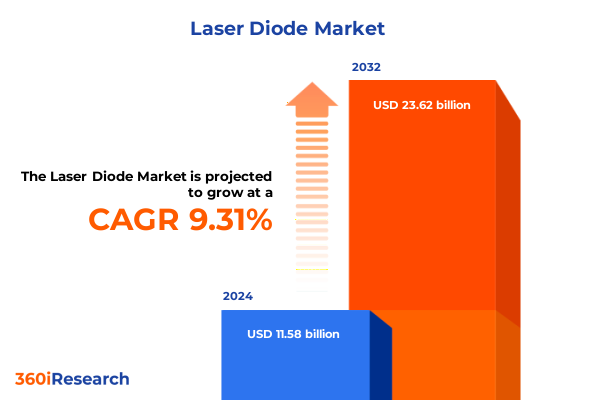

The Laser Diode Market size was estimated at USD 12.62 billion in 2025 and expected to reach USD 13.76 billion in 2026, at a CAGR of 9.36% to reach USD 23.62 billion by 2032.

Exploring the Fundamental Drivers and Strategic Imperatives That Define the Current Landscape and Future Trajectory of the Laser Diode Industry

As industries across the globe increasingly depend on high-precision optical solutions, the laser diode has emerged as a foundational technology driving innovation. From accelerated data transmission in telecommunications to advanced sensing in automotive applications and from sophisticated medical imaging systems to compact consumer electronics, the applications of laser diodes continue to expand. This introduction examines the fundamental forces powering this expansion, outlines the key technological breakthroughs propelling new use cases, and highlights the strategic imperatives that industry leaders must recognize.

In recent years, rising demand for miniaturization and energy efficiency has encouraged manufacturers to pursue novel material compositions and refined device architectures. Concurrently, the convergence of photonics with integrated circuit technologies is creating a new class of hybrid products that offer unprecedented performance at reduced footprints. Moreover, the imperative to reduce time-to-market has accelerated collaborative partnerships between component suppliers, system integrators, and research institutions. Consequently, stakeholders must not only appreciate the core advantages of laser diodes but also recognize how emerging alliances and converging technologies are reshaping competitive dynamics.

Uncovering the Major Technological Advances and Market Dynamics Revolutionizing the Production and Application of Laser Diodes Across Industries

The laser diode ecosystem is experiencing transformative shifts as a wave of technological advancements and evolving market demands converge. Beyond traditional continuous-wave and pulsed systems, innovations in quantum-engineered designs are enabling devices that operate at previously unattainable wavelengths and power levels. Additionally, the rapid maturation of vertical cavity surface emitting lasers has unlocked new frontiers in short-reach optical interconnects and 3D sensing for augmented reality devices.

At the same time, industry dynamics are being influenced by a push for higher efficiency and lower thermal footprints, prompting breakthroughs in gallium nitride-based diodes and novel heterostructures. Furthermore, the integration of real-time digital control and telemetry capabilities has elevated product differentiation, giving rise to “smart” diode modules equipped with self-monitoring and adaptive feedback. In parallel, strategic alliances between semiconductor foundries and photonics specialists have accelerated production scale-up of advanced diode designs. These shifts underscore a market that is not only diversifying in terms of technical specifications but also restructuring around collaborative innovation models.

Evaluating the Comprehensive Consequences of Recent United States Tariff Policies on the Laser Diode Supply Chain and Cost Structures in 2025

The United States has maintained an array of import duties targeting advanced optoelectronic devices under Section 301, with laser diodes among the affected components. Since the initial imposition in 2018, the cumulative impact of these tariffs has endured through 2025, resulting in an estimated 25% surcharge on qualifying imports. Consequentially, cost structures for components sourced from major manufacturing hubs have risen significantly, compelling buyers to reassess traditional supply-chain configurations.

In response, OEMs and distributors have pursued alternative sources in Taiwan, South Korea, and domestic fabrication facilities, spurred by government incentives aimed at revitalizing local semiconductor manufacturing. Nevertheless, the transition to new suppliers entails qualification timelines and validation processes that can extend project schedules. Furthermore, ongoing trade uncertainties continue to influence inventory strategies, with many businesses opting to maintain elevated stock levels to hedge against potential disruptions. Taken together, these factors illustrate how persistent tariff measures have reshaped buyer behavior, accelerated diversification efforts, and elevated the strategic importance of supply-chain resilience.

Digging into the Critical Segmentation Variables That Illuminate Diverse Market Opportunities and Specialized Applications for Laser Diodes

Segmenting the laser diode domain according to device characteristics reveals distinct pockets of opportunity and specialization. By type, multi-mode diodes have found favor in industrial applications where high power output and beam spread tolerance are paramount, whereas single-mode variants dominate telecommunications and precision instrumentation owing to their superior coherence and spectral purity. Looking at doping materials, aluminum gallium indium phosphide compositions serve visible-light applications while gallium aluminum arsenide solutions fulfill near-infrared requirements. Meanwhile, gallium arsenide remains a versatile platform, and advanced quaternary alloys like gallium indium arsenic antimonide enable mid-infrared emission. Emerging nitride compounds such as gallium nitride and indium gallium nitride have paved the way for high-brightness blue and ultraviolet diodes.

Considering technology platforms, distributed feedback lasers are the mainstay of high-capacity fiber-optic networks, Fabry-Pérot diodes provide cost-effective light sources for barcode scanning and pumping applications, and quantum cascade lasers cater to environmental monitoring and spectroscopy, with vertical cavity surface emitting lasers carving out space in optical mice and facial recognition sensors. From the perspective of mode of operation, continuous wave devices deliver steady beams for surgical and manufacturing processes, whereas pulsed diodes enable time-of-flight measurements in LiDAR and pulse-pumping regimes in laser machining. Finally, examining application end-uses reveals that the automotive and transportation sector leverages these diodes for adaptive headlights and distance sensing; consumer electronics integrates them into projection systems; defense and aerospace depend on them for targeting and countermeasure systems; healthcare and life sciences employ them in diagnostics and therapy; industrial applications harness them for cutting and welding; and telecommunications utilize them to sustain ever-faster data links.

This comprehensive research report categorizes the Laser Diode market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Doping Material

- Technology

- Mode of Operation

- Application

Mapping the Regional Dynamics and Growth Drivers That Are Shaping Demand Patterns and Strategic Priorities for Laser Diodes Globally

Geographical trends in the laser diode field highlight unique regional drivers and challenges. Across the Americas, the United States remains a hub for advanced research and development, with defense spending catalyzing upgrades in precision targeting systems and LiDAR technologies fueling autonomous vehicle initiatives. Canada’s automotive supply chain also incorporates high-power diodes for manufacturing automation, while Latin American markets are gradually adopting diode-based solutions in agriculture and mining operations.

In Europe, Middle East & Africa, stringent emission regulations and sustainability targets have increased demand for energy-efficient CW laser diodes in manufacturing, while telecommunications operators in the Middle East invest in next-generation fiber infrastructure employing distributed feedback sources. European automotive OEMs continue to integrate pulsed diodes into driver-assist radar and LiDAR suites. The Asia-Pacific region serves as both a leading production base and a major consumer, with significant output capacity in China, Japan, and South Korea. Here, consumer electronics giants drive high-volume adoption of VCSELs for smartphone sensing, and telecom service providers expand 5G backhaul links through GaAs-based diode installations. Government-led incentives across multiple APAC nations further bolster domestic manufacturing capabilities and technology development.

This comprehensive research report examines key regions that drive the evolution of the Laser Diode market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives Driving Innovation, Partnerships, and Market Leadership in Laser Diode Technologies

Prominent corporations are steering the laser diode market through a combination of technological prowess, strategic mergers, and collaboration with end users. Leading photonics specialists have invested heavily in proprietary design platforms that streamline integration with photonic integrated circuits, while diversified semiconductor firms are leveraging their process capabilities to scale production of high-performance diode chips. Partnerships between tier-one OEMs and component suppliers have intensified, focusing on co-development programs that address specific industry needs, such as reliability improvements for aerospace and higher modulation speeds for data centers.

Meanwhile, several well-established laser diode manufacturers have undertaken bolt-on acquisitions to broaden their material portfolios and expand into adjacent product lines. These moves have not only deepened their IP holdings but also created cross-selling opportunities across sectors. In parallel, a wave of specialized start-ups is challenging incumbents with breakthrough quantum cascade solutions and next-generation nitride materials. Collectively, these corporate maneuvers strive to balance volume-driven growth with targeted innovation, thus setting the stage for an increasingly competitive and collaborative marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Diode market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams-OSRAM AG

- Bluglass Limited

- Coherent Corp.

- Egismos Technology Corporation

- Frankfurt Laser Company

- Furukawa Electric Co., Ltd.

- Hamamatsu Photonics K.K.

- Infineon Technologies AG

- IPG Photonics Corporation

- Jenoptik AG

- Kyocera Corporation

- Lumentum Holdings Inc.

- Mitsubishi Electric Corporation

- MKS Instruments, Inc.

- Northrop Grumman Corporation

- Nuvoton Technology Corporation

- Power Technology, Inc.

- Renesas Electronics Corporation

- ROHM CO., LTD.

- SemiNex Corporation

- Sharp Corporation by Hon Hai Precision Industry Co., Ltd.

- Sony Semiconductor Solutions Corporation

- Sumitomo Electric Industries, Ltd.

- Thorlabs, Inc.

- TRUMPF SE + Co. KG

- Ushio, Inc.

Delivering Targeted Strategic Recommendations That Empower Industry Leaders to Navigate Emerging Challenges and Capitalize on Laser Diode Market Opportunities

To thrive in a landscape marked by shifting trade policies and rapid technological change, industry leaders must adopt proactive strategies that reinforce resilience and foster sustained growth. It is imperative to shore up supply-chain diversity by engaging multiple qualified suppliers across distinct geographical regions, thus mitigating the risk associated with tariff-affected imports and production bottlenecks. Parallel investment in in-house testing and qualification capabilities can shorten lead times and reduce reliance on external validation partners.

Furthermore, aligning R&D roadmaps with customer use-case requirements will accelerate the development of specialized diode solutions-whether for high-temperature operation in aerospace or ultra-low noise for quantum applications. Collaborative consortia and pre-competitive partnerships should be explored to spread development costs and standardize emerging interfaces. Equally, monitoring policy developments and participating in trade advocacy forums will empower companies to anticipate regulatory changes, shaping a more stable operating environment. By embracing these measures, industry participants can position themselves to capture new segments, sustain margin performance, and lead the next generation of laser diode innovations.

Detailing the Rigorous Research Methodology Employed to Gather, Validate, and Synthesize Comprehensive Insights on the Laser Diode Sector

This research synthesized insights from a combination of primary and secondary sources to ensure a holistic understanding of the laser diode environment. Primary inputs were gathered through structured interviews and roundtable discussions with senior executives and technical experts representing semiconductor foundries, system integrators, and end-user organizations. These conversations were complemented by on-site plant visits to major manufacturing facilities, affording a first-hand view of production processes and quality assurance practices.

Secondary data collection encompassed an extensive review of patent filings, academic publications, regulatory filings, and company financial disclosures. Market intelligence was further enriched by analyzing trade data and customs records to track shipment volumes and tariff classifications. Throughout the process, data validation workshops were conducted to triangulate findings and reconcile any discrepancies. A framework of competitive benchmarking was also applied to assess relative positioning, while scenario analysis was used to explore potential impacts of evolving trade and technology trends. This rigorous methodology underpins the credibility and depth of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Diode market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Diode Market, by Type

- Laser Diode Market, by Doping Material

- Laser Diode Market, by Technology

- Laser Diode Market, by Mode of Operation

- Laser Diode Market, by Application

- Laser Diode Market, by Region

- Laser Diode Market, by Group

- Laser Diode Market, by Country

- United States Laser Diode Market

- China Laser Diode Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Reflections on the Strategic Imperatives and Future Trajectories That Will Shape the Evolution of Global Laser Diode Innovations

Bringing together insights from technological, regulatory, and corporate developments reveals several strategic imperatives for participants in the laser diode space. Maintaining agility in sourcing and manufacturing is crucial amid persistent tariff uncertainties, while investment in advanced materials and device architectures will define competitive differentiation. Diversified segmentation strategies-spanning mode, technology, and application-allow firms to tailor offerings that meet specialized requirements, driving deeper partnerships with end users.

Regionally, aligning go-to-market approaches with local drivers and policy incentives can accelerate adoption and support long-term growth. Concurrently, industry alliances and consortia are proving instrumental in standardizing interfaces and lowering barriers to entry for emerging technologies. As we look ahead, the convergence of laser diodes with integrated photonics, augmented reality, and quantum systems will unlock transformative use cases. By heeding these lessons, executives can position their organizations to navigate complexity, capitalize on disruptive shifts, and chart a course toward sustained innovation and value creation.

Taking Decisive Action to Unlock Strategic Advantages by Securing Exclusive Laser Diode Market Intelligence with a Senior Sales Leadership Expert

To secure a comprehensive window into the evolving landscape of laser diode innovation, reach out immediately to Ketan Rohom, Associate Director, Sales & Marketing. He stands ready to guide you through the nuanced insights contained within our latest market research report and to tailor a solution that aligns with your strategic objectives. Whether you seek deeper understanding of supply chain shifts, segmentation dynamics, or the cumulative fallout of new tariff regimes, his expertise will ensure you obtain the critical intelligence you need to make informed decisions. Engage now to obtain your exclusive copy and unlock the bespoke support required to navigate emerging challenges and capitalize on future opportunities in the laser diode arena

- How big is the Laser Diode Market?

- What is the Laser Diode Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?