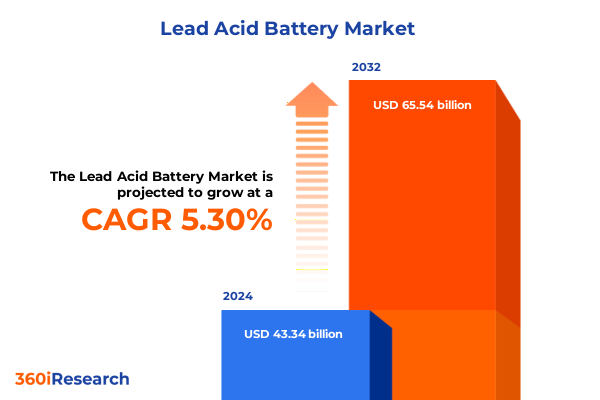

The Lead Acid Battery Market size was estimated at USD 51.14 billion in 2025 and expected to reach USD 53.44 billion in 2026, at a CAGR of 4.64% to reach USD 70.26 billion by 2032.

Setting the Stage for Lead Acid Battery Market Dynamics with Purposeful Insight into Trends, Drivers, and Enduring Significance

The Lead Acid Battery market stands at a pivotal juncture where traditional energy storage solutions intersect with evolving global demands for reliable, cost-effective power reserves. Abundant in applications from automotive ignition to backup power systems, these batteries embody a legacy technology that continues to underpin critical infrastructure and everyday conveniences. As the world navigates energy transitions and sustainability imperatives, Lead Acid Batteries retain their relevance through high recyclability and well-established manufacturing ecosystems.

Within this market context, an intricate interplay of regulatory frameworks, technological enhancements, and shifting end-use requirements shapes strategic decisions for stakeholders. Traditional flooded variants compete alongside sealed, Valve Regulated Lead Acid (VRLA) types, which in turn subdivide into Absorbent Glass Mat (AGM) and gel configurations. These distinctions influence performance characteristics such as cycle life, maintenance needs, and operational safety, prompting manufacturers to refine product portfolios in response to specialized applications.

Against this backdrop, growing attention to renewable energy integration and grid stabilization has reinvigorated interest in large-format VRLA installations. Meanwhile, the automotive sector’s pursuit of cost-efficient hybridization and stop-start functionality sustains demand for AGM batteries. This introduction presents the foundational landscape of lead acid battery technologies, setting the stage for a deeper exploration of disruptive shifts, trade policy impacts, and strategic segmentation that define the market’s trajectory.

Understanding the Transformative Technological, Regulatory and Consumer Shifts Reshaping the Lead Acid Battery Market Landscape

In recent years, the Lead Acid Battery industry has undergone transformative shifts driven by technological innovation, environmental mandates, and evolving consumer expectations. One notable trend is the progressive enhancement of VRLA chemistry, where advancements in absorbent glass mat and gel separators have elevated cycle life and deep-discharge resilience, reducing total cost of ownership and broadening applications beyond traditional automotive and stationary backup domains.

Concurrently, stricter environmental regulations concerning sulfuric acid handling and lead emissions have incentivized manufacturers to invest in closed-loop recycling systems and adopt more stringent workplace safety standards. These developments not only mitigate regulatory risk but also reinforce the inherent sustainability advantage of lead acid systems, which can achieve a closed-loop recyclability rate exceeding 95 percent.

On the demand side, accelerated integration of renewable energy assets has spotlighted energy storage solutions capable of rapid discharge and reliable standby performance. While lithium-ion batteries capture headlines for grid-scale applications, lead acid systems retain a competitive edge where upfront costs, proven track record, and recyclability outweigh energy density metrics. At the same time, the digitalization of monitoring tools and predictive maintenance technologies has enhanced operational transparency, enabling asset owners to optimize replacement schedules and reduce lifecycle costs.

Together, these technological refinements, regulatory pressures, and shifting end-user requirements converge to reshape traditional market boundaries, ushering in an era where lead acid batteries reaffirm their strategic importance amidst a diversifying energy storage ecosystem.

Evaluating the Compound Effects of United States Tariff Measures on Lead Acid Battery Trade, Supply Chain Resilience, and Industry Costs in 2025

Throughout 2025, a series of United States tariff measures have compounded costs and disrupted established supply chain channels for Lead Acid Battery components and finished goods. Beginning January 1, new duties on chemicals such as sulfuric acid and lead oxide under the International Emergency Economic Powers Act increased input costs for domestic manufacturers. Concurrent reciprocal tariffs imposed by key trading partners further restricted access to competitively priced raw materials and finished battery imports, necessitating rapid supply chain realignments.

In early February, reciprocal tariffs on imports from Canada and Mexico translated to elevated steel and nickel prices, critical inputs for battery grids and protective separators. Manufacturers reliant on just-in-time imports encountered delays and margin compression, prompting many to reassess supplier portfolios and expedite domestic sourcing initiatives. These pressures were magnified when March’s tariff extension to Chinese battery imports introduced layered duties that exceeded 80 percent on certain categories, effectively excluding low-cost VRLA products from large segments of the U.S. market.

By April, the blanket 10 percent tariff on all imports added another dimension of cost uncertainty, encouraging some original equipment manufacturers to relocate assembly operations closer to end markets or to pivot toward alternative chemistries. Despite these headwinds, industry players accelerated cross-border partnerships to mitigate duty exposure and qualify for tariff exemptions via trade agreements. Strategic inventory stockpiling emerged as a short-term buffer, while mid-stream producers increased automation and process efficiency to absorb residual cost impacts.

Collectively, the cumulative effect of these tariff interventions has reinforced the need for supply chain resilience, cost optimization, and diversified sourcing strategies. This period of trade volatility underscores the critical role of proactive policy engagement and agile procurement practices in safeguarding market stability and future-proofing operations.

Unraveling Key Segmentation Dynamics Across Product Types Voltage Ranges Technologies Distribution Channels and End-User Verticals

Examining the Lead Acid Battery market through the lens of type segmentation reveals distinct value propositions and innovation pathways. Flooded Lead Acid Batteries maintain their stronghold in traditional automotive and industrial backup segments due to their proven reliability and low entry cost. Parallel growth in Valve Regulated Lead Acid and Sealed Lead Acid categories highlights demand for maintenance-free operation and enhanced safety, with AGM variants favored for high-vibration automotive applications and gel batteries selected for deep-cycling renewable energy installations.

Voltage range segmentation further underscores the versatility of lead acid technologies. Batteries operating below 8 volts address specialty electronics and remote monitoring equipment, while the 8-to-24-volt segments account for standard automotive, commercial vehicle, and telecommunications power systems. Over-24-volt configurations cater to large-scale UPS deployments and grid-tied installations, where multiple modules are assembled to meet megawatt-class energy storage requirements.

Technology stratification distinguishes between conventional Lead Acid Battery chemistries, which offer simplicity and cost efficiency, and advanced designs incorporating micro-porous separators, anti-sulfation additives, and improved electrode alloys. These enhancements yield superior cycle life, reduced maintenance frequency, and greater environmental resilience. In tandem, distribution channels reflect an omnichannel dynamic: established offline networks continue to serve industrial and automotive aftermarket channels, while online platforms gain traction among smaller end-users seeking rapid delivery and digital procurement experiences.

Finally, end-user segmentation illuminates the diverse demand profile across automotive, consumer electronics, industrial, and renewable energy & utility segments. Each vertical imposes unique performance and regulatory criteria, driving manufacturers to tailor product specifications, warranty structures, and service models. This intricate segmentation landscape underpins targeted go-to-market strategies and underscores the importance of aligning product innovation with evolving end-user needs.

This comprehensive research report categorizes the Lead Acid Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Voltage Range

- Capacity Range

- Cell Configuration

- Application

- Sales Channel

Examining Regional Market Variations and Growth Opportunities for Lead Acid Batteries across the Americas, Europe Middle East Africa and Asia-Pacific

Regional market behavior for Lead Acid Batteries reflects a tapestry of economic conditions, energy policies, and infrastructure maturity. In the Americas, strong legacy demand in automotive and industrial backup applications is complemented by growing interest in microgrid and telecommunication tower deployments. North American manufacturers leverage established recycling frameworks to reinforce sustainability credentials, while Latin American markets exhibit rising uptake of batteries for farm equipment and rural electrification.

Across Europe, Middle East & Africa, regulatory mandates for energy storage integration and carbon emissions reduction fuel investment in stationary VRLA systems for grid balancing and uninterruptible power supply. European producers emphasize product safety standards and eco-design directives, whereas Middle Eastern regions focus on solar hybridization projects that rely on high-durability deep-cycle batteries. African markets, by contrast, are characterized by nascent distribution networks and emerging entrepreneurial ecosystems that pilot mini-grid solutions in off-grid communities.

Asia-Pacific remains the largest consumption hub, driven by automotive production centers in Japan, South Korea, and China, alongside robust backup power requirements in India and Southeast Asia. Investments in advanced manufacturing and recycling capacity in China have fortified domestic lead acid supply chains, while policy incentives in India accelerate electrification of rural and urban sectors. Meanwhile, Australia’s energy transition toward renewables underscores demand for robust energy storage assemblies combining VRLA modules.

Collectively, these regional insights reveal a multifaceted market where growth trajectories hinge on localized regulatory drivers, infrastructure investment, and end-user application profiles. Strategic alignment with regional priorities and tailored service models will be essential for stakeholders aiming to expand footprint and capture emerging growth pockets.

This comprehensive research report examines key regions that drive the evolution of the Lead Acid Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Operational Strengths and Market Positioning of Leading Companies in the Global Lead Acid Battery Sector

Leading companies in the Lead Acid Battery sector are navigating a complex interplay of innovation imperatives and supply chain challenges to secure competitive advantage. Established manufacturers leverage long-standing brand recognition and extensive distribution networks to serve global markets, while simultaneously investing in advanced VRLA chemistries and digital monitoring solutions that differentiate their offerings. Strategic capacity expansions in low-cost geographies are complemented by joint ventures that reinforce regional market access and consolidate procurement of critical raw materials.

These firms also prioritize research collaborations with academic and technological partners to refine separator materials and electrode formulations, seeking incremental performance gains without significant cost inflation. Parallel initiatives target the development of integrated energy storage systems, wherein lead acid modules interface seamlessly with power electronics and remote diagnostics platforms to deliver turnkey solutions for telecom, renewable integration, and uninterruptible power applications.

Furthermore, top players maintain robust post-sales services, including battery health monitoring, extended warranty programs, and recycling partnerships, underscoring their commitment to total lifecycle value. Financial strength enables selective acquisitions of niche technology providers and aftermarket service specialists, broadening product portfolios and solidifying end-user relationships. Amid tariff headwinds and raw material volatility, leading companies cultivate supplier partnerships based on long-term agreements and joint innovation roadmaps, fostering supply chain resilience and mutual growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lead Acid Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CLARIOS, LLC

- Chaowei Power Holdings Limited

- GS Yuasa Corporation

- EnerSys

- Exide Industries Ltd.

- C&D Technologies, Inc.

- East Penn Manufacturing Company

- Amara Raja Energy & Mobility Limited

- Tianneng Group

- Leoch Battery Technology Co., Ltd.

- Eternity Technologies

- FURUKAWA BATTERY CO., LTD.

- HOPPECKE Carl Zoellner & Sohn GmbH

- HBL Engineering Limited

- MIDAC S.p.A.

- Teledyne Technologies Incorporated

- Camel Group Co., Ltd.

- CHILWEE GROUP

- Concorde Battery Corporation

- Crown Equipment Corporation

- CSB Energy Technology Co., Ltd.

- Discover Battery

- FIAMM Energy Technology S.p.A.

- First National Battery by METINDUSTRIAL (PTY) LIMITED

- Gridtential Energy, Inc.

- Guangzhou NPP New Energy Co.,Ltd

- JYC Battery Manufacturer Co., Ltd.

- Koyo Battery Co., Ltd.

- Lento Industries Pvt. Ltd.

- Oriental and Motolite Marketing Corporation

- Power-Sonic Corporation

- Ritar International Group Limited

- Sunlight Group

- TAB Company

- Thai Bellco Battery Co. Ltd

Actionable Strategies and Best Practices for Industry Leaders to Navigate Market Disruptions and Capitalize on Emerging Opportunities in Lead Acid Batteries

Industry leaders seeking to thrive amid evolving market conditions should first prioritize supply chain diversification by qualifying alternate raw material suppliers and negotiating flexible contract terms. This proactive approach will mitigate exposure to tariff fluctuations and raw material shortages while fostering collaborative innovation that drives cost efficiencies and quality improvements.

In parallel, companies should accelerate investment in advanced VRLA chemistries, leveraging proprietary separator technologies and anti-sulfation additives to deliver products with superior cycle life and maintenance profiles. By aligning these innovations with end-user performance criteria, manufacturers can command premium pricing and reinforce differentiation in increasingly competitive segments.

Optimizing distribution channels is equally critical. Organizations must blend traditional offline presence with robust e-commerce platforms, offering value-added services such as digital procurement portals, predictive order fulfillment, and customized warranty options. Tailoring service models to regional preferences will enhance end-user engagement and strengthen customer loyalty across diverse markets.

Finally, engaging with policy makers and industry associations can influence trade and environmental regulations, ensuring that tariff frameworks and sustainability standards reflect the sector’s unique heritage of recyclability and safety. By adopting a holistic strategy that couples operational agility with technological leadership and stakeholder advocacy, industry leaders can navigate uncertainties and capitalize on emerging opportunities within the Lead Acid Battery ecosystem.

Detailed Research Methodology Integrating Primary Insights Secondary Sources and Rigorous Analysis to Ensure Robust Lead Acid Battery Market Intelligence

This research draws upon a rigorous methodology that integrates primary insights from in-depth interviews with senior executives across the Lead Acid Battery value chain, including manufacturers, distributors, and end-users. These qualitative perspectives illuminate evolving market dynamics, technology roadmaps, and regulatory impacts that quantitative data alone cannot capture. Complementing primary research, a comprehensive review of secondary sources-including industry publications, trade association reports, and peer-reviewed studies-provides a broad contextual foundation and benchmarks regional practices.

Data triangulation ensures accuracy and reliability, as findings are cross-verified against historical trends, trade data, and financial disclosures. Statistical analysis of shipment volumes, product launches, and recycling rates yields pattern recognition and actionable insights. Scenario planning exercises assess potential outcomes under varying tariff regimes, technological adoption rates, and regulatory adjustments, offering stakeholders a range of plausible futures to inform strategic planning.

Regional case studies highlight localized growth drivers and infrastructure constraints, while segmentation analysis clarifies product, voltage, and end-use distinctions that underpin targeted go-to-market approaches. Methodological rigor is further bolstered by consultations with academic experts and policy advisors, ensuring that legal and environmental considerations are accurately represented. This multi-layered approach delivers a holistic, fact-based assessment of the Lead Acid Battery market, equipping decision-makers with the intelligence needed for informed investments and proactive risk management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lead Acid Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lead Acid Battery Market, by Type

- Lead Acid Battery Market, by Voltage Range

- Lead Acid Battery Market, by Capacity Range

- Lead Acid Battery Market, by Cell Configuration

- Lead Acid Battery Market, by Application

- Lead Acid Battery Market, by Sales Channel

- Lead Acid Battery Market, by Region

- Lead Acid Battery Market, by Group

- Lead Acid Battery Market, by Country

- United States Lead Acid Battery Market

- China Lead Acid Battery Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Reflections on Market Evolution Critical Insights and Future Outlook for Stakeholders in the Lead Acid Battery Industry

As the Lead Acid Battery market navigates a landscape defined by technological advances, regulatory evolution, and geopolitical volatility, its foundational value proposition endures. High recyclability, proven performance, and cost-efficiency continue to anchor demand across automotive, industrial, and energy storage applications. At the same time, the rise of advanced VRLA chemistries and enhanced monitoring capabilities position lead acid systems to maintain relevance alongside emerging storage technologies.

While tariff fluctuations and raw material constraints present short-term challenges, they also catalyze innovation in supply chain resilience and strategic sourcing. Companies that harness operational agility and invest in targeted product enhancements will sustain growth and amplify competitive differentiation. Likewise, engagement with policymakers to shape balanced trade and environmental policies will safeguard the industry’s capacity to contribute to energy security and circular economy objectives.

Regional markets each offer unique growth trajectories, from mature automotive hubs in the Americas to renewable energy-driven adoption in Europe, Middle East & Africa, and large-scale infrastructure expansion across Asia-Pacific. By aligning with localized priorities and customizing service delivery, stakeholders can unlock value and navigate complexity.

In conclusion, the Lead Acid Battery sector stands at an inflection point where heritage strengths converge with emerging opportunities. Equipped with comprehensive insights into transformative shifts, tariff impacts, segmentation nuances, and regional dynamics, industry participants are well-positioned to chart a course toward sustainable innovation and enduring market leadership.

Connect Directly with Ketan Rohom to Access Comprehensive Lead Acid Battery Market Research and Unlock Strategic Intelligence for Business Growth

Don't navigate market uncertainties alone; connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His deep expertise in market dynamics, client-driven methodologies, and strategic insights will guide your organization toward informed decisions and competitive advantage. Whether you seek a customized research approach, deeper analytical dive into segments, or specific regional intelligence, Ketan facilitates seamless engagement and delivers tailored solutions. Reach out to Ketan to gain immediate access to the comprehensive Lead Acid Battery Market Research Report, fostering growth, driving innovation, and unlocking new business potential across your operations.

- How big is the Lead Acid Battery Market?

- What is the Lead Acid Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?