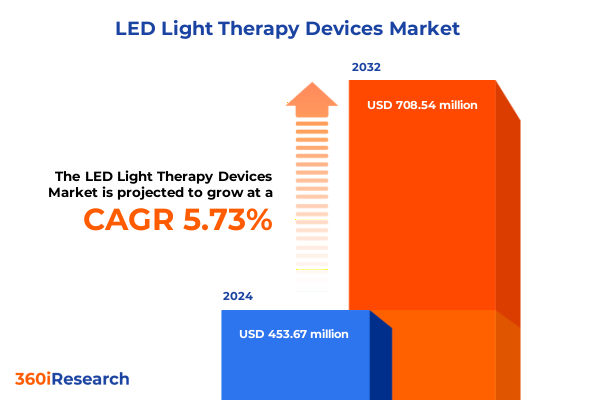

The LED Light Therapy Devices Market size was estimated at USD 453.67 million in 2024 and expected to reach USD 478.22 million in 2025, at a CAGR of 5.73% to reach USD 708.54 million by 2032.

Pioneering the Revolution of LED Light Therapy Devices as a Cutting-Edge Solution Transforming Wellness and Beauty Applications Worldwide

Over the past decade, LED light therapy devices have transcended their laboratory origins to become a mainstream solution for wellness and aesthetic improvement. Driven by advancements in diode technology and optical engineering, these platforms now offer precise control over light wavelength, intensity and exposure duration. As a result, dermatology clinics and beauty professionals routinely integrate handheld and panel devices into treatment regimens for skin rejuvenation, inflammation reduction and pain management. Meanwhile, the emergence of consumer-grade mask systems has democratized access to therapeutic light, empowering individuals to incorporate clinical efficacy into their daily routines.

Furthermore, the evolution of wearable and portable formats has fostered greater user adherence and satisfaction. Modern iterations combine ergonomic design with intelligent feedback, enabling personalized protocols that adapt to individual skin types and treatment goals. In addition, regulatory bodies in key markets have increasingly recognized the safety profile of non-invasive photobiomodulation, accelerating device approvals and market acceptance. Consequently, manufacturers invest heavily in research partnerships to validate new applications spanning hair restoration, scar reduction and chronic pain relief. Against this dynamic backdrop, this executive summary provides an in-depth exploration of industry drivers, innovative shifts, tariff impacts, segmentation insights and regional trends shaping the LED light therapy device landscape.

Unveiling the Transformative Waves Redefining the LED Light Therapy Landscape Through Technological Innovations and Evolving Consumer Expectations

Over the past two years, breakthroughs in optoelectronic engineering have catalyzed a profound transformation within the LED light therapy sector. High-efficiency light-emitting diodes now deliver targeted wavelengths spanning blue, red and near-infrared spectra, enabling multifunctional platforms to address diverse therapeutic needs. Concurrently, the integration of microcontroller-based feedback loops and IoT connectivity permits real-time monitoring of dose delivery and remote adjustment through companion apps. Consequently, next-generation devices offer granular protocol customization, ensuring optimal efficacy while minimizing safety risks. Moreover, collaborative research between photonics experts and medical institutions has yielded novel hybrid technologies that combine LED arrays with acoustic or microcurrent modalities to enhance tissue penetration and regenerative outcomes.

Alongside these technical advancements, consumer expectations have shifted dramatically toward on-demand, personalized health solutions. Individuals increasingly seek at-home alternatives to clinical treatments, valuing devices that blend medical-grade performance with intuitive user interfaces. Telehealth platforms now partner with device manufacturers to facilitate guided LED therapy sessions and progress tracking, further bridging the gap between professional oversight and home-based therapy. In parallel, rising interest in holistic wellness has encouraged cross-industry collaborations that integrate LED light therapy into smart home ecosystems and wearable health monitors. As a result, the ecosystem surrounding LED devices has expanded to include digital analytics, subscription-based treatment plans and AI-driven protocols, heralding a new era of precision phototherapy and experiential engagement.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Supply Chains and Strategic Sourcing Decisions in the LED Device Market

In early 2025, the United States government instituted a series of additional tariffs on imported components and finished assemblies used in LED light therapy devices as part of broader trade policy adjustments. These measures targeted high-volume imports from key manufacturing hubs, compelling device producers to reassess their global supply chains and cost structures. Initially, enterprises reliant on turnkey production overseas faced immediate margin compression as duty obligations eroded historical cost advantages. Furthermore, the uncertainty surrounding tariff extensions introduced volatility into procurement planning, leading to conservative inventory strategies and higher working capital requirements.

To mitigate cost pressures and secure future resilience, many leading manufacturers have accelerated investments in regional assembly facilities and nurtured partnerships with domestic component suppliers. This strategic shift toward local sourcing not only reduces exposure to tariff fluctuations but also enhances control over quality assurance and lead times. However, the transition entails significant capital expenditure and potential scalability constraints during ramp-up phases. Consequently, device developers are adopting hybrid models that blend in-country assembly with limited offshore manufacturing to balance cost efficiency and supply security.

Additionally, consumer price sensitivity and competitive pricing strategies will shape the extent to which higher import costs are absorbed or passed through to end users. Vendors that proactively renegotiate supplier contracts or co-invest in domestic component fabrication can mitigate margin erosion while preserving affordability. As the industry adjusts, cost management will emerge as a core competency alongside technological prowess, reshaping competitive positioning in a market increasingly defined by regulatory complexity.

Unlocking Critical Segmentation Insights Spanning Device Types Applications Distribution Channels and End User Preferences in LED Therapy Devices

The device type segmentation reveals distinct growth trajectories across handheld, mask and panel systems. Handheld devices continue to appeal to professional practitioners for localized treatment protocols, offering precise dose control and portability during clinic sessions. In contrast, mask devices have bifurcated into eye masks and full-face masks, each catering to specific consumer needs: eye masks drive demand for periorbital wrinkle reduction and targeted relief for digital eye strain, while full-face masks address comprehensive skin rejuvenation and acne therapy. Panel devices further subdivide into flexible panels, favored for their conformability on curved anatomical regions, and rigid panels, which deliver high-intensity multi-wavelength output over large treatment areas. Collectively, these form factors demonstrate complementary roles, with flexible panels gaining traction in home-based regimes and rigid constructs maintaining prominence in professional clinics.

Based on application, acne treatment and skin rejuvenation dominate consumer awareness, yet there is a notable uptick in devices engineered for chronic pain management and hair growth. Inflammatory and non-inflammatory acne therapies remain the cornerstone of dermatological protocols, supported by clinical evidence of anti-microbial and anti-inflammatory effects. Meanwhile, hair growth platforms tailored to alopecia areata, female pattern baldness and male pattern baldness leverage red and near-infrared wavelengths to stimulate follicular activity, carving out a high-potential niche.

The distribution channel landscape reflects an ongoing shift toward digital commerce, as online brand websites and e-commerce platforms empower direct-to-consumer relationships and subscription-based treatment plans. Nonetheless, beauty clinics, pharmacies and specialty stores within the offline channel preserve their strategic value for professional endorsements and product validation. Across both channels, home use applications vie with professional-grade systems, with the former prioritizing ease of use and integrated safety features, and the latter emphasizing performance benchmarks and customizable protocols for accreditation bodies.

This comprehensive research report categorizes the LED Light Therapy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Wavelength

- Application

- End User

- Distribution Channel

Exploring Key Regional Dynamics and Growth Drivers Shaping the LED Light Therapy Device Market Across Americas EMEA and Asia Pacific

In the Americas, the United States stands as the preeminent market for LED light therapy devices, fueled by robust healthcare expenditure and a dense network of aesthetic and dermatology clinics. Consumer willingness to invest in anti-aging and wellness technologies is particularly strong, driven by social media influence and growing acceptance of non-invasive procedures. Regulatory clarity from authorities such as the FDA has accelerated product approvals and bolstered professional confidence in device efficacy. Meanwhile, Canada mirrors these dynamics on a smaller scale, with leading clinics integrating at-home devices as complementary therapies. Investment in U.S.-based assembly and R&D centers further strengthens the regional supply chain, reducing lead times and enhancing quality control.

In Europe, Middle Eastern and African markets, regulatory harmonization under the CE marking system has facilitated cross-border commercialization, enabling manufacturers to scale operations across key EU economies like Germany, France and the UK. High-income Gulf Cooperation Council countries, particularly the UAE, have emerged as hotspots for luxury wellness services, driving uptake of premium LED mask and panel systems. Although reimbursement pathways for light therapy remain limited, private cosmetic clinics frequently bundle device usage into package offerings. In select North African and Middle Eastern markets, nascent adoption is underscored by growing beauty tourism and increasing healthcare infrastructure investments.

The Asia-Pacific region encapsulates both mature and emerging segments, with Japan and South Korea leading in advanced phototherapy innovations and China leveraging its manufacturing prowess to offer cost-competitive solutions. Consumers in these markets exhibit high digital literacy, favoring online purchasing channels and integrated health management platforms. Government initiatives promoting domestic medical device production have incentivized local manufacturing hubs, particularly in metropolitan centers. Meanwhile, markets such as India, Australia and Southeast Asia present greenfield opportunities where rising disposable incomes and expanding clinical networks create fertile ground for both professional and home use device penetration.

This comprehensive research report examines key regions that drive the evolution of the LED Light Therapy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators Strategic Partnerships and Competitive Moves That Are Shaping the Future of the LED Light Therapy Device Industry

Leading innovators within the LED light therapy device arena are characterized by their ability to converge medical rigor with consumer-centric design. Established medical device manufacturers have expanded their portfolios to include photobiomodulation offerings, integrating multi-wavelength arrays with proprietary firmware that adapts dose delivery based on real-time skin impedance feedback. Simultaneously, agile startups emphasize wearable form factors and cloud-enabled data analytics, cultivating differentiated user experiences through smartphone integration and algorithm-driven treatment recommendations. Together, these pioneering efforts underscore a broader shift toward evidence-backed, digitally-enabled therapies that align with modern wellness expectations.

Strategic partnerships further delineate the competitive landscape, as device producers collaborate with academic research centers to validate novel clinical applications and co-author peer-reviewed studies. Telehealth platforms are also forging alliances with manufacturers to embed guided LED therapy sessions into virtual care pathways, broadening accessibility and enhancing patient compliance. In the retail sphere, select beauty brands and e-commerce leaders have struck exclusive distribution agreements to feature co-branded LED modules within holistic skincare regimens, amplifying market reach through established consumer channels.

Competitive moves in the industry are typified by targeted mergers and acquisitions, licensing of cutting-edge optical technologies and infusion of private equity capital into high-growth phototherapy ventures. These activities enable rapid scaling of manufacturing capabilities, extension of global distribution networks and acceleration of R&D roadmaps. To maintain a competitive edge, manufacturers increasingly differentiate through software-driven ecosystems, leveraging remote firmware upgrades and data-driven insights to foster brand loyalty and deliver continuous innovation in light-based therapeutics.

This comprehensive research report delivers an in-depth overview of the principal market players in the LED Light Therapy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Lumenis Ltd.

- Freedom Laser Therapy, Inc.

- Celluma by Biophotas, Inc.

- Omnilux LED by GlobalMed Technologies

- LightStim

- Red Light Man Ltd.

- Platinum LED Holdings LLC

- Mito Red Light, LLC

- Joovv, Inc.

- Syrma Johari MedTech Ltd.

- Lumos Infrared Sauna

- Beacon Face & Dermatology

- Shenzhen Idea Light Limited

- bestqool, Inc.

- Koninklijke Philips N.V.

- Curallux, LLC

- Nuage Health Devices Pvt. Ltd.

- Hologic, Inc.

- Alma Lasers Ltd.

- Johnson & Johnson Services, Inc.

- Dermalux LED

Driving Sustainable Growth and Competitive Advantage through Product Innovation and Strategic Market Expansion in LED Light Therapy Devices

Industry leaders aiming for sustainable growth must prioritize product innovation that transcends basic phototherapy capabilities. Modular device architectures, for example, allow end users to interchange wavelength cartridges or adjust panel configurations in response to evolving treatment protocols. Connectivity features such as Bluetooth-enabled monitoring and cloud-based dashboards not only enhance user engagement but also generate valuable usage data that can inform iterative product enhancements. Additionally, incorporation of integrated sensors to measure skin temperature, hydration levels and photonic dose delivery empowers manufacturers to deliver fully personalized experiences, strengthening clinical credibility and consumer trust.

Strategic market expansion demands a nuanced approach that aligns product offerings with specific regional and demographic requirements. In mature markets, partnership-driven distribution and subscription services can foster recurring revenue streams while reinforcing customer loyalty. Conversely, in emerging economies, collaborations with local medical device distributors and tiered pricing models can facilitate rapid market entry and volume-based cost efficiencies. Rolling out scalable e-commerce platforms alongside targeted experiential marketing campaigns ensures that home-based and professional segments alike perceive value in premium device solutions.

Cultivating collaborative ecosystems also emerges as a critical driver of competitive advantage. By investing in comprehensive training programs for dermatologists, physiotherapists and aesthetic practitioners, manufacturers can accelerate adoption and elevate perceived brand authority. Moreover, alliances with health systems and virtual care providers enable pilot programs that demonstrate clinical outcomes in real-world settings. Such cooperative strategies not only expand market footprint but also position device makers as indispensable partners in multidisciplinary care pathways, ultimately securing long-term relevance and impact within the evolving phototherapy industry.

Detailing a Robust Research Methodology Combining Comprehensive Primary Interviews and Rigorous Secondary Analysis to Ensure Data Integrity

The insights presented in this analysis are grounded in a robust research methodology designed to deliver high levels of data integrity and actionable intelligence. Primary research initiatives included in-depth interviews with device manufacturers, clinical practitioners and regulatory experts, providing firsthand perspectives on technological advancements, adoption hurdles and policy developments. In addition, structured surveys were administered to a representative sample of end users spanning professional clinics and home-based consumers, yielding quantitative metrics on usage patterns, satisfaction drivers and pain points. Complementary field visits to leading dermatology centers enabled direct observation of device deployment within clinical workflows, enriching qualitative understanding of performance requirements and user preferences.

Secondary research efforts encompassed systematic reviews of publicly available information, including regulatory filings with health authorities, patent databases, industry white papers and corporate press releases. This phase ensured comprehensive coverage of product pipelines, strategic partnerships and M&A activity, while also identifying emerging trends through patent landscaping and citation analysis. To enhance reliability, findings from secondary sources were meticulously triangulated with primary data, reconciling any discrepancies through follow-up inquiries and cross-validation exercises. Throughout the process, proprietary data governance protocols were enforced to maintain consistency in terminology and classification across segmentation dimensions. By synthesizing multiple research pillars, this methodology supports nuanced strategic recommendations and fosters confidence in the overarching conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our LED Light Therapy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- LED Light Therapy Devices Market, by Product Type

- LED Light Therapy Devices Market, by Power Source

- LED Light Therapy Devices Market, by Wavelength

- LED Light Therapy Devices Market, by Application

- LED Light Therapy Devices Market, by End User

- LED Light Therapy Devices Market, by Distribution Channel

- LED Light Therapy Devices Market, by Region

- LED Light Therapy Devices Market, by Group

- LED Light Therapy Devices Market, by Country

- Competitive Landscape

- List of Figures [Total: 32]

- List of Tables [Total: 1173 ]

Concluding Insights Emphasizing Strategic Imperatives and Future Outlook for Stakeholders Navigating the Evolving LED Light Therapy Device Market Landscape

This executive summary underscores several strategic imperatives for stakeholders in the LED light therapy device market. First, relentless innovation in optoelectronic performance and digital connectivity will remain a foundational pillar for differentiation, driving consumer preference and clinical adoption. Second, granular segmentation across device form factors, therapeutic applications, distribution channels and end-user profiles provides a roadmap for targeted product development and marketing initiatives. Third, the advent of 2025 tariff measures in the United States necessitates agile supply chain strategies that balance cost efficiency with manufacturing sovereignty. Finally, regional dynamics spanning the Americas, EMEA and Asia-Pacific reveal diverse growth vectors and partnership opportunities, highlighting the importance of localized go-to-market approaches and strategic alliances.

Looking ahead, the market is poised for continued expansion as next-generation phototherapy platforms integrate artificial intelligence, biosensing and telemedicine functionalities. Regulatory frameworks are expected to evolve in tandem, further legitimizing novel therapeutic applications and expanding reimbursement avenues. Supply chain resilience will remain in focus, as manufacturers seek to preempt future policy shifts and geopolitical disruptions through diversified sourcing and in-region production. For industry participants, success will hinge on the ability to anticipate emerging consumer behaviors, forge collaborative ecosystems and deliver on the promise of evidence-based, patient-centric solutions. By embracing these principles, stakeholders can capitalize on the transformative potential of LED light therapy devices and solidify their roles in an increasingly competitive market.

Connect with Ketan Rohom to Secure Exclusive Access to the Comprehensive Market Research Report on the Dynamic LED Light Therapy Device Industry

To access the full breadth of market intelligence and strategic guidance detailed in this summary, interested stakeholders are encouraged to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with this bespoke research offering enables organizations to obtain granular analyses across technology trends, policy implications, competitive landscapes and regional dynamics.

By securing this comprehensive report, companies gain a competitive edge through validated insights, actionable recommendations and methodological transparency. Whether pursuing product development, market entry or strategic partnerships, the data-driven frameworks and scenario planning tools provided will inform decision-making and minimize execution risks. Schedule a consultation with Ketan Rohom to explore customized intelligence packages, clarify specific market queries and initiate the acquisition process for an all-encompassing resource on LED light therapy devices.

In addition to the core report, clients can opt for executive briefings and hands-on workshops led by subject-matter experts, as well as interactive dashboards that track emerging trends in real time. Ongoing advisory support ensures that new developments-ranging from regulatory updates to competitive movements-are promptly communicated, helping stakeholders stay ahead of market shifts and capitalize on evolving opportunities.

- How big is the LED Light Therapy Devices Market?

- What is the LED Light Therapy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?