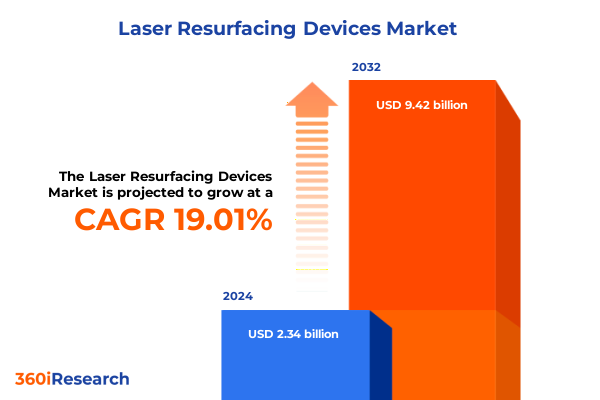

The Laser Resurfacing Devices Market size was estimated at USD 2.78 billion in 2025 and expected to reach USD 3.28 billion in 2026, at a CAGR of 19.03% to reach USD 9.42 billion by 2032.

Laser resurfacing devices are revolutionizing aesthetic dermatology as patients and practitioners embrace minimally invasive solutions for skin rejuvenation

Laser resurfacing devices have emerged as pivotal tools within aesthetic dermatology, delivering advanced solutions for patients seeking minimally invasive skin renewal. By harnessing targeted energy sources, these systems precisely ablate or thermally stimulate tissue layers, promoting collagen remodeling, reducing signs of aging, and enhancing skin texture. The convergence of clinical efficacy, patient preference for shorter recovery times, and expanding procedural expertise among practitioners has positioned laser resurfacing as a mainstream therapeutic approach rather than a niche treatment modality.

In the current landscape, technological refinements have broadened application scope beyond traditional facial treatments to encompass body contouring and neck restoration, further driving adoption rates across diversified care settings. Simultaneously, educational initiatives and standardized training protocols have elevated clinician confidence, reinforcing the trustworthiness of laser-centric therapies in both clinical and aesthetic practices. As regulatory frameworks adapt to these innovations, reimbursement pathways are gradually evolving, reducing barriers to entry for new market participants.

This report introduces the foundational dynamics shaping the proliferation of laser resurfacing technologies and establishes the context for understanding how these influences coalesce to redefine market expectations, foster competitive differentiation, and chart a course for sustained growth within the evolving world of dermatologic devices.

Rapid technological advances in laser resurfacing are reshaping treatment paradigms by integrating artificial intelligence and precision delivery systems

The laser resurfacing domain is undergoing a paradigm shift fueled by rapid technological advancements and evolving clinical requirements. Artificial intelligence–driven treatment planning platforms now deliver personalized energy dosing by analyzing real-time skin feedback, enabling clinicians to optimize safety profiles and efficacy outcomes. At the same time, the miniaturization of optical components and modular delivery systems has given rise to portable devices, dismantling traditional fixed-system constraints and expanding accessibility to outpatient clinics and medical spas.

Meanwhile, novel wavelength combinations and dual-mode systems are enhancing the versatility of resurfacing protocols, targeting chromophores and water-rich tissues with unprecedented precision. This, in turn, is reducing downtime and broadening the candidate pool to include patients with diverse skin types and concerns. Concurrently, manufacturers are integrating user-centric interfaces and guided treatment algorithms to streamline operational workflows and mitigate the learning curve associated with complex laser parameters.

As cross-industry collaborations proliferate, partnerships between device innovators, software developers, and clinical research centers are accelerating the translation of emerging science into commercially viable solutions. This fusion of technological prowess and collaborative networks is catalyzing a novel era of tailored resurfacing therapies, positioning the industry to meet rising patient demand while adhering to stringent safety and efficacy standards.

The introduction of US tariffs in 2025 on laser equipment imports has disrupted price structures and supply chains across the domestic aesthetic device market

The imposition of United States tariffs in early 2025 on imported laser components and devices has reverberated throughout the domestic supply chain, compelling manufacturers and distributors to reevaluate sourcing strategies. As duties elevated the landed cost of critical optics and electronic modules, original equipment manufacturers have absorbed a portion of the increased expenses to maintain price competitiveness, while selectively passing through incremental costs to end users when market conditions permitted.

Faced with these heightened entry barriers, several industry players have pivoted toward localizing production, establishing partnerships with US-based suppliers, or redesigning device architectures to incorporate domestically sourced materials. These adjustments have catalyzed innovation in component standardization, yielding more modular designs that can flex between imported and locally manufactured parts depending on tariff regimes. However, smaller market entrants without scale advantages have experienced pressure on margins, prompting consolidation and strategic alliances as mechanisms to preserve financial viability.

In parallel, service providers, including dermatology clinics and medical spas, have adopted adjusted procurement practices, negotiating volume-based contracts and embracing rental or leasing models to mitigate upfront capital expenditures. The net effect is an industry in flux, balancing short-term cost challenges with long-term resilience strategies that prioritize supply chain agility and diversified manufacturing footprints.

In-depth segmentation insights reveal how distinctions in laser type modality treatment area application and end user influence strategic market positioning

In-depth segmentation insights reveal how variations across product typologies, delivery modalities, treatment areas, application purposes, end-user demographics, and distribution channels converge to shape strategic market approaches. Differentiating between ablative technologies-where carbon dioxide or erbium:YAG lasers precisely ablate epidermal layers-and non-ablative systems such as Nd:YAG or pulsed dye platforms highlights the trade-off between downtime and collagen-stimulating efficacy, influencing practitioner preferences in clinical decision making.

Similarly, the choice between fixed console installations and portable handheld devices informs purchasing frameworks, with larger hospital facilities favoring robust integrated systems and boutique dermatology clinics or medical spas gravitating toward compact units that facilitate in-office versatility. Treatment area segmentation further nuances competitive positioning: body-focused protocols demand higher energy outputs and specialized scanning accessories, whereas facial and neck or chest treatments prioritize fine-tuned calibration and ergonomic applicators.

Overlaying these dimensions, disparities emerge in application focus-ranging from pigmentation removal and scar management to comprehensive skin rejuvenation and targeted wrinkle attenuation-underlining the need for manufacturers to offer software presets and accessory kits tailored to specific protocols. Finally, the end-user environment and sales channel rationale-whether direct sales with dedicated training, distributor networks ensuring regional support, or online channels catering to cost-sensitive buyers-determine engagement strategies and post-sale service commitments that underpin long-term brand loyalty.

This comprehensive research report categorizes the Laser Resurfacing Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Modality

- Treatment Area

- Application

- End User

- Sales Channel

Regional dynamics in the Americas Europe Middle East Africa and Asia-Pacific illuminate diverse adoption rates regulatory frameworks and growth opportunities

Regional dynamics present a complex interplay of regulatory environments, reimbursement frameworks, and cultural attitudes toward aesthetic interventions. In the Americas, established reimbursement schemes and a mature network of dermatology clinics accelerate adoption, while recent expansions in medical spa certifications have democratized access to resurfacing treatments beyond traditional hospital settings. Latin American markets are progressively aligning with North American standards, with rising medical tourism flows further invigorating device uptake.

Across Europe, Middle East, and Africa, regulatory heterogeneity demands tailored market entry strategies: European Union compliance pathways, particularly CE marking protocols for medical devices, foster a unified standard, yet divergent reimbursement policies across member states necessitate bespoke health-economics evidence. In the Middle East, government-led modernization programs and investment in private healthcare infrastructure have spurred demand for premium aesthetic technologies, whereas African markets remain nascent, with growth driven by mobile clinics and emerging private-pay patient segments.

Asia-Pacific encapsulates diverse trajectories, from the high-adoption hubs of Japan and South Korea, where K-beauty influences fuel cutting-edge protocol innovation, to burgeoning markets in Southeast Asia and India. Favorable demographic trends, an expanding middle class, and increasing disposable incomes, coupled with digital marketing proliferation, support sustained growth in consumer awareness and clinic proliferation. Regional nuances in skin phototypes and treatment preferences further compel product customization and educational outreach strategies for all market participants.

This comprehensive research report examines key regions that drive the evolution of the Laser Resurfacing Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Industry leaders are driving technology advancements and strategic alliances to expand the adoption and efficacy of cutting-edge laser resurfacing solutions

Leading industry participants are driving technology advancements and strategic alliances to expand the adoption and efficacy of cutting-edge laser resurfacing solutions. Major manufacturers are channeling R&D investments into multi-wavelength platforms that combine ablative and non-ablative modalities, addressing a broader spectrum of dermatologic conditions through unified hardware architectures. These companies are also pursuing intellectual property protection around proprietary cooling systems and spot-size control mechanisms to enhance patient comfort and procedural precision.

Strategic partnerships between device makers and digital health firms are catalyzing the development of augmented reality interfaces and tele-mentoring capabilities, enabling remote treatment planning and support for clinicians in underserved regions. Meanwhile, select players are executing targeted acquisitions of specialized optics suppliers and contract research organizations to consolidate vertical integration, securing supply chain stability and accelerating product validation cycles.

In addition, several firms have launched comprehensive educational platforms and certification programs, coupling device sales with accredited training modules to reduce adoption barriers. By establishing dedicated centers of excellence, these organizations are fostering evidence-based practices, generating robust clinical data, and reinforcing device differentiation through documented safety and efficacy outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Resurfacing Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerolase

- Alma Lasers Ltd.

- Asclepion Laser Technologies

- BISON Medical

- BTL Aesthetics

- Candela Corporation

- Cutera, Inc.

- Cynosure

- DEKA

- Fotona d.o.o.

- G&H

- Hologic, Inc.

- Iridex

- Lasering USA

- Lumenis Ltd.

- Lutronic Corporation

- Quanta System S.p.A.

- Sciton, Inc.

- Solta Medical, Inc.

- Venus Concept

Industry stakeholders should adopt integrated strategies that enhance innovation pipelines compliance manufacturing efficiency and patient satisfaction

Industry stakeholders should adopt integrated strategies that enhance innovation pipelines compliance manufacturing efficiency and patient satisfaction. Companies must prioritize modular device designs that accommodate component sourcing flexibility, thereby minimizing exposure to geopolitical disruptions and tariff volatility. Simultaneously, cross-functional teams should collaborate to embed automated safety checks and adaptive treatment algorithms into next-generation platforms, solidifying differentiation and streamlining operator training.

Manufacturers and service providers alike are encouraged to invest in robust data analytics infrastructure that captures real-world outcomes, enabling continuous protocol optimization and generating compelling health-economics evidence for payers and regulatory bodies. In parallel, forging alliances with academic institutions and clinical research networks can facilitate large-scale validation studies, bolstering credibility and accelerating reimbursement approvals.

To drive market penetration, a phased go-to-market approach leveraging targeted pilot programs in high-potential geographies can yield actionable insights into end-user requirements and regulatory nuances. Lastly, elevating patient engagement through integrated digital platforms-offering pre-treatment education, follow-up monitoring, and satisfaction tracking-can enhance loyalty, support premium pricing tiers, and foster positive word-of-mouth referrals.

Comprehensive research methodology combines primary expert interviews secondary data evaluation and quantitative analysis to deliver validated market insights

This report’s findings are grounded in a comprehensive research methodology that combines primary and secondary data sources with rigorous analytical techniques. Foundational insights were derived from in-depth interviews with leading dermatologists, aesthetic surgeons, device engineers, and regulatory experts, ensuring the capture of nuanced perspectives on clinical workflows, technology performance, and market access challenges.

Secondary research encompassed a systematic review of peer-reviewed journals, conference proceedings, patent filings, and regulatory filings, complemented by analysis of corporate disclosures, financial statements, and industry association publications. To quantify market dynamics, proprietary quantitative models were developed, incorporating historical adoption trends, pricing elasticity assessments, and scenario-based sensitivity analyses.

Cross-validation exercises were conducted through triangulation of data points, ensuring consistency between micro-level insights and macro-economic indicators. In addition, iterative consultations with a dedicated expert advisory panel provided ongoing validation, reinforcing the accuracy and relevance of conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Resurfacing Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Resurfacing Devices Market, by Product Type

- Laser Resurfacing Devices Market, by Modality

- Laser Resurfacing Devices Market, by Treatment Area

- Laser Resurfacing Devices Market, by Application

- Laser Resurfacing Devices Market, by End User

- Laser Resurfacing Devices Market, by Sales Channel

- Laser Resurfacing Devices Market, by Region

- Laser Resurfacing Devices Market, by Group

- Laser Resurfacing Devices Market, by Country

- United States Laser Resurfacing Devices Market

- China Laser Resurfacing Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

The laser resurfacing sector stands at the cusp of transformation propelled by innovative technologies evolving regulations and shifting patient expectations

The laser resurfacing sector stands at the cusp of transformation propelled by innovative technologies evolving regulations and shifting patient expectations. The convergence of AI-driven protocols, multi-wavelength platforms, and modular device architectures heralds a new era of precision medicine within aesthetic dermatology. Meanwhile, evolving trade policies and regional regulatory variances underscore the imperative for adaptive business models and diversified manufacturing footprints.

Segmentation analysis reveals that tailoring product offerings across ablative and non-ablative modalities, delivery formats, treatment areas, and application focuses is essential for sustaining competitive advantage. Regional insights highlight differentiated growth vectors, with mature markets driving incremental innovation and emerging regions presenting high-velocity adoption opportunities underpinned by expanding healthcare infrastructure.

As leading players fortify their positions through strategic alliances, vertical integration, and educational initiatives, industry stakeholders must champion evidence-based protocols and comprehensive training frameworks. By embracing a holistic approach that aligns technological innovation with end-user needs and regulatory landscapes, the market is poised to deliver transformative patient outcomes and create enduring value across the global healthcare ecosystem.

Unlock critical market insights for laser resurfacing devices by reaching out to Associate Director Ketan Rohom to obtain your customized research report copy

We invite you to deepen your strategic decision-making and stay ahead of competitors by accessing the full report on laser resurfacing devices. Connect with Associate Director Ketan Rohom at your earliest convenience to secure your personalized research report copy and accelerate your ability to capitalize on emerging opportunities, refine your market positioning, and make informed investment choices that drive long-term success.

- How big is the Laser Resurfacing Devices Market?

- What is the Laser Resurfacing Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?