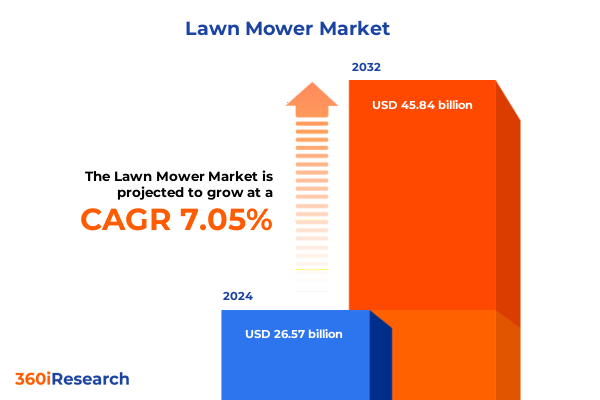

The Lawn Mower Market size was estimated at USD 28.36 billion in 2025 and expected to reach USD 30.29 billion in 2026, at a CAGR of 7.09% to reach USD 45.84 billion by 2032.

Exploring the Dynamic Evolution of Lawn Mower Technologies and Market Forces Shaping the Future of Outdoor Power Equipment Industry

Introduction

The outdoor power equipment industry has witnessed profound transformation over the past decade, driven by rapid technological innovation and shifting consumer expectations. The traditional image of a gasoline-powered push mower is giving way to a broad spectrum of solutions designed for efficiency, sustainability, and ease of use. Homeowners and professional landscapers alike are seeking equipment that not only delivers reliable performance but also aligns with growing environmental and regulatory demands. As a result, manufacturers are diversifying their product portfolios, investing heavily in research and development, and embracing digital channels for marketing and distribution.

Against this backdrop of relentless change, stakeholders across the value chain require a clear, concise overview of the forces shaping the lawn mower sector today. From the advent of robotic cutting machines to stringent emissions standards, the competitive landscape is more complex and dynamic than ever before. Moreover, market participants must navigate geopolitical developments, supply chain disruptions, and evolving trade policies that directly influence production costs and price structures.

This executive summary offers decision-makers a concise yet comprehensive introduction, outlining the critical trends, regulatory shifts, segmentation frameworks, and regional nuances defining the modern lawn mower industry. By synthesizing key insights and strategic imperatives, this section equips you with the foundational understanding needed to evaluate market opportunities, anticipate future disruptions, and chart a path toward sustainable growth.

Tracing the Paradigm Shift in Lawn Mower Industry Driven by Electrification Automation and Changing Consumer and Regulatory Demands

The landscape of lawn maintenance equipment has undergone a transformative shift in recent years, underpinned by multiple converging factors that are redefining industry standards. Firstly, electrification has emerged as a powerful driver of change, propelled by advancements in battery density and power management. Electric mowers-both corded and increasingly cordless-are now viable alternatives to traditional gasoline models, offering reduced noise levels, lower maintenance requirements, and zero on-site emissions. Concurrently, automating capabilities such as GPS-guided navigation and sensor-driven obstacle detection have facilitated the rise of robotic mowers that operate autonomously for extended periods, enabling landscape professionals and homeowners to reallocate time toward other tasks.

In addition to technological innovations, shifting consumer attitudes toward sustainability have placed environmental considerations at the forefront of product development. Manufacturers are responding by integrating eco-friendly materials, optimizing engine configurations for fuel efficiency, and designing modular platforms to simplify end-of-life recycling. Meanwhile, tightening regulatory frameworks-especially in metropolitan regions-are accelerating the phase-out of older, higher-emission models, incentivizing both large-scale commercial buyers and residential users to adopt cleaner, more efficient equipment.

Finally, the digital revolution in distribution and service models has reshaped how products reach end users. E-commerce platforms and direct-to-consumer websites allow buyers to research specifications, configure custom options, and access virtual demonstrations prior to purchase. At the same time, data-driven after-sales services, including predictive maintenance alerts and software-based performance enhancements, are delivering new avenues for recurring revenue streams and deeper customer engagement. Altogether, these transformative shifts are redefining competitive boundaries, elevating performance benchmarks, and unlocking novel growth opportunities across the lawn mower market.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Supply Chains Manufacturing Costs and Market Dynamics in Lawn Maintenance Sector

The imposition of new United States tariffs in 2025 has exerted a cumulative impact that reverberates throughout the lawn mower supply chain and marketplace. These import duties, targeting both finished equipment and key input materials such as steel and aluminum, have translated into increased production costs for manufacturers reliant on offshore component sourcing. As importers grapple with higher landed costs, many have been compelled to re-evaluate their supply chain networks, forging alternative partnerships with domestic suppliers or regions not subject to punitive duties. This strategic pivot entails both logistical complexity and time-to-market considerations, as producers work to secure stable access to essential raw materials while maintaining tight production schedules.

On the demand side, the pass-through effect of elevated tariffs has manifested in higher retail prices for end users, potentially dampening purchasing intent among budget-conscious homeowners. In response, several industry participants have introduced tiered value propositions, bundling service plans or offering financing options to preserve affordability and customer loyalty. Moreover, some vendors have accelerated localization of manufacturing operations, establishing assembly lines within the United States to mitigate tariff exposure and demonstrate commitment to domestic job creation.

Simultaneously, tariff-related uncertainties have spurred an uptick in vertical integration initiatives and inventory buffer strategies, as companies seek to insulate their operations from further trade policy fluctuations. These risk mitigation efforts extend beyond procurement to encompass warranty and spare-parts frameworks, ensuring uninterrupted after-sales support in the face of supply constraints. Ultimately, the cumulative impact of the 2025 tariffs underscores the critical importance of supply chain resilience, agile manufacturing practices, and adaptive pricing models in navigating an increasingly protectionist trade environment.

Uncovering Essential Segmentation Insights that Illuminate Distinct Product Types Power Sources Engine Configurations End Uses and Distribution Pathways

Market segmentation provides an essential lens through which to understand the diverse preferences and requirements that define customer choices. Beginning with product typologies, the analysis distinguishes traditional push mowers designed for straightforward lawn upkeep, robust ride-on models tailored for expansive grounds, innovative robotic units offering autonomous operation, and self-propelled machines engineered for improved mobility on varied terrain. Layered upon these category differentiations is the power source dimension, which evaluates electrically powered equipment-both corded and increasingly cord-free-alongside gasoline engines and manual, human-driven alternatives, each reflecting trade-offs between convenience, performance, and environmental impact.

Further granularity emerges when considering engine configurations, where single-cylinder units serve entry-level requirements, three-cylinder architectures deliver balanced torque and efficiency, and twin-cylinder systems cater to high-demand professional landscapes. Cutting mechanisms also shape the user experience, with reel-style blade assemblies excelling in precision trimming and rotary blades providing rapid material removal suited to dense or uneven turf. Beyond the hardware distinctions, end-user segmentation separates commercial deployments-encompassing golf courses, parks and recreational areas, and sports grounds-from residential use cases, where ease of operation and noise considerations often take precedence.

Finally, distribution channels reveal the routes through which manufacturers connect with buyers. Offline approaches leverage direct sales teams and distributor networks to service professional and institutional clients, while online channels span corporate websites and third-party e-commerce platforms to capture digitally native homeowners. By weaving together these segmentation layers, stakeholders can pinpoint areas of unmet need, tailor product roadmaps and marketing initiatives, and align investment priorities with targeted consumer segments.

This comprehensive research report categorizes the Lawn Mower market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Engine Configuration

- Cutting Mechanism

- End-User

- Distribution Channel

Highlighting Regional Nuances and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Lawn Mower Markets

Regional dynamics in the lawn mower industry highlight distinct growth patterns and operational challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, a combination of mature residential markets and expansive commercial green spaces underpins stable demand. Heightened environmental awareness in key urban centers has accelerated adoption of battery-powered and zero-emission models, while large-scale landscaping projects continue to rely on heavy-duty ride-on mowers and specialized equipment. In contrast, Europe Middle East & Africa presents a heterogeneous mosaic of regulatory frameworks and consumer behaviors. Western European countries enforce rigorous emissions standards and noise ordinances, prompting manufacturers to innovate around quieter, low-emission designs. Meanwhile, emerging markets in the Middle East and Africa balance rapid urban expansion with limited infrastructure, opening opportunities for compact, low-maintenance solutions among both commercial and residential users.

Moving to Asia-Pacific, the landscape is defined by sharp contrasts between highly developed economies with stringent quality requirements and fast-growing markets where cost efficiency and accessibility drive purchasing decisions. Japan and South Korea feature a strong preference for technologically advanced models, including robotic mowers equipped with AI-based navigation. In Southeast Asia, expanding suburban lifestyles are boosting demand for affordable push and ride-on mowers, often supported by brand partnerships and flexible financing schemes. Across the entire region, the push toward electrification benefits from substantial investments in lithium-ion battery production, enabling manufacturers to offer extended runtime and faster charging solutions. Thus, understanding the nuanced regulatory, economic, and cultural factors across these geographic clusters is instrumental for aligning product strategies and market entry plans.

This comprehensive research report examines key regions that drive the evolution of the Lawn Mower market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Strategies and Innovations Driving Competitive Advantage in the Global Lawn Mower Market Landscape

Leading companies in the lawn mower sector are deploying a variety of strategic initiatives to strengthen their competitive positions. Established incumbents have intensified investment in cordless electric platforms, capturing early adopter segments and setting performance benchmarks for torque, runtime, and charging cycle efficiency. Partnerships with battery innovators and component specialists are enabling these firms to integrate next-generation power systems into their core product lines. Simultaneously, a cohort of emerging challengers is differentiating through advanced software integration, leveraging IoT connectivity to provide real-time performance monitoring and predictive maintenance capabilities via mobile applications.

Mergers and acquisitions continue to reshape the landscape, with several major players acquiring complementary businesses that expand their distribution reach or enhance their technology portfolios. In parallel, joint ventures focused on localized manufacturing have proliferated, designed to mitigate trade policy risks and fulfill ‘made-in-region’ preferences among institutional customers. Research and development efforts are increasingly directed toward modular designs, allowing manufacturers to introduce incremental upgrades to key subsystems without overhauling entire platforms. This modularity not only accelerates time to market but also fosters scalable production and streamlined after-sales support.

Moreover, leading brands are enhancing sustainability credentials by adopting circular economy principles across design and lifecycle management. Initiatives include the use of recycled or bio-based materials in housing components, factory-level recycling programs for titanium steel alloys, and trade-in incentives to ensure end-of-life equipment is responsibly decommissioned. Ultimately, the convergence of advanced powertrain technologies, digital services, and sustainability commitments will distinguish the next generation of market leaders in the global lawn mower industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lawn Mower market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AL-KO GmbH

- Alfred Kärcher SE & Co. KG

- Altoz Inc.

- AriensCo

- Bad Boy Mowers

- Caterpillar Inc.

- Chervon Holdings Limited

- Deere & Company

- Doosan Corporation

- Greenworks North America LLC

- Honda Motor Co., Ltd.

- Husqvarna AB

- iRobot Corporation

- Jacobsen by Textron Inc.

- Kingdom Technologies Ltd.

- Kubota Corporation

- LASTEC LLC

- Makita Corporation

- Mamibot Manufacturing USA Inc.

- Positec Tool Corporation

- Robert Bosch GmbH

- RYOBI Limited by Techtronic Industries Co. Ltd.

- SCAG Power Equipment by Metalcraft of Mayville, Inc.

- Stanley Black & Decker, Inc.

- Stiga C S.à r.l.

- STIHL HOLDING AG & CO. KG

- Swardman USA Inc.

- Swisher Inc.

- The Toro Company

- Yamabiko Corporation

- Yamaha Motor Co., Ltd.

Formulating Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in Lawn Equipment Sector

Industry leaders must adopt a multifaceted strategy to harness emerging growth vectors and safeguard against market volatility. First, prioritizing investment in electrification-particularly cordless battery systems-will address escalating environmental regulations and shifting customer preferences. Companies should forge partnerships with advanced materials and battery technology firms to optimize weight, energy density, and thermal management. Concurrently, expanding digital capabilities through connected services will enhance customer retention and unlock recurring revenue streams tied to software updates, performance analytics, and remote diagnostics.

To mitigate trade policy risks illuminated by recent tariff changes, firms should diversify their supplier base and evaluate near-shoring or reshoring options for critical components. Establishing regional manufacturing hubs not only reduces exposure to import duties but also underscores commitment to local job creation and sustainability objectives. Moreover, developing modular product architectures will empower rapid configuration adjustments in response to evolving regulatory requirements or consumer preferences, ensuring agility across diverse market conditions.

Finally, differentiation through sustainability leadership and customer experience excellence will be crucial. Manufacturers should implement transparent lifecycle management practices, from eco-friendly materials sourcing to end-of-life recycling programs, reinforcing brand credibility in an increasingly conscious marketplace. At the same time, personalized digital interfaces and streamlined e-commerce journeys will attract digitally native end users, while dedicated field support networks remain essential for professional and institutional segments. By weaving together these strategic threads, industry participants can build resilient business models primed for long-term growth amid ongoing disruption.

Detailing a Rigorous Research Methodology Incorporating Primary and Secondary Data Collection Validation and Analytical Frameworks

The research methodology underpinning this analysis integrates both primary and secondary approaches to ensure comprehensive coverage and robust validation. Secondary research involved extensive examination of publicly available sources including regulatory databases, patent filings, financial reports of leading manufacturers, and specialized industry journals. This phase established foundational insights into technological evolutions, tariff structures, and regional regulatory variations.

Complementing this, primary research comprised in-depth interviews with a broad cross-section of stakeholders, including product development executives, supply chain managers, distribution partners, and end-user focus groups. These conversations provided qualitative perspectives on adoption drivers, pain points, and emerging preferences across both commercial and residential segments. In addition, targeted surveys quantified attitudes toward power sources, feature priorities, and pricing sensitivities, further enriching the segmentation framework.

Analytical rigor was maintained through data triangulation techniques, comparing findings across multiple sources to identify consistencies and surface outliers. Scenario analysis and sensitivity testing gauged the influence of tariffs, raw material price fluctuations, and regulatory shifts on key operational metrics. Finally, an iterative review process with subject-matter experts ensured that conclusions and strategic recommendations are grounded in real-world feasibility and aligned with current industry trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lawn Mower market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lawn Mower Market, by Product Type

- Lawn Mower Market, by Power Source

- Lawn Mower Market, by Engine Configuration

- Lawn Mower Market, by Cutting Mechanism

- Lawn Mower Market, by End-User

- Lawn Mower Market, by Distribution Channel

- Lawn Mower Market, by Region

- Lawn Mower Market, by Group

- Lawn Mower Market, by Country

- United States Lawn Mower Market

- China Lawn Mower Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Future Outlook to Illuminate Strategic Imperatives and Long Term Directions for Lawn Mower Industry Stakeholders

This executive summary has synthesized the most salient forces reshaping the lawn mower industry, from the electrification wave and autonomous innovations to the pronounced effects of 2025 United States tariffs. Key segmentation insights illuminate how product type, power source, engine configuration, cutting mechanism, end-user category, and distribution channel interplay to define distinct market niches. Regional analysis underscores the heterogeneous growth drivers and regulatory landscapes across the Americas, Europe Middle East & Africa, and Asia-Pacific territories, each presenting unique opportunities and challenges.

Leading companies are thus advised to pursue agile strategies that leverage partnerships, modular architectures, and data-driven services to capture value across diverse customer segments. Mitigating trade policy risks through supply chain diversification and near-shoring initiatives will safeguard cost structures and maintain competitive pricing. Simultaneously, sustainability leadership-manifested through eco-friendly materials, circular economy practices, and transparent lifecycle management-will resonate strongly with both commercial and residential buyers.

Looking ahead, the ability to seamlessly integrate hardware innovations with digital platforms will emerge as a critical differentiator, as customer expectations evolve toward holistic, service-enhanced equipment experiences. By aligning product roadmaps with regulatory trajectories and adopting a customer-centric approach to design and distribution, stakeholders can position themselves at the forefront of long-term value creation in this dynamic sector.

Compelling Invitation to Engage with Associate Director Sales and Marketing to Secure a Comprehensive Lawn Mower Market Research Report

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, empowers you to secure unparalleled insights and strategic guidance tailored to your specific objectives. By requesting our comprehensive lawn mower market research report, you gain immediate access to in-depth analysis spanning emerging technological advancements, evolving regulatory landscapes, and competitive company profiles. Whether you aim to refine product development roadmaps or optimize go-to-market strategies, our detailed findings and expert recommendations will guide your decision-making and help you capitalize on growth opportunities. Connect now with Ketan Rohom to elevate your understanding of this dynamic sector and position your organization at the forefront of innovation in the outdoor power equipment arena!

- How big is the Lawn Mower Market?

- What is the Lawn Mower Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?