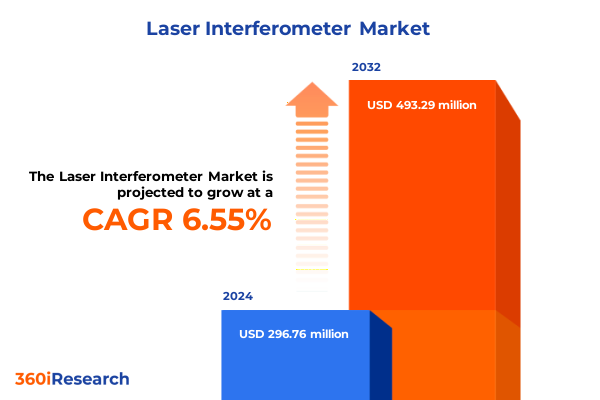

The Laser Interferometer Market size was estimated at USD 309.08 million in 2025 and expected to reach USD 323.72 million in 2026, at a CAGR of 6.90% to reach USD 493.29 million by 2032.

Pioneering the Era of Precision Measurement with Laser Interferometry: Defining Opportunities and Technological Frontiers Unveiled Across Industries

The dawn of a new era in precision measurement has been defined by the remarkable capabilities of laser interferometry, a technology that has transcended its research origins to become an indispensable tool across a multitude of industries. From detecting gravitational waves at the furthest reaches of the cosmos to ensuring the integrity of semiconductor wafers in high-volume manufacturing, laser interferometers have proven their unrivaled sensitivity and accuracy. As global demand surges for ever-more precise measurement solutions, the laser interferometer market stands on the cusp of significant expansion, driven by technological advancements and burgeoning end-user requirements.

Across the aerospace, defense, and telecommunications sectors, laser interferometry has become synonymous with reliability, enabling real-time diagnostics and predictive maintenance protocols that optimize performance and reduce downtime. Concurrently, the rapid evolution of photonic integration and quantum-enhanced detection methods is ushering in novel applications, extending the reach of interferometry into medical imaging, automated vehicle navigation, and vibration analysis in civil engineering. With research institutions and private enterprises alike investing heavily in next-generation instrumentation, the foundational role of laser interferometers in precision science and industrial quality control is clearer than ever.

Transitioning from a predominantly laboratory-based technology to a versatile commercial solution, laser interferometers are now integral to a variety of mission-critical operations. As stakeholders seek to harness their transformative potential, understanding the strategic landscape, disruptive forces, and segmentation dynamics will be essential to capturing emerging opportunities and maintaining competitive advantage.

Navigating Rapid Technological Evolution and Disruptive Innovations That Are Redefining the Laser Interferometer Industry Landscape

The landscape of laser interferometry is undergoing profound shifts as disruptive innovations and rapid technological evolution redefine its capabilities. Integration with advanced digital signal processing and machine learning algorithms now enables interferometers to adaptively filter noise and automate alignment procedures, greatly enhancing measurement reliability in challenging environments. Miniaturization efforts, driven by photonic integrated circuits and microelectromechanical system (MEMS) technologies, have led to compact, field-deployable interferometry modules that can be seamlessly incorporated into autonomous vehicles and portable diagnostic instruments.

Moreover, quantum-enhanced sensing techniques are pushing the boundaries of precision, allowing for sub-femtometer displacement measurements that were previously unattainable. These breakthroughs, coupled with the adoption of fiber laser sources and low-noise photonic components, are catalyzing a shift toward all-fiber interferometer architectures, which offer superior stability and reduced susceptibility to environmental perturbations. In parallel, open-platform hardware initiatives and standardized communication protocols are fostering interoperability, accelerating time-to-market for novel interferometer designs.

Consequently, industry stakeholders are witnessing a transformative realignment of value chains. Traditional component suppliers are partnering with software firms specializing in predictive analytics, while academic consortia collaborate with OEMs to validate quantum-enhanced interferometer prototypes. As a result, the once-clear demarcation between research laboratories and commercial production lines is blurring, heralding a dynamic era in which technological convergence and cross-sector collaboration will determine market leadership.

Unpacking the Comprehensive Implications of United States Tariffs Implemented in 2025 on Laser Interferometer Supply Chains and Component Economics

In 2025, the United States implemented a new tranche of tariffs targeting precision optical components, including high-stability laser sources, specialized beam splitters, and ultralow-loss optical fibers. These measures, aimed at bolstering domestic manufacturing and reducing supply chain vulnerabilities, have led to notable cost increases for imported subsystems originating from established European and East Asian suppliers. As a result, end users and OEMs are experiencing margin pressures that compel a reevaluation of sourcing strategies and supplier partnerships.

The immediate aftermath has seen smaller system integrators facing the greatest challenges, as their limited procurement volumes reduce their negotiating power to absorb tariff-induced price hikes. In contrast, larger corporations have leveraged vertical integration and forward-buying agreements to secure critical components at more predictable costs. Simultaneously, government-backed incentives for reshoring precision optics fabrication have gained traction, enabling domestic vendors to expand capacity and narrow the gap with incumbent international providers.

Looking ahead, the 2025 tariff landscape is expected to catalyze a broader strategic realignment within the laser interferometer ecosystem. Companies are exploring dual sourcing from emerging markets, accelerating investments in in-house component development, and forming consortiums to lobby for phased tariff relief. Through these adaptive measures, the industry is laying the groundwork for a more resilient supply chain that balances cost-efficiency with the need for high-performance optical instrumentation.

Deriving Strategic Insights by Examining Technique, Technology, Application, and End-User Dimensions Shaping the Laser Interferometer Market

A nuanced analysis of market segmentation reveals the multifaceted drivers shaping demand for laser interferometers. Based on technique, heterodyne systems continue to dominate applications requiring dynamic displacement measurements, owing to their superior sensitivity and immunity to phase noise. Homodyne configurations, however, are witnessing increased adoption in compact metrology setups where simplicity and cost-effectiveness are paramount. Transitioning to technology, the landscape is marked by a diverse array of interferometer architectures. Fabry-Perot variants excel in cavity-length measurement for laser stabilization, while Fizeau designs are preferred for high-throughput optical communications testing. Mach-Zehnder and Michelson frameworks underpin large-scale facilities such as gravitational wave observatories, benefitting from their established performance and modular scalability. Meanwhile, Sagnac interferometers are gaining recognition for rotation sensing in navigation systems, and Twyman-Green systems remain central to precision optical component inspection.

In terms of application, the gravitational wave detection segment drives cutting-edge research funding and sets performance benchmarks for displacement resolution. Metrology applications, encompassing semiconductor wafer inspection and machining calibration, contribute substantial volume demand. Optical communications testing consistently underscores the need for high-speed, low-distortion measurements in fiber-optic networks, while optical testing in research and lab environments fuels continuous product innovation. Vibration measurement applications, particularly in aerospace structural testing and civil engineering monitoring, further expand the market’s scope.

Considering end-user profiles, aerospace & defense exploit laser interferometers for precision navigation, guided weapon systems, and satellite alignment, establishing a baseline for ruggedized, high-reliability instrumentation. The automotive industry increasingly integrates interferometric sensors into advanced driver-assistance systems and electric vehicle battery characterizations. Construction stakeholders deploy vibration measurement interferometers in structural health monitoring of bridges and high-rise buildings. Electronics & semiconductor firms rely on these instruments for nanometer-scale lithography alignment and wafer metrology, while manufacturing sectors leverage them for machine tool calibration. Medical & healthcare innovators pursue non-invasive diagnostic tools based on interferometric imaging, and telecommunications companies harness high-speed optical testing to validate next-generation network components.

This comprehensive research report categorizes the Laser Interferometer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Technology

- Measurement Dimension

- Application

- End-User

Unveiling Regional Dynamics and Growth Drivers Influencing Demand for Laser Interferometers Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the trajectory of the laser interferometer market, reflecting divergent industrial priorities and funding architectures. In the Americas, government agencies and private laboratories are spearheading large-scale research initiatives in gravitational physics and quantum sensor development. Substantial federal grants underpin collaborations between national laboratories and commercial OEMs, fostering an ecosystem where innovation is incentivized through both public and private investment.

Traveling across to Europe, Middle East & Africa, the market is propelled by multinational consortia targeting collaborative projects such as space-based interferometry missions and advanced metrology networks. Regulatory frameworks promoting precision manufacturing and Industry 4.0 adoption have stimulated demand for tailored interferometry solutions, especially within the high-value automotive and aerospace clusters concentrated in Germany, France, and the United Kingdom. Simultaneously, defense modernization programs in the Middle East are integrating interferometric systems for naval and unmanned aerial vehicle (UAV) applications, while research institutions in South Africa leverage these instruments for geophysical monitoring.

In the Asia-Pacific region, strategic government roadmaps prioritizing quantum technology development and semiconductor self-sufficiency are key growth drivers. China’s national laboratory investments, coupled with domestic optics manufacturing expansion, have accelerated the availability of cost-competitive interferometer components. Japan and South Korea continue to advance precision photonics research, supporting both academic and industrial applications. In addition, emerging markets such as India and Southeast Asia increasingly adopt interferometric sensors for infrastructure monitoring and medical imaging, signaling a broadening of the end-user base. Each region’s unique combination of policy support, industrial specialization, and research collaboration shapes a distinct demand profile, underscoring the importance of tailored go-to-market strategies.

This comprehensive research report examines key regions that drive the evolution of the Laser Interferometer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Market Leaders’ Strategic Initiatives, Innovation Portfolios, and Competitive Positioning Driving Advances in Laser Interferometry Technologies

Market leaders are deploying concerted strategies to capture emerging opportunities and safeguard their competitive positioning. Established players have accelerated investments in integrated photonic platforms, leveraging in-house research facilities to develop compact, turnkey systems. Collaborative partnerships between incumbent OEMs and niche technology startups are advancing the commercialization of quantum-enhanced interferometers, while joint ventures with fiber laser specialists optimize source performance for industrial applications.

Several firms have also undertaken targeted acquisitions to expand their product portfolios and geographic reach. By integrating complementary technologies-such as low-noise detectors, automated alignment modules, and cloud-based analytics platforms-vendors are delivering end-to-end solutions that address both hardware and software requirements. Concurrently, customized service offerings, including remote diagnostics, calibration-as-a-service, and on-site training programs, are strengthening customer loyalty and enabling recurring revenue streams.

Beyond product innovation, leading companies are actively shaping industry standards through participation in professional consortia and international standards bodies. Their thought leadership in defining interface protocols and performance benchmarks enhances interoperability and drives adoption, particularly within highly regulated sectors such as aerospace, defense, and life sciences. Together, these strategic initiatives underscore a collective focus on integrated systems, customer-centric services, and collaborative innovation as the cornerstones of sustained market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Interferometer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Apre Instruments

- attocube systems AG

- Automated Precision Inc.

- Bruker Corporation

- Chotest Technology Inc.

- Haag-Streit Group by Metall Zug AG

- Holmarc Opto-Mechatronics Ltd.

- HÜBNER GmbH & Co. KG

- Keysight Technologies, Inc.

- Lapmaster Wolters

- Lasertex Co. Ltd.

- LT Ultra-Precision Technology GmbH

- Mahr GmbH

- MICRO-EPSILON MESSTECHNIK GmbH & Co. KG

- M³ Measurement Solutions Inc.

- Novacam Technologies, Inc.

- Onto Innovation Inc.

- Palomar Technologies, Inc.

- Polytec GmbH

- Pratt and Whitney Measurement Systems, Inc.

- QED Technologies International, Inc.

- Renishaw PLC

- SIOS Messtechnik GmbH

- SmarAct GmbH

- Status Pro Maschinenmesstechnik GmbH

- TOKYO SEIMITSU CO., LTD.

- Trioptics GmbH

- Zygo Corporation by AMETEK, Inc.

Offering Actionable Strategic Roadmaps for Industry Stakeholders to Capitalize on Emerging Opportunities in the Laser Interferometer Ecosystem

Industry stakeholders seeking to secure a sustainable competitive advantage must adopt a series of targeted actions designed to harness the market’s evolving dynamics. First, diversifying supply chains through strategic partnerships with both established domestic vendors and emerging international suppliers can mitigate tariff risks and ensure continuity of critical optical components. Simultaneously, investing in integrated photonic and quantum-enhanced architectures will position organizations at the vanguard of technological breakthroughs and accelerate time-to-market for next-generation solutions.

Furthermore, forging alliances with academic institutions and government laboratories can facilitate early access to cutting-edge research, enabling pilot deployments and joint validation efforts. Developing modular, software-defined interferometer platforms will enhance adaptability across application domains, from high-volume industrial metrology to bespoke research installations. Equally important is the cultivation of in-house expertise through comprehensive training and certification programs, ensuring that technical teams remain proficient in emerging techniques and alignment protocols.

Finally, actively engaging in industry consortia and standards-setting initiatives will influence regulatory frameworks and interface specifications, paving the way for broader interoperability and market adoption. By implementing these strategic recommendations, industry leaders can effectively navigate geopolitical headwinds and capitalize on the full spectrum of growth opportunities presented by the dynamic laser interferometer ecosystem.

Detailing Comprehensive Multi-Source Research Methodologies Employed to Ensure Accuracy and Credibility of Laser Interferometer Market Analysis

This analysis integrates a multifaceted research methodology designed to ensure both rigor and relevance. Primary data collection was conducted through in-depth interviews with key executives from instrument OEMs, leading end-users in aerospace, telecommunications, and semiconductor sectors, as well as academic researchers specializing in photonics and quantum sensing. These qualitative insights were complemented by a thorough review of technical white papers, patent filings, and government policy documents to capture the breadth of technological innovation and regulatory developments.

Secondary research encompassed industry journals, conference proceedings, and trade publications, enabling triangulation with primary findings. Quantitative data inputs were standardized using a combination of bottom-up analyses-aggregating sales volumes of major players-and top-down assessments that reconcile macroeconomic indicators with technology adoption trends. Regional breakdowns were aligned with trade statistics and public funding allocations to accurately reflect localized growth drivers.

To validate conclusions and refine market segmentation, expert panel reviews were conducted with representatives from international standards bodies and professional societies. Calibration checks, data normalization procedures, and cross-validation of forecasts ensured the integrity of the final insights. The segmentation framework, spanning technique, technology, application, and end-user dimensions, provides a structured lens through which stakeholders can evaluate strategic priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Interferometer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Interferometer Market, by Technique

- Laser Interferometer Market, by Technology

- Laser Interferometer Market, by Measurement Dimension

- Laser Interferometer Market, by Application

- Laser Interferometer Market, by End-User

- Laser Interferometer Market, by Region

- Laser Interferometer Market, by Group

- Laser Interferometer Market, by Country

- United States Laser Interferometer Market

- China Laser Interferometer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Implications to Illuminate the Future Trajectory of Laser Interferometer Applications and Technologies

Synthesizing the array of insights reveals that laser interferometry is poised at an inflection point, driven by converging technological trajectories and evolving end-user demands. Quantum-enhanced detection and integrated photonic platforms are redefining performance benchmarks, while tariff-induced supply chain realignments underscore the imperative for diversified sourcing and domestic capacity-building. Regional nuances-from federal research investments in the Americas to collaborative consortia in EMEA and policy-driven expansions in Asia-Pacific-further accentuate the need for tailored market entry strategies.

Strategic initiatives such as modular software-defined systems, comprehensive service offerings, and active participation in standards development will differentiate market leaders and catalyze broader adoption across traditional and emerging application domains. As gravitational wave observatories push instrument sensitivity to new extremes, and semiconductor manufacturers demand ever-finer metrology tolerances, the confluence of hardware innovation and advanced analytics emerges as the cornerstone of value creation.

Looking forward, organizations that proactively align R&D investments with evolving application requirements, cultivate strategic partnerships across academia and industry, and navigate geopolitical shifts with agile supply chain strategies will secure a leadership position. The future trajectory of laser interferometry promises unparalleled measurement precision, expanded application frontiers, and a rich landscape of collaborative innovation.

Engaging Directly with Ketan Rohom to Acquire In-Depth Laser Interferometer Market Insights and Secure Strategic Intelligence for Your Organization’s Growth

Elevate your strategic decision-making and operational excellence by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure an exclusive copy of the comprehensive laser interferometer market research report. This meticulously crafted analysis equips you with actionable intelligence on the latest technological innovations, shifting regulatory landscapes, and competitive dynamics shaping the industry.

By connecting with Ketan Rohom, you unlock tailored insights into supply chain adaptations, regional growth drivers, and emerging application segments, ensuring your organization remains at the forefront of precision measurement advancements. Don’t miss this opportunity to leverage data-driven recommendations and capitalize on transformative market trends. Reach out today to acquire unparalleled market visibility and accelerate your growth trajectory through authoritative guidance and deep-dive analysis.

- How big is the Laser Interferometer Market?

- What is the Laser Interferometer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?