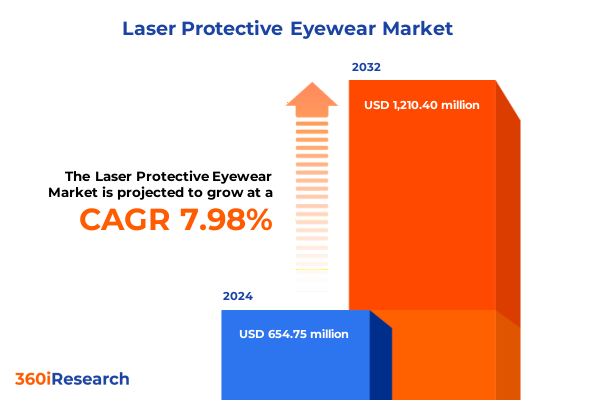

The Laser Protective Eyewear Market size was estimated at USD 706.64 million in 2025 and expected to reach USD 763.84 million in 2026, at a CAGR of 7.99% to reach USD 1,210.40 million by 2032.

Unveiling the Critical Role of Advanced Protective Eyewear Solutions in Safeguarding Professionals Across Diverse Laser Applications

Laser protective eyewear stands at the intersection of human safety and technological advancement, creating a vital barrier between high-intensity light sources and professional practitioners across numerous fields. From precision industrial cutting operations to delicate medical procedures, these protective solutions ensure that users can harness the power of lasers without compromising vision or wellbeing. As laser applications continue to proliferate, protective eyewear has evolved with innovations in optical filters, lens materials, and ergonomic designs.

This executive summary provides a comprehensive overview of the laser protective eyewear domain, highlighting recent shifts in technology, regulatory influences, and market dynamics. The sections that follow delve into transformative innovations, the repercussions of U.S. tariff adjustments, segmentation analysis by end user, laser type, and product form. Regional perspectives illuminate geographical variations, while profiles of leading companies showcase how innovators are shaping the competitive environment. Concluding with actionable recommendations and a transparent methodology, this summary lays the groundwork for informed decision-making and strategic planning in an industry where safety and performance are paramount.

Revolutionary Technological Breakthroughs and Shifting Regulatory Standards Reshaping the Global Landscape of Laser Protective Eyewear

The laser protective eyewear landscape is undergoing a period of rapid transformation driven by breakthroughs in filter coatings, adaptive lens technologies, and integration with digital safety systems. Traditional dye-based filters are giving way to thin-film interference coatings, offering more precise attenuation at specific wavelengths and improved optical clarity. Concurrently, modular eyewear frames equipped with smart sensors are emerging, capable of adjusting filter density in real-time based on laser intensity and ambient lighting assessments.

Regulatory developments are equally influential in reshaping market direction. International safety standards have grown more stringent, with updates to ANSI Z136 guidelines in the United States and revisions to IEC 60825 protocols globally. These changes mandate enhanced testing procedures, including accelerated ultraviolet degradation trials and extended multi-band attenuation requirements. As a result, manufacturers are investing heavily in research to ensure compliance and maintain certification across multiple jurisdictions. The convergence of advanced materials and evolving regulations is redefining performance benchmarks, compelling stakeholders to adapt swiftly or risk obsolescence.

Assessing the Far-Reaching Effects of 2025 U.S. Tariff Measures on the Dynamics and Competitiveness of the Protective Eyewear Market

In 2025, newly implemented tariff measures imposed on imported polymer resins and specialized optical components have introduced complex cost dynamics for protective eyewear producers. These duties have directly affected the procurement of polycarbonate and high-grade acrylic materials commonly used in lens fabrication, leading to increased input expenses. Consequently, many manufacturers have reevaluated their sourcing networks, considering regional suppliers and alternate composite materials to mitigate financial pressures.

The tariff-induced inflationary impact has extended beyond material costs to influence production timelines and inventory strategies. Companies have adjusted lead-time forecasts, leveraging forward purchasing and renegotiation of supplier contracts to counteract the uncertainty of variable duty rates. Some organizations have opted to absorb short-term cost increases to preserve market pricing stability, while others have passed portions of these expenses onto end users, potentially dampening demand in cost-sensitive segments such as packaging and metal fabrication. As a result, strategic supply chain diversification and agile pricing models have become critical to maintaining competitive advantage amidst the evolving trade policy environment.

Uncovering Deep Insights into Laser Protective Eyewear Demand through Comprehensive End-User, Laser-Type, and Product-Type Segmentation Analyses

A granular view of market segmentation reveals how distinct end-user groups shape demand for protective eyewear in unique ways. The cosmetic and aesthetic sector prioritizes high optical transparency and lightweight designs to enhance wearer comfort during extended procedures. In contrast, industrial customers in automotive assembly and semiconductor fabrication demand robust impact resistance and high-intensity attenuation levels, driven by rigorous operational safety standards. Within the medical domain, practitioners in cosmetic surgery, dental, and ophthalmology settings require specialized lenses tuned to the laser wavelengths most prevalent in their treatments, ensuring both user safety and procedural precision. Military and defense organizations emphasize multi-wavelength protection coupled with ballistic resistance, while research and development laboratories seek versatile eyewear adaptable to various experimental laser platforms.

Laser types themselves further influence product specifications. Protective solutions designed for CO2 and Nd:YAG lasers focus on narrowband filtration at 10.6 microns and 1.064 microns respectively, whereas excimer applications necessitate precision blocking of ultraviolet emissions. Diode-based eyewear continues to diversify as high-power diode instruments push the limits of continuous high-flux attenuation, and low-power diodes embedded in consumer and medical devices require thinner, more ergonomic models. Fiber laser protection, spanning continuous-wave to ultrafast pulsed operations, calls for broadband filtering capabilities with minimal signal distortion across a wide spectral range.

Product type adds another layer of differentiation. Engineers working in harsh industrial environments often favor non-ventilated goggles with sealed frames to guard against debris, while laboratory personnel may choose ventilated goggles for airflow and fog prevention. Metal-framed glasses appeal to sectors where durability and chemical resistance are critical, whereas plastic frames are preferred in settings seeking cost-efficiency and adjustable fit. Face shields continue to be adopted in applications requiring full-face coverage, integrating filter panels tailored to the specific laser wavelengths in use, thus bridging the gap between localized eye protection and broader facial safety.

This comprehensive research report categorizes the Laser Protective Eyewear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Laser Type

- Application

- End User

Examining Regional Dynamics Shaping Laser Protective Eyewear Adoption Trends across the Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics reveal distinctive adoption patterns shaped by industrial focus, regulatory landscapes, and technological maturity. In the Americas, the United States maintains a leadership position driven by robust medical device and automotive manufacturing sectors. The region’s stringent regulatory framework under OSHA and ANSI standards has cultivated a demand for premium protective eyewear, while Canada’s research institutions contribute to innovation in ultrafast fiber laser protection. Mexico’s burgeoning electronics and packaging industries further support market growth, leveraging cost advantages while adhering to North American safety protocols.

The Europe, Middle East & Africa region presents a blend of mature markets in Western Europe and emerging opportunities in the Gulf Cooperation Council states. European countries prioritize integrated safety systems, prompting eyewear that seamlessly interfaces with protective helmets and face shields. Germany’s automotive expertise, coupled with France’s advancements in cosmetic surgery technology, underscores diverse applications. In the Middle East, defense spending fuels demand for ballistic-rated laser protection, while Africa’s developing industrial base creates niche requirements for cost-effective yet compliant eyewear solutions.

Asia-Pacific demonstrates some of the fastest growth trajectories, anchored by significant manufacturing hubs in China, Japan, South Korea, and Southeast Asia. China’s electronics and semiconductor sectors drive large-scale procurement of high-durability goggles, while Japan emphasizes precision protection for Nd:YAG and excimer laser uses in medical and research environments. South Korea’s investment in cosmetic aesthetic clinics spurs demand for lightweight, high-transmission eyewear, and Australia’s mining and research centers prioritize multi-wavelength protective technologies. Across the region, evolving national standards and localized manufacturing capabilities continue to shape tailored regional offerings.

This comprehensive research report examines key regions that drive the evolution of the Laser Protective Eyewear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers Driving Innovation and Market Presence through Advanced Materials, Design Differentiation, and Strategic Partnerships

Leading companies in the protective eyewear domain are distinguished by their commitment to material science, product innovation, and strategic collaborations. Honeywell has leveraged its polymer expertise to develop anti-scratch, anti-fog coatings that extend product lifecycle and enhance optical performance. II-VI Incorporated remains at the forefront of thin-film deposition technologies, enabling the creation of interference filters with pinpoint attenuation characteristics. ROFIN-SINAR, with its laser system heritage, integrates domain expertise into protective eyewear designs that align with its own laser product lines.

MKS Instruments’ Newport division offers modular eyewear platforms capable of rapid filter cartridge changes, catering to multi-laser research laboratories. Gentex Corporation’s aerospace background informs its development of ballistic-rated goggles with integrated laser protection, while smaller specialized providers such as NoIR supply custom lens assemblies designed to block specific wavelength bands for niche applications. Secure Restraint Systems has earned acclaim for its ergonomic face shields that balance comfort and coverage, appealing to high-volume medical and industrial users seeking full-face protection. These industry leaders continue to pursue joint ventures, research partnerships, and acquisitions to expand their technology portfolios, address evolving safety standards, and broaden geographic reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Protective Eyewear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Bollé Safety SAS

- DiOptika Pty Ltd

- Drägerwerk AG & Co. KGaA

- ESS

- Excelitas Technologies Corp.

- Gentex Corporation

- Global Laser Ltd.

- Honeywell International Inc.

- Hoya Corporation

- Kentek Corporation

- Laser Components GmbH

- Lasermet Ltd

- Laservision GmbH

- MSA Safety Incorporated

- NoIR Laser Company, LLC

- PerriQuest Defense Research Enterprises, LLC

- Phillips Safety Products, Inc.

- Protective Industrial Products, Inc.

- Revision Military, Inc.

- Rockwell Laser Industries, Inc.

- Thorlabs, Inc.

- UNIVET S.R.L.

- UVEX WINTER HOLDING GmbH & Co. KG

- VS Eyewear, Inc.

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities and Address Key Challenges in the Protective Eyewear Landscape

To navigate the complexities of the laser protective eyewear market and secure a competitive edge, companies must pursue a multifaceted strategic approach. Prioritizing investments in advanced lens materials such as hybrid nanocomposites and high-refractive-index polymers can deliver superior optical clarity and durability, addressing the dual demands of safety and comfort. Simultaneously, forging alliances with filtering technology specialists and regulatory bodies can accelerate product certification processes, ensuring timely market entry aligned with evolving standards.

Supply chain resilience is another critical focus area; diversifying raw material sources across multiple regions and leveraging local manufacturing capacities reduces exposure to tariff volatility and logistical disruptions. Organizations should adopt dynamic pricing strategies that account for fluctuating input costs, maintaining profitability without alienating cost-conscious customers. For emerging markets, developing tiered product portfolios can balance affordability with essential safety features, expanding reach while preserving premium offerings in mature regions.

Finally, integrating digital tools-such as RFID-enabled component tracking and augmented reality training modules-can enhance customer engagement and adherence to safety protocols. By leveraging data analytics to monitor usage patterns and maintenance schedules, manufacturers can offer proactive service programs that foster long-term client relationships. Collectively, these strategic initiatives will enable industry leaders to capitalize on growth opportunities, mitigate risks, and solidify their position in an increasingly competitive landscape.

Robust Research Framework Employing Diverse Data Collection, Rigorous Validation, and Analytical Techniques to Ensure Insight Accuracy

This research is grounded in a robust framework that combines extensive secondary data analysis with primary market validation. Initially, global safety standards and regulatory documents were reviewed to establish the technical requirements and compliance parameters guiding protective eyewear specifications. Concurrently, company financial reports, patent filings, and industry publications were scrutinized to map technological trends and competitive positioning.

To corroborate secondary findings, structured interviews were conducted with safety engineers, procurement managers, and end-user experts across key sectors including automotive, healthcare, and defense. These conversations provided firsthand insights into purchasing criteria, pain points, and innovation drivers. Further quantitative reinforcement was achieved through targeted surveys, capturing real-world preferences in lens materials, design ergonomics, and service support models.

All data points underwent triangulation, cross-checked against shipment data and trade statistics to validate supply chain dynamics and the impact of trade policies. Any discrepancies identified during analysis were resolved through follow-up consultations, ensuring the highest level of accuracy. The final synthesis integrates qualitative perspectives with quantitative metrics, yielding a comprehensive view of market forces and informing the strategic recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Protective Eyewear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Protective Eyewear Market, by Product Type

- Laser Protective Eyewear Market, by Laser Type

- Laser Protective Eyewear Market, by Application

- Laser Protective Eyewear Market, by End User

- Laser Protective Eyewear Market, by Region

- Laser Protective Eyewear Market, by Group

- Laser Protective Eyewear Market, by Country

- United States Laser Protective Eyewear Market

- China Laser Protective Eyewear Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Summarizing Key Findings and Industry Implications to Provide a Cohesive Closing Perspective on the Evolution of Protective Eyewear Solutions

The evolution of laser protective eyewear is anchored in the convergence of advanced optical materials, stringent regulatory measures, and dynamic market forces. Technological developments-from thin-film filters to adaptive sensor integration-are redefining performance expectations, while the 2025 U.S. tariffs underscore the importance of supply chain agility and cost management. Segmentation insights highlight the specialized demands of end-user groups, laser types, and product formats, revealing that a one-size-fits-all approach is increasingly untenable.

Regional analyses demonstrate that market maturity varies significantly across the Americas, EMEA, and Asia-Pacific, with each region influenced by distinct industrial priorities and safety standards. Leading manufacturers are responding through strategic partnerships, material innovations, and modular product designs. The strategic prescription for industry participants includes targeted R&D investments, diversified sourcing strategies, tiered portfolio offerings, and digital integration to enhance customer engagement.

By synthesizing these findings, stakeholders can navigate the complexities of the protective eyewear sector with clarity and confidence. The insights presented form a cohesive narrative that supports informed decision-making, fosters competitive differentiation, and aligns operational strategies with emerging safety and performance benchmarks.

Inspiring Direct Engagement with Associate Director of Sales and Marketing to Obtain Tailored Market Research Insights on Protective Eyewear

To explore tailored insights and strategize effectively for safe and compliant laser operations, it’s essential to engage directly with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. With his expertise in market dynamics and his commitment to delivering actionable intelligence, Ketan can guide stakeholders through customized solutions that align with specific end-user requirements and regulatory frameworks.

Initiating a conversation with Ketan will provide access to in-depth analyses, detailed segmentation breakdowns, and forward-looking strategic recommendations that are not available in public domain resources. His consultative approach ensures that each discussion is focused on your organization’s unique challenges, whether the need is for advanced technical specifications, compliance guidelines, or competitive positioning strategies.

By partnering with Ketan Rohom, stakeholders will benefit from a comprehensive understanding of the evolving laser protective eyewear landscape, including the latest innovations, tariff implications, and regional market trends. Reach out to schedule a personalized briefing and gain the clarity needed to make informed investment decisions and procurement plans that enhance safety and drive long-term value.

- How big is the Laser Protective Eyewear Market?

- What is the Laser Protective Eyewear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?