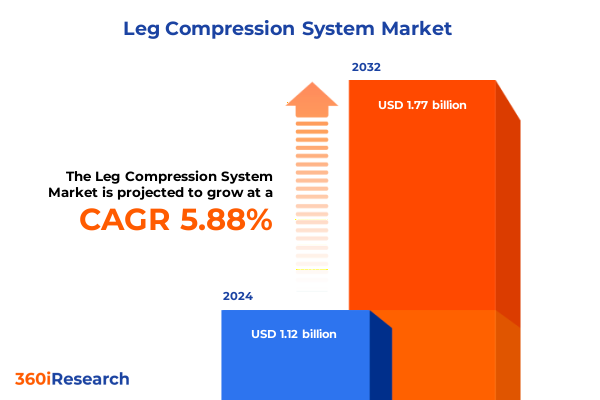

The Leg Compression System Market size was estimated at USD 1.18 billion in 2025 and expected to reach USD 1.25 billion in 2026, at a CAGR of 5.92% to reach USD 1.77 billion by 2032.

Unveiling the critical evolution of leg compression systems in contemporary healthcare environments to frame strategic priorities and establish foundational perspectives for stakeholders

Since their inception as therapeutic devices aimed at improving circulatory health, leg compression systems have undergone profound design refinements and functional innovations. What began as rudimentary pneumatic sleeves has evolved into highly sophisticated platforms integrating digital monitoring, adaptive pressure control algorithms, and connectivity features that support remote patient management. This evolution reflects an overarching trend in medical device development, wherein technologies are assessed not only for clinical efficacy but also for patient comfort and ambulatory care compatibility.

Moreover, this rapid technological progress has been paralleled by a growing emphasis on evidence-based practice and regulatory rigor. Clinical studies validating outcomes in blood circulation enhancement and deep vein thrombosis prevention have accelerated the adoption of advanced compression modalities in surgical recovery protocols and rehabilitation programs. At the same time, regulatory bodies have instituted updated standards for safety, materials biocompatibility, and electromagnetic compatibility, elevating baseline requirements for device approval. Together, these dynamics establish a complex strategic environment in which innovation, compliance, and user-centered design converge.

Examining transformative technological advancements and shifting operational paradigms reshaping the landscape of leg compression solutions for enhanced patient outcomes

The leg compression landscape is being reshaped by an array of technological breakthroughs and emerging patient care models. On one hand, miniaturization of pneumatic pumps and the integration of smart textiles have facilitated the development of wearable systems that patients can use throughout daily activities without disruption. At the same time, enhancements in sensor accuracy and data analytics enable real-time monitoring of limb perfusion metrics, offering clinicians actionable insights that drive personalized treatment regimens.

Concurrently, healthcare providers are adopting value-based care frameworks that prioritize measurable outcomes over procedural volume. This shift compels manufacturers to demonstrate not only the clinical benefits of their systems but also their economic impact in terms of reduced hospital length of stay, lower incidence of post-operative complications, and enhanced patient satisfaction. As a result, strategic alliances between device producers, digital health platform companies, and healthcare institutions have proliferated, exemplifying a move toward integrated care delivery models that leverage leg compression technology as a core component of circulatory health management.

Assessing the cumulative ramifications of United States tariff adjustments enacted in twenty-twenty-five on leg compression device supply chains production costs and market accessibility

In twenty-twenty-five, the United States implemented revised tariff schedules that have significantly affected the importation costs of medical devices, including leg compression systems. Under the Section 301 framework, certain pneumatic components and electronic modules sourced from overseas faced incremental duties, thereby inflating landed costs for finished products. Parallel trade measures on steel and aluminum used for manufacturing frame assemblies further compounded cost pressures for domestic producers reliant on imported raw materials.

These cumulative impacts have driven both contract manufacturers and original equipment manufacturers to reassess their supply chain strategies. Some have accelerated localization of key components by investing in domestic production lines, while others have pursued strategic partnerships with tariff-exempt trading partners. Amid these shifts, pricing strategies have become more dynamic, reflecting variable tariff burdens and currency fluctuations. Ultimately, the tariff landscape has underscored the importance of supply chain resilience and cost-mitigation planning in preserving access to advanced leg compression therapies.

Deriving in-depth segmentation insights across product typologies applications end-user categories distribution channels portability options and pricing tiers

Insight into product typology reveals that electrical compression systems continue to gain traction where consistent pressure profiles and programmability are prioritized, while mechanical alternatives maintain relevance in cost-sensitive settings due to their lower complexity. Pneumatic solutions exhibit differentiated adoption patterns: gradient pneumatic devices are often favored in post-operative recovery for their ability to mimic natural circulatory rhythms, intermittent pneumatic models find utility in intensive care units to facilitate prophylactic thrombosis prevention, and sequential pneumatic configurations support ambulatory rehabilitation by delivering dynamic pressure sequences tailored to patient mobility.

When considering applications, blood circulation improvement channels represent the foundational use case, demonstrating broad appeal across surgical, outpatient, and long-term care contexts. Devices tailored for deep vein thrombosis prevention benefit from stringent clinical guidelines that endorse their prophylactic efficacy in high-risk patient cohorts. Lymphedema management has emerged as a fast-growing segment, driven by rising incidences of chronic lymphatic conditions and the need for gentle sequential compression therapies designed to reduce limb volume and discomfort.

End users span a diverse spectrum of care settings. Ambulatory surgical centers leverage compact, plug-and-play electrical systems to expedite patient throughput, whereas home care adoption is bolstered by portable battery-powered units that enable self-administered treatment. Hospital deployments encompass all modalities, with specialty clinics often seeking pneumatic configurations optimized for manual control and incremental pressure adjustment.

Distribution channel dynamics reflect the tension between traditional procurement pathways and digital commerce. Direct sales efforts remain essential for high-touch clinical partnerships, while hospital purchasing agreements secure volume placements. Online retail platforms facilitate rapid access for home users, and specialty distributors bridge the gap by delivering customized bundles and service contracts to niche care settings.

Portability considerations influence design trade-offs. Portable models emphasize lightweight construction and user-friendly interfaces to support on-the-go therapy, whereas stationary units deliver more robust performance profiles suited to clinical environments. Price tier segmentation correlates strongly with feature sets: economy models offer basic compression cycles with manual controls; mid-range systems integrate digital presets and moderate programmability; and high-end devices deliver advanced connectivity, data analytics, and multi-zone pressure management.

This comprehensive research report categorizes the Leg Compression System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Portability

- Distribution Channel

- Application

- End User

Illuminating critical regional dynamics and growth drivers across the Americas Europe Middle East Africa and Asia Pacific markets for leg compression therapies

In the Americas, robust infrastructure for outpatient and home care has accelerated adoption of portable electrical and battery-powered compression devices. Additionally, proactive reimbursement policies in North America incentivize the use of advanced prophylactic solutions in surgical settings, supporting steady uptake of both pneumatic and sequential technologies. Meanwhile, Latin American markets are characterized by a mix of public-sector procurement and private clinic investments, with cost-efficient mechanical systems retaining a strong foothold.

Within Europe, the Middle East, and Africa, diverse healthcare reimbursement frameworks shape demand. Western European nations exhibit high adoption of digital-enabled compression solutions driven by bundled payment models and strict clinical guidelines. In contrast, emerging markets in the Middle East and North Africa exhibit selective uptake, favoring pneumatic compression devices backed by government-sponsored thrombosis prevention initiatives. Across the EMEA region, distributors with localized service networks remain critical in bridging technical support gaps and ensuring regulatory compliance.

Asia-Pacific presents a tapestry of growth trajectories. Developed markets such as Japan and Australia demonstrate mature demand for high-end sequential compression systems integrated with electronic health record platforms. In contrast, Southeast Asian and South Asian countries are experiencing rising interest in portable and economy models, fueled by expanding home care services and cost containment measures. Manufacturers have responded with regionally tailored portfolios and in-market assembly partnerships to navigate tariff barriers and local certification requirements.

This comprehensive research report examines key regions that drive the evolution of the Leg Compression System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting competitive positioning strategies leadership initiatives and innovation pipelines of prominent organizations in the leg compression system arena

A handful of global medical device enterprises have cemented leadership through comprehensive portfolios spanning electrical, pneumatic, and mechanical systems. These organizations leverage economies of scale, extensive distribution networks, and robust R&D investments to continually enhance device ergonomics and digital integration. Their strategic roadmaps emphasize acquisitions of smaller specialist firms that bring niche compression technologies or analytics platforms into their ecosystems.

Innovative mid-sized players differentiate through agile development cycles and focused clinical collaborations, often partnering with leading hospitals to pilot next-generation features such as closed-loop pressure control and cloud-based therapy tracking. These agile innovators also experiment with novel materials and textile-embedded sensors to drive incremental performance gains. Furthermore, they exploit digital marketing channels and telehealth integrations to secure footholds in home care segments.

Regional specialists in EMEA and Asia-Pacific demonstrate strong local market knowledge, aligning product offerings with country-specific reimbursement policies and regulatory pathways. These companies often form joint ventures with international manufacturers to localize production, expedite approvals, and tailor service offerings. Collectively, their competitive strategies underscore the importance of adaptability, regional footprint, and value-added services in sustaining growth within a fragmented global marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Leg Compression System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arjo AB

- B. Braun Melsungen AG

- Bio Compression Systems, Inc.

- Cardinal Health, Inc.

- Devon Medical Products

- DJO Global, Inc.

- Essity AG

- Hyperice, Inc.

- Julius Zorn GmbH

- Medline Industries, LP

- Medtronic plc

- Mego Afek A.C. Ltd.

- Mölnlycke Health Care AB

- SIGVARIS International SA

- Smith & Nephew plc

- Tactile Systems Technology, Inc.

- Zimmer Biomet Holdings, Inc.

Formulating pragmatic strategic recommendations for industry leaders to capitalize on emerging trends optimize operational efficiencies and drive sustainable growth

Industry leaders should prioritize the development of modular platforms that accommodate multiple compression modalities within a single chassis, thereby streamlining manufacturing processes and offering end users greater flexibility. By focusing on interoperability with digital health ecosystems, especially electronic health records and telemedicine platforms, companies can enhance clinical adoption and foster stronger partnerships with healthcare providers.

At the same time, building resilient supply chains remains paramount. Stakeholders are advised to diversify component sourcing, pursue tariff-exempt manufacturing locations, and establish domestic assembly capabilities to mitigate import cost volatility. Collaborations with logistics partners specializing in cold-chain and medical-grade transportation can further improve service levels and reduce time-to-market for critical device shipments.

Moreover, investing in post-market clinical evidence generation will reinforce product value propositions. Real-world data studies that quantify reductions in post-operative complications and improvements in patient quality of life can be leveraged to secure favorable reimbursement terms and justify premium pricing tiers. Finally, cultivating direct-to-consumer engagement models through digital commerce channels and remote support services will expand market reach and strengthen brand loyalty among home users.

Detailing the rigorous multi-stage research methodology employed to gather analyze and validate comprehensive data insights within the leg compression sector

This research employed a multi-stage framework, beginning with a comprehensive review of public regulatory filings, product approvals, and patent databases to map the competitive landscape and innovation trajectories. Primary qualitative interviews were conducted with C-level executives, clinical specialists, and supply chain directors to capture nuanced perspectives on technology adoption, tariff impacts, and segmentation dynamics.

Quantitative data collection incorporated shipment records from industry associations, as well as procurement and usage statistics obtained through hospital electronic health record systems and home care service providers. These datasets were triangulated with company financial disclosures and tariff schedules to assess cost structures and market access patterns. Additional validation was achieved by convening expert panels comprised of vascular surgeons, rehabilitation therapists, and device engineers to critique preliminary findings and ensure methodological rigor.

Throughout the study, adherence to ISO standard research protocols and Good Clinical Practice guidelines ensured data integrity and ethical compliance. All insights were subjected to cross-verification using multiple sources, and any outlier data points were subjected to rigorous sensitivity analyses to confirm their validity and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Leg Compression System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Leg Compression System Market, by Product Type

- Leg Compression System Market, by Portability

- Leg Compression System Market, by Distribution Channel

- Leg Compression System Market, by Application

- Leg Compression System Market, by End User

- Leg Compression System Market, by Region

- Leg Compression System Market, by Group

- Leg Compression System Market, by Country

- United States Leg Compression System Market

- China Leg Compression System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding synthesized perspectives on market evolution competitive forces and strategic imperatives guiding the future trajectory of leg compression solutions industry

The leg compression market is at a pivotal juncture, energized by technological advancements, shifting reimbursement paradigms, and evolving patient care models. While increased tariffs in twenty-twenty-five have introduced supply chain complexities, they have also catalyzed strategic localization and cost optimization initiatives that will likely strengthen domestic manufacturing capabilities.

Segmentation analysis underscores the value of tailored product portfolios that address specific clinical applications, end-user preferences, and distribution frameworks. Regional insights reveal a nuanced interplay between regulatory environments and market adoption patterns, suggesting that success will hinge on the ability to navigate diverse healthcare infrastructures and reimbursement schemes. Competitive analysis further highlights the dual importance of scale-manifested in broad portfolios and global distribution-and agility, reflected in rapid innovation cycles and targeted clinical collaborations.

Looking ahead, companies that harmonize robust R&D investment with supply chain resilience, evidence-based value demonstrations, and digital health integration will be best positioned to capture the next wave of growth. The future trajectory of leg compression therapies will be shaped by stakeholders who can translate these imperatives into cohesive strategies that deliver both clinical and economic value.

Mobilizing decisive stakeholder engagement with Ketan Rohom for personalized access to the comprehensive leg compression market report

For tailored insights into the pioneering leg compression market research report and to explore how these findings can inform your strategic roadmap, please connect with Associate Director of Sales & Marketing, Ketan Rohom, to secure your copy and begin charting a path toward competitive differentiation and sustainable growth. Ketan Rohom stands ready to guide you through personalized consultations, answer any report-specific queries, and facilitate immediate access to the comprehensive analysis your organization requires. Reach out today and transform the way you approach leg compression innovation and market engagement.

- How big is the Leg Compression System Market?

- What is the Leg Compression System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?