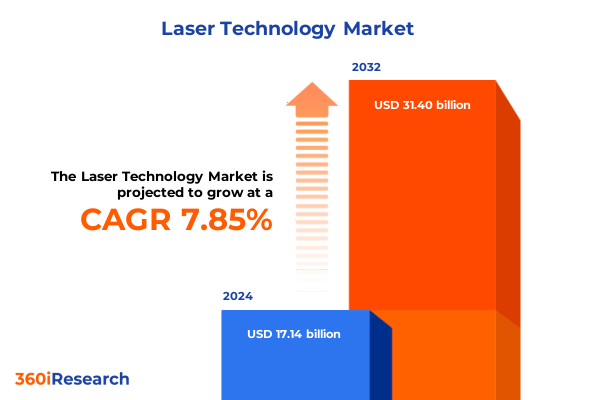

The Laser Technology Market size was estimated at USD 18.42 billion in 2025 and expected to reach USD 19.81 billion in 2026, at a CAGR of 7.91% to reach USD 31.40 billion by 2032.

Unveiling the Transformative Power of Laser Technology Across Industries While Illuminating Emerging Frontiers in Innovation and Global Applications

The field of laser technology has emerged as a cornerstone of modern industry, driving innovation and enabling precision across an ever-expanding array of applications. From manufacturing floors where ultrafast femtosecond and picosecond lasers deliver exceptional micro-machining performance to life science laboratories that rely on laser-based imaging for groundbreaking biomedical research, lasers have transcended their origins as mere light sources to become indispensable tools of progress. As automation and digital transformation initiatives sweep across sectors, laser systems are increasingly integrated into smart factories, medical devices, and computing infrastructures, underscoring their versatility and strategic importance.

Over the past decade, continuous advancements in fiber laser architectures, diode-pumped solid-state configurations, and compact ultrafast platforms have driven improvements in power efficiency, beam quality, and reliability. These enhancements, coupled with ongoing reductions in size and cost, have broadened both the addressable market and the pace of adoption. Meanwhile, the convergence of artificial intelligence and laser control has begun unlocking new levels of process optimization, real-time quality assurance, and predictive maintenance. As this executive summary will explore, the confluence of technological innovation, shifting trade dynamics, and diverse end-use demands is creating a highly dynamic landscape ripe with opportunity for stakeholders across the ecosystem.

Charting the Pivotal Shifts That Are Redefining Laser Technology Through Ultrafast Pulse Innovations, Integrated Photonics, and AI-Driven Operational Excellence

Recent years have witnessed a series of paradigm shifts that are redefining the capabilities and applications of laser technology. Ultrafast pulse generation, once confined to specialized research environments, has now become accessible to industrial users, enabling near-zero heat-affected zone machining for micro-electronics and medical device fabrication. The rise of femtosecond and picosecond lasers in these domains has been driven by continuous improvements in fiber laser pumps and solid-state laser materials, resulting in significant manufacturing flexibility and reduced post-processing requirements.

Simultaneously, the integration of artificial intelligence and machine learning algorithms into laser control systems is enhancing operational efficiency and quality control. AI-based optimization routines can now dynamically adjust beam parameters, scanning patterns, and power settings to minimize defects and extend equipment lifespan. This trend is particularly evident in high-volume, precision-critical applications such as semiconductor wafer scribing and additive manufacturing, where real-time feedback loops are critical to maintaining yield.

Moreover, the maturation of photonic integrated circuits and silicon photonics is ushering in an era of on-chip light-based signal processing, promising orders of magnitude gains in data throughput and energy efficiency for AI data centers and advanced communication networks. Industry leaders are investing heavily in co-packaged optics and photonic interconnects to meet the insatiable bandwidth demands of generative AI and machine learning workloads, with the photonic integrated circuit market projected to eclipse US$54 billion by 2035. These transformative shifts underscore a broader narrative: lasers are no longer isolated tools but are becoming deeply embedded in digital and photonic ecosystems.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Measures on Laser Technology Supply Chains, Costs, and Strategic Responses

Trade policy developments in early 2025 have added a new dimension to the strategic calculus for laser technology stakeholders. Notably, the Office of the United States Trade Representative implemented a Section 301 tariff increase on certain polysilicon and wafer imports, raising duties to 50 percent and tungsten products to 25 percent effective January 1, 2025. While these actions targeted solar and semiconductor supply chains, the ripple effects have been felt across optical component sourcing, particularly for companies reliant on high-precision substrates and coatings imported from China.

In April, a dramatic escalation saw tariffs on Chinese goods surge to 104 percent, specifically impacting laser cutting equipment and raw materials used in laser-based manufacturing. Although a 90-day reprieve was applied to many non-retaliating countries, China remained subject to a 145 percent reciprocal tariff, creating acute cost pressures and supply chain disruptions for U.S.-based laser system integrators and OEMs. These measures have prompted a significant realignment of global supply networks, with many businesses exploring nearshoring and reshoring strategies to mitigate tariff exposure and ensure continuity of critical laser-based processes.

Consequently, U.S. industry leaders are reassessing procurement pathways, accelerating investments in domestic manufacturing capabilities, and forging new partnerships with alternative suppliers in Southeast Asia and Europe. While higher input costs are an immediate challenge, these strategic adjustments are intended to enhance long-term resilience and reinforce competitive positioning in a landscape marked by evolving trade regulations and geopolitical uncertainties.

Synthesizing Essential Insights from Laser Technology Segmentation Spanning Laser Types, Operating Technologies, Wavelength Categories, and Diverse Application Domains

A nuanced understanding of market segmentation is essential to navigating the laser technology landscape. By type, the market spans gas, liquid, and solid-state lasers. Gas lasers such as argon, CO₂, excimer, and helium-neon variants continue to serve specialized applications in research and high-precision material processing, while chemical lasers maintain strategic relevance in defense and aerospace. Solid-state offerings, including fiber lasers, YAG configurations, semiconductor lasers, and emerging thin-disk designs, dominate industrial material processing and additive manufacturing due to their robustness and efficiency. Meanwhile, liquid lasers - though a smaller segment - provide unique tunability benefits for certain biomedical and spectroscopy tasks.

Technological segmentation reveals two primary categories: continuous wave and pulsed systems. Continuous wave lasers are prized for steady-state power delivery in welding, cutting, and marking applications, whereas pulsed lasers - from nanosecond to femtosecond regimes - are indispensable for micromachining, non-linear spectroscopy, and ultra-precision surgery. The choice of wavelength further differentiates offerings into infrared, ultraviolet, and visible lasers, each tailored to specific material interactions, absorption profiles, and optical penetration depths.

Applications stretch across communication and data storage, defense, entertainment, industrial manufacturing, medical and aesthetic treatments, and research. Communication lasers underpin data center interconnects and optical networks, while defense applications span targeting, ranging, and directed energy systems. Entertainment lasers enrich live performances and simulation environments. Industrial use cases - particularly additive manufacturing, semiconductor fabrication, and precision material processing - account for a significant share of installed base. In healthcare, lasers facilitate ophthalmic surgery, dermatological therapies, and diagnostic imaging. Research activities harness lasers for environmental monitoring, fundamental physics exploration, metrology, and spectroscopy. Recognizing these interwoven segments enables stakeholders to tailor strategies and capitalize on the most promising growth vectors.

This comprehensive research report categorizes the Laser Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Wavelength

- Application

Deciphering Regional Market Dynamics for Laser Technology Across the Americas, Europe Middle East Africa, and Asia-Pacific to Illuminate Strategic Growth Opportunities

Geographic dynamics are shaping divergent growth trajectories for laser technology. In the Americas, a sustained emphasis on reshoring and domestic capacity-building is reinforcing leadership in fiber laser development and ultrafast systems integration. Major manufacturing clusters in North America are also investing in smart laser systems to advance aerospace, automotive, and semiconductor processing, supported by government incentives and academic-industry partnerships.

Europe, the Middle East, and Africa exhibit robust demand driven by defense modernization initiatives and the automotive industry’s pivot toward electric vehicle battery welding. The region’s strong photonics consortiums and research networks accelerate the adoption of silicon photonics and integrated laser solutions, particularly in Germany, France, and the United Kingdom. Concurrently, Middle Eastern sovereign wealth funds are allocating capital toward optical technologies for telecommunications and renewable energy applications, reflecting a broader diversification strategy.

Asia-Pacific remains the largest manufacturing hub for laser components and systems, buoyed by extensive production ecosystems in China, Japan, South Korea, and emerging markets like India and Southeast Asia. Rapid industrialization, expanding medical device manufacturing, and the rollout of 5G/6G infrastructure drive demand for compact, cost-effective laser modules. Moreover, strategic investments in national photonics initiatives are positioning the region at the forefront of quantum optics, LiDAR, and advanced sensing developments. Collectively, these regional insights highlight the need for tailored approaches to market entry, partner selection, and value proposition design.

This comprehensive research report examines key regions that drive the evolution of the Laser Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Laser Technology Players and Their Strategies in Innovation, Collaborative Ventures, and Competitive Positioning Across Critical Market Segments

Key players in the laser technology arena are maneuvering to consolidate market share through continuous innovation, strategic collaborations, and targeted investments. IPG Photonics, as a leading fiber laser manufacturer, has recently introduced a rack-integrated platform that reduces floor space by 60 percent while delivering enhanced reliability and integration ease for manufacturing environments. By extending its product portfolio with real-time sensing and compact ultrafast options, IPG is reinforcing its position in advanced applications from deep-weld imaging to high-precision cutting.

TRUMPF continues to leverage automation and AI through its “Cutting Assistant” application, which autonomously optimizes laser cutting parameters based on real-time edge quality analysis, addressing labor shortages and elevating production efficiency in metal fabrication. The company’s expansion into turnkey 3D laser material processing systems further underscores its commitment to delivering end-to-end solutions that reduce cycle times and lower total cost of ownership.

Other established players such as Lumentum, Jenoptik, Coherent, and Newport (MKS Instruments) are also accelerating R&D efforts in diode lasers, ultrafast amplifiers, and integrated photonics to capture emerging opportunities in telecom, biomedical, and defense sectors. Collaborative ventures between semiconductor foundries and photonics specialists are increasingly common, reflecting a shift toward convergence of electronic and optical technologies. These competitive moves illustrate a landscape where technological differentiation and ecosystem partnerships are key drivers of sustained leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laser Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 600 Group PLC

- ALLTEC Angewandte Laserlicht Technologie GmbH

- Ametek, Inc.

- Automated Laser Corporation

- Boss Laser LLC

- Bystronic Group

- Coherent Inc.

- EKSPLA

- Epilog Corporation

- eurolaser GmbH

- Gravotech Marking SAS by Brady Corporation

- Han's Laser Technology Industry Group Co., Ltd.

- IPG Photonics Corporation

- Iridex Corp.

- Jenoptik AG

- Keyence Corporation

- Laserax Inc.

- LaserStar Technologies Corporation

- Lumentum Operations LLC

- Lumibird SA

- Maxphotonics Co.,Ltd.

- MKS Instruments, Inc.

- Novanta Inc.

- Photonics industries international. Inc

- Sahajanand Laser Technology Limited

- TRUMPF SE + Co. KG

- Universal Laser Systems, Inc.

- XiAn Bright Laser Technologies Co Ltd.

Formulating Actionable Strategies for Industry Leaders to Capitalize on Emerging Laser Technology Trends, Supply Chain Resilience, and Regulatory Developments

Industry leaders should prioritize the diversification of supply chains to mitigate tariff-related disruptions, including expanding manufacturing footprints in low-tariff jurisdictions and forging alliances with alternative suppliers in Southeast Asia and Europe. To capitalize on transformative trends, companies should accelerate investment in AI-enabled process control and predictive maintenance platforms, which can significantly enhance equipment utilization and reduce defect rates.

Strengthening partnerships between laser manufacturers, system integrators, and end-user companies will catalyze the development of turnkey solutions tailored to sector-specific challenges. By co-innovating around emerging applications-such as quantum sensing, LiDAR for autonomous vehicles, and advanced medical diagnostics-stakeholders can unlock novel revenue streams and differentiate their offerings.

Moreover, fostering collaboration with academic institutions and government research consortia will ensure early access to breakthrough photonic and quantum optics inventions. Finally, aligning talent development initiatives, including apprenticeship programs and specialized training centers, will address the growing skills gap and preserve institutional knowledge critical to advancing next-generation laser technologies.

Detailing a Rigorous Research Methodology Combining Secondary Data Analysis, Expert Interviews, and Quantitative Validation to Ensure Comprehensive Market Insight

This report’s findings are grounded in a rigorous research methodology that combined extensive secondary data analysis, expert interviews, and quantitative validation. Secondary data sources included regulatory filings, trade association publications, and peer-reviewed journals to ensure accuracy and relevance. In addition, over 25 in-depth interviews were conducted with C-level executives, R&D directors, and procurement specialists across leading laser technology firms and end-use industries, providing qualitative insights and strategic perspectives.

Quantitative data was triangulated using corroborative sources, including industry databases, government trade statistics, and company financial disclosures, to validate trend trajectories and competitive benchmarks. Proprietary frameworks were employed to segment the market by type, technology, wavelength, application, and geography, ensuring a comprehensive view of market dynamics. Finally, iterative reviews with subject matter experts refined key assumptions and enhanced the robustness of the actionable recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laser Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laser Technology Market, by Type

- Laser Technology Market, by Technology

- Laser Technology Market, by Wavelength

- Laser Technology Market, by Application

- Laser Technology Market, by Region

- Laser Technology Market, by Group

- Laser Technology Market, by Country

- United States Laser Technology Market

- China Laser Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Reflections on Laser Technology Evolution, Strategic Imperatives, and the Roadmap for Stakeholders Seeking Sustainable Competitive Advantage

The evolution of laser technology is marked by the convergence of ultrafast pulse innovations, AI-driven control, and integrated photonic platforms that together are redefining performance thresholds across industries. As trade dynamics shift and regional strategies diverge, laser stakeholders must navigate a complex matrix of cost pressures, technological opportunities, and regulatory changes to maintain and extend competitive advantage.

By leveraging the insights detailed throughout this summary-from segmentation nuances to regional growth vectors and company case studies-decision-makers can craft informed strategies that align with both current market realities and future trajectories. The recommendations outlined offer a roadmap for enhancing supply chain resilience, deepening collaborative ecosystems, and investing in emerging applications that promise high-value returns. Ultimately, success in this dynamic landscape will hinge on agility, strategic foresight, and the capacity to translate innovation into scalable solutions.

Empowering Decision Makers to Gain Exclusive Laser Technology Market Intelligence Through a Personalized Consultation with Ketan Rohom Associate Director Sales & Marketing

Ready to elevate your strategic planning and harness the full potential of the laser technology market? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive market research report tailored to your needs. Ketan’s expertise in market dynamics and sales strategy ensures a personalized consultation that will clarify emerging opportunities, validate your investment decisions, and outline best practices for growth and innovation. Connect with Ketan today to secure your copy of the in-depth report and gain a competitive edge in this rapidly evolving landscape

- How big is the Laser Technology Market?

- What is the Laser Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?