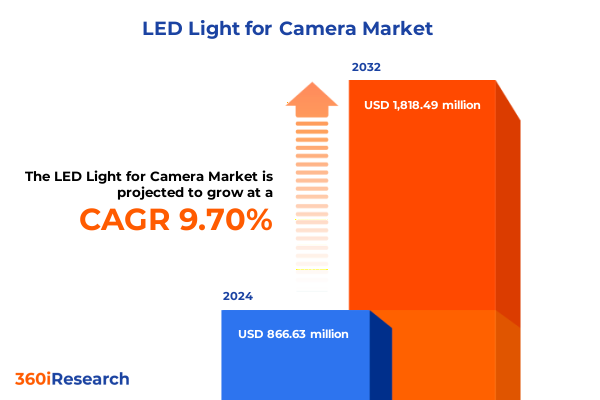

The LED Light for Camera Market size was estimated at USD 932.59 million in 2025 and expected to reach USD 1,004.49 million in 2026, at a CAGR of 10.00% to reach USD 1,818.48 million by 2032.

Exploring the Evolution and Significance of LED Lighting Technologies in Modern Camera Workflows Across Diverse Media Applications

The evolution of LED camera lighting has redefined visual storytelling by combining technological sophistication with creative flexibility. In response to escalating demands for high-quality imagery, lighting solutions have transitioned from bulkier tungsten and fluorescent fixtures to compact, energy-efficient LED systems. This shift has not only reduced power consumption and heat generation but also enabled photographers and filmmakers to sculpt light with unprecedented precision. As content creation diversifies across formats-from cinematic films to immersive live streams-the role of LED lighting has expanded beyond mere illumination to become a core component of production design.

Moreover, the proliferation of social media and the democratization of content creation have catalyzed rapid innovation in LED design. Ring lights and on-camera fixtures have become staples for influencers and mobile journalists, offering balanced frontal illumination that enhances facial features and reduces shadows. Simultaneously, studio panel lights with flat and tubular configurations provide large, even light fields conducive to complex multi-camera setups. Underpinning these advances is a continual push for miniaturization, wireless connectivity, and app-based control, which collectively empower users to tailor color temperature, intensity, and beam angle on the fly. This introduction sets the stage for a deeper exploration of the forces reshaping the LED camera lighting domain and underscores its integral role in modern visual production workflows.

Uncovering the Technological Innovations and Market Drivers Redefining the LED Camera Lighting Ecosystem Worldwide

In recent years, technological breakthroughs have spurred a transformative shift in LED camera lighting, fundamentally altering how professionals and enthusiasts approach illumination. Innovations in chip efficiency and thermal management have yielded bi-color and RGB fixtures capable of rendering colors with remarkable accuracy, eliminating the green or magenta tint that once plagued earlier LED models. As a result, content creators can seamlessly transition between daylight-balanced setups and stylized color effects without changing hardware, fostering creative experimentation and expediting shoot schedules.

Concurrently, the integration of smart controls via Bluetooth, Wi-Fi, and proprietary apps has redefined operational workflows. Remote adjustment of hue, saturation, and intensity grants lighting technicians the agility to fine-tune scenes in real time from mobile devices, reducing downtime and minimizing physical intervention on set. This wireless paradigm extends to battery-powered panel lights and video bars, which now offer extended run times and rapid USB-C charging, catering to on-location shoots in remote or power-restricted environments. The convergence of IoT capabilities has further enabled automated scene recall presets, facilitating consistent lighting across multiple take setups and streamlining collaboration between cinematographers and gaffers.

Additionally, environmental sustainability has emerged as a pivotal driver of innovation. Manufacturers are increasingly adopting recyclable materials and low-impact packaging, while developing fixtures with lower energy draw and longer operational lifespans. This eco-conscious ethos resonates with broadcasters and production studios seeking to reduce carbon footprints. Taken together, these transformative shifts underscore a rapidly evolving LED lighting ecosystem marked by technological sophistication, user-centric design, and sustainable practices.

Understanding the Multifaceted Effects of 2025 US Tariff Measures on the LED Camera Lighting Supply Chain and Market Dynamics

The implementation of new United States tariff measures on imported LED camera lighting products in 2025 has introduced a complex array of challenges and strategic responses across the value chain. By imposing additional duties on components and finished fixtures primarily sourced from key manufacturing hubs, the tariffs have elevated input costs for both domestic assemblers and global distributors. In reaction, some manufacturers have accelerated efforts to diversify their supplier networks, seeking out non-subject countries or investing in local production facilities to mitigate escalating duty burdens.

Furthermore, the tariff-induced cost pressures have triggered adjustments in pricing strategies as brands weigh the trade-off between margin preservation and competitive positioning. For some, the solution has involved selective absorption of incremental costs to maintain end-user price points, while others have opted for premium tiers and value-added service bundles to justify higher sticker prices. Meanwhile, resellers and e-commerce platforms have recalibrated their inventory planning, prioritizing tariff-exempt models or domestically assembled lights to stabilize supply and ensure timely delivery to content creators and professional users.

In tandem with these financial implications, the tariffs have also spurred collaborative dialogues between industry associations and regulatory bodies. Stakeholders are evaluating potential exemptions for specialized film and broadcast equipment, advocating for policy refinements that recognize the unique demands of creative industries. As firms adapt to this evolving trade landscape, they are also leveraging the impetus to reinforce local R&D initiatives, cultivate advanced manufacturing capabilities, and explore alternative materials. Ultimately, the cumulative impact of the 2025 tariffs has galvanized a renewed focus on supply chain resilience and strategic agility within the LED camera lighting segment.

Dissecting Product, Application, User, Distribution, and Light Type Segments to Reveal Nuanced Insights into Market Demand

A comprehensive examination of product type segmentation reveals that on-camera LED lights continue to serve as foundational tools for run-and-gun videography, while portable LED fixtures offer a versatile blend of power and mobility for storytellers operating in dynamic environments. Ring lights, with their distinctive circular design, remain indispensable for solo creators seeking portrait-style lighting that flatters subject features and minimizes shadows. Meanwhile, studio LED panel lights encompass flat panel and tubular panel variants, delivering expansive, uniform illumination for controlled settings, and video light bars have gained traction among vloggers for their sleek profiles and adjustable mounting options.

Looking at application-based segmentation, broadcasting environments demand fixtures with exceptional color fidelity and flicker-free performance, whereas film production pipelines prioritize high output intensity and precise beam shaping. Live streaming setups benefit from bi-color and RGB solutions that enable rapid aesthetic adjustments during interactive sessions, and photography workflows leverage daylight-balanced panels to achieve consistent color rendition. Vlogging enthusiasts often favor compact, app-controlled lights that integrate seamlessly with cameras and smartphones, underscoring the importance of user-friendly interfaces.

When considering end users, amateur photographers and hobbyists typically gravitate toward budget-friendly kits with basic bi-color functionality, while content creators and professionals invest in premium fixtures featuring advanced control, higher CRI ratings, and accessory ecosystems. In distribution channel segmentation, original equipment manufacturers collaborate closely with OEM partners to embed custom LED modules in camera rigs, and offline retail channels span general retailers and specialty stores that offer hands-on product demonstrations. Online retail encompasses brand websites and major e-commerce platforms, providing a broad selection of styles and price points, while wholesale distributors enable large-scale procurement for institutional buyers. Lastly, light type segmentation underscores the prevalence of bi-color lights for adaptable color temperature control, daylight lights for true-to-life visual accuracy, and RGB lights for highly customizable color effects, each addressing distinct creative and technical requirements.

This comprehensive research report categorizes the LED Light for Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Light Type

- Application

- End User

- Distribution Channel

Evaluating Regional Disparities and Growth Opportunities Across Americas, Europe Middle East & Africa, and Asia-Pacific Territories

The Americas region has emerged as a critical battleground for LED camera lighting innovation, driven by strong demand from broadcast networks, film studios, and burgeoning live content creators. In North America, early adoption of cutting-edge fixtures has accelerated the transition away from legacy lighting systems, while Latin American markets demonstrate growing interest in cost-effective on-camera and ring light solutions among independent creators. Transitioning to Europe, Middle East & Africa, sophisticated regulatory frameworks and sustainability mandates in Western Europe have inspired manufacturers to emphasize eco-friendly designs, whereas production hubs and emerging consumer markets across Eastern Europe and the Middle East are increasingly integrating LED lighting into localized broadcast and training facilities.

Moreover, the Africa subregion is witnessing gradual uptake of LED lighting for educational and small-scale media projects, supported by initiatives aimed at expanding digital infrastructure. In the Asia-Pacific sphere, robust manufacturing ecosystems in China and Southeast Asia continue to supply a significant portion of global LED light production, often coupled with rapid innovation in wireless controls and integrated battery technology. Simultaneously, developed markets such as Japan, South Korea, and Australia prioritize high-CR I, compact solutions that cater to professional studios and mobile journalists. Across these regions, variances in regulatory tariffs, import duties, and distribution logistics shape pricing models and product availability, compelling global brands to tailor their regional strategies. Consequently, understanding these geographical nuances is essential for aligning supply, marketing campaigns, and service networks with localized demand drivers.

This comprehensive research report examines key regions that drive the evolution of the LED Light for Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Moves That Drive Competitive Edge in the LED Camera Lighting Sector

Among the prominent players leading the charge in LED camera lighting, Aputure has distinguished itself through relentless innovation, particularly in high-CRI COB panels and sophisticated app ecosystems that facilitate multi-unit synchronization. Godox has carved out market share by offering modular and cost-effective solutions that balance performance with affordability, appealing broadly to both amateur content creators and professional studios. Nanlite has built a reputation on super-compact fixtures featuring advanced thermal management, while Westcott has reinforced its position by integrating creative lighting accessories tailored to photography and videography workflows.

Meanwhile, Rotolight has set benchmarks in bi-color LED rings and on-camera lights, leveraging unique pulse and highlight settings for dramatic effects in portrait and cinematic shoots. Lume Cube’s rugged, waterproof designs have resonated with adventure filmmakers and live broadcasters, enabling lighting in challenging environments. Falcon Eyes continues to push the envelope with value-driven panel systems and light modifiers that cater to emerging markets, while Dracast emphasizes durable construction and comprehensive warranty services to serve rental houses and educational institutions. Collectively, these companies employ a blend of strategic partnerships with camera manufacturers, targeted sponsorship of digital influencers, and participation in leading trade exhibitions to heighten brand visibility. Their product roadmaps underscore ongoing R&D in AI-driven color correction, wireless mesh networking, and next-generation chip technologies, reflecting a commitment to staying ahead of evolving creative demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the LED Light for Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aperture Imaging Technology Co., Ltd.

- Bron Elektronik AG

- Dracast Inc.

- Elinchrom Ltd.

- Falcon Eyes Photographic Equipment Co., Ltd.

- Fiilex, LLC

- Fovitec USA, LLC

- Godox Photo Equipment Co., Ltd.

- Hyundai Fomex Co., Ltd.

- Ikan Enterprises, LLC

- Kino Flo, Inc.

- Kino Flo, LLC

- Lino Manfrotto + Co. S.p.A.

- Lume Cube LLC

- Lume Cube, Inc.

- Lupo Lighting GmbH

- Luxli, Inc.

- NanGuang Photographic Equipment Co., Ltd.

- Quasar Science, Inc.

- Rotolight Ltd.

- SmallRig Technology Co., Ltd.

- Vitec Group PLC

- Yongnuo Photographic Equipment Co., Ltd.

- Yongnuo Technology Co., Ltd.

Crafting Strategic Guidelines and Tactical Approaches to Accelerate Market Penetration and Product Innovation in LED Camera Lighting

Leaders in the LED camera lighting space should prioritize investments in advanced modulation techniques that enhance dimming smoothness and extend color gamut range, thereby reinforcing product differentiation. By forming collaborative alliances with camera OEMs, companies can embed intelligent lighting controls directly into camera firmware, streamlining end-to-end setup processes and reducing reliance on third-party apps. Additionally, expanding distribution partnerships with specialty retailers and targeted e-commerce platforms will help capture both hands-on buyers seeking personalized demos and digital-native customers prioritizing convenience.

Another critical action involves bolstering after-sales services through comprehensive training modules and digital knowledge hubs. Providing workshops, certifications, and virtual support not only elevates brand loyalty but also ensures that photographers and videographers harness the full potential of advanced lighting features. From a sustainability perspective, adopting circular economy principles-such as offering modular upgrade kits and take-back programs-can strengthen corporate social responsibility credentials and resonate with environmentally conscious buyers. Finally, proactively engaging with policy makers to clarify tariff exemptions for creative equipment will safeguard the supply chain and mitigate future disruptions. By executing these targeted recommendations, industry leaders can secure a resilient, innovation-driven growth trajectory.

Outlining a Robust Mixed-Methods Research Framework That Ensures Comprehensive Insights into LED Camera Lighting Trends

This research methodology combined exhaustive secondary research with targeted primary investigations to ensure a holistic understanding of LED camera lighting trends. The initial phase involved reviewing technical whitepapers, manufacturer datasheets, and thematic industry publications to identify key technological milestones and emerging use cases. Concurrently, proprietary databases on import-export statistics and trade policies were analyzed to evaluate the impact of recent tariff implementations and supply chain realignments.

Subsequently, qualitative insights were gathered through in-depth interviews with lighting designers, cinematographers, and technical directors operating in broadcast, film, and digital content environments. These expert consultations provided firsthand perspectives on performance requirements, operational challenges, and evolving creative preferences. To complement these discussions, a structured survey was distributed across a diverse pool of end users-including amateur photographers, live streamers, and professional studio managers-capturing quantitative data on purchase criteria, feature priorities, and channel preferences. All findings underwent rigorous validation through triangulation, cross-referencing responses with published case studies and third-party certification benchmarks. The result is a methodologically robust framework that accurately reflects both technological advances and real-world usage patterns within the LED camera lighting domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our LED Light for Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- LED Light for Camera Market, by Product Type

- LED Light for Camera Market, by Light Type

- LED Light for Camera Market, by Application

- LED Light for Camera Market, by End User

- LED Light for Camera Market, by Distribution Channel

- LED Light for Camera Market, by Region

- LED Light for Camera Market, by Group

- LED Light for Camera Market, by Country

- United States LED Light for Camera Market

- China LED Light for Camera Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Critical Findings and Strategic Implications That Illuminate the Future Trajectory of LED Camera Lighting Innovation

This executive summary has illuminated the convergence of technological innovation, policy shifts, and evolving user demands that define the current LED camera lighting landscape. From the advent of high-CRI, app-enabled fixtures to the strategic adjustments prompted by US tariff measures, the industry has demonstrated remarkable adaptability and forward momentum. Detailed segmentation analysis highlighted how product types-ranging from on-camera adaptors to studio flat and tubular panels-align with application requirements in broadcasting, film production, live streaming, photography, and vlogging. End user distinctions further underscored the divergent priorities of amateur, hobbyist, content creator, and professional cohorts.

Regional insights revealed that while the Americas and Europe Middle East & Africa continue to lead in adoption of cutting-edge solutions, the Asia-Pacific remains pivotal as both a manufacturing powerhouse and a rapidly maturing consumer base. Profiled corporate strategies showcased how leading companies leverage innovation ecosystems, strategic partnerships, and sustainability initiatives to maintain competitive advantage. Actionable recommendations offered clear pathways for enhancing product distinctiveness, optimizing distribution networks, and reinforcing supply chain resilience. Collectively, these findings provide a strategic roadmap for businesses seeking to navigate market complexities, capitalize on emerging opportunities, and elevate creative excellence within the LED camera lighting sphere.

Take Action Today to Secure Detailed Market Intelligence on LED Camera Lighting from an Industry Sales and Marketing Expert

To gain unparalleled insights and strategic clarity on the LED camera lighting landscape, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the detailed market research report, highlighting the most critical trends, segment dynamics, regional nuances, and competitive strategies that matter to your business. By partnering with an experienced industry expert, you can fortify your product roadmap, refine your go-to-market approach, and stay ahead of emerging shifts in the competitive environment. Secure access to comprehensive analysis today and empower your organization with actionable intelligence that drives innovation and growth in LED camera lighting.

- How big is the LED Light for Camera Market?

- What is the LED Light for Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?