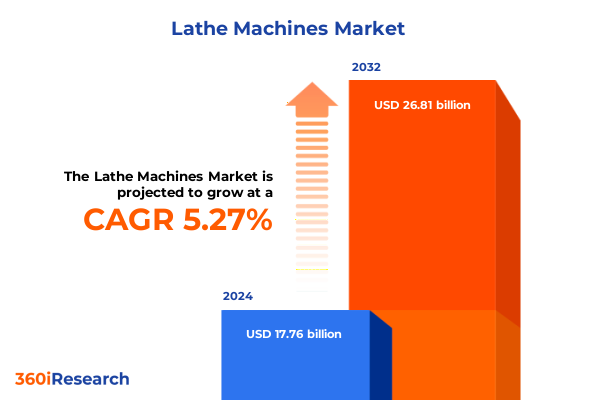

The Lathe Machines Market size was estimated at USD 18.69 billion in 2025 and expected to reach USD 19.66 billion in 2026, at a CAGR of 5.29% to reach USD 26.81 billion by 2032.

Comprehensive Overview of Lathe Machine Evolution Highlighting Technological Advancements Strategic Impact and Industry Relevance Across Manufacturing Sectors

Lathe machines have been a cornerstone of precision manufacturing for centuries, evolving from simple manual devices into sophisticated, computer-controlled assets that shape modern production landscapes. Rooted in the basic principle of rotating a workpiece against a cutting tool, these machines have enabled the creation of components ranging from simple rods to intricate aerospace parts. Over time, manual engine lathes gave way to turret lathes and eventually to computer numerical control (CNC) variants, embedding computing power directly into the heart of the equipment. This progression has driven remarkable improvements in repeatability, complexity of geometry, and overall throughput. As manufacturers pursue ever-tighter tolerances and leaner operations, lathe machines continue to be reimagined with advanced features such as live tooling and multi-spindle configurations to meet evolving demands.

In parallel, the integration of digital twin technology has revolutionized how lathe operations are planned, monitored, and optimized. Digital twins-virtual replicas of physical machines and processes-enable the simulation of machining parameters, predictive maintenance scheduling, and remote diagnostics. This capability reduces unplanned downtime and enhances machine life by anticipating tool wear or process deviations before they impact production. Consequently, decision-makers now leverage these virtual models to streamline setup, accelerate time-to-market, and minimize waste. As the manufacturing sector embraces Industry 4.0 principles, lathe machines are becoming indispensable data hubs, connecting the shop floor to enterprise resource planning systems and empowering data-driven decision-making.

Analytical Exploration of Transformative Shifts Driving Lathe Machine Adoption Including Automation Digitalization Sustainability and Supply Chain Resilience

The lathe machine landscape is undergoing transformative shifts fueled by the convergence of automation, advanced materials, and digital connectivity. One of the most significant developments is the emergence of hybrid, multi-tasking platforms that integrate turning, milling, and grinding functions within a single machine. These unified systems dramatically reduce changeover times and footprint requirements, enabling manufacturers to produce complex parts with fewer setups. Companies are directing resources toward designing modular tool turrets and flexible workholding solutions that can adapt to diverse production needs with minimal reconfiguration. By consolidating operations onto fewer machines, shops can achieve higher throughput and lower per-part costs while maintaining stringent quality control.

Concurrent with hardware consolidation is the adoption of artificial intelligence (AI) and machine learning algorithms to automate programming and process optimization. Advanced CAM software now embeds AI-driven toolpath optimization, which can cut programming time by up to 80 percent for common operations. In addition, AI-enabled vision systems and sensor arrays provide real-time feedback on cutting forces and vibration, allowing dynamic adjustment of spindle speeds and feed rates. This closed-loop control not only enhances surface finish and dimensional accuracy but also mitigates the risk of tool failure and associated scrap. These capabilities are especially valuable in unmanned “lights-out” operations where machines run overnight without direct human supervision.

Sustainability is another crucial shift reshaping lathe applications. Manufacturers are increasingly prioritizing energy efficiency, leveraging high-efficiency drives and optimized coolant delivery systems to minimize power consumption and resource usage. Coupled with the rising adoption of eco-friendly cutting fluids and biodegradable lubricants, the focus on environmental stewardship is creating new competitive differentiators. Companies that integrate sustainable machining practices stand to benefit from both reduced operating costs and enhanced brand reputation among environmentally conscious customers.

In-Depth Assessment of the Cumulative Impact of United States Tariff Policies on Lathe Machine Operational Costs Supply Chains and Strategic Planning

The early months of 2025 witnessed a dramatic escalation in U.S. tariff policies, culminating in an average applied tariff rate of approximately 27 percent-a level unseen in over a century. A universal 10 percent tariff on virtually all imports took effect in April 2025 under the International Emergency Economic Powers Act, compounding existing duties on key materials and components. Steel and aluminum faced 50 percent duties, while passenger vehicles and certain machine tools were hit with 25 percent levies. Concurrently, the baseline tariffs on Chinese imports peaked at 145 percent before a negotiated reduction to 30 percent later in the spring. These layered measures have significantly increased the landed cost of lathe machine inputs such as alloy steel, high-strength fasteners, and precision bearings.

For lathe machine manufacturers, many of which source subcomponents and raw materials from China, North America, and Europe, the tariff landscape has introduced pronounced supply chain volatility. Chinese-made machine tool parts remain subject to the enduring Section 301 duty of 25 percent, now compounded by the universal tariff. U.S. plant operations have faced cost increases ranging from 15 to 30 percent on imported subassemblies, prompting delayed capital expenditures and inventory stockpiling. End-users in sectors like aerospace and automotive report extended lead times as suppliers struggle to assess cumulative duty impact and warehouse costs for longer horizons.

In response, machine tool producers are exploring geographic diversification of production. Some have shifted assembly lines from China to Mexico or Central America to exploit preferential trade treatments, although recent reciprocal duties of 25 percent on Canadian and Mexican imports have tempered nearshoring advantages. Others are investing in domestic tooling capacity or renegotiating long-term supply contracts to hedge against future tariff escalations. While these strategies offer partial mitigation, industry participants emphasize that sustained policy certainty is essential to restore confidence and unlock renewed capital investment in advanced lathe equipment domestically.

Insightful Analysis of Key Segmentation Dynamics Based on Machine Type Spindle Orientation Construction Type and Diverse End Use Industry Applications

An insightful look at segmentation dynamics reveals how product variations and application contexts shape strategic priorities across the lathe machine market. Within the realm of machine types, the automatic lathe segment includes sophisticated sliding headstock and turret lathe designs optimized for high-volume, precise operations. These systems feature rapid indexing capabilities and integrated tool changers to minimize part cycle times. Conversely, manual lathes remain indispensable in tool rooms and for low-volume, bespoke component manufacture. Traditional bench lathes, engine lathes, and specialized tool room lathes continue to serve prototyping workflows and maintenance shops, where tactile control and operator-led adjustment offer unique advantages under constrained batch sizes.

Spindle orientation and construction type further refine the product landscape. Horizontal lathes dominate general machining applications offering robust chip evacuation and compatibility with bar feeders, while vertical orientations are preferred for large-diameter workpieces and monolithic part setups. Flat bed, gap bed, and slant bed frameworks accommodate different workpiece geometries and spindle alignments, balancing rigidity and accessibility. These structural variations influence tooling strategies, floor space utilization, and integration with automated handling solutions.

Beyond equipment attributes, end-use industry segmentation underscores the diverse demands placed on lathe technologies. The aerospace sector drives investments in ultra-precise, multi-axis turning for critical engine components, while automotive manufacturers seek high-throughput turret lathes tailored for drivetrain and transmission part fabrication. General manufacturing firms leverage bench and engine lathes for maintenance and small-batch runs, whereas medical device producers require cleanroom-compatible configurations and micro-turning capabilities. In the oil and gas domain, downstream refiners utilize heavy-duty bench and turret lathes for valve and pump housing servicing, and upstream operators maintain on-site tool room lathes for field repairs of drilling equipment.

This comprehensive research report categorizes the Lathe Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Spindle Orientation

- Construction Type

- End Use Industry

Comprehensive Regional Insights Exploring Lathe Machine Market Trends Competitive Dynamics Across Americas Europe Middle East Africa and Asia Pacific

The Americas region remains a pillar of lathe machine demand, supported by a mature automotive supply chain and robust aerospace manufacturing footprint. North American production facilities emphasize flexible, modular CNC lathes that align with just-in-time assembly and lean manufacturing methodologies. Additionally, the region’s growing energy infrastructure market sustains machine tool sales for equipment servicing in the downstream oil and gas sector. Latin American manufacturers are gradually increasing automation investments to offset labor cost volatility, driving interest in turnkey lathe solutions that combine ease of operation with remote monitoring capabilities.

Europe, the Middle East, and Africa (EMEA) exhibit differentiated demand patterns. Western European machine shops prioritize high-precision, chip-to-chip efficiency and seamless digital integration with Industry 4.0 architectures. German and Swiss equipment makers maintain leading positions by delivering premium lathe platforms with embedded IoT sensors and scalable software modules for process analytics. Meanwhile, Middle Eastern economies are expanding domestic manufacturing hubs, resulting in stepped-up procurement of medium-capacity CNC lathes for infrastructure development. In Africa, smaller markets often rely on refurbished manual lathes for basic component fabrication, gradually considering entry-level CNC upgrades as training and support ecosystems mature.

Asia-Pacific stands out as the fastest-growing market, fueled by escalating production in China, India, and Southeast Asian nations. These regions exhibit a strong appetite for high-speed, multi-axis lathe machines that support both domestic automotive assembly and electronics hardware fabrication. Local manufacturers are rapidly enhancing R&D investments to produce competitive, lower-cost CNC lathes tailored for regional SMEs. Government initiatives promoting manufacturing self-sufficiency and export-oriented industrial corridors are further accelerating equipment adoption, making APAC a focal point for long-term growth strategies.

This comprehensive research report examines key regions that drive the evolution of the Lathe Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Analysis of Leading Lathe Machine Manufacturers Innovations Partnerships and Market Positioning Driving Competitive Leadership and Growth Trajectories

The competitive landscape of the lathe machine industry is shaped by a handful of global leaders executing targeted strategies to capture value across key segments. DMG MORI stands out as a preeminent force, leveraging its German-Japanese heritage to deliver a broad portfolio of CNC lathes, multi-axis turning centers, and hybrid machine tools. With over 7,500 employees and 161 international sales and service sites, the company offers world-class after-sales support and rapid spare parts delivery. Its strategic focus on additive manufacturing integration and laser-assisted machining reflects a commitment to next-generation lathe innovations.

Yamazaki Mazak, another industry powerhouse, underscores multi-tasking capabilities through its VARIAXIS and INTEGREX product lines. Renowned for high-speed, high-power spindle options and seamless software ecosystems, Mazak’s machines cater to sectors demanding precision and agility, including aerospace and medical device manufacturing. The company’s network of technology centers provides hands-on training and process validation, reinforcing its position as a partner rather than merely an equipment vendor.

On the American front, Haas Automation has carved out a formidable niche by offering lower-cost CNC lathes with user-friendly controls and extensive automation accessories. Headquartered in California, Haas sells direct to end-users, eliminating distributor margins and accelerating lead times. Its modular automation ecosystem-including bar feeders, automatic parts loaders, and robot integrations-empowers shops to transition from manual machining to lights-out production with minimal capital outlay.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lathe Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- DMG Mori Co., Ltd.

- Doosan Machine Tools Co., Ltd.

- EMAG GmbH & Co. KG

- Haas Automation, Inc.

- Hardinge Inc.

- JTEKT Corporation

- Kent Industrial Co., Ltd

- Matsuura Machinery Corporation

- Nakamura-Tome Precision Industry Co., Ltd.

- Okuma Corporation

- Racer Machinery International Inc.

- Shenyang Machine Tool Part Co., Ltd.

- Shun Chuan Precision Machinery Co., Ltd.

- SMEC America Corporation

- Summit Machine Tool LLC

- TAIG Tools

- Takisawa Machine Tool Co., Ltd.

- TORNOS SA

- Tsugami Corporation

- Victor Taichung Machinery Works Co., Ltd.

- Yamazaki Mazak Corporation

Actionable Recommendations to Strengthen Lathe Machine Competitive Advantage Through Innovation Digitalization Supply Chain Optimization and Sustainability

Industry leaders seeking to enhance their competitive posture should prioritize a balanced technology roadmap that marries core machining excellence with digital ecosystem integration. First, investments in modular automation-such as bar feeders and tool presetter systems-can deliver immediate productivity gains without wholesale floorplan redesign. These solutions facilitate incremental scaling of lights-out operations and reduce reliance on operator availability.

Second, implementing data-driven maintenance programs through digital twins and embedded sensor networks will preemptively identify wear patterns and process drifts. This capability liberates production from reactive downtime and extends machine lifecycles, ultimately lowering total cost of ownership.

Third, stakeholder alignment on sustainability goals creates long-term operational efficiencies. By adopting energy-efficient drive systems, optimizing coolant delivery, and integrating biodegradable lubricants, manufacturers can reduce resource consumption and demonstrate environmental stewardship to end customers.

Finally, supply chain resilience must be reinforced through diversified sourcing strategies and strategic inventory buffers. Evaluating alternative suppliers in low-tariff jurisdictions and negotiating multi-year contracts can mitigate the impact of policy volatility. Leveraging localized assembly or aftermarket capabilities will also cushion against cross-border disruptions, ensuring continuous production flow and customer satisfaction.

Comprehensive Research Methodology Detailing Primary Interviews Secondary Data Sources Expert Validation and Analytical Frameworks Supporting Insights

The research underpinning this analysis combines rigorous primary and secondary methodologies to ensure robust and actionable insights. Primary research involved in-depth interviews with C-level executives, plant managers, and service technologists across leading OEMs and end-user organizations. These conversations yielded firsthand perspectives on emerging technology adoption, regulatory impacts, and strategic investment priorities.

Secondary research encompassed the examination of company releases, trade publications, industry association reports, and government policy archives. Where applicable, data points were cross-validated to maintain accuracy and consistency. The research team also leveraged public economic indicators, such as the Federal Reserve’s machinery production indices and tariff rulings, to contextualize market dynamics.

Finally, all findings were subjected to expert review sessions, where subject matter specialists vetted interpretations, identified potential blind spots, and provided qualitative assessments. This multilayered approach ensures that the conclusions and recommendations articulated here rest on a foundation of comprehensive data triangulation and real-world practitioner insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lathe Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lathe Machines Market, by Machine Type

- Lathe Machines Market, by Spindle Orientation

- Lathe Machines Market, by Construction Type

- Lathe Machines Market, by End Use Industry

- Lathe Machines Market, by Region

- Lathe Machines Market, by Group

- Lathe Machines Market, by Country

- United States Lathe Machines Market

- China Lathe Machines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Strategic Conclusion Summarizing Key Lathe Machine Industry Insights Future Outlook and Imperatives for Stakeholder Decision Making

In conclusion, the lathe machine sector stands at a pivotal juncture, propelled by advances in hybrid machining, data-driven operations, and sustainable design imperatives. While technological upgrades unlock novel production efficiencies and competitive differentiation, external forces such as shifting tariff landscapes and supply chain complexities impose operational challenges. Successful stakeholders will be those who harmonize investments in automation and digital platforms with strategic sourcing resiliency and environmental stewardship.

By aligning organizational objectives with industry best practices-ranging from modular automation deployment to comprehensive maintenance analytics-manufacturers can navigate near-term uncertainties while laying the groundwork for sustained growth. Emphasizing collaboration with equipment suppliers and service partners will further reinforce capabilities and accelerate time-to-value for capital equipment investments. Ultimately, a proactive, data-centric approach will enable the sector to fulfill its critical role in underpinning global manufacturing competitiveness.

Empowering Strategic Decisions Collaborate with Ketan Rohom Associate Director Sales Marketing to Access the Comprehensive Lathe Machine Market Research Report

In today’s fiercely competitive industrial machinery landscape, staying ahead requires actionable insights and decisive strategy. Connecting with Ketan Rohom, an experienced leader in sales and marketing, is your direct path to unlocking the full spectrum of in-depth analysis, competitive intelligence, and market opportunities within the lathe machine sector. By partnering with him, decision-makers gain unparalleled access to tailored recommendations, granular segmentation insights, and regional intelligence that can drive sustainable growth and mitigate regulatory risks.

Seize the moment to transform raw data into strategic advantage by securing the comprehensive lathe machine market research report. Engage with Ketan Rohom now to empower your planning, elevate your positioning, and realize new avenues for innovation and expansion in your operations.

- How big is the Lathe Machines Market?

- What is the Lathe Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?