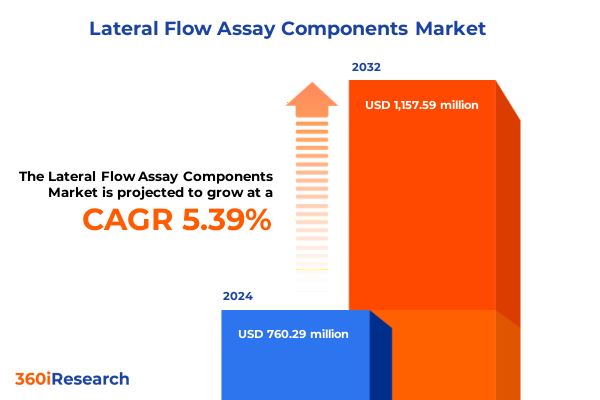

The Lateral Flow Assay Components Market size was estimated at USD 801.01 million in 2025 and expected to reach USD 843.01 million in 2026, at a CAGR of 5.40% to reach USD 1,157.59 million by 2032.

Setting the Stage for a Deep Dive into the Critical Role and Evolving Dynamics of Lateral Flow Assay Components in Modern Diagnostics

The landscape of point-of-care diagnostics has undergone a profound transformation over the past decade, positioning lateral flow assays as an indispensable tool for rapid, on-site detection of biomarkers across medical, environmental, and veterinary applications. At the heart of this evolution lies the interplay between reader systems and test kits, which collectively shape the sensitivity and usability of these assays. Reader systems-spanning benchtop instruments designed for laboratory settings and handheld devices engineered for field deployment-provide the quantitative rigor increasingly demanded by clinicians and public health professionals. Meanwhile, test kits remain the frontline interface for end users seeking swift, qualitative or semi-quantitative results.

This executive summary distills key findings from an in-depth market analysis focused on lateral flow assay components. By exploring transformative shifts, tariff implications, segmentation insights, regional dynamics, and the strategies of leading companies, this report offers a cohesive framework for understanding how technological advancements, regulatory changes, and global trade policies converge to shape the future of rapid diagnostic solutions. Intended for decision-makers seeking actionable intelligence, this summary paves the way for informed strategies that can capitalize on emerging opportunities in the assay components ecosystem.

Exploring the Catalytic Transformations Shaping the Lateral Flow Assay Landscape through Technology, Access, and User Experience Innovations

The past two years have witnessed catalytic changes in the lateral flow assay arena, driven by a convergence of digital integration, data analytics, and evolving user expectations. Integration of digital technologies into lateral flow devices has accelerated widely, with smartphone-based readers enabling semi-quantitative or fully quantitative outputs that were once restricted to laboratory environments. These innovations not only enhance diagnostic accuracy but also support real-time data sharing, facilitating epidemiological tracking and public health interventions.

Simultaneously, the rise of artificial intelligence in image analysis has enabled development of algorithms capable of detecting subtle variations in test line intensity. Such AI-driven enhancements have improved sensitivity and reliability, bridging the gap between traditional point-of-care testing and emerging at-home diagnostics. Alongside this, the emergence of multiplex lateral flow assays allows simultaneous detection of multiple biomarkers, reducing the time and resources required to diagnose complex or co-infections. These multiplex formats are increasingly adopted in both clinical and field settings to address urgent needs in infectious disease monitoring and chronic condition management.

A parallel trend involves the incorporation of wearable platforms, where compact lateral flow modules integrate seamlessly with health monitoring devices. These wearables facilitate continuous screening for specific analytes, offering timely health insights and supporting proactive care models. Lastly, regulatory bodies worldwide are adapting frameworks to accelerate approval pathways for digital and multiplex lateral flow solutions, reflecting a broader commitment to innovation that enhances diagnostic reach and efficacy.

Unraveling the Complex Cumulative Impact of Recent United States Tariff Measures on Lateral Flow Assay Components and Supply Chains

Recent tariff measures imposed by the United States have introduced significant complexity into the supply chains of lateral flow assay components. Escalating tensions with China have prompted several firms to secure alternative raw material sources and stockpile critical reagents, anticipating potential disruptions in access to high-precision membranes and conjugate pads. This strategic pivot underscores the vulnerability of globalized biomanufacturing networks to policy shifts.

Simultaneously, industry stakeholders exhibit a divided stance on the imposition of duties. Major medical equipment manufacturers have lobbied for exemptions, arguing that levies on imported diagnostic readers and test kit materials will inflate costs and dampen innovation. In contrast, domestic producers of consumables such as test strips welcome tariffs on overseas competitors, viewing them as an opportunity to bolster local manufacturing. Hospital associations have echoed concerns over patient care, warning that increased procurement costs could strain budgets and delay the adoption of advanced diagnostic tools.

The cumulative impact of these tariffs extends beyond immediate price increases. Many companies report planning production relocations to lower-tariff regions, a transition that risks introducing regulatory delays and quality control challenges. Moreover, despite relatively low overall import reliance in the U.S. device sector, economists caution that reciprocal tariff measures may disrupt established global partnerships, leading to longer lead times for device calibration and reader maintenance components. As policymakers deliberate on carve-outs for healthcare technologies, stakeholders must navigate this evolving landscape to maintain supply continuity and protect patient outcomes.

Dissecting Core Market Segments to Reveal Key Drivers and Adoption Patterns across Products, Technologies, Formats, Applications, and End Users

Dissecting the market through a product lens reveals distinct growth trajectories for reader systems and test kits. While test kits continue to dominate adoption for their simplicity and cost-effectiveness in point-of-care settings, the reader segment is gaining traction as institutions seek quantitative precision. Within readers, benchtop instruments maintain a foothold in laboratory environments demanding high throughput, whereas handheld readers expand testing capabilities in remote or resource-limited sites by combining portability with data capture functionality.

Examining the technological underpinnings further clarifies the competitive landscape. Traditional colloidal gold assays retain widespread use for rapid results, yet advancements in chemiluminescence and fluorescence detection have ushered in heightened sensitivity, catering to applications where low analyte concentrations must be quantified. Magnetic and colorimetric platforms also play a critical role in specialized formats, offering tailored solutions where specific assay chemistries or environmental resilience is required.

Format considerations, namely sandwich versus competitive assays, influence both end-user workflows and assay design. Sandwich formats predominate when analyte concentration exceeds threshold levels, providing clear visual indicators, whereas competitive assays are leveraged for small molecule detection where inverse signal relationships better reflect analyte presence. These choices intersect with application needs-spanning clinical diagnostics, environmental testing, food safety screening, and veterinary health-to shape custom solutions aligned with user expertise and regulatory mandates.

Finally, the end-user landscape encompasses academic and research institutes, diagnostic laboratories, home care environments, and hospitals and clinics, each driving unique demand profiles. Research institutes fuel innovation through experimental assay development, diagnostic labs demand validated quantitative platforms, home care settings prioritize ease of use and safety, and hospitals require comprehensive data integration, underscoring the multifaceted nature of lateral flow assay adoption.

This comprehensive research report categorizes the Lateral Flow Assay Components market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Format

- Application

- End User

Uncovering Regional Dynamics and Strategic Opportunities across the Americas, Europe Middle East Africa, and Asia Pacific in Lateral Flow Assay Market

Regional dynamics in the Americas are shaped by strong reimbursement frameworks, particularly in the United States where rapid coverage decisions for diagnostic innovations encourage early adoption of advanced reader technologies. Canada follows this lead, emphasizing interoperability and integration with provincial public health systems to enhance disease surveillance. In Latin America, rising public healthcare investments and partnerships with global suppliers are expanding access, yet affordability and infrastructure gaps continue to moderate uptake of sophisticated assay solutions.

In Europe, Middle East and Africa, harmonized regulatory standards under the European In Vitro Diagnostic Regulation establish a high-bar for assay validation, compelling manufacturers to invest in robust performance data. The Middle East, buoyed by government-led modernization of healthcare facilities, is increasingly receptive to point-of-care technologies that reduce turnaround times. Sub-Saharan Africa represents a growth frontier where non-governmental initiatives and public-private collaborations drive deployment of lateral flow tests in remote settings, albeit with ongoing challenges related to supply chain resilience and local training.

Across Asia-Pacific, China’s focus on domestic production has accelerated innovation, with government incentives encouraging local manufacturing of membranes, conjugates, and readers. India’s burgeoning diagnostics sector leverages cost-effective production capabilities to serve both local markets and global OEM partnerships. Southeast Asian nations embrace public health screening programs that rely on scalable lateral flow solutions, while Australia and Japan integrate high-precision readers into routine clinical workflows, reflecting a spectrum of economic and regulatory environments that inform regional market evolution.

This comprehensive research report examines key regions that drive the evolution of the Lateral Flow Assay Components market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Positioning, Innovation Priorities, and Collaborative Networks of Leading Lateral Flow Assay Component Manufacturers

Leading developers and manufacturers of lateral flow assay components differentiate themselves through distinct portfolios and strategic initiatives. One major player leverages advanced fluorescence-based reader platforms to deliver semi-quantitative diagnostics for cardiac and infectious disease markers, positioning itself at the intersection of speed and analytical performance. Another global diagnostics firm emphasizes an integrated ecosystem of test kits and cloud-connected readers, aligning product roadmaps with telehealth and remote monitoring trends.

Several specialized suppliers focus on enhancing membrane technologies and conjugate formulations to improve test strip sensitivity and shelf-stability under challenging environmental conditions. These innovations cater to high-volume screening programs in both clinical and field contexts. At the same time, established life sciences companies are forging partnerships with digital health startups to embed AI algorithms into reader devices, enabling real-time quality control and predictive maintenance alerts.

Emerging contenders concentrate on niche applications, developing multiplex lateral flow assays for veterinary diagnostics and environmental toxin detection. By tailoring assay chemistries to specific biomarkers, these firms address unmet needs in specialized verticals. Across the competitive landscape, collaborative ventures and co-development agreements underscore a collective drive toward end-to-end solutions that span sample preparation, assay execution, and data management, reflecting the ecosystem’s maturation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lateral Flow Assay Components market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abcam plc

- ACON Laboratories, Inc.

- Advanced Microdevices Pvt. Ltd.

- Ahlstrom Corporation

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Creative Diagnostics Corporation

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Hologic, Inc.

- Lumos Diagnostics Holdings Limited

- Merck KGaA

- Meridian Bioscience, Inc.

- QIAGEN N.V.

- Revvity, Inc.

- Sartorius AG

- Sekisui Chemical Co., Ltd.

- Surmodics, Inc.

- Thermo Fisher Scientific Inc.

Advancing Success through Actionable Strategic Recommendations to Empower Industry Leaders in Navigating the Evolving Lateral Flow Assay Ecosystem

To capitalize on evolving market dynamics, industry leaders should diversify supply chains by establishing regional manufacturing hubs and securing alternative raw material sources. This approach mitigates the risk of policy-driven disruptions and ensures continuity of critical membrane and conjugate supplies in the face of tariff volatility.

Investment in digital integration technologies is paramount. By embedding AI-driven analytics and connectivity features directly into reader systems, companies can deliver differentiated solutions that meet the growing demand for real-time data capture and remote monitoring. Such capabilities also facilitate regulatory compliance through automated record-keeping and audit trails.

Collaborative partnerships offer a path to accelerated innovation. Engaging with academic research centers and digital health startups can expedite development of next-generation multiplex assays and wearable platforms, broadening application scope and enhancing patient engagement. Leaders should also proactively engage with regulatory agencies to shape guidelines that support rapid approval of hybrid diagnostic devices.

Finally, embedding sustainability principles into product design and manufacturing processes will resonate with end users and procurement bodies prioritizing environmental stewardship. By adopting recyclable strip materials and energy-efficient reader electronics, manufacturers can balance performance with long-term ecological responsibility.

Detailing Rigorous Research Methodology and Data Collection Approaches Driving Robust Insights into Lateral Flow Assay Components Market Analysis

This analysis synthesizes insights from a robust research framework combining primary and secondary methodologies. Primary research involved in-depth interviews with senior executives at diagnostic laboratories, test kit manufacturers, reagent suppliers, and policy experts. These conversations provided firsthand perspectives on supply chain challenges, technology adoption trends, and regulatory considerations.

Secondary research included a comprehensive review of industry publications, technical whitepapers, and policy briefs to contextualize market developments. Peer-reviewed journals and thought leadership from global health organizations informed the evaluation of emerging assay formats, digital integration, and multiplex technology. Benchmarking studies and patent reviews further illuminated the competitive landscape and innovation trajectories.

Data triangulation techniques ensured the accuracy of qualitative insights, with cross-validation against published trade data and company annual reports. An expert advisory panel comprising biomedical engineers, public health specialists, and supply chain strategists provided critical feedback through workshops, refining key findings and validating strategic recommendations.

This integrated approach guarantees that stakeholders receive an objective, multi-dimensional view of the lateral flow assay components market, grounded in empirical evidence and expert analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lateral Flow Assay Components market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lateral Flow Assay Components Market, by Product

- Lateral Flow Assay Components Market, by Technology

- Lateral Flow Assay Components Market, by Format

- Lateral Flow Assay Components Market, by Application

- Lateral Flow Assay Components Market, by End User

- Lateral Flow Assay Components Market, by Region

- Lateral Flow Assay Components Market, by Group

- Lateral Flow Assay Components Market, by Country

- United States Lateral Flow Assay Components Market

- China Lateral Flow Assay Components Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Define the Future Trajectory and Strategic Imperatives for Lateral Flow Assay Component Stakeholders

The convergence of technological advancements, shifting regulatory landscapes, and global trade policies has set the stage for a dynamic evolution in lateral flow assay components. Quantitative reader systems are redefining accuracy standards, while innovative test kits expand access to rapid diagnostics across diverse environments. The interplay of these forces underscores the necessity for agile supply chain strategies, digital integration capabilities, and collaborative innovation models.

As industry stakeholders navigate the complexity introduced by recent tariff measures, a proactive stance toward regional manufacturing diversification and strategic partnerships will be critical. Embracing AI-enabled analytics and multiplex assay formats offers a competitive edge, catering to an increasingly data-driven healthcare ecosystem. Moreover, aligning product development with sustainability imperatives and evolving regulatory frameworks will enhance market acceptance and long-term viability.

Ultimately, organizations that integrate comprehensive market intelligence with agile execution will be best positioned to harness emerging opportunities. By synthesizing core insights presented here, decision-makers can chart a clear path forward-one that balances technological innovation, operational resilience, and strategic collaboration-ensuring sustained growth in the rapidly evolving lateral flow assay landscape.

Engage Expert Sales Leadership to Secure Comprehensive Market Research and Accelerate Strategic Decisions in Lateral Flow Assay Components

For tailored insights and to secure an authoritative market research report on lateral flow assay components, engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His deep understanding of diagnostic device trends, data-driven market intelligence, and client-focused approach will ensure you have the strategic guidance needed to navigate complex supply chains, technological innovation cycles, and competitive landscapes. By partnering with Ketan Rohom, you gain access to a comprehensive analysis that empowers your organization to make informed decisions, accelerate product development, and enhance market positioning. Take the next step in harnessing actionable intelligence for your business objectives by contacting Ketan Rohom today and unlocking the full potential of this critical diagnostic segment

- How big is the Lateral Flow Assay Components Market?

- What is the Lateral Flow Assay Components Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?