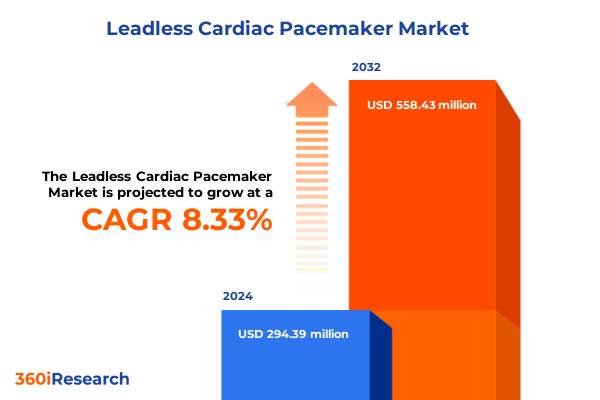

The Leadless Cardiac Pacemaker Market size was estimated at USD 318.99 million in 2025 and expected to reach USD 346.58 million in 2026, at a CAGR of 8.32% to reach USD 558.43 million by 2032.

Comprehensive Introduction to Leadless Cardiac Pacemakers Tracing Their Technological Progression, Patient Benefits, and Crucial Relevance in Current Cardiology

The leadless cardiac pacemaker represents a paradigm shift in the management of bradyarrhythmias, diverging from traditional transvenous systems by eliminating leads and subcutaneous pockets. These devices, miniaturized to fit entirely within the right ventricle, have demonstrated reduced infection rates, lower procedural complications, and enhanced patient comfort compared to conventional systems. Since the first commercial introduction, iterative technological enhancements have extended battery longevity, refined implantation techniques, and integrated remote monitoring capabilities, fostering broader clinical acceptance.

As cardiovascular disease prevalence continues to rise alongside an aging global population, the clinical community has shown growing enthusiasm for leadless pacemakers. These devices address concerns over lead-related failures, venous obstruction, and generator pocket complications, while offering a discreet and cosmetically favorable solution. Furthermore, the shift toward ambulatory procedures and same-day discharge has been facilitated by the minimally invasive nature of leadless systems. Collectively, these factors underscore the strategic importance of leadless cardiac pacemakers in contemporary cardiology, positioning them as critical innovations for both clinicians and healthcare providers seeking to improve patient outcomes and operational efficiencies.

Capturing the Major Transformational Shifts Driving the Leadless Cardiac Pacemaker Market Amid Technological, Clinical, and Regulatory Advances

The landscape of leadless cardiac pacemakers has been reshaped by rapid technological breakthroughs, notably the evolution of device miniaturization and enhanced battery chemistry. These advancements have enabled extended device longevity and more reliable performance, while integrated remote telemetry platforms have transformed post-implantation monitoring. Clinicians can now access real-time device diagnostics through secure cloud-based systems, reducing the frequency of in-clinic visits and fostering proactive management of pacing thresholds and battery status.

Clinical practice patterns are also evolving, with an expanding array of indications for leadless pacemakers beyond traditional bradycardia management. High-risk patient cohorts, such as those with prior device infections or limited venous access, are increasingly recognized as primary candidates. Additionally, emerging evidence supports their use in patients with paroxysmal atrial fibrillation requiring intermittent ventricular pacing, driving broader adoption across various electrophysiology practices.

Regulatory frameworks and reimbursement landscapes have further accelerated market growth. Recent approvals from major health authorities and updated coverage policies from public and private payers have reduced barriers to adoption, while consistent post-market surveillance data have reinforced confidence in device safety and efficacy. Together, these technological, clinical, and regulatory shifts are catalyzing a transformative phase in which leadless pacemakers are rapidly transitioning from niche therapy to mainstream practice.

Examining the Cumulative Impact of 2025 United States Tariffs on Leadless Cardiac Pacemaker Supply Chains, Pricing Structures, and Market Dynamics

In 2025, new United States tariff policies targeting imported medical device components have introduced a series of incremental duties on critical materials and subassemblies used in leadless pacemaker production. These levies have affected both original equipment manufacturers and contract device assemblers, prompting supply chain reassessment and cost recalibration. Manufacturers heavily reliant on offshore fabrication facilities have faced increased landed costs, necessitating strategic adjustments to sourcing and production footprints.

Beyond component procurement, the tariff impact has reverberated through pricing dynamics across the value chain. Device manufacturers have been compelled to evaluate margin strategies, balancing the need to absorb portions of the tariff burden against the necessity of maintaining competitive price points for hospitals and ambulatory surgery centers. In certain cases, tiered pricing models have been introduced to reflect the varying cost structures across different segments of the health system.

Simultaneously, healthcare providers and distributors have responded by diversifying supplier relationships and seeking localized manufacturing partnerships to mitigate exposure to trade policy volatility. These adaptive strategies have underscored the importance of supply chain resilience in an era of geopolitical uncertainty, influencing long-term capital investment decisions and contractual negotiations within the leadless pacemaker market.

Insights on Segmentation of Leadless Cardiac Pacemaker Market Across Product Types, End Users, Pacing Modes, Distribution Channels, and Clinical Indications

A nuanced understanding of the leadless cardiac pacemaker market emerges when analyzed across multiple segmentation dimensions. Looking at product architectures, the contrast between dual chamber and single chamber devices reveals distinct clinical applications, with dual chamber systems gaining traction among patients requiring atrioventricular synchrony, while single chamber variants continue to dominate indications centered on isolated ventricular pacing.

End-use settings further delineate market pathways, as ambulatory surgery centers capitalize on streamlined procedural workflows to accommodate minimally invasive implantations. Hospitals maintain a strong foothold for complex cases requiring comprehensive perioperative care, yet specialized clinics, including dedicated outpatient heart clinics and telecardiology facilities, are increasingly integral for follow-up and remote device management.

Different pacing modalities offer additional granularity. VVI pacing continues to serve straightforward bradycardia cases, whereas VVIR systems, enhanced with adaptive rate response technology, appeal to active patients seeking physiologically responsive support during exertion. The ability to modulate pacing rates dynamically has become a key decision factor for electrophysiologists aiming to optimize patient quality of life.

Distribution channels shape market accessibility and commercial strategies. Direct sales relationships facilitate deeper integration with hospital groups and ASC networks, while traditional distributors provide extensive geographic reach. The emergence of online channels, particularly e-commerce platforms, offers a complementary route for supply continuity, especially in regions with well-developed digital procurement infrastructures.

Clinical indications form the final segmentation pillar. Atrial fibrillation patients, whether experiencing paroxysmal or permanent forms of the arrhythmia, represent a growing share of leadless pacemaker recipients. Atrioventricular block remains a core use case, and symptomatic bradycardia continues to drive baseline demand across diverse patient cohorts.

This comprehensive research report categorizes the Leadless Cardiac Pacemaker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Pacing Mode

- Distribution Channel

- Indication

Unveiling Regional Dynamics and Growth Drivers for Leadless Cardiac Pacemakers in the Americas, Europe Middle East & Africa, and Asia Pacific markets

Regional dynamics in the leadless cardiac pacemaker market underscore the interplay of healthcare infrastructure, regulatory policy, and economic factors. In the Americas, the United States leads in device innovation and clinical research activity, supported by broad reimbursement coverage and a well-established ecosystem of electrophysiology centers. Canada has mirrored these trends on a smaller scale, with provincial health plans gradually integrating leadless technologies into public formularies.

Across Europe Middle East & Africa, fragmentation in regulatory requirements and reimbursement pathways presents both challenges and opportunities. Western European nations often exhibit rapid adoption tied to national health service approvals, while Eastern European markets show steady uptake as clinical guidelines evolve. In the Middle East and Africa, selective urban care centers in the Gulf Cooperation Council countries have embraced leadless implants, though broader diffusion is moderated by capital constraints and infrastructure readiness.

The Asia Pacific region is marked by striking heterogeneity. Japan stands out for stringent device safety regulations and extensive post-approval surveillance, fostering clinician confidence and patient uptake. In Greater China, local manufacturing initiatives and government stimulus for domestic medical technologies have facilitated volume growth, while India’s emerging private hospital networks are increasingly exploring leadless solutions despite the continued predominance of traditional systems. Across all markets in this region, evolving reimbursement frameworks and growing awareness of infection-avoidance benefits are driving a gradual but sustained shift toward leadless pacing.

This comprehensive research report examines key regions that drive the evolution of the Leadless Cardiac Pacemaker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analysis of Leading Medical Device Manufacturers Shaping the Global Leadless Cardiac Pacemaker Landscape Through Innovation and Competitiveness

Leading medical device manufacturers have strategically positioned themselves to capture value in the expanding leadless cardiac pacemaker landscape. Key industry innovators have channeled R&D investments into next-generation device architectures aimed at biocompatible materials and extended battery life. Collaborative partnerships between established firms and specialized technology startups have accelerated the rollout of implantable telemetry features and advanced pacing algorithms.

Competition has intensified as global device leaders enhance their product portfolios through acquisitions and in-licensing agreements that broaden clinical indications and delivery systems. Concurrently, emerging players from regional markets have leveraged local production capabilities to introduce cost-competitive alternatives, focusing on incremental innovations that address specific patient subsets and healthcare system needs.

Mergers among companies with complementary strengths in catheter delivery, remote diagnostics, and data analytics services have fostered integrated solutions that promise end-to-end pacemaker management. This consolidation trend underscores the strategic imperative to combine clinical validation, manufacturing scale, and post-market support into cohesive platforms that deliver sustained value to providers and patients alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Leadless Cardiac Pacemaker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AtriCure, Inc.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Cardiac Science Corporation

- Cook Medical LLC

- EBR Systems, Inc.

- Integer Holdings Corporation

- Lepu Medical Technology Co., Ltd

- LivaNova plc

- Medico S.p.A.

- Medtronic plc

- MicroPort Scientific Corporation

- Neovasc Inc.

- Osypka Medical GmbH

- Shree Pacetronix Ltd.

- Terumo Corporation

- Vitatron Holding B.V.

- ZOLL Medical Corporation

Actionable Recommendations for Industry Leaders to Navigate Market Complexities and Capitalize on Leadless Cardiac Pacemaker Commercialization Opportunities

To thrive in the evolving leadless cardiac pacemaker arena, industry leaders must adopt a multifaceted strategy encompassing innovation, supply chain resilience, and market development. Prioritizing continuous R&D investment in adaptive pacing algorithms and extended-life power sources will maintain technological leadership and address emerging patient needs. Simultaneously, constructing diversified supplier networks and exploring regional assembly partnerships can mitigate the impact of tariff fluctuations and reduce time-to-market.

Engagement with payers and regulatory stakeholders is essential to optimize reimbursement pathways for novel device features, particularly those offering remote monitoring advantages. By presenting robust clinical and economic evidence, manufacturers can secure favorable coverage for advanced pacing modes and expanded indications, thereby unlocking broader adoption across care settings. Furthermore, forging targeted collaborations with ambulatory surgery centers and specialized outpatient clinics will facilitate streamlined procedural protocols, enhancing clinician familiarity and patient throughput.

Finally, aligning commercial models with digital health trends-such as integrating e-commerce channels and offering subscription-based remote monitoring services-will meet the growing demand for flexible procurement solutions. By leveraging data analytics to drive personalized training programs for implanting physicians, companies can further solidify their market position within a competitive landscape.

Detailed Overview of Research Methodology Combining Primary and Secondary Data Collection, Qualitative Expert Interviews, and Rigorous Data Validation Processes

This research employed a hybrid methodology combining primary and secondary data collection to ensure depth and rigor. In the primary phase, structured interviews were conducted with leading electrophysiologists, hospital procurement directors, and device manufacturing executives to capture firsthand perspectives on clinical adoption, operational challenges, and supply chain dynamics.

The secondary phase involved an exhaustive review of peer-reviewed journals, regulatory filings, conference proceedings, and public policy documents to contextualize primary insights within broader market trends. Data triangulation techniques were applied to reconcile discrepancies and validate key findings, while a database of global device approvals provided a foundation for understanding regulatory timelines.

Quantitative data on procedure volumes, reimbursement rates, and import duty schedules were integrated with qualitative assessments of patient outcomes and clinician preferences. This comprehensive approach allowed for the segmentation of the market across product type, end-use environment, pacing mode, distribution channel, and indication, ensuring robust and actionable insights. Rigorous data validation procedures, including consistency checks and expert panel reviews, further enhanced the reliability of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Leadless Cardiac Pacemaker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Leadless Cardiac Pacemaker Market, by Product Type

- Leadless Cardiac Pacemaker Market, by End User

- Leadless Cardiac Pacemaker Market, by Pacing Mode

- Leadless Cardiac Pacemaker Market, by Distribution Channel

- Leadless Cardiac Pacemaker Market, by Indication

- Leadless Cardiac Pacemaker Market, by Region

- Leadless Cardiac Pacemaker Market, by Group

- Leadless Cardiac Pacemaker Market, by Country

- United States Leadless Cardiac Pacemaker Market

- China Leadless Cardiac Pacemaker Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Conclusive Summary Emphasizing the Strategic Imperatives, Clinical Benefits, and Future Growth Trajectories of Leadless Cardiac Pacemakers in Evolving Markets

Leadless cardiac pacemakers represent a transformative advancement in cardiac rhythm management, offering compelling clinical benefits and operational efficiencies. From the elimination of lead-related complications to the facilitation of minimally invasive procedures across diversified care settings, these devices are redefining standards of patient care. Moreover, ongoing technological innovation in pacing algorithms and remote monitoring promises to unlock new therapeutic applications and enhance long-term outcomes.

Given the dynamic interplay of regulatory shifts, tariff policies, and regional adoption patterns, stakeholders must remain agile in their strategic planning. The segmentation framework detailed here illuminates critical decision pathways for product development, commercial engagement, and policy advocacy. Simultaneously, regional analyses highlight where reimbursement reforms and healthcare infrastructure investments are driving accelerated uptake.

Ultimately, the collective insights underscore the strategic imperatives for device manufacturers, healthcare providers, and payers to collaborate in advancing the clinical and economic value proposition of leadless pacemakers. By embracing innovation, optimizing supply chains, and aligning reimbursement mechanisms with demonstrated patient benefits, market participants can secure a leadership position in this rapidly evolving field.

Connect with Ketan Rohom to Secure Your Comprehensive Market Insight Report on Leadless Cardiac Pacemaker Trends, Dynamics, and Strategic Opportunities

For organizations seeking a detailed and actionable understanding of the leadless cardiac pacemaker market, partnering with Ketan Rohom represents a direct pathway to strategic insights that can accelerate growth and competitive advantage. Ketan’s expertise in sales and marketing within the medical device sector enables prospective clients to translate market intelligence into targeted go-to-market strategies, tailored commercial models, and optimized product positioning.

By connecting with Ketan Rohom, stakeholders will gain access to in-depth analyses, granular segmentation data, and nuanced regional perspectives that inform decision-making from the boardroom to the operating theater. Whether the objective is to refine reimbursement negotiation tactics, identify emerging clinical indications, or streamline supply chain resilience in response to recent tariff shifts, Ketan can guide organizations through every phase of market engagement.

Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure the comprehensive leadless cardiac pacemaker market research report. This collaboration will empower your team to harness the full potential of leadless pacemaker innovations, stay ahead of regulatory and competitive dynamics, and capitalize on growth opportunities in today’s complex healthcare environment.

- How big is the Leadless Cardiac Pacemaker Market?

- What is the Leadless Cardiac Pacemaker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?