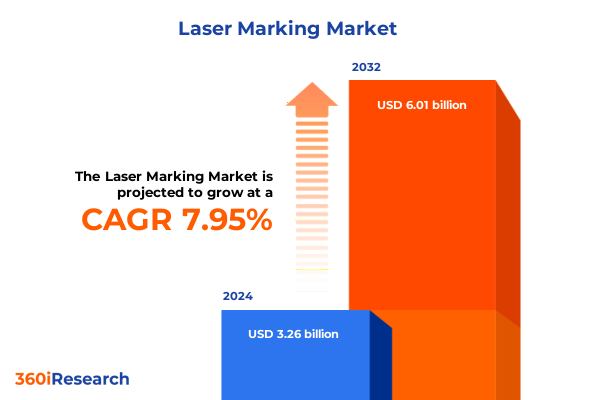

The Laser Marking Market size was estimated at USD 3.50 billion in 2025 and expected to reach USD 3.77 billion in 2026, at a CAGR of 8.02% to reach USD 6.01 billion by 2032.

Unveiling the Critical Role of Laser Marking in Advancing Precision Manufacturing Across Diverse Industry Verticals in 2025

Laser marking has emerged as a cornerstone technology in modern manufacturing, transforming the way products are tracked, authenticated, and personalized across a multitude of industry verticals. As industries continue to demand higher levels of traceability, precision, and speed, laser marking solutions have responded with innovations that address both intricate material characteristics and the stringent quality requirements of today’s end-use sectors. These marking systems, leveraging sources ranging from CO2 to ultraviolet wavelengths, enable non-contact, permanent identification on substrates that span metals, plastics, ceramics, rubber, and wood. Consequently, they facilitate compliance with regulatory mandates for serialization, anti-counterfeiting measures, and unique device identification, all while minimizing consumables and environmental impact.

Given the accelerating pace of technological advancement, stakeholders require a concise but thorough synthesis of market dynamics to support informed decision-making and strategic planning. This executive summary delivers an integrated overview of the forces shaping the laser marking landscape in 2025, highlighting key industry shifts, tariff influences, segmentation nuances, competitive profiles, and regional adoption patterns. By drawing connections between emerging trends and actionable insights, this report equips executives and decision-makers with the essential context needed to navigate current complexities and anticipate future disruptions.

Examining the Revolutionary Technological and Operational Transformations Reshaping the Laser Marking Ecosystem In The Smart Manufacturing Era

The laser marking industry is undergoing transformative changes driven by converging technological and operational forces that redefine how manufacturers approach identification and traceability. First, the integration of artificial intelligence and adaptive control systems has enabled next-generation equipment to automatically optimize parameters in real time, resulting in marked improvements in throughput and consistency across varying substrates. The infusion of AI algorithms into marking workflows is reshaping maintenance models as well, with predictive diagnostics reducing unplanned downtime and lowering total cost of ownership.

Simultaneously, breakthroughs in ultra-short pulse laser technology, particularly picosecond and femtosecond sources, are expanding the range of viable applications. As pricing for these advanced systems declines, they are now accessible for marking brittle and transparent materials with minimal thermal impact, unlocking new opportunities across semiconductor, medical device, and microelectronics industries. Moreover, the pursuit of sustainable manufacturing has accelerated the development of energy-efficient fiber and green laser sources that align with global initiatives to reduce carbon footprints. These eco-friendly architectures deliver up to 25 percent lower power consumption while enhancing mark quality on heat-sensitive polymers and composite materials.

Taken together, these paradigm shifts are fostering a market environment where innovation in hardware is complemented by advancements in software and connectivity. Cloud-enabled monitoring, coupled with modular designs, provides a foundation for scalable Industry 4.0 integration, driving higher overall equipment effectiveness and paving the way for future functionality enhancements.

Assessing the Cascading Effects of Escalating United States Tariffs on Global Laser Marking Operations And Supply Chains in 2025

In 2025, the United States dramatically escalated tariff rates on imports from China, creating a complex cost dynamic for laser marking equipment manufacturers and end users alike. Beginning with an initial 10 percent duty early in the year, the U.S. swiftly increased levies to 20 percent in March, followed by a 54 percent IEEPA rate on April 5, and culminating in a staggering 104 percent total tariff by April 9. These tariffs introduce substantial cost pressures across sourcing channels for fiber lasers, diode modules, and other critical components, compelling importers to reassess supply chain resilience and procurement strategies.

The immediate effect has been a significant uptick in landed costs for Chinese-origin marking systems and subsystems, translating into elevated capital expenditures for adopters in automotive, electronics, and medical device manufacturing segments. In response, many organizations have accelerated diversification efforts, embracing China+1 sourcing strategies and exploring nearshoring options in Mexico and Vietnam to mitigate duty exposure. Concurrently, domestic laser equipment producers are seizing market share opportunities by emphasizing localized support, shorter lead times, and tariff-free offerings. While these shifts may stabilize pricing in the medium term, they also introduce complexity in inventory planning and long-term supplier partnerships.

Moreover, the overarching protectionist policies have spurred a recalibration of global business models, with increased investment in automation and higher-performance marking solutions that offset tariff-driven cost escalations through enhanced throughput and reduced scrap rates. Although heightened duties pose short-term challenges, they also incentivize innovation in laser marking technologies and supply chain restructuring to build greater strategic flexibility.

Distilling Strategic Growth Opportunities Through In-Depth Analysis Of Laser Marking Market Segments Defined By Type, Material, And Functional Parameters

Segmentation analysis reveals critical insights into where growth and innovation are most pronounced. Within laser types, fiber laser marking commands attention for its versatility and efficiency in metal processing, while CO2 lasers remain indispensable for non-metal materials like glass, wood, and certain plastics. Meanwhile, green and UV laser segments are gaining momentum in high-precision applications requiring minimal thermal damage. End users seeking fine-feature marking of semiconductors or medical-grade polymers are increasingly drawn to these shorter-wavelength sources.

Material considerations further refine market opportunities. Metals, particularly aluminum and stainless steel, dominate due to their prevalence in automotive chassis components and surgical instruments. Ceramics and glass marking continue to expand in sectors such as electronics packaging and specialty optics, while plastics and rubber remain foundational in consumer goods and packaging applications. Understanding these material-specific drivers is essential, especially as composite materials garner interest for lightweighting in aerospace and electric vehicles.

Beyond substrate categories, the distinction between 2D and 3D marking technologies opens new dimensions for customization, especially in branding and anti-counterfeiting contexts. Annealing, engraving, and etching marking types cater to varying requirements for surface integrity and mark permanence. The growing demand for portable marking systems reflects a shift toward on-site traceability needs in maintenance, repair, and aftermarket services. Additionally, power-class segmentation highlights how lower-wattage solutions excel in non-metal applications, whereas units above 100 watts drive high-speed metal marking in automotive and heavy manufacturing sectors. This nuanced segmentation underscores the importance of aligning equipment selection with precise application requirements.

This comprehensive research report categorizes the Laser Marking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Laser Type

- Material Marking

- Technology

- Marking Type

- Product Type

- Optical Power Input

- Application

- End Use Industry

Uncovering Distinct Regional Dynamics And Adoption Patterns Driving The Laser Marking Market Across Americas, EMEA, And Asia-Pacific Markets

Regional dynamics shape the competitive landscape and adoption trajectories across the Americas, Europe-Middle East-Africa, and Asia-Pacific zones. In the Americas, robust demand is driven by automotive, aerospace, and medical device manufacturing hubs in the United States, Mexico, and Canada. Local suppliers leverage proximity advantages to offer rapid deployment, service responsiveness, and compliance support, all crucial under stringent FDA and aerospace quality regulations.

Across Europe, the Middle East, and Africa, stringent environmental standards, particularly in Germany and the Nordic countries, propel investments in energy-efficient laser technologies. The prevalence of small to medium-sized enterprises in manufacturing clusters augments demand for versatile, modular marking systems that can adapt to diverse product portfolios. In the Middle East, ongoing infrastructure initiatives and defense procurements in Gulf states generate opportunities for portable marking solutions used in on-site maintenance and asset verification.

In the Asia-Pacific region, aggressive industrial modernization in China and Southeast Asia underpins substantial growth, especially as manufacturers pursue digital transformation under Industry 4.0 frameworks. Japan and South Korea continue to prioritize precision marking for semiconductor and electronics assembly, while emerging economies like India are ramping up automotive and pharmaceutical production capacities. Regional supply chain realignments, influenced by tariff landscapes and “China+1” strategies, are fostering new assembly lines in ASEAN countries. This geographical mosaic reflects how varying regulatory environments and industry focuses dictate the pace and complexion of laser marking adoption globally.

This comprehensive research report examines key regions that drive the evolution of the Laser Marking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies And Innovation Leadership Among Leading Global Laser Marking Equipment Manufacturers And Solution Providers

The competitive arena is defined by a blend of global incumbents and specialized innovators championing distinct strategic imperatives. Established multinational corporations focus on expanding product portfolios with advanced green and ultra-short pulse laser systems, while integrating software solutions that facilitate seamless Industry 4.0 connectivity. These leaders emphasize comprehensive global service networks and adherence to the most stringent certifications, supporting critical end-use sectors such as aerospace, automotive, and medical devices.

Concurrently, regional players and niche providers are carving out market share through agile customization and rapid deployment. They leverage flexible manufacturing footprints to reduce lead times and tailor marking solutions to specific material and application requirements. These companies often partner with local automation integrators to embed marking modules within broader production lines, offering one-stop-shop convenience. In parallel, alliances between laser source manufacturers and control system developers are generating synergistic offerings that enhance mark consistency and reduce operational complexity.

Despite variances in scale, all key players are converging on themes of sustainability, digitalization, and service excellence. Whether through lower-energy fiber architectures, predictive maintenance software, or modular upgrade pathways, the leading vendors are moving beyond basic hardware sales toward outcome-based business models that align with evolving customer priorities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Marking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACSYS Lasertechnik GmbH

- Beamer Laser Systems by Fonon Corporation

- Coherent Corp.

- Datalogic S.p.A.

- Domino Printing Sciences PLC by Brother Industries Limited

- Dover Corporation

- Epilog Corporation

- Gravotech Marking

- Han’s Laser Technology Industry Group Co., Ltd.

- Hitachi, Ltd.

- IPG Photonics Corporation

- Keyence Corporation

- Laser Marking Technologies, LLC

- Laserax

- LaserStar Technologies Corporation

- Macsa ID, S.A.

- MECCO

- Novanta Inc.

- Omron Corporation

- Panasonic Holdings Corporation

- RMI Laser LLC

- Sea Force Co., Ltd.

- Sushree Laser Pvt. Ltd.

- Trotec Laser GmbH

- TRUMPF SE + Co. KG

- TYKMA Electrox

- Videojet Technologies, Inc.

- Wuhan HGLaser Engineering Co., Ltd

Proposing Targeted Strategic Initiatives To Enhance Competitive Positioning And Operational Resilience For Laser Marking Industry Leaders

To thrive amid intensifying competition and regulatory headwinds, industry participants should prioritize a multifaceted strategy centered on innovation, supply chain resilience, and customer-centricity. First, accelerating the development of adaptive control platforms that harness AI-driven process optimization will differentiate offerings by maximizing throughput and minimizing scrap across diverse material profiles. Integrating machine learning capabilities for predictive maintenance can further reduce unplanned downtime and bolster total cost of ownership propositions.

Second, diversifying component sourcing through a China+1 model and nearshoring initiatives can mitigate tariff exposures and logistical risks. Establishing strategic partnerships with regional integrators and service providers enhances local presence, accelerates deployment, and builds loyalty among customers who demand rapid response and regulatory compliance support. Third, investing in sustainable laser architectures, such as high-efficiency fiber and green laser modules, aligns with corporate environmental commitments and can unlock preferences among end users facing increasing ESG reporting mandates.

Lastly, adopting outcome-based service agreements-bundling hardware, software, maintenance, and training-enables deeper client engagement and predictable revenue streams. This shift from transactional to solution-oriented models fosters long-term relationships, provides differentiated value, and supports future upselling of advanced modules and analytics services.

Clarifying Robust Research Framework Incorporating Primary Interviews, Secondary Analysis, And Triangulation To Ensure Credible Laser Marking Market Insights

Our research methodology combines a rigorous mix of primary and secondary approaches, ensuring that the insights presented herein are both credible and comprehensive. Secondary research involved an exhaustive review of publicly available corporate filings, industry white papers, trade publications, and regulatory documents to map historical trends, tariff statutes, and technology adoption patterns. Additionally, patent analysis provided perspective on emerging innovations and investment focus areas.

Primary research comprised in-depth interviews with senior executives, application engineers, and procurement specialists across equipment manufacturers, integrators, and end-user segments. These dialogues elucidated qualitative considerations such as purchase criteria, maintenance expectations, and evolving sustainability targets. Quantitative surveys supplemented interviews, capturing comparative data on performance metrics, service requirements, and investment horizons.

Data triangulation was achieved by cross-referencing findings from multiple sources, ensuring consistency and accuracy. A detailed sensitivity analysis evaluated the potential impact of tariff fluctuations, regional regulatory changes, and technology cost curves on market dynamics. Together, these methodological pillars underpin the report’s conclusions, providing decision-makers with a robust foundation for strategy formulation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Marking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Marking Market, by Laser Type

- Laser Marking Market, by Material Marking

- Laser Marking Market, by Technology

- Laser Marking Market, by Marking Type

- Laser Marking Market, by Product Type

- Laser Marking Market, by Optical Power Input

- Laser Marking Market, by Application

- Laser Marking Market, by End Use Industry

- Laser Marking Market, by Region

- Laser Marking Market, by Group

- Laser Marking Market, by Country

- United States Laser Marking Market

- China Laser Marking Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Synthesizing Insights And Forward-Looking Perspectives To Illuminate The Strategic Imperatives For Stakeholders In The Laser Marking Landscape

The laser marking market stands at the nexus of technological innovation and shifting geopolitical landscapes, presenting both challenges and unprecedented opportunities for stakeholders. Advancements in intelligent control, ultra-short pulse lasers, and eco-conscious source architectures are expanding application horizons, driving precision and sustainability to the forefront. At the same time, new tariff structures and supply chain realignments are compelling organizations to reimagine sourcing strategies and operational models.

Success in this complex environment requires a holistic approach that marries cutting-edge R&D with agile commercial and procurement tactics. By understanding the nuanced demands of segmentation across laser types, materials, and applications, companies can tailor solutions that align with sector-specific requirements and regional regulatory frameworks. Moreover, the shift toward software-enabled service ecosystems and outcome-based models promises to deepen customer engagement and capture recurring revenue streams.

Looking forward, the convergence of digitalization trends-spanning AI, IIoT, and cloud-native architectures-with next-generation laser technologies will continue to reshape how manufacturers address traceability, compliance, and productivity imperatives. Those that proactively adapt, innovate, and collaborate will be best positioned to lead the laser marking landscape into its next chapter.

Act Now To Secure Comprehensive Laser Marking Market Analysis And Gain Executive Insights Through Direct Engagement With Ketan Rohom

To obtain the definitive strategic perspective that will keep your organization ahead of rapidly evolving competitive and regulatory pressures, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, for a personalized discussion and sample insights. Engaging with Ketan will unlock tailored guidance on leveraging cutting-edge laser marking solutions, optimizing supply chains in light of new tariff regimes, and capitalizing on emerging technology trends to secure market leadership. Act now to benefit from exclusive executive briefings, detailed customization of reports based on your specific operational priorities, and priority access to advanced analyses. Your direct connection with Ketan Rohom ensures that your investment in market intelligence translates into actionable strategies and measurable growth. Contact Ketan today to transform data into decisive action and drive your business forward with the most comprehensive laser marking market research available.

- How big is the Laser Marking Market?

- What is the Laser Marking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?