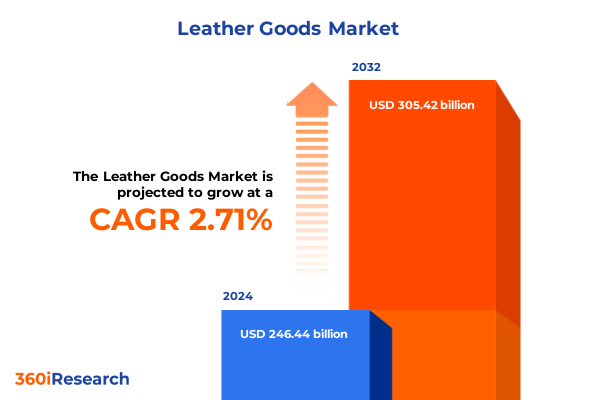

The Leather Goods Market size was estimated at USD 250.29 billion in 2025 and expected to reach USD 254.20 billion in 2026, at a CAGR of 2.88% to reach USD 305.42 billion by 2032.

Unveiling the Dynamics of the Global Leather Goods Industry in an Evolving Marketplace Shaped by Consumer Demand and Technological Advancements

The leather goods industry stands at the crossroads of tradition and innovation, where time-honored craftsmanship meets modern consumer expectations. As leather continues to symbolize quality, luxury, and durability, brands and manufacturers are grappling with shifts in production techniques, distribution strategies, and consumer aspirations that redefine the very essence of the market. This executive summary serves as a guide through these complexities, offering an integrated perspective on how established practices and emerging forces are reshaping competitive landscapes.

Drawing upon qualitative insights gathered from industry leaders, design ateliers, and distribution executives, this report explores the multifaceted drivers that underpin growth and transformation. From evolving sustainability commitments to the relentless pace of digital integration, each trend interweaves with consumer attitudes toward authenticity and heritage value. By setting the stage with a comprehensive overview, the introduction elucidates both the external pressures and internal responses that are catalyzing reinvention across the global supply chain.

Moreover, the introduction highlights the importance of strategic agility in navigating cost volatility and regulatory changes. It underscores the pivotal role of agile leadership in orchestrating cross-functional collaboration, aligning product innovation with logistical efficiency. Ultimately, this opening section offers an indispensable foundation for decision-makers seeking to balance the revered traditions of leather craftsmanship with the imperatives of a rapidly evolving marketplace.

Navigating the Transformative Shifts in Leather Goods Through Sustainability Innovations Digital Integration and Evolving Consumer Preferences

The leather goods sector is undergoing a paradigm shift driven by sustainability imperatives, digital transformation, and the demand for personalized experiences. Sustainability has emerged not merely as a buzzword but as a strategic imperative. Brands are integrating eco-friendly tanning processes and traceability solutions to meet consumer expectations for ethical sourcing and reduced environmental impact. Consequently, suppliers are reengineering chemical inputs and water management protocols to comply with tighter regulations and voluntary industry initiatives.

Furthermore, digital integration is revolutionizing the way leather goods are designed, manufactured, and marketed. Computer-aided design platforms enable rapid prototyping, while virtual reality showrooms create immersive shopping experiences that transcend traditional retail boundaries. Simultaneously, data analytics tools synthesize consumer behavior patterns, enabling firms to anticipate preferences and tailor collections with unprecedented precision.

In addition, consumer expectations have evolved from generic luxury to bespoke expression. Brands are responding by offering customizable embellishments, monogramming services, and limited-edition collaborations that resonate with discerning audiences seeking distinctiveness. This shift has prompted manufacturers to adopt modular production lines capable of accommodating small-batch runs and rapid changeovers.

Moreover, supply chain transparency has become a critical factor in cultivating brand loyalty. Blockchain-based tracking solutions and supplier audits are enhancing visibility, thereby strengthening trust and mitigating reputational risks. By charting these transformative shifts, this section underscores the intricate interdependencies that define the modern leather goods ecosystem.

Assessing the Cumulative Impact of New United States Tariffs on Leather Goods Supply Chains Pricing Strategies and International Trade Dynamics

The imposition of new tariffs by the United States in 2025 has introduced a layer of complexity to the global leather goods supply chain. These trade measures, aimed at balancing domestic manufacturing interests with international obligations, have triggered a reassessment of sourcing strategies across the value chain. Import duties applied to finished leather goods and certain raw hides have magnified cost pressures, compelling companies to revisit their origin portfolios.

As a result, many brands have accelerated their shift toward nearshoring and regional production hubs to mitigate tariff burdens. Producers in Mexico and Central America, benefiting from preferential trade arrangements, have seen increasing investment in tannery capacity and specialized craftsmanship. At the same time, certain segments of the market have encountered volatile pricing dynamics, as importers absorb or pass through incremental costs to end consumers. This scenario underscores the need for adaptive pricing strategies that sustain margin integrity without eroding customer loyalty.

Moreover, the tariff environment has elevated the importance of tariff classification expertise and customs optimization. Firms are leveraging specialized trade advisory services to identify duty relief programs, tariff engineering opportunities, and compliance frameworks that reduce effective duty exposure. Consequently, collaborative initiatives between logistics providers, customs brokers, and in-house trade teams have become crucial to ensuring seamless cross-border flows.

In addition, the cumulative impact of these tariffs is reshaping competitive positioning. Companies able to integrate agile sourcing models and maintain operational flexibility will likely outperform peers in cost management and delivery reliability. This section underscores how tariff-driven imperatives are influencing strategic decisions, from supplier selection to distribution footprint design, in the ongoing quest for resilience.

Uncovering Key Segmentation Insights across Leather Types Price Ranges Product Categories Distribution Channels and End User Applications

Understanding the leather goods market requires a nuanced appreciation of how product attributes and consumer segments intersect. Segmentation by leather type distinguishes between engineered options such as faux and PU leather, alongside genuine variants including corrected-grain, full-grain, split, and top-grain hides. Each material category carries distinct performance attributes, cost structures, and consumer perceptions that inform design choices and marketing narratives.

Price-based segmentation further refines insight into consumer targeting, with budget-conscious shoppers gravitating toward affordable options designed for mass appeal and entry-level use. Conversely, luxury and premium tiers cater to audiences prepared to invest in artisanal craftsmanship and exclusive design elements, while mid-range offerings balance quality with accessibility. These pricing segments shape not only product positioning but also distribution strategies and retail partnerships.

Product type segmentation illuminates the diversity within the category, encompassing accessories such as key holders and watch straps, a broad range of bags including crossbody and shoulder styles, belts in both casual and formal iterations, and an expansive footwear category featuring boots, loafers, pumps, and sandals. Wallets and small leather goods intersect with contemporary consumer needs through bi-fold, tri-fold, and card holder formats that combine functionality with aesthetic refinement.

Distribution channels play a pivotal role in shaping consumer journeys and brand perception. Offline presence via brand outlets, department stores, independent retailers, and specialty shops offers tactile engagement and curated service, while online channels spanning brand websites, e-commerce platforms, and marketplaces deliver convenience, rapid fulfillment, and broad reach.

End-user segmentation unveils demand differentials among men’s and women’s collections, with the kids’ segment subdividing into offerings for boys and girls, each influenced by styling preferences and parental purchase behaviors. Finally, application-based segmentation identifies critical use cases spanning automotive interiors, where seat covers and steering wheel wraps prioritize durability and comfort, fashion applications that emphasize trend responsiveness, and furniture and upholstery end markets that demand both elegance and wear resistance in chairs, ottomans, and sofas. This integrated segmentation framework enables stakeholders to align product development, marketing, and distribution strategies with distinct consumer expectations, ensuring relevance and differentiation across a fragmented marketplace.

This comprehensive research report categorizes the Leather Goods market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Leather Type

- Distribution Channel

- End-User

- Application

Gaining Critical Regional Insights Highlighting Market Drivers and Challenges across Americas Europe Middle East Africa and Asia Pacific Territories

Regional dynamics exert a powerful influence on leather goods market development, with each territory presenting unique drivers and challenges. In the Americas, strong consumer affinity for heritage brands and a growing appetite for sustainable alternatives are reshaping product portfolios. North American markets continue to prioritize domestic sourcing credentials, while Latin American countries are emerging as both growing consumer bases and competitive manufacturing hubs.

Transitioning to Europe, Middle East, and Africa, regulatory frameworks around chemical use and labor standards have heightened compliance requirements. Western European markets remain at the forefront of luxury innovation, where artisanal savoir-faire coexists with stringent environmental mandates. Meanwhile, the Middle East is experiencing rapid expansion in high-end retail infrastructure, driven by tourism and affluent local demand. In sub-Saharan Africa, nascent opportunities exist in both artisanal export models and burgeoning domestic consumption fueled by rising middle-class incomes.

In the Asia-Pacific region, dynamic economic growth and evolving consumer preferences are accelerating market maturation. China continues to dominate both sourcing capacity and domestic consumption, with advancing technology integration and e-commerce proliferation. Southeast Asian nations are enhancing their tanning and manufacturing capabilities, positioning themselves as viable alternatives to traditional supply centers. India’s expanding middle class and emphasis on handcrafted goods contribute to an increasingly diversified market landscape.

This tri-regional perspective underscores how geographical nuances dictate strategic priorities, from regulatory compliance to channel optimization and local consumer engagement. By recognizing these distinct regional patterns, stakeholders can tailor approaches that maximize penetration, navigate policy complexities, and harness growth potential within each territory.

This comprehensive research report examines key regions that drive the evolution of the Leather Goods market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Companies Driving Innovation Competitive Strategies and Collaborative Efforts in the Volatile Leather Goods Ecosystem

A handful of leading companies are steering the leather goods industry toward greater efficiency, innovation, and sustainability. Legacy luxury maisons have leveraged centuries-old expertise to introduce advanced material sciences, partnering with research institutions to develop eco-conscious tanning processes and biodegradable finishes. These heritage brands are simultaneously investing in digital platforms to enhance direct-to-consumer engagement, offering personalized virtual consultations and limited-edition capsule collections that resonate with discerning clientele.

Concurrently, new entrants are disrupting conventional models through vertically integrated production and agile supply chains. These agile operators harness real-time data analytics and lean manufacturing principles to reduce lead times, optimize inventory management, and swiftly adapt to trend shifts. Their digitally native approaches prioritize seamless omnichannel experiences, with micro-fulfillment centers ensuring rapid delivery and hassle-free returns.

Industry collaborations have also gained traction, as manufacturers, chemical suppliers, and material innovators form consortiums dedicated to sustainable raw material sourcing and closed-loop systems. Such partnerships enhance scalability of renewable leather alternatives derived from plant-based sources, mushroom mycelium, and recycled polymers. At the same time, strategic alliances between established brands and emerging designers are driving fresh creative expression and tapping into new demographic segments.

Furthermore, logistics and technology providers are playing crucial roles in enabling transparency, traceability, and compliance. By integrating blockchain tracking and automated documentation workflows, these service partners reduce friction at border crossings and fortify reputational safeguards. Collectively, these corporate initiatives are redefining competitive benchmarks, signaling an industry-wide pivot toward resilience, responsibility, and consumer-centric innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Leather Goods market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Capri Holdings Limited

- Chanel SA

- Fossil Group, Inc.

- Hermès International S.C.A.

- Hugo Boss AG

- Kering SA

- LVMH Moët Hennessy Louis Vuitton SE

- Prada S.p.A.

- Salvatore Ferragamo S.p.A.

- Tapestry, Inc.

Delivering Actionable Recommendations for Industry Leaders to Optimize Operations Strengthen Supply Resilience and Capitalize on Emerging Trends

Leaders in the leather goods sector must adopt a multifaceted approach to thrive amid evolving market conditions. Prioritizing sustainability across the value chain by incorporating low-impact tanning methods and responsibly sourced hides not only meets regulatory requirements but also strengthens brand equity among environmentally conscious consumers. Simultaneously, investing in digital capabilities such as advanced design software and AI-driven forecasting tools will enhance responsiveness to fast-changing style trends and consumer demands.

Moreover, diversification of sourcing footprints through strategic nearshoring or multi-regional partnerships can mitigate risks associated with geopolitical fluctuations and tariff disruptions. By establishing contingency plans and leveraging free trade agreements, companies can safeguard continuity and control costs. In tandem, embedding tariff management expertise within cross-functional teams ensures that supply chain decisions are informed by the latest trade regulations and duty optimization strategies.

In addition, cultivating an omnichannel retail strategy that seamlessly bridges physical and digital touchpoints will foster deeper consumer engagement. Flagship boutiques should serve as experiential hubs, where storytelling and craftsmanship demonstrations reinforce brand narratives, while online platforms provide personalized experiences through virtual try-ons and interactive customization options.

Finally, fostering collaborations across the ecosystem-from raw material innovators to logistics providers-will accelerate progress toward circularity and supply chain transparency. Industry players should proactively participate in standard-setting bodies and sustainability consortiums to co-create scalable solutions and share best practices. By embracing these actionable recommendations, leaders can position their organizations to capture emerging opportunities while building durable competitive advantage.

Detailing the Robust Research Methodology Employed to Gather Primary Data Analyze Market Dynamics and Ensure Unbiased Insight Generation

To ensure robust and unbiased insights, this study employed a mixed-methods research framework that integrates primary and secondary data sources. Primary research encompassed in-depth interviews with executives from key manufacturing hubs, leather goods designers, and distribution channel managers. These conversations provided firsthand perspectives on operational challenges, innovation roadmaps, and consumer behavior dynamics.

In parallel, a comprehensive review of industry literature, trade association reports, and regulatory guidelines formed the backbone of secondary research. This phase involved systematic analysis of policy documents related to environmental standards, international trade agreements, and tariff schedules, ensuring contextual accuracy and currency. Data points were cross-verified through triangulation, comparing insights from multiple credible sources to mitigate bias and confirm reliability.

Furthermore, the research process incorporated expert panel discussions with veteran tanners, sustainability specialists, and logistics advisors. These forums facilitated peer validation of preliminary findings, refinement of thematic frameworks, and identification of emerging trends. Quantitative data was supplemented by qualitative case studies, spotlighting successful adaptation strategies and illustrating best practices across diverse market segments.

Throughout the methodology, rigorous protocols governed data collection, ethical considerations, and confidentiality. Participants provided consent under anonymity guarantees, and all proprietary information was handled in accordance with industry-standard data protection procedures. This meticulous approach ensured that the analysis presented herein is both comprehensive and actionable, providing decision-makers with a reliable foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Leather Goods market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Leather Goods Market, by Product Type

- Leather Goods Market, by Leather Type

- Leather Goods Market, by Distribution Channel

- Leather Goods Market, by End-User

- Leather Goods Market, by Application

- Leather Goods Market, by Region

- Leather Goods Market, by Group

- Leather Goods Market, by Country

- United States Leather Goods Market

- China Leather Goods Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Drawing Conclusions on Future Pathways for Leather Goods Industry Growth Sustainability Innovation and Resilience in a Rapidly Changing Global Economy

In summation, the leather goods industry stands poised at a critical juncture where innovation, sustainability, and strategic agility converge to shape future growth trajectories. The transformative shifts in materials technology, digital engagement, and consumer expectations underscore a broader evolution toward responsible luxury and personalized experiences. Concurrently, trade policies and tariff adjustments demand proactive management of sourcing networks and customs strategies to maintain competitive resilience.

Segmentation analysis highlights the importance of tailoring offerings to distinct leather types, price tiers, product categories, distribution channels, end-user demographics, and application contexts. Regional insights reveal that nuanced market characteristics-from North American sustainability priorities to European regulatory rigor and Asia-Pacific’s manufacturing dynamism-require customized approaches for optimal market penetration.

Key industry players are driving progress through collaborative sustainability initiatives, digital-first operations, and agile supply chain models. By embracing recommended best practices, organizations can enhance their ability to anticipate shifts, mitigate risks, and capitalize on emerging opportunities. Ultimately, the path forward is defined by a delicate balance between honoring the heritage of leather craftsmanship and harnessing the innovations that will secure the industry’s relevance in a fast-changing global economy.

Connect with Ketan Rohom to Unlock Comprehensive Leather Goods Market Intelligence and Drive Strategic Decisions with Confidence

Elevate your strategic planning by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive market research report tailored to your leather goods business needs. Connect directly for a personalized consultation that delves into market dynamics, emerging trends, and actionable insights designed to optimize supply chains, refine product portfolios, and amplify competitive advantage. Secure your copy today to harness robust intelligence and drive confident decision-making in an ever-evolving global marketplace.

- How big is the Leather Goods Market?

- What is the Leather Goods Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?