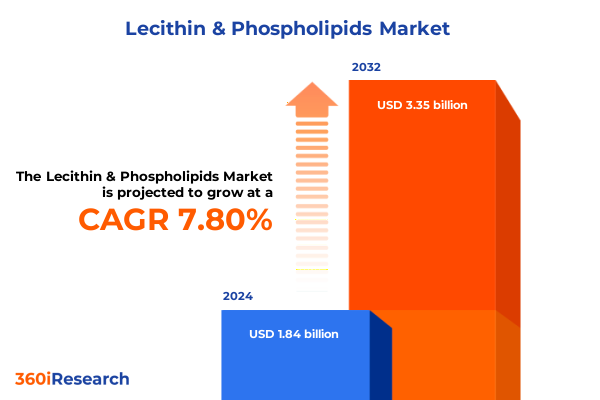

The Lecithin & Phospholipids Market size was estimated at USD 1.98 billion in 2025 and expected to reach USD 2.12 billion in 2026, at a CAGR of 7.78% to reach USD 3.35 billion by 2032.

Unveiling the Integral Role of Lecithin and Phospholipids as Foundational Emulsifiers and Bioactives Across Diverse Industries

Lecithin and phospholipids are indispensable functional ingredients that underpin product performance and stability across an expansive range of industries. Derived primarily from egg yolk, rapeseed, soybean, and sunflower sources, these phospholipid compounds enable superior emulsification, encapsulation of active components, and textural enhancement. Their amphiphilic molecular structure makes them ideal for creating homogenous systems where oil and water phases coexist seamlessly, powering applications from food and beverage formulations to high-precision pharmaceutical drug delivery. As a result, lecithin and phospholipids occupy a unique niche at the intersection of formulation science, regulatory compliance, and consumer health trends.

Over the past decade, market participants have increasingly recognized the bioactive potential of phospholipids beyond their traditional role as emulsifiers. Clinical studies have highlighted their positive effects on neurological function, liver health, and gastrointestinal integrity, driving growth in nutraceutical and pharmaceutical segments. In parallel, demand for clean-label and non-GMO lecithin derivatives has spawned innovation in extraction and refinement processes, reinforcing the strategic importance of robust sourcing and quality assurance. These trends underscore lecithin’s transformation from a commodity emulsifier to a high-value biofunctional ingredient in the global formulators’ toolkit.

This executive summary synthesizes the latest transformative shifts, tariff-related impacts specific to the United States in 2025, and deep segmentation perspectives based on source, form, grade, and application. It also explores critical regional dynamics, highlights key competitive strategies among leading producers, and offers actionable recommendations for industry leaders. Together, these insights lay the groundwork for informed strategic decisions that will shape the future direction of the lecithin and phospholipid market.

Examining the Pivotal Technological, Regulatory, and Consumer-Driven Evolution Shaping the Lecithin and Phospholipids Landscape

Rapid advancements in extraction and purification technologies have fundamentally redefined the lecithin and phospholipid value chain. Innovative supercritical CO₂ methods and membrane filtration systems now enable producers to isolate specific phospholipid fractions with unprecedented purity, meeting the rigorous demands of pharmaceutical and high-end cosmetic formulations. This shift toward precision fractionation marks a departure from conventional crude lecithin processing, elevating the technological bar for both new entrants and established players.

Concurrently, evolving regulatory frameworks in major markets such as the United States, European Union, and China have imposed stricter labeling requirements and safety assessments, driving alignment toward standardized quality benchmarks. Global regulatory bodies now demand detailed characterizations of fatty acid profiles, residual solvent levels, and allergen declarations, prompting manufacturers to invest in advanced analytical capabilities. As a result, compliance has become a key competitive differentiator, influencing partnerships and mergers among entities striving to bolster their technical expertise.

Moreover, the rise of health-conscious consumers has spurred demand for bio-based and sustainably sourced lecithin and phospholipids. Brands are leveraging traceable supply chains and transparent certification schemes to appeal to end-users who prioritize ethical and eco-friendly ingredients. This consumer-driven imperative has catalyzed collaborations between ingredient suppliers and biotechnology firms, fostering innovation in underexploited feedstocks such as algae and microbial fermentation. Ultimately, these converging forces create a fertile landscape for growth and transformative value creation.

Analyzing the Comprehensive Economic Effects of United States 2025 Tariff Measures on Lecithin and Phospholipid Sourcing and Pricing Dynamics

In 2025, the United States government implemented a revised tariff regime targeting specific lecithin and phospholipid imports, with duty rates increasing by an average of 15 percent across key entry points. These measures aimed to protect domestic processors and incentivize local production, yet they also introduced substantial cost pressures for manufacturers reliant on imported crude lecithin. The immediate consequence was a recalibration of supply chain strategies, as formulators sought to balance cost volatility against uninterrupted ingredient availability.

Domestic producers responded by scaling up capacity and enhancing process efficiencies, often through capital investments in high-yield fractionation equipment and integrated refining operations. This expansion enabled greater self-sufficiency in sourcing base lecithin and phospholipid fractions, mitigating reliance on imported soybean and sunflower lecithin. However, for smaller players lacking economies of scale, the elevated duties translated into higher raw-material costs that proved challenging to pass on fully to end-users, squeezing margin profiles.

To navigate this new tariff environment, industry participants have diversified procurement channels and explored indirect sourcing mechanisms. Some have entered joint ventures with overseas phosphate processing companies to secure tariff-exempt intermediate products, while others have accelerated development of alternative feedstocks such as egg and rapeseed lecithin, which remain subject to lower levy rates. These adaptive strategies underscore the tariff regime’s cumulative impact: reshaping global trade flows and compelling a strategic realignment of both procurement and production philosophies.

Revealing Deep Dive Segmentation Perspectives That Illuminate Variations in Source, Form, Grade, and Application of Lecithin and Phospholipids

Segmentation by source reveals nuanced dynamics between traditional and emerging raw materials. Soybean lecithin continues to command a significant share of global production, attributable to its widespread cultivation and established supply chains. Yet rapeseed lecithin is gaining traction in regions where rapeseed cultivation offers environmental advantages, while egg-derived lecithin retains a niche appeal in premium formulations. Sunflower lecithin, prized for its non-GMO profile, is particularly favored by clean-label brands seeking to differentiate via transparent ingredient sourcing.

When examining product form, the dichotomy between liquid and powder lecithin highlights divergent usability considerations. Liquid lecithin offers ease of incorporation into continuous processing lines, making it ideal for high-volume beverage and sauce applications. Powder lecithin, on the other hand, delivers enhanced shelf life and dosage precision, winning preference in dry mix systems and encapsulated delivery matrices. These form-based distinctions directly influence downstream formulation strategies and storage protocols.

Grade-based segmentation further delineates market opportunities across quality tiers. Feed grade lecithin, with its cost-effective profile, underpins nutritional enrichment in animal feed segments spanning aqua, pet, poultry, and swine, thereby supporting livestock health and productivity. Food grade variants prioritize sensory and functional performance in bakery, confectionery, dairy, frozen desserts, dressings, and sauces. Pharmaceutical grade phospholipids, distinguished by rigorous purity standards, serve critical roles in drug delivery systems and nutraceutical supplements, where precise bioavailability and regulatory compliance are paramount. The interplay of these segmentation axes informs targeted product development and marketing strategies across the value chain.

This comprehensive research report categorizes the Lecithin & Phospholipids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Grade

- Application

Surveying Regional Nuances and Market Drivers Across Americas, Europe Middle East Africa, and Asia Pacific Lecithin and Phospholipid Markets

The Americas lead in mature market adoption, with the United States and Canada supporting robust demand for lecithin across food, feed, and pharmaceutical applications. Advanced processing infrastructure and a well-established regulatory regime foster innovation in next-generation lecithin derivatives. Meanwhile, South American producers, particularly in Brazil and Argentina, are expanding cultivation of soy and sunflower feedstocks to capitalize on favorable agronomic conditions and growing domestic consumption.

Europe, the Middle East, and Africa collectively present a mosaic of regulatory landscapes and consumer preferences. Western Europe’s stringent clean-label movement drives demand for non-GMO and organic lecithin, prompting manufacturers to secure certifications and bolster supply chain transparency. In contrast, emerging markets in the Middle East and North Africa are experiencing rapid growth in dairy and confectionery sectors, fueling incremental demand for functional emulsifiers. Sub-Saharan Africa remains an untapped frontier, with nascent processing capabilities and rising investment flows laying the groundwork for future market entry.

In the Asia-Pacific region, surging demand in China, India, and Southeast Asian economies is propelled by urbanization, rising disposable incomes, and increased focus on health and wellness. Local producers are investing in capacity expansions and joint ventures to address logistical constraints and import dependency. Simultaneously, regulatory authorities in Japan and Australia maintain high quality benchmarks, compelling international suppliers to adhere to exacting safety and labeling standards. Together, these regional nuances shape competitive strategies and pinpoint growth opportunities for both global and local market participants.

This comprehensive research report examines key regions that drive the evolution of the Lecithin & Phospholipids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Positioning of Leading Global Companies in the Lecithin and Phospholipid Market

The competitive landscape is anchored by established agribusiness giants that leverage integrated operations spanning cultivation, extraction, and refinement. Their global footprints enable strategic sourcing flexibility, mitigating regional supply disruptions and harnessing economies of scale. In parallel, specialty chemical firms distinguish themselves through advanced fractionation technologies and tailored phospholipid formulations that cater to niche end-use requirements.

Mid-sized producers and biotech startups are carving out competitive advantages by focusing on emerging feedstocks and proprietary extraction processes. Their agility allows for rapid commercialization of non-traditional lecithin sources such as algal and microbial phospholipids, meeting the rising demand for sustainable and vegan-friendly alternatives. Strategic partnerships between these firms and established players are increasingly common, as they combine R&D expertise with distribution networks to accelerate market penetration.

Across the board, leading companies are prioritizing research to optimize phospholipid yield, purity, and functional performance. Investments in digitalization and advanced analytics are streamlining supply chain visibility, enabling real-time monitoring of quality parameters. Companies that successfully integrate these capabilities are well positioned to respond swiftly to shifting regulatory requirements and consumer trends, thereby reinforcing their market leadership and long-term resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lecithin & Phospholipids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- American Lecithin Company

- Archer-Daniels-Midland Company

- Avril Group S.A.

- Bunge Limited

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Fismer Lecithin GmbH

- IMCD Group B.V.

- Kewpie Corporation

- Lasenor Emul S.L.

- Lecilite Ingredients Private Limited

- Lipoid GmbH

- Matrix Life Science Private Limited

- Sodrugestvo Group S.A.

- Sonic Biochem Extraction Private Limited

- Stern-Wywiol Gruppe GmbH & Co. KG

- Sun Nutrafoods Private Limited

- VAV Life Sciences Private Limited

- Wilmar International Limited

Delivering Targeted Strategic Recommendations to Propel Innovation, Efficiency, and Growth for Lecithin and Phospholipid Industry Leaders

Industry leaders should intensify investment in next-generation extraction technologies that enhance phospholipid specificity while reducing energy consumption. By adopting cutting-edge methods such as membrane ultrafiltration and enzymatic fractionation, companies can yield product variants that address the unique functional demands of high-end pharmaceuticals and personal care formulations.

To buffer against geopolitical and tariff-related uncertainties, executives must diversify sourcing strategies by forging strategic alliances with alternative raw-material suppliers. Engaging in long-term contracts for egg and rapeseed lecithin, as well as cultivating partnerships with microbial fermentation specialists, will create a more resilient supply chain and protect margins under fluctuating regulatory regimes.

Finally, aligning product development with evolving health and sustainability narratives is crucial. Firms should accelerate clinical research exploring phospholipids’ bioactive properties, thereby unlocking new nutraceutical applications. Concurrently, transparent communication regarding traceability and environmental impact will resonate with eco-conscious consumers and bolster brand equity in competitive markets.

Outlining a Robust Mixed Methodology Combining Primary Interviews, Secondary Sources, and Advanced Analytical Tools in Market Research

The research design integrates primary and secondary methodologies to ensure comprehensive market coverage and analytical rigor. Key industry stakeholders-including technical formulators in food and pharmaceutical sectors-were engaged through in-depth interviews to capture qualitative insights on emerging trends, technological adoption, and regional regulatory dynamics. These firsthand accounts were triangulated with secondary data sourced from trade association publications, peer-reviewed scientific journals, and government regulatory filings.

Quantitative data underpinning segmentation and regional analyses were obtained through careful examination of import-export records, production statistics, and consumption reports from reputable national databases. Advanced analytical techniques, such as regression modeling and scenario analysis, were applied to historical data to discern patterns and validate the robustness of strategic inferences. Quality control measures, including cross-validation and consistency checks, were employed throughout to safeguard data integrity.

This mixed-methods framework ensures that the findings reflect both the nuanced perspectives of industry practitioners and the statistical veracity of large-scale datasets. As a result, the research delivers actionable intelligence that supports evidence-based decision-making across strategic planning, product development, and supply chain optimization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lecithin & Phospholipids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lecithin & Phospholipids Market, by Source

- Lecithin & Phospholipids Market, by Form

- Lecithin & Phospholipids Market, by Grade

- Lecithin & Phospholipids Market, by Application

- Lecithin & Phospholipids Market, by Region

- Lecithin & Phospholipids Market, by Group

- Lecithin & Phospholipids Market, by Country

- United States Lecithin & Phospholipids Market

- China Lecithin & Phospholipids Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Strategic Implications from the Lecithin and Phospholipid Sector to Guide Informed Decision Making

The lecithin and phospholipid market stands at a pivotal inflection point, driven by technological breakthroughs, evolving consumer demands, and shifting trade policies. By synthesizing segmentation insights, regional dynamics, and competitive strategies, this summary clarifies the multifaceted landscape that industry players must navigate. It highlights how advanced extraction methods and targeted applications in pharmaceuticals and nutraceuticals offer pathways to high-value growth.

Moreover, the analysis illustrates the profound influence of the United States’ 2025 tariff adjustments, which have reshaped sourcing calculus and incentivized domestic capacity expansion. Successful companies will be those that combine diversification of raw‐material supply with strategic investments in process optimization and quality assurance. Simultaneously, a clear focus on sustainable, clean-label credentials and bioactive functionality will differentiate market leaders in increasingly discerning end-use segments.

Ultimately, organizations that leverage these insights-deploying adaptive procurement frameworks, forging collaborative alliances, and championing innovation-will unlock new revenue streams and fortify their competitive positioning. The convergence of robust segmentation, regional opportunity mapping, and targeted strategic initiatives outlines a clear roadmap for sustained success in the dynamic lecithin and phospholipid market.

Engage with Ketan Rohom to Acquire Comprehensive Lecithin and Phospholipid Market Intelligence Tailored to Your Strategic Objectives

For tailored insights and an in-depth understanding of evolving lecithin and phospholipid dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you in securing the full market research study, ensuring your organization benefits from granular segmentation data, up-to-date tariff impact analyses, and regionally specific trends. By collaborating with Ketan, you will gain access to actionable intelligence on sourcing strategies, competitive positioning, and future innovation pathways designed to strengthen your market presence. Contact him today to accelerate your decision-making process and position your enterprise at the forefront of the lecithin and phospholipid landscape.

- How big is the Lecithin & Phospholipids Market?

- What is the Lecithin & Phospholipids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?