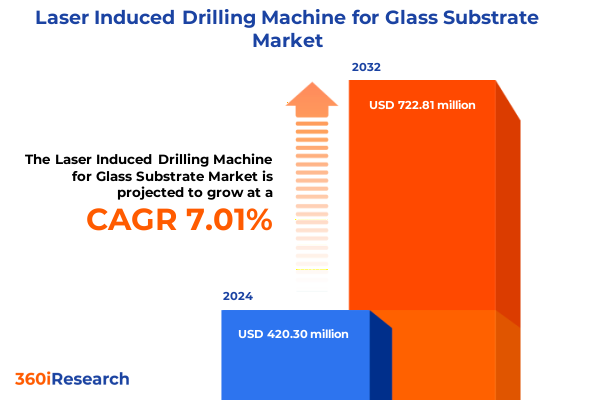

The Laser Induced Drilling Machine for Glass Substrate Market size was estimated at USD 447.44 million in 2025 and expected to reach USD 481.16 million in 2026, at a CAGR of 7.09% to reach USD 722.81 million by 2032.

Pioneering Glass Substrate Laser-Induced Drilling Technologies to Accelerate Advanced Manufacturing Across Multiple High-Tech Sectors

From the earliest applications in microelectronics to today’s cutting-edge display and medical device innovations, laser-induced drilling on glass substrates has emerged as a cornerstone technology enabling precision, miniaturization, and high throughput. By harnessing ultrashort pulse lasers and advanced beam delivery systems, manufacturers achieve near-perfect hole geometries with minimal thermal damage, ensuring optical clarity and structural integrity across diverse substrates.

As the demand for thinner, more intricate, and higher performance components intensifies, laser drilling has transcended its traditional role. In display glass, the ability to craft microvias for touch panels and microLED arrays has revolutionized visual performance and energy efficiency. In the medical sector, laser-drilled diagnostic components and surgical tools benefit from micron-level precision that enhances device reliability and patient outcomes. Additionally, printed circuit boards rely on seamless via formation in both flexible and rigid formats, while solar cell producers embrace laser texturing and drilling to boost light absorption and efficiency.

With growing emphasis on Industry 4.0 integration, manufacturers are rapidly adopting automated laser drilling systems that incorporate real-time monitoring, adaptive process control, and predictive maintenance. This convergence of digitalization and laser technology is propelling the sector toward unprecedented levels of yield optimization, cost reduction, and process transparency. Consequently, laser-induced drilling has secured its position as an indispensable enabler of next-generation glass-based manufacturing.

Emerging Innovations and Strategic Developments Reshaping Laser-Induced Glass Drilling to Meet Evolving Demands in Display, Medical and Energy Applications

Over the past decade, laser-induced drilling has undergone transformative evolution, driven by breakthroughs in source development, process control, and integration capabilities. Advances in fiber and ultrashort pulse lasers now deliver peak powers sufficient to ablate glass substrates at submicron tolerances, while sophisticated beam shaping and scanning architectures enable complex hole patterns at exceptional speeds.

At the same time, the convergence of artificial intelligence and process analytics is redefining how drilling operations are managed. Machine learning algorithms now analyze real-time sensor data to predict tool wear, optimize pulse parameters, and detect defects before they propagate, thereby elevating yield and consistency. Concurrently, hybrid manufacturing cells-combining laser drills with additive and subtractive processes-are unlocking multifunctional platforms capable of creating three-dimensional microstructures with unparalleled flexibility.

From an operational perspective, the integration of digital twins and virtual commissioning tools has reduced setup times and facilitated remote diagnostics. Laser systems equipped with cloud connectivity enable seamless software updates and centralized performance benchmarking across global facilities. These paradigm shifts are fostering a new era of agile, data-centric manufacturing where laser drilling aligns seamlessly with smart factory initiatives, quality assurance mandates, and sustainability imperatives.

Evaluating the Comprehensive Effects of 2025 US Tariff Measures on Laser-Induced Drilling Machine Supply Chains and Pricing Dynamics

The introduction of new United States tariffs in 2025 targeting imported laser drilling equipment and optical components has significantly influenced supply chain configurations and cost structures for glass substrate drilling solutions. Tariff levies on critical components such as precision optics, galvanometric scanners, and specialized beam delivery modules have resulted in elevated landed costs for original equipment manufacturers and end users alike.

In response, many system integrators and component suppliers have expedited initiatives to localize production and diversify their vendor base. North American-based optics manufacturers have scaled capacity to fill the void, while partnerships with regional laser source producers have gained prominence. This shift toward nearshoring has succeeded in alleviating some lead time challenges, yet it has also introduced the need for accelerated qualification protocols and expanded technical support infrastructures.

Meanwhile, end users have adopted strategic procurement measures to offset higher procurement costs. Extended warranty agreements, bundled service contracts, and multi-year purchase commitments have emerged as common mitigation strategies. As a result, procurement cycles have become more deliberate, with cross-functional teams collaborating closely to align technical specifications, total cost of ownership considerations, and long-term maintenance plans under the new tariff environment.

Unveiling Critical Insights from Application, Laser Type, Pulse Duration, End User, Machine Type, and Power Rating Segmentation Perspectives

An in-depth segmentation analysis provides clarity on the varied pathways through which laser-induced drilling systems generate value across industries and applications. When examining the market through the lens of applications, it becomes clear that display glass leads adoption, driven by the proliferation of LCD and OLED panels requiring precise microvia formation. Medical devices follow closely, as diagnostic components and surgical tools demand the exact hole quality only lasers can deliver. In parallel, printed circuit board producers utilize both flexible and rigid PCBs to meet consumer electronics miniaturization, while solar cell manufacturers increasingly rely on crystalline silicon, perovskite, and thin-film cell texturing and hole drilling to enhance energy capture.

Switching focus to laser type segmentation, CO2 lasers maintain relevance in thicker glass applications due to their cost-effectiveness, whereas fiber lasers have garnered favor for their superior beam quality and low maintenance. Nd:YAG lasers, with their versatility and beam wavelength suitability, continue to satisfy niche requirements. Pulse duration segmentation reveals that femtosecond lasers dominate high-precision tasks, picosecond lasers balance throughput and accuracy for general-purpose drilling, and nanosecond lasers serve lower precision, high-volume processes.

Analyzing end-user categories shows that electronics manufacturers prioritize speed and repeatability, automotive OEMs require robust process integration for sensor and display components, medical device producers focus on regulatory compliance and traceability, and solar cell manufacturers emphasize throughput and surface quality. Machine type insights indicate that inline configurations support seamless integration into continuous production lines, robotic integration cells offer flexible automation for batch processing, and standalone units provide cost-effective solutions for research or low-volume environments. Finally, power rating segmentation illustrates that high-power systems address thick or high-volume drilling needs, medium-power units optimize energy efficiency for standard tasks, and low-power lasers serve delicate or prototype applications.

This comprehensive research report categorizes the Laser Induced Drilling Machine for Glass Substrate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Laser Type

- Pulse Duration

- Machine Type

- Power Rating

- Application

Mapping Regional Dynamics and Growth Drivers Across Americas, Europe Middle East and Africa, and Asia-Pacific in the Laser-Induced Glass Drilling Market

Regional dynamics in the laser-induced drilling market reflect a combination of manufacturing capability, end-user demand, and policy influences. In the Americas, advanced automotive electronics, consumer devices, and aerospace components drive robust demand for precision drilling solutions. The United States, in particular, leverages government incentives for advanced manufacturing and renewable energy development, thereby fueling local installations of high-power and ultrashort pulse laser systems.

Conversely, Europe, the Middle East, and Africa exhibit a diverse landscape shaped by stringent quality standards and sustainability goals. Western European nations emphasize compliance with environmental regulations and data traceability, prompting laser suppliers to integrate real-time monitoring and waste reduction features. Meanwhile, emerging markets in the Middle East and Africa focus on infrastructure modernization and renewable energy projects, creating growth opportunities for solar cell drilling and large-format glass processing.

In the Asia-Pacific region, high-volume electronics production centers in China, Japan, South Korea, and Taiwan continue to adopt laser drilling en masse to support consumer electronics, semiconductor packaging, and display manufacturing. Government-led initiatives to advance renewable energy and smart city deployments further stimulate demand for solar cell texturing and glass-based sensor arrays. Additionally, local laser source and optics manufacturers have scaled capacity, driving competitive pricing and accelerated technology diffusion throughout the region.

This comprehensive research report examines key regions that drive the evolution of the Laser Induced Drilling Machine for Glass Substrate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Laser-Induced Drilling Machine Manufacturers Across Global Markets

Key players in the laser-induced drilling space are advancing their competitive positioning through a blend of product innovation, strategic partnerships, and global footprint expansion. Leading laser source innovators have introduced next-generation fiber and ultrashort pulse platforms that offer improved beam quality, enhanced process control, and simplified maintenance. These product launches underscore a shift toward modular architectures that facilitate upgrades and customization for diverse end-user requirements.

Simultaneously, system integrators are forging alliances with optics and automation specialists to deliver turnkey drilling solutions. By embedding advanced monitoring systems and automated loading mechanisms, these collaborations address the pressing need for reduced cycle times and elevated throughput. Some companies have also pursued acquisitions of niche technology providers to bolster their capabilities in areas such as machine vision, adaptive optics, and digital twin simulations.

Geographically, top-tier manufacturers are extending their service networks to offer localized technical support and training across major markets. This strategy not only mitigates tariff impacts but also aligns with customer expectations for rapid response times and comprehensive after-sales care. Moreover, several firms have established regional centers of excellence that combine demonstrator lines, application labs, and expert consultation to accelerate customer adoption and co-development of next-generation drilling processes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Induced Drilling Machine for Glass Substrate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdValue Photonics, Inc.

- Amada Holdings Co., Ltd.

- Coherent, Inc.

- E&R Engineering Corp.

- Han’s Laser Technology Industry Group Co., Ltd.

- Honstec Machine Co., Ltd

- IGOLDENLASER (China) Co., Ltd.

- IPG Photonics Corporation

- Jenoptik AG

- LPKF Laser & Electronics AG

- nLIGHT, Inc.

- Sahajanand Laser Technology Limited

- Trotec Laser GmbH

- TRUMPF GmbH + Co. KG

- Universal Laser Systems, Inc.

Driving Operational Excellence and Strategic Growth with Targeted Recommendations for Industry Leaders in Laser-Induced Glass Drilling Solutions

Industry leaders seeking to capitalize on laser-induced drilling growth should adopt a multi-pronged strategy that balances technological advancement, supply chain resilience, and operational excellence. First, investing in ultrashort pulse technologies and adaptive beam delivery systems will enable manufacturers to tackle emerging applications requiring submicron precision. Concurrently, deploying digital twins and AI-driven process analytics can unlock yield improvements and predictive maintenance capabilities, thus minimizing unplanned downtime and preserving throughput targets.

Second, stakeholders must address supply chain risks exposed by tariff fluctuations and component scarcity. Establishing strategic partnerships with regional optics and laser source suppliers, combined with dual-sourcing arrangements, will ensure continuity of critical parts. Organizations should also pursue nearshoring initiatives to reduce lead times and strengthen their ability to respond to shifting policy landscapes.

Finally, workforce development and collaborative innovation must remain central to any growth agenda. Implementing comprehensive training programs for laser engineers, integrating cross-functional teams to accelerate process development, and engaging with academic and research institutions for co-funded R&D projects will fortify long-term competitiveness. By aligning these recommendations with a clear governance framework and performance metrics, industry leaders can achieve sustainable growth and maintain a leadership position in precision glass drilling.

Employing Rigorous Mixed-Method Research Methodologies to Ensure Robust Market Insights for Laser-Induced Drilling on Glass Substrates

This research employs a robust mixed-method approach to ensure the validity and reliability of insights on laser-induced drilling for glass substrates. Secondary research included a comprehensive review of technical white papers, standards publications, and industry association reports to establish the technological fundamentals and identify key market drivers. Primary research involved in-depth interviews with C-level executives, R&D directors, and process engineers across leading OEMs, system integrators, and end-user organizations, capturing firsthand perspectives on adoption challenges and future innovation priorities.

Quantitative data were triangulated through validation with proprietary installation and service databases, enabling a nuanced understanding of equipment deployment patterns. Segmentation matrices were constructed by synthesizing application, laser type, pulse duration, end user, machine type, and power rating dimensions, ensuring comprehensive coverage of market dynamics. Geographical insights were substantiated through macroeconomic analyses and policy reviews, highlighting regional incentives, tariff structures, and manufacturing capabilities.

To uphold methodological rigor, all data points were cross-verified by independent analysts and reviewed by a panel of domain experts. Quality control measures, including consistency checks and gap analysis, were applied throughout the research lifecycle. This structured methodology provides a transparent and replicable framework for stakeholders to reference when evaluating the strategic implications of laser drilling innovations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Induced Drilling Machine for Glass Substrate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Induced Drilling Machine for Glass Substrate Market, by Laser Type

- Laser Induced Drilling Machine for Glass Substrate Market, by Pulse Duration

- Laser Induced Drilling Machine for Glass Substrate Market, by Machine Type

- Laser Induced Drilling Machine for Glass Substrate Market, by Power Rating

- Laser Induced Drilling Machine for Glass Substrate Market, by Application

- Laser Induced Drilling Machine for Glass Substrate Market, by Region

- Laser Induced Drilling Machine for Glass Substrate Market, by Group

- Laser Induced Drilling Machine for Glass Substrate Market, by Country

- United States Laser Induced Drilling Machine for Glass Substrate Market

- China Laser Induced Drilling Machine for Glass Substrate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Consolidating Key Takeaways and Strategic Imperatives to Navigate the Evolving Landscape of Laser-Induced Drilling in Glass Substrate Manufacturing

As laser-induced drilling technologies continue to evolve, the convergence of ultrashort pulse sources, advanced beam control, and digital integration will redefine the benchmarks for precision, throughput, and process reliability. Manufacturers that harness these innovations and embed them within smart factory ecosystems will unlock higher yields, reduced maintenance costs, and faster time-to-market for critical glass-based components.

Simultaneously, the ripple effects of new tariff measures underscore the importance of supply chain agility and strategic vendor diversification. Organizations that anticipate policy shifts and invest in localized capabilities will be better positioned to manage cost volatility and maintain continuity of operations.

Moving forward, a clear focus on end-user collaboration, workforce upskilling, and sustainable manufacturing practices will determine which players emerge as market leaders. By embracing a holistic approach that integrates technology roadmaps, risk mitigation, and performance governance, stakeholders can navigate the complex landscape of laser-induced glass drilling and capitalize on emerging opportunities across displays, medical devices, electronics, and renewable energy sectors.

Engage with Ketan Rohom to Unlock Comprehensive Laser-Induced Drilling Insights and Empower Your Strategic Decision-Making Today

For tailored insights and strategic guidance on laser-induced drilling technologies for glass substrates, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep market expertise and can provide a comprehensive overview of the latest technological advancements, industry dynamics, and competitive intelligence. Whether you are evaluating new equipment investments, seeking to optimize manufacturing processes, or looking to refine your go-to-market strategy, Ketan can customize the report to address your unique requirements and strategic objectives. Reach out today to secure your copy of the full market research report and position your organization at the forefront of precision drilling innovation.

- How big is the Laser Induced Drilling Machine for Glass Substrate Market?

- What is the Laser Induced Drilling Machine for Glass Substrate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?