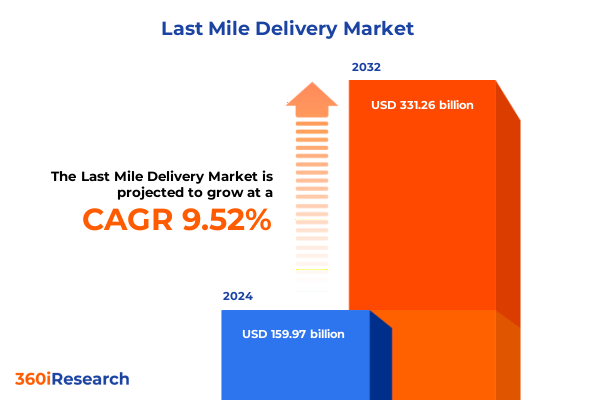

The Last Mile Delivery Market size was estimated at USD 174.40 billion in 2025 and expected to reach USD 190.14 billion in 2026, at a CAGR of 9.59% to reach USD 331.26 billion by 2032.

Understanding the Critical Dynamics of Last Mile Delivery and the Shifting Consumer and Operational Expectations That Define Modern Logistics

Last mile delivery represents the critical final step in the logistics chain, bridging the gap between distribution centers and end consumers with remarkable precision and speed. This phase is widely regarded as the most resource-intensive and complex segment of supply chain operations, underscoring its strategic importance for businesses across industries. Rising consumer expectations for rapid, transparent and sustainable deliveries have redefined competitive benchmarks, making the last mile a pivotal battleground for market differentiation.

Against the backdrop of exponential e-commerce growth and shifting urban demographics, organizations are compelled to innovate in order to maintain operational resilience and customer loyalty. As we examine this landscape, it becomes clear that relevancy hinges on the ability to orchestrate deliveries that not only meet tight time windows but do so while managing cost pressures and regulatory constraints. Consequently, last mile delivery has evolved from a logistical afterthought to a central driver of corporate strategy and investment.

In acknowledging these realities, this analysis illuminates the key factors shaping performance, highlights emerging technologies, and identifies actionable insights for stakeholders. By exploring structural transformations in the market and the cumulative impact of new trade policies, this executive summary equips decision-makers with the context needed to navigate a rapidly evolving environment and capitalize on the opportunities ahead.

Charting the Technological and Consumer-Driven Transformations Reshaping Last Mile Delivery From Autonomous Vehicles to Sustainability and Urban Microhubs

The last mile delivery landscape has undergone profound transformation as disruptive technologies, evolving consumer behaviors and sustainability imperatives converge. Artificial intelligence–driven route optimization engines now enable real-time adjustments to delivery paths, reducing idle time and emissions, while electric vehicles and drones have moved from pilot programs into commercial deployment in select urban centers. These innovations are complemented by the proliferation of micro-fulfillment centers and dark stores, which bring inventory closer to end users and shorten delivery corridors.

Meanwhile, the rise of the gig economy and crowdshipping models has introduced unprecedented flexibility into workforce management, allowing companies to dynamically scale driver capacity during peak demand periods. This shift has been enabled by advanced mobile platforms that provide on-demand connectivity between drivers and dispatchers, fostering higher service levels even during surges. At the same time, data analytics and machine learning are driving enhanced transparency through predictive ETAs and proactive exception management, fostering trust among both merchants and recipients.

Moreover, regulatory frameworks are evolving to accommodate these disruptions, with urban congestion charges, low-emission zones and drone flight corridors emerging as critical considerations for planners. Sustainability goals have also become increasingly central, prompting investments in carbon-neutral delivery initiatives and circular packaging solutions. As a result, the last mile ecosystem has become a vibrant arena where technology, policy and consumer demand intersect, creating fertile ground for new business models and strategic partnerships.

Analyzing the Growing Impact of United States 2025 Tariff Measures on Cross-Border Last Mile Delivery Costs and Supply Chain Dynamics

In 2025, the United States expanded its tariff portfolio with several measures targeting key imported goods, exerting knock-on effects on cross-border last mile delivery economics. Products originating from impacted trade partners now face elevated duties that not only increase landed costs but also introduce additional administrative complexity for logistics providers. Carriers serving markets with heightened tariff exposure have had to recalibrate their customs brokerage operations and absorb extended clearance times.

This environment has driven many shippers to reassess sourcing strategies, favoring domestic warehousing and reshoring where feasible, which in turn has shifted last mile network footprints. Such repositioning of inventory has reduced certain long-haul dependencies but has also heightened competition for urban distribution real estate. In parallel, delivery providers have introduced specialized tariff management services and digital compliance tools to mitigate risk and streamline import processes.

Through these adaptive strategies, the industry has absorbed much of the direct cost impact, yet pressures remain in the form of lengthened cycle times and potential margin erosion. Looking ahead, supply chain executives must weigh the tradeoffs between duty liabilities, inventory localization and network agility to sustain service levels. As regulatory environments continue to evolve, collaboration between importers, carriers and policymakers will be essential to stabilize the last mile delivery ecosystem.

Extracting Actionable Insights From Diverse Segmentation Perspectives to Optimize Delivery Models and Enhance Service Differentiation

Diving deeper into market segmentation reveals nuanced performance drivers and opportunities for specialization. When examining delivery by type, demand surges for instantaneous, on-demand services coexist with the predictability of scheduled routing, prompting operators to develop hybrid networks that balance rapid response with consolidated loads. Service type further differentiates strategic approaches, as business-to-business shipments prioritize reliability and volumetric efficiency, business-to-consumer deliveries demand flexible time windows and individualized communication, whereas consumer-to-consumer transactions emphasize peer-to-peer convenience and trust mechanisms.

Technological segmentation underscores diverging investment paths: firms pursuing autonomous solutions are engaged in controlled environment trials and pilot corridors to validate safety and scalability, while non-autonomous fleets continue to refine human-driven operations through smarter telematics and driver training. Use case segmentation highlights specialized delivery verticals such as heavy equipment and automotive parts, which rely on robust handling protocols; grocery and meal services, which require tight cold chain management and rapid last-leg execution; legal document couriers demanding heightened security and chain-of-custody assurance; pesticide logistics that necessitate regulatory compliance and safe handling; prescription fulfillment with strict temperature and privacy controls; and relief supply missions that prioritize speed and route adaptability under unpredictable conditions.

Examining industries served reveals tailored requirements: automotive and construction deliveries depend on just-in-time precision, courier and postal services leverage extensive ground networks, emergency and government channels focus on resilience, food and beverage logistics hinge on spoilage mitigation, furniture and appliances require white-glove service, healthcare and pharmaceutical shipments mandate traceability, retail and e-commerce drive convenience through omnichannel fulfillment, and utilities and energy sectors demand heavy and irregular payload solutions. Finally, customer type segmentation draws a line between enterprise-level contracts, which emphasize SLAs and integrated IT ecosystems, and individual orders that prioritize user-friendly interfaces and transparent delivery tracking. Together, these multifaceted segmentation lenses offer a roadmap for customizing service offerings and prioritizing investments to capture distinct market segments.

This comprehensive research report categorizes the Last Mile Delivery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Service Type

- Technology

- Use Cases

- Industry

- Customer Type

Examining the Regional Nuances Across the Americas, EMEA, and Asia-Pacific to Reveal Strategic Opportunities in Last Mile Delivery

Regional market dynamics exhibit pronounced contrasts that can guide strategic deployment of last mile assets. In the Americas, dense metropolitan hubs such as New York City and São Paulo intensify the need for micro-fulfillment nodes and zero-emission last-leg transport, while sprawling suburban and rural areas incentivize partnerships with local courier networks to bridge the gap between scalable routes and final delivery points. The regulatory environment in North America increasingly favors electric vehicle subsidies and low-emission zones, fuelling fleet electrification pilots and charging infrastructure investments.

Conversely, the Europe, Middle East & Africa region presents a tapestry of regulatory frameworks and urban archetypes. Western European markets push ahead with advanced drone corridors and congestion pricing schemes, encouraging lean urban operations. Meanwhile, the Middle East capitalizes on smart city initiatives to integrate real-time traffic management with delivery scheduling, and parts of Africa are advancing mobile-enabled crowdshipping models to overcome infrastructural constraints. These diverse conditions have prompted service providers to forge local alliances and adapt technology stacks to regional protocols.

In Asia-Pacific, rapid urbanization and high population density in cities like Shanghai and Mumbai place a premium on high-throughput microhubs and digital wallet payments to streamline cashless transactions. Japan and South Korea lead in autonomous vehicle regulations and robot-based delivery pods, setting benchmarks for safe integration. Across Southeast Asia, motorcycle couriers remain vital in navigating congested streets, driving investments in two-wheeler electric fleets and platform-based gig management. Such regional nuances underscore the importance of tailoring network design, technology adoption and partnership strategies to localized demands and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Last Mile Delivery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Players and Their Strategic Initiatives That Are Driving Innovation and Competitive Advantage in Last Mile Delivery

Leading organizations have distinguished themselves through targeted investments, strategic acquisitions and collaborative ventures aimed at reinforcing last mile capabilities. Global e-commerce giants continue to expand proprietary fulfillment networks and integrate forward-looking technologies such as autonomous delivery vehicles and advanced robotics within fulfillment centers. Traditional logistics carriers have accelerated partnerships with technology startups, acquiring telematics solutions and real-time visibility platforms to elevate service reliability.

Moreover, specialized courier firms have carved out niches by offering vertical-specific solutions, such as temperature-controlled pharmaceutical delivery and on-demand legal document transport, securing premium contracts and forging deep customer loyalty. Drone delivery pioneers have obtained regulatory approvals for expanded flight corridors, enabling pilot programs that reinforce brand positioning in innovation. Simultaneously, new entrants in the crowdshipping space are leveraging data-driven matchmaking algorithms to optimize delivery assignments and reduce idle capacity.

Through these varied approaches, the market’s most agile players are driving competitive differentiation by balancing scale with specialization, and standardization with customization. They are also forging forward with sustainability initiatives, from transitioning to electric and hydrogen-powered vehicles to adopting reusable or compostable packaging, thereby aligning operational improvements with environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Last Mile Delivery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Møller - Mærsk A/S

- Amazon.com, Inc.

- Aramex Group

- C.H. Robinson Worldwide, Inc.

- Delhivery Limited

- DHL Group

- DoorDash, Inc.

- Drone Delivery Canada

- Dropoff, Inc.

- DSV A/S

- FedEx Corporation

- Flytrex Inc.

- Geodis

- GeoPost

- GoBolt (Bolt Technologies Incorporated)

- HelloFresh SE

- Hermes Group

- Japan Post Holdings Co., Ltd.

- Jet Delivery, Inc.

- Meituan

- Nippon Express Co., Ltd.

- Onfleet, Inc.

- OnTrac

- Postmates by Uber Technologies, Inc.

- Power Link Expedite

- Royal Mail Group

- SkyDrop (Formerly Flirtey)

- United Parcel Service, Inc.

- United States Postal Service

- XPO, Inc.

- Yamaha Motor Co., Ltd.

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Thrive in the Evolving Last Mile Delivery Ecosystem

To succeed in this fluid environment, industry leaders must adopt a multifaceted strategy that integrates operational excellence, customer-centric innovation and regulatory foresight. Investment in robust real-time analytics platforms is imperative for enabling dynamic route optimization and predictive exception management, which not only enhances on-time performance but also reduces overall cost per delivery. In parallel, forging partnerships with local courier networks and technology providers can extend geographic reach and accelerate the rollout of advanced solutions such as drone and autonomous vehicle pilots.

Moreover, embedding sustainability into the core operating model-through electric vehicle adoption, carbon-neutral delivery programs and circular packaging innovations-can strengthen brand equity and satisfy mounting regulatory requirements. Equally, prioritizing seamless customer experiences by offering flexible delivery windows, transparent tracking communications and easy returns processes will drive loyalty and reduce failed delivery attempts.

Finally, industry leaders should engage proactively with policymakers to shape urban logistics regulations and advocate for supportive infrastructure investments. By fostering collaborative ecosystems that bridge the public and private sectors, companies can unlock new operational efficiencies and pave the way for scalable innovation. Together, these actionable imperatives form a cohesive framework for thriving in the rapidly evolving last mile delivery domain.

Outlining the Robust Research Methodology Leveraging Primary Interviews, Secondary Sources, and Data Triangulation to Ensure Comprehensive Insights

This research employs a comprehensive methodology designed to capture a holistic view of the last mile delivery market. Primary insights were gathered through in-depth interviews with industry executives, technology providers and regulatory experts to surface real-world perspectives on operational challenges and strategic priorities. These qualitative inputs were complemented by secondary data obtained from publicly available financial reports, trade publications and government regulations documentation to validate trends and identify emerging patterns.

To ensure robustness, data triangulation techniques were applied, cross-referencing interview findings with secondary sources to corroborate insights and minimize biases. Key drivers such as technology adoption rates, sustainability initiatives and regulatory developments were mapped against market segmentation and regional dynamics to discern correlations and causal relationships. Additionally, case studies of leading organizations were analyzed to illustrate best practices and benchmark performance. Throughout the process, quality control measures, including peer reviews and expert validations, safeguarded the accuracy and relevance of the final insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Last Mile Delivery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Last Mile Delivery Market, by Type

- Last Mile Delivery Market, by Service Type

- Last Mile Delivery Market, by Technology

- Last Mile Delivery Market, by Use Cases

- Last Mile Delivery Market, by Industry

- Last Mile Delivery Market, by Customer Type

- Last Mile Delivery Market, by Region

- Last Mile Delivery Market, by Group

- Last Mile Delivery Market, by Country

- United States Last Mile Delivery Market

- China Last Mile Delivery Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Takeaways to Illuminate the Path Forward in the Competitive Last Mile Delivery Environment

In summary, the last mile delivery sector stands at the nexus of technological innovation, shifting consumer demands and regulatory reform. The interplay of on-demand and scheduled services, autonomous and traditional fleets, and vertical-specific use cases presents a rich array of strategic pathways. Meanwhile, regional disparities in infrastructure and policy demand nuanced approaches to network design and technology deployment.

As market participants navigate the compounded effects of new tariff measures, sustainability mandates and urban logistics constraints, success will hinge on agility, collaboration and data-driven decision making. By embracing the actionable recommendations outlined here, stakeholders can position themselves to capitalize on growth opportunities, deliver superior customer experiences and drive long-term resilience in one of the most dynamic segments of global supply chains.

Connect With Associate Director Ketan Rohom to Secure Your Comprehensive Last Mile Delivery Market Research Report and Accelerate Decision-Making

For further insights and to empower your strategic roadmap, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore our in-depth last mile delivery market research report and drive transformative outcomes.

- How big is the Last Mile Delivery Market?

- What is the Last Mile Delivery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?