established players absorbing smaller innovators to bolster their intellectual property portfolios and accelerate technology rollouts. Collectively, these strategies reflect an industry focus on delivering end-to-end value, from initial consultation and process validation through to lifecycle service agreements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Cleaning Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adapt Laser Systems LLC

- Amada Ltd.

- CleanLASER GmbH

- Coherent, Inc.

- Han's Laser Technology Industry Group Co., Ltd.

- IPG Photonics Corporation

- Jenoptik AG

- Laser Photonics Corporation

- Laserax Inc.

- Laserline GmbH

- TRUMPF GmbH + Co. KG

- Wuhan Huagong Laser Engineering Co., Ltd.

Practical and Forward-Thinking Strategies for Industry Leaders to Optimize Laser Cleaning Operations Enhance ROI and Achieve Sustainable Competitive Advantages

Industry leaders should prioritize the development of flexible service offerings that bundle predictive maintenance, real-time performance monitoring, and consumable management to enhance customer stickiness and recurring revenue streams. By integrating remote diagnostics and cloud-based analytics, original equipment manufacturers can deliver actionable insights that preemptively identify wear patterns and optimize scheduling of preventive interventions. This approach not only safeguards uptime but also builds long-term partnerships based on transparency and measurable value.

Moreover, companies should diversify their product portfolios by offering modular system configurations that cater to both portable field applications and stationary production environments. Tailoring power and beam delivery options for specific industry requirements-such as high-power continuous cleaning for heavy fabrication or low-power pulsed modules for precision electronics-will ensure alignment with customer workflows. Strategic alliances with regional distributors and system integrators can also amplify market reach, particularly in emerging territories where local expertise is critical to navigating regulatory and operational nuances.

Finally, to counteract the impact of tariffs and supply chain dynamics, leaders must cultivate geographically diversified manufacturing footprints and supplier ecosystems. Nearshoring key component production, forging joint ventures in tariff-exempt zones, and engaging in proactive trade compliance planning will reduce exposure to abrupt policy shifts. Coupling these measures with robust workforce training programs will equip service teams to deliver consistent quality and uphold stringent health, safety, and environmental standards in all markets.

Rigorous Research Methodology Details Comprehensive Data Collection Analytical Frameworks and Quality Assurance Protocols Underpinning the Market Insights

This research initiative combined qualitative and quantitative methods to deliver a comprehensive market perspective. Extensive secondary research encompassed peer-reviewed journals, technical white papers, and regulatory filings to establish foundational understanding of laser cleaning principles, emerging technologies, and industry standards. Proprietary trade and patent databases were mined to track innovation trajectories and identify leading technology developments worldwide.

In parallel, primary research involved in-depth interviews with C-level executives, R&D specialists, and application engineers to capture firsthand accounts of adoption drivers, pain points, and future priorities. These stakeholder engagements provided nuanced insights into process requirements across end use verticals. The analytical framework was then constructed using a multi-layered approach that triangulated primary inputs, secondary data, and expert validation to ensure consistency and objectivity. Rigorous quality control protocols, including cross-sampling and hypothesis testing, were implemented throughout the data collection and analysis phases to uphold the integrity and reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Cleaning Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Cleaning Machine Market, by Laser Type

- Laser Cleaning Machine Market, by Power Rating

- Laser Cleaning Machine Market, by System Type

- Laser Cleaning Machine Market, by End User Industry

- Laser Cleaning Machine Market, by Application Area

- Laser Cleaning Machine Market, by Sales Channel

- Laser Cleaning Machine Market, by Region

- Laser Cleaning Machine Market, by Group

- Laser Cleaning Machine Market, by Country

- United States Laser Cleaning Machine Market

- China Laser Cleaning Machine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis of Key Findings Emphasizes Strategic Imperatives Technological Opportunities and Future Outlook in the Evolving Laser Cleaning Landscape

In summary, laser cleaning technology is poised to redefine industrial surface treatment by offering environmentally responsible, cost-efficient, and highly precise solutions across multiple sectors. The intersection of advanced laser sources, digital controls, and integrated automation is catalyzing a new era of process reliability and operational agility. Segmentation analysis reveals diverse performance requirements based on laser type, end user vertical, and application area, underscoring the need for flexible system architectures.

Regional dynamics highlight differentiated growth trajectories, with mature markets emphasizing compliance and sustainability while emerging economies focus on rapid adoption and cost optimization. Competitive intensity is escalating as key players expand their technology portfolios and value-added services, prompting industry leaders to adopt targeted recommendations for service innovation, product modularity, and supply chain resilience. Collectively, these insights equip decision-makers with the strategic foresight required to navigate shifting policies, tariff realities, and evolving customer expectations in the fast-moving laser cleaning landscape.

Connect with Ketan Rohom to Unlock Actionable Insights Secure Your Customized Laser Cleaning Machine Market Research Report and Stay Ahead of Industry Trends

To receive the complete market research report and gain unparalleled insights into the evolving landscape of laser cleaning technologies, reach out directly to Ketan Rohom. As the Associate Director of Sales & Marketing, his expertise will guide you in selecting the most relevant intelligence and deliver a customized research package tailored to your strategic objectives. Engaging with Ketan ensures swift access to detailed data, comprehensive analyses, and practical guidance to help your organization harness emerging opportunities and mitigate risks. Take the next step toward informed decision-making and position your enterprise for sustained growth in a competitive market by contacting him today and securing your copy of the definitive laser cleaning machine market research report.

- How big is the Laser Cleaning Machine Market?

- What is the Laser Cleaning Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?