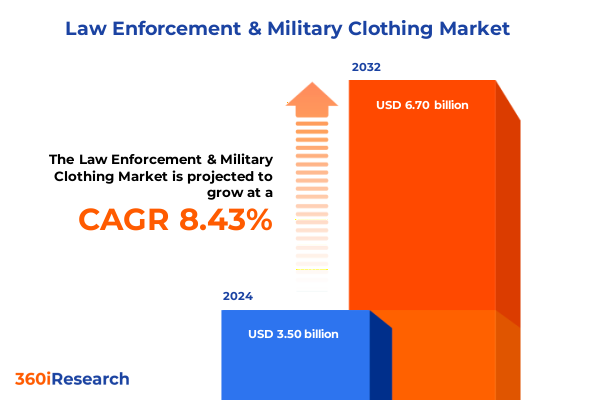

The Law Enforcement & Military Clothing Market size was estimated at USD 3.78 billion in 2025 and expected to reach USD 4.07 billion in 2026, at a CAGR of 8.53% to reach USD 6.70 billion by 2032.

Introducing the Comprehensive Overview of the United States Law Enforcement and Military Clothing Market and Its Critical Role in Operational Preparedness

The modern operating environment for law enforcement and military forces demands an unwavering commitment to protective clothing and gear. An introduction to this market reveals a dynamic interplay between technology advancements, tactical requirements, and procurement practices that collectively shape operational effectiveness. From urban policing scenarios to expeditionary military deployments, decision makers must reconcile performance needs with ergonomic design and cost-effectiveness to ensure personnel safety and mission success.

Throughout this executive summary, we will explore the strategic drivers that underpin demand for body armor, outerwear, tactical uniforms, and specialized vests. By presenting a clear framework for understanding the sector’s core product categories and end-user segments, this overview establishes the foundational context necessary for deeper analysis. Transitional insights into regulatory shifts, supply chain considerations, and competitive benchmarks will set the stage for a comprehensive examination of regional dynamics and industry best practices. As you delve into subsequent sections, this introduction will serve as your guide to the overarching themes that influence procurement, manufacturing, and innovation in the protective clothing space.

Examining the Transformational Shifts Reshaping the Law Enforcement and Military Apparel Landscape Driven by Technological and Tactical Innovations

The landscape of protective apparel for security forces has undergone a series of transformative shifts in recent years, propelled by emerging threats and technological breakthroughs. Innovations in material science have yielded lightweight aramid fibers and advanced UHMWPE solutions, allowing manufacturers to deliver soft armor systems that provide superior ballistic protection without compromising mobility. Concurrently, the integration of modular design principles into plate carriers and tactical vests has enhanced adaptability to mission-specific requirements, enabling rapid reconfiguration of load-bearing systems in evolving operational theaters.

Beyond material advancements, digital manufacturing techniques such as 3D knitting and laser cutting are revolutionizing garment fit and production efficiency. These capabilities support the customization of shell jackets-whether rainproof or windproof-tailored to diverse climatic conditions and mission profiles. The convergence of smart textile integration with wearable electronics technologies is also beginning to unlock real-time health monitoring and threat detection capabilities directly embedded within coats and jackets. As agencies increasingly prioritize asset sustainment and lifecycle management, the emergence of predictive maintenance platforms further underscores the industry’s commitment to driving down total cost of ownership.

As we transition into discussions on policy impacts and market segmentation, these transformative shifts set the groundwork for understanding how protective clothing solutions are evolving to meet the dual imperatives of performance and affordability.

Analyzing the Multifaceted Effects of United States Tariffs Implemented in 2025 on Supply Chains and Procurement Strategies for Protective Gear

In 2025, the imposition of new tariff schedules on imported ballistic plates, textile components, and finished outerwear has introduced significant complexity for procurement officers and manufacturers alike. These trade measures, designed to bolster domestic production, have elevated input costs for ceramic plates and composite plate carriers, incentivizing end users to reassess their supply chains and consider reshoring certain manufacturing processes. In parallel, tariffs on specialized aramid fiber imports have strained relationships with traditional global suppliers, compelling material engineers to explore alternative sources and hybrid composite formulations.

Procurement teams across federal agencies, police units, and military branches have responded by recalibrating contract structures to mitigate price escalations. This has led to a growing interest in framework agreements that allow for fluctuation clauses tied to raw material indices and currency exchange rates. As organizations weigh the merits of localized manufacturing hubs against established production centers in Asia-Pacific, strategic partnerships and co-development efforts are on the rise to preserve cost predictability. Moreover, a shift toward lifecycle cost modeling-rather than purchase price alone-has emerged as a best practice, aligning investment decisions with long-term sustainment objectives.

These adjustments illustrate the multifaceted nature of tariff impact, where supply chain resilience and procurement agility serve as critical levers for maintaining force readiness amid evolving trade policies.

Unveiling Critical Segmentation Insights Illuminating Product Type and End User Dynamics That Define the Defense and Law Enforcement Clothing Market

A nuanced view of this market requires attention to how product type distinctions and end user roles influence demand dynamics and design priorities. Based on product type, the sector encompasses body armor, coats & jackets, pants, tactical vests, and uniforms, each of which addresses distinct operational requirements. Within body armor solutions, hard armor, plate carriers, and soft armor categories reflect varying protection levels and mission profiles. Hard armor itself subdivides into ceramic plates, composite plates, and steel plates, while plate carriers range from minimalist carriers intended for covert operations to rugged tactical carriers configured for high-intensity engagements. Soft armor options leverage aramid fiber or UHMWPE materials, balancing weight and flexibility.

Transitioning to outerwear, coats & jackets are differentiated into parkas, shell jackets, and softshell jackets, with shell jackets further delineated by rainproof shells versus windproof shells to suit precipitation and wind conditions. In lower body protection, cargo pants, combat trousers, and tactical pants answer different mobility and storage requirements, where cargo pants include 4-pocket and 6-pocket iterations, combat trousers support both battle dress uniform styles and specialized forces variants, and tactical pants utilize either ripstop fabric or stretch fabric for durability and comfort. Tactical vests incorporate chest rigs and modular vests, with chest rigs offering single mag or triple mag configurations, and modular vests providing MOLLE compatibility or bespoke tactical configurability. Uniform offerings complete the picture through combat and dress variants, where combat uniforms feature desert, digital, or woodland camouflage patterns and dress uniforms are available in female or male tailoring.

This comprehensive research report categorizes the Law Enforcement & Military Clothing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- End User

- User Gender

- Distribution Channel

- Application Area

Deciphering the Influence of Americas, Europe Middle East & Africa, and Asia Pacific Regions on Defense and Law Enforcement Apparel Market Trends

Geographic nuances profoundly shape both procurement protocols and design specifications for protective clothing. The Americas region, encompassing North and Latin America, is characterized by well-established defense budgets and a strong emphasis on domestic manufacturing capabilities, which supports localized production of ceramic plates and soft armor panels. Meanwhile, federal law enforcement agencies in the United States have driven demand for specialized tactical vests and SWAT-grade tactical pants, fostering innovation in minimalism and modularity.

In contrast, the Europe, Middle East & Africa region exhibits a fragmented landscape where varied threat profiles-ranging from urban terrorism in Europe to border security challenges in the Middle East and peacekeeping missions in Africa-fuel diverse requirements for body armor and uniform systems. European law enforcement units prioritize ergonomics for prolonged duty cycles, whereas armies operating in desert environments demand high-performance parkas and desert camouflage combat uniforms. Regional reliance on composites and steel plates reflects a balance between cost pressures and ballistic performance.

Over in Asia-Pacific, rapid modernization programs among national armies and expanding coast guard mandates have accelerated interest in advanced soft armor and hybrid plate carrier solutions. Partnerships with local textile manufacturers are increasingly common, supporting the development of ripstop and stretch-fabric tactical pants tailored for humid climates. These regional insights underscore the importance of aligning product portfolios with local procurement frameworks and environmental conditions.

This comprehensive research report examines key regions that drive the evolution of the Law Enforcement & Military Clothing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Maneuvers and Competitive Strengths of Key Industry Players Transforming Performance Apparel Solutions for Security Forces

Key industry players have pursued differentiated strategies to capture growth and address unique customer pain points. Technology-driven enterprises have invested heavily in proprietary material science, while legacy manufacturers have optimized production scale and supply chain integration. For instance, one leading firm has leveraged its expertise in aramid fiber technology to launch a new line of ultra-lightweight soft armor solutions compatible with existing plate carrier platforms, thus reducing soldier fatigue without compromising protection.

Meanwhile, another established producer has focused on modularity by introducing a next-generation tactical vest architecture that supports both MOLLE and non-MOLLE attachments, catering to a broad spectrum of law enforcement and military applications. Several niche providers specializing in combat uniforms have secured long-term contracts with national military forces by offering custom camouflage patterns and female-specific dress uniform designs, demonstrating the importance of adaptability in bidding processes.

Additionally, vertically integrated organizations have doubled down on regional manufacturing facilities to address local content requirements and mitigate tariff exposure. By forming joint ventures with domestic textile companies, these players have streamlined material procurement, accelerated delivery schedules, and strengthened after-sales support services-actions that have collectively reinforced their competitive positioning and fueled incremental market share gains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Law Enforcement & Military Clothing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- 5.11, Inc.

- Ansell Limited

- Ballistic Body Armour (Pty) Ltd.

- Blauer Manufacturing Co., Inc.

- Blue Force Gear, LLC

- Condor Outdoor Products, Inc.

- Crye Precision LLC

- DuPont de Nemours, Inc.

- Fechheimer Brothers Company

- FirstSpear, LLC

- Heathcoat Fabrics Limited

- Honeywell International Inc.

- Kimberly-Clark Corporation

- Longworth Industries, Inc.

- Point Blank Enterprises, Inc.

- Propper International, LLC

- Safariland, LLC

- Seyntex N.V.

- Under Armour, Inc.

- VF Corporation

- W. L. Gore & Associates, Inc.

Offering Actionable Strategic Recommendations to Empower Industry Leaders in Innovating and Optimizing Military and Law Enforcement Clothing Operations

Industry leaders must embrace a multi-pronged approach to stay ahead of evolving mission demands and trade considerations. First, investing in advanced composite and fiber research will enable companies to offer differentiated products that address both ballistic protection and wearer comfort. By forging partnerships with material science institutes and leveraging public-private consortiums, organizations can accelerate product development cycles and reduce time to market.

Secondly, enhancing supply chain resilience through dual sourcing strategies for critical components-such as plates and ballistic fabrics-can mitigate the impact of tariff fluctuations and geopolitical disruptions. Establishing strategic stockpiles of key inputs in central distribution hubs can further buffer against short-term supply constraints. Concurrently, adopting digital supply chain platforms that allow real-time tracking of shipments and automated inventory replenishment will strengthen procurement forecasting and operational agility.

Finally, tailoring product portfolios to region-specific requirements-whether it be humid-climate tactical pants in Asia-Pacific or high-end shell jackets for European law enforcement-will ensure offerings remain relevant. Cultivating consultative sales models that integrate lifecycle cost analysis and total cost of ownership evaluations will resonate with decision makers seeking transparent, value-driven procurement pathways.

Detailing the Rigorous Research Methodology Employed to Ensure Reliability and Depth in Assessing Law Enforcement and Military Apparel Dynamics

This analysis is grounded in a rigorous research methodology that combines primary interviews with defense procurement officials, law enforcement agencies, and military subject matter experts, alongside secondary data from industry journals, regulatory filings, and trade databases. The triangulation of qualitative and quantitative inputs ensures a holistic perspective on material availability, technology adoption, and procurement practices. Over one hundred in-depth interviews were conducted across North America, Europe, and Asia-Pacific to capture region-specific insights and emerging trends.

To maintain accuracy and relevance, the research team employed a three-phased validation process: initial data collection, cross-source verification, and expert panel review. This structure allowed for continuous refinement of market segmentation definitions and a robust assessment of tariff impacts. Ethical considerations were observed throughout, with all primary respondents participating under conditions of confidentiality and voluntary disclosure. Statistical techniques, including cross-tabulations and trend analysis, were applied to secondary datasets to identify correlations between policy shifts and purchasing patterns, thereby reinforcing the analytical framework.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Law Enforcement & Military Clothing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Law Enforcement & Military Clothing Market, by Product Category

- Law Enforcement & Military Clothing Market, by End User

- Law Enforcement & Military Clothing Market, by User Gender

- Law Enforcement & Military Clothing Market, by Distribution Channel

- Law Enforcement & Military Clothing Market, by Application Area

- Law Enforcement & Military Clothing Market, by Region

- Law Enforcement & Military Clothing Market, by Group

- Law Enforcement & Military Clothing Market, by Country

- United States Law Enforcement & Military Clothing Market

- China Law Enforcement & Military Clothing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights Highlighting the Strategic Imperative of Advanced Clothing Solutions for Enhanced Operational Readiness and Force Protection

As the convergence of advanced materials, modular design, and geopolitical forces accelerates, the law enforcement and military clothing sector stands at a strategic inflection point. Organizations that prioritize innovation, supply chain resilience, and regionally attuned product customization will emerge as market leaders and secure long-term contracts with key agencies. The interplay between tariff policies and procurement practices necessitates agile decision making, underpinned by robust data and expert guidance.

In conclusion, the imperative for advanced protective clothing extends beyond individual comfort-it is integral to mission effectiveness, personnel safety, and overall force readiness. By integrating the insights provided throughout this executive summary, stakeholders can align procurement strategies with operational imperatives and budgetary realities.

Compelling Invitation to Partner with Associate Director Sales & Marketing Ketan Rohom to Secure Definitive Defense & Law Enforcement Apparel Insights Report

Securing advanced insights into protective clothing design and procurement has never been more crucial for stakeholders seeking to maintain a competitive edge. By partnering with Associate Director Sales & Marketing Ketan Rohom, decision makers gain unparalleled access to a definitive insights report crafted to address the most pressing operational challenges facing law enforcement and military apparel programs today. This tailored offering synthesizes deep market understanding, segmentation analysis, and strategic guidance into a single resource designed to facilitate informed investments, optimize supply chain resilience, and accelerate adoption of next-generation protective gear. Prospective buyers will discover a clear roadmap for aligning procurement priorities with emerging threats and budgetary constraints, leveraging the latest tariff impact assessments, and capitalizing on region-specific growth dynamics. Don’t miss this opportunity to harness comprehensive expertise and transform decision making processes-connect with Ketan Rohom to acquire the authoritative defense and law enforcement apparel insights report that will redefine your strategic planning and operational readiness

- How big is the Law Enforcement & Military Clothing Market?

- What is the Law Enforcement & Military Clothing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?