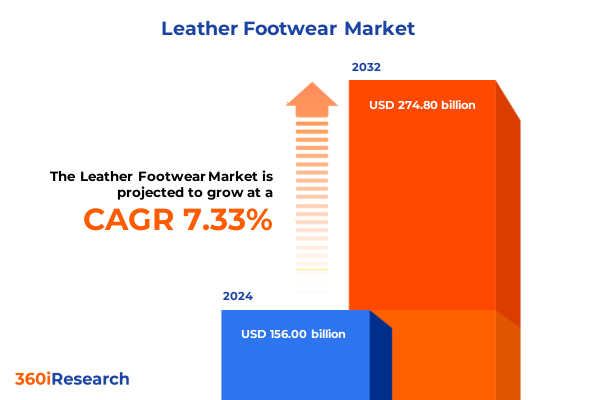

The Leather Footwear Market size was estimated at USD 165.23 billion in 2025 and expected to reach USD 175.01 billion in 2026, at a CAGR of 7.53% to reach USD 274.80 billion by 2032.

Pioneering Perspectives on the Leather Footwear Market and Its Emerging Dynamics Shaping Innovation, Demand, and Strategic Growth

The leather footwear market stands at the confluence of heritage craftsmanship and modern innovation, representing a dynamic sector where tradition meets technology to meet evolving consumer expectations. As urbanization intensifies and disposable incomes rise globally, footwear choices increasingly reflect a blend of style consciousness, functionality, and value orientation. Recent shifts toward eco-conscious lifestyles have further underscored the importance of sustainable sourcing, with brands racing to adopt responsibly tanned leather and reduce their carbon footprints while preserving the tactile and aesthetic appeal that have defined premium leather footwear for centuries.

Against this backdrop, market participants are challenged to harmonize time-honored manufacturing techniques with digital transformation. From virtual fitting rooms to data-driven design platforms, technology is reshaping product development cycles, enabling faster time-to-market and more precise alignment with consumer tastes. Meanwhile, the competitive landscape is intensifying as direct-to-consumer disruptors leverage agile supply chains and personalized marketing to gain traction, prompting established players to reevaluate distribution strategies and strengthen brand equity. In this context, stakeholders require a granular understanding of emerging demand drivers, regulatory impacts, and segmentation nuances to inform strategic investments and optimize product portfolios.

Uncovering Major Transformative Shifts Reshaping the Leather Footwear Landscape Through Technological, Sustainable, and Consumer Behavior Innovations

Significant transformative shifts are redefining the leather footwear ecosystem, with sustainability initiatives, digital engagement, and material innovation taking center stage. Brands are investing heavily in alternative tanning processes that minimize water usage and chemical runoff, responding directly to consumer demand for transparency and environmental stewardship. This commitment to sustainability is not merely a public relations exercise; it is driving product differentiation, fostering loyalty among eco-conscious segments, and unlocking new channels through certifications and green partnerships.

Simultaneously, digital transformation is accelerating purchasing cycles and amplifying the voice of the consumer. Advanced analytics and artificial intelligence enable predictive modeling of style trends and inventory optimization, reducing markdowns and improving margins. Meanwhile, immersive technologies such as augmented reality are revolutionizing the retail experience, allowing shoppers to virtually try on styles and visualize custom colorways without stepping into a physical store. These innovations are complemented by the rise of on-demand manufacturing, which not only reduces waste but also empowers consumers to co-create products, strengthening brand engagement and enabling premium pricing strategies.

In addition, supply chain resilience has emerged as a critical focus area, driven by the complexities of global trade, geopolitical tensions, and disruptions like the pandemic. Companies are diversifying sourcing networks, nearshoring leather processing facilities, and forging strategic alliances with logistics providers to reduce lead times and mitigate risk. Together, these developments are catalyzing a more responsive, sustainable, and consumer-centric leather footwear industry.

Analyzing the Comprehensive Consequences of 2025 United States Tariffs on Leather Footwear Imports and Domestic Manufacturing Ecosystems

In 2025, the United States implemented a series of tariff adjustments specifically targeting leather footwear imports, aiming to bolster domestic manufacturing capabilities and reduce reliance on foreign suppliers. These measures have introduced incremental duties on finished footwear products, compelling importers and retailers to reassess sourcing strategies and cost structures. As a result, many global brands have relocated segments of their production closer to U.S. soil or sought tariff exemptions through trade agreements and qualified industrial zones, reshaping traditional supply corridors.

The cumulative impact of these tariff changes extends beyond simple cost pass-through. Retail pricing strategies have had to account for increased landed costs, leading some brands to shift toward premium positioning to preserve margin profiles, while discount-oriented players are scrutinizing their product assortments to maintain competitive price points. Moreover, the heightened tariff environment has accelerated investment in domestic manufacturing infrastructure, with operator incentives fueling the expansion of tannery capacities and assembly lines within the United States. This uptick in local production is expected to yield long-term benefits in terms of shortened lead times and greater control over quality and compliance.

However, challenges persist as not all domestic facilities have the capacity or technical expertise to replicate the craftsmanship found in established overseas hubs. Consequently, firms are balancing the trade-off between reshoring for tariff advantages and sustaining product quality that meets brand heritage standards. Collaborative ventures, joint development projects, and skill-transfer programs are becoming more prevalent as stakeholders work to harmonize efficiency gains with artisanal craftsmanship.

Deriving Strategic Insights from Segmentation of Leather Footwear Market Across Product Types, Gender, Channels, Price Ranges, and Style Preferences

A nuanced understanding of market segmentation is critical for tailoring product development and marketing strategies to distinct customer cohorts. Leather footwear can be examined across Boots, Sandals, Shoes, and Slippers categories, with Boots further divided into Fashion, Hiking, and Work segments, reflecting the divergent functional and aesthetic requirements of each use case. Shoes span Casual, Formal, and Sports subcategories, where Formal variants are themselves segmented into Derby, Loafer, and Oxford styles, each carrying unique design cues and consumer appeals. Slippers and Sandals share the stage by addressing comfort and leisure applications, responding to lifestyle trends that prioritize versatility and ease.

Gender-based segmentation reveals differentiated consumption patterns among Kids, Men, and Women, each demanding tailored fits, design motifs, and value propositions. Children’s footwear emphasizes durability and rapid growth accommodation, whereas men’s and women’s lines focus on balancing fashion-forward styling with comfort technologies and premium detailing. The distribution channel perspective contrasts Offline and Online pathways, highlighting the resurgence of experiential retail amidst the sustained growth of e-commerce platforms. Offline environments continue to drive brand discovery and personalized service, while digital channels deliver convenience, broader assortments, and data-rich consumer insights.

Price range further crystallizes market positioning into Budget, Mid Range, and Premium tiers, enabling brands to calibrate material selections, craftsmanship levels, and brand narratives to targeted income brackets. Style segmentation-Casual, Formal, Safety, and Sport-captures consumer intent from everyday wear to occupational requirements and performance-driven applications. Integrating these segmentation dimensions equips stakeholders with the granularity needed to align product roadmaps, promotional investments, and channel strategies with evolving consumer demands.

This comprehensive research report categorizes the Leather Footwear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gender

- Price Range

- Style

- Distribution Channel

Illuminating Regional Variations in Leather Footwear Demand and Distribution Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional distinctions in consumer preferences, regulatory frameworks, and distribution infrastructures shape the global leather footwear landscape across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, North American consumers prioritize a blend of performance and casual styling with heightened interest in domestically produced and sustainably certified offerings, while Latin American markets exhibit strong demand for value-oriented options and vibrant design palettes that reflect cultural affinities.

Europe’s mature markets are characterized by stringent environmental regulations and sophisticated retail ecosystems, driving manufacturers to innovate in both material sourcing and circular economy initiatives. Meanwhile, Middle Eastern markets are experiencing rapid growth in luxury and premium segments, fueled by high disposable incomes and evolving lifestyle aspirations. In contrast, Africa presents a tapestry of emerging urban centers where affordability and durability take precedence, and informal distribution channels remain prominent.

Asia-Pacific combines vast heterogeneity ranging from high-volume production hubs to digitally savvy consumers. In China and India, local brands are gaining ground by catering to mass-market price points, whereas Japan and South Korea emphasize craftsmanship, heritage-inspired designs, and limited-edition releases. Southeast Asian markets display accelerating online adoption, underpinned by mobile-first shopping behaviors, while regulatory shifts in environmental policy are prompting manufacturers to explore alternative leathers and eco-friendly processing techniques. Navigating these regional nuances is essential for brands aiming to optimize supply chain configurations and penetration strategies.

This comprehensive research report examines key regions that drive the evolution of the Leather Footwear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders and Emerging Innovators Driving Competitive Differentiation and Growth in the Global Leather Footwear Sector

Leading companies in the leather footwear sector are distinguishing themselves through a combination of heritage brand equity, technological prowess, and sustainability commitments. Iconic heritage labels leverage decades of artisanal expertise to command premium positioning, while younger disruptors focus on direct-to-consumer engagement, rapid design-to-production cycles, and digital storytelling. Strategic partnerships with material science innovators and eco-certification bodies have become key differentiators, demonstrating a brand’s ability to deliver high-performance products with reduced environmental impact.

Concurrently, multinational conglomerates are strengthening their omnichannel presence by integrating physical retail networks with proprietary e-commerce platforms, leveraging customer data to refine personalization engines and loyalty programs. At the operational level, companies are investing in advanced manufacturing techniques-such as 3D knitting and robotic assembly-to streamline production and reduce waste, positioning their supply chains for greater agility amidst tariff-induced supply disruptions. In addition, joint ventures with regional distributors and format-specific collaborations underscore the importance of localized go-to-market strategies in diverse geographies.

Collectively, these leading players are setting new benchmarks for product innovation, sustainability leadership, and customer-centric experiences. Their differentiated approaches to branding, channel management, and technological integration serve as a roadmap for emerging competitors and established incumbents alike seeking to elevate their market standing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Leather Footwear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- adidas AG

- Deckers Outdoor Corporation

- Dr. Martens plc

- Nike, Inc.

- Prada Holding B.V.

- PUMA SE

- Red Wing Shoe Company, Inc.

- Salvatore Ferragamo S.p.A.

- Santoni S.p.A.

- SKECHERS USA, Inc.

- Steven Madden, Ltd.

- Tapestry Inc

- Under Armour, Inc.

- VF Corporation

- Wolverine World Wide, Inc.

Strategic Roadmap for Industry Leaders to Capitalize on Consumer Preferences Sustainability Advances and Supply Chain Transformations in Leather Footwear

To navigate the complexities of shifting consumer tastes, regulatory landscapes, and tariff pressures, industry leaders must adopt a multifaceted strategic roadmap that emphasizes both resilience and differentiation. First, embedding sustainability at the core of product development-from responsibly sourced hides to closed-loop manufacturing processes-will not only future-proof brand reputations but also unlock new consumer segments that place environmental ethics at a premium.

Second, investing in digital capabilities across the value chain, including predictive demand modeling and immersive retail experiences, will enhance supply chain efficiency and elevate customer engagement. Companies should explore partnerships with technology providers that specialize in augmented and virtual reality, enabling personalized fitting solutions and digital customizations that reduce return rates and foster deeper brand loyalty. Third, optimizing distribution strategies by balancing the experiential advantages of offline showrooms with the breadth and analytical power of e-commerce ecosystems will ensure maximal market coverage and adaptability to shifting channel preferences.

Finally, fostering collaborative innovation through cross-industry alliances-such as co-development initiatives with material scientists, joint research projects with academic institutions, and strategic tie-ups with logistics providers-will accelerate the adoption of next-generation materials and production techniques. By aligning these strategic imperatives with clear performance metrics and agile governance structures, companies can drive sustainable growth and maintain competitive differentiation in a rapidly evolving leather footwear market.

Comprehensive Research Methodology Emphasizing Data Collection Sources Analysis Techniques and Quality Assurance Protocols for Leather Footwear Market Insights

This research framework combines rigorous primary and secondary methodologies to deliver holistic insights into the leather footwear market. Primary data collection involved structured interviews with senior executives across manufacturing, retail, and distribution segments, supplemented by on-the-ground surveys of end consumers in key geographies to capture real-time sentiment and purchasing criteria. Expert panels comprising material scientists, logistics professionals, and sustainability consultants provided qualitative perspectives that enriched quantitative findings.

Secondary research drew from industry white papers, trade associations, regulatory filings, and international trade data, enabling a comprehensive review of historical trends, tariff schedules, and environmental policy developments. Data triangulation ensured consistency across sources, while advanced analytical techniques-such as regression analysis and cluster segmentation-were employed to isolate key demand drivers and forecast relative performance of market segments. Quality assurance protocols included multi-tier validation, cross-referencing of raw data sets, and peer reviews by independent market analysts to guarantee accuracy and reliability.

This blended methodology ensures that the insights presented are not only statistically robust but also grounded in practical expertise, equipping stakeholders with the confidence to make informed strategic decisions in the complex and evolving leather footwear landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Leather Footwear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Leather Footwear Market, by Product Type

- Leather Footwear Market, by Gender

- Leather Footwear Market, by Price Range

- Leather Footwear Market, by Style

- Leather Footwear Market, by Distribution Channel

- Leather Footwear Market, by Region

- Leather Footwear Market, by Group

- Leather Footwear Market, by Country

- United States Leather Footwear Market

- China Leather Footwear Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights Synthesizing Key Findings Trends and Strategic Implications to Guide Future Decision Making in the Leather Footwear Sector

The leather footwear market is undergoing a period of profound transformation, driven by sustainability imperatives, digital innovation, and evolving consumer expectations. From the ripple effects of United States tariff adjustments to the nuanced demands of diverse regional markets, stakeholders must navigate a complex web of forces to capture growth opportunities and safeguard profitability. Segmentation insights reveal the importance of tailoring product design, pricing, and channel strategies to specific consumer cohorts, while competitive profiling underscores the necessity of embracing technological advancements and collaborative partnerships.

Looking ahead, companies that can seamlessly integrate eco-friendly materials, agile production processes, and immersive customer experiences will be best positioned to lead the market. By adhering to a strategic roadmap that balances resilience with differentiation, industry participants can mitigate risks associated with geopolitical shifts and supply chain disruptions while capitalizing on new avenues for value creation. Ultimately, the ability to anticipate trends, adapt quickly, and execute with precision will define market leaders in the next chapter of leather footwear evolution.

Connect with Ketan Rohom to Access Exclusive Leather Footwear Market Research Insights and Propel Strategic Growth Through Informed Partnership

To secure a competitive edge and translate strategic insights into tangible outcomes, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing) to explore how this detailed leather footwear market research report can inform your next critical business decisions and accelerate growth trajectories for your brand. Ketan’s expertise in aligning comprehensive market intelligence with targeted sales and marketing initiatives ensures that you will receive personalized guidance on how to leverage the data effectively, tailor product development strategies, and optimize distribution channels. Whether you are planning to launch a new premium line, expand into emerging regions, or enhance operational resilience against tariff-induced disruptions, partnering with Ketan will provide you with the clarity and support needed to execute with confidence and precision.

- How big is the Leather Footwear Market?

- What is the Leather Footwear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?