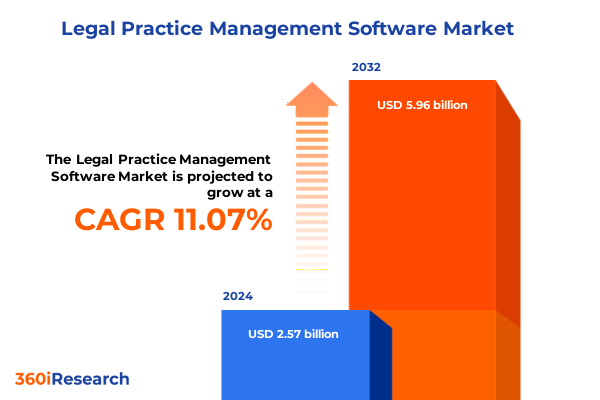

The Legal Practice Management Software Market size was estimated at USD 2.84 billion in 2025 and expected to reach USD 3.14 billion in 2026, at a CAGR of 11.15% to reach USD 5.96 billion by 2032.

Navigating the Complex Evolution of Legal Practice Management Software in an Era of Digital Transformation and Strategic Agility

Legal practice management software serves as the technological backbone for modern law firms, streamlining operations from client intake and matter management to billing and document handling. In an environment characterized by rapid digital change and evolving client expectations, these platforms have transitioned from simple case-tracking tools to comprehensive ecosystems that enhance productivity, compliance, and profitability. The functionality now spans advanced workflow automation, integrated communication channels, and sophisticated analytics that collectively empower legal professionals to focus on delivering high-value advisory services rather than administrative tasks.

As the marketplace becomes increasingly competitive, decision-makers must navigate a myriad of options, deployment models, and service offerings to select solutions that align with their organizational objectives. This executive summary synthesizes critical insights into the transformative shifts shaping the legal practice management software landscape, examines the impact of external factors such as trade policies, and presents segmentation and regional perspectives that reveal distinct user requirements. By integrating these findings, stakeholders can formulate strategies rooted in a clear understanding of technological innovation trends and operational imperatives, enabling them to optimize resource allocation, strengthen client relationships, and drive sustainable growth.

Examining the Transformative Shifts Redefining Legal Practice Management Software through AI Integration Cloud Scalability and Elevated Client Experience

The legal technology landscape is undergoing a profound metamorphosis driven by the convergence of artificial intelligence, cloud computing, and shifting client demands. AI-powered features such as automated document review, predictive analytics for litigation outcomes, and natural language processing for contract analysis are moving from proof-of-concept to production-ready capabilities, fundamentally redefining how legal services are delivered. Simultaneously, the widespread adoption of cloud infrastructure has enabled on-demand scalability, seamless remote access, and reduced dependency on in-house IT resources, accelerating migration away from legacy on-premise systems.

Moreover, clients now expect greater transparency, faster turnaround times, and collaborative interfaces that mirror consumer-grade digital experiences. This has catalyzed the integration of matter and billing modules with client portals, mobile applications, and customer relationship management frameworks. At the same time, robust data security and compliance controls have become non-negotiable in view of tightening regulatory standards and escalating cyber threats. As a result, leading providers are embedding encryption, multi-factor authentication, and continuous monitoring into core offerings. Taken together, these shifts demand that law firms and solution vendors adopt agile development practices, foster cross-functional partnerships, and prioritize user-centric design to deliver platforms that are both resilient and responsive to emerging market needs.

Assessing the Cumulative Impact of 2025 United States Tariffs on Legal Practice Management Software Costs Supply Chains and Technology Procurement

In 2025, United States trade policy changes introduced a suite of tariffs that have had material effects on both the development and deployment costs of legal practice management software. A 25% duty imposed on Chinese-origin cloud infrastructure components and SaaS-enabled services has increased the cost base for providers that rely on data centers and software platforms sourced from affected regions. Many established vendors have been compelled to explore alternative supply chains or negotiate revised service agreements to mitigate these elevated operating expenses.

Consequently, a 20% tariff applied to imported software licenses and intellectual property products has disrupted the traditional procurement pipelines for certain modules such as analytics, AI engines, and specialized document processing tools. This levy has particularly impacted mid-sized solution providers that historically partnered with overseas development houses, prompting them to evaluate diversification into European and South Korean technology ecosystems to preserve margin integrity.

Beyond software, hardware components underpinning on-premise implementations have not been immune. The baseline 10% duty on all computing imports, with China-specific rates reaching up to 54%, has driven significant price increases for servers, networking equipment, and workstations used in law firm environments. In response, some organizations are extending hardware refresh cycles, while others are accelerating investment in cloud-native architectures to sidestep sharply rising capital expenditures.

Taken as a whole, these tariffs have catalyzed a strategic reorientation among software vendors and end users alike, compelling more resilient technology procurement approaches, supply chain diversification, and a renewed emphasis on software-driven solutions that minimize reliance on imported hardware.

Uncovering Key Segmentation Insights That Illuminate the Diverse Needs for Services Software Deployment Models and End Users

The legal practice management software market exhibits a multifaceted segmentation structure that aligns solution features with the diverse operational demands of legal organizations. Each component offering can be categorized as either services or software, where professional consulting, integration support, and ongoing maintenance coexist alongside comprehensive platforms available as all-in-one suites or modular configurations tailored to specific functional needs. This duality enables firms to select holistic turnkey systems or assemble bespoke stacks by combining discrete modules for calendaring, document management, or client engagement.

When viewed through the lens of organizational scale, large enterprises often deploy robust, enterprise-grade platforms with extensive customization and dedicated support, whereas smaller practices and solo practitioners gravitate toward streamlined, cost-efficient configurations that deliver core case management and billing features with minimal overhead. Medium-sized firms typically occupy an intermediate position, balancing advanced capabilities with manageable implementation complexity.

Deployment preferences further differentiate the landscape, with cloud-based solutions gaining traction for their agility and subscription-based cost models, while certain traditionalists continue to rely on on-premise deployments to retain data sovereignty and in-house infrastructure control. Meanwhile, specialized application types such as legal calendaring and docketing, task management, and customer relationship management modules are integrated to address nuanced workflows. Across these segments, government agencies, corporate law firms, litigation boutiques, and solo practitioners each drive unique requirements, ensuring that leading providers must maintain flexible architectures capable of accommodating wide-ranging user profiles.

This comprehensive research report categorizes the Legal Practice Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Deployment Mode

- Application Type

- End User

Highlighting Key Regional Insights into the Adoption and Customization of Legal Practice Management Software across the Americas EMEA and Asia-Pacific Markets

Regional variation in the adoption and evolution of legal practice management software underscores distinct market drivers and strategic priorities. In the Americas, the embrace of cloud-native platforms has been particularly pronounced, fueled by an entrepreneurial legal market and regulatory frameworks that encourage digital transformation. Law firms across North and South America are prioritizing integration with financial systems, mobile-first user interfaces, and built-in analytics to optimize billing efficiency and client satisfaction in competitive commercial environments.

In the Europe, Middle East & Africa region, data localization and cross-border compliance requirements shape procurement decisions. Providers are investing heavily in regional data centers and certification processes to adhere to GDPR and emerging privacy laws. This has led to a hybrid infrastructure approach where sensitive matters are managed on-premise or within sovereign cloud environments, while standardized functions such as matter intake and e-billing are centralized in scalable SaaS offerings.

The Asia-Pacific market, driven by rapid economic growth and expanding legal services sectors, demonstrates a blend of accelerated cloud adoption and appetite for localized language support and region-specific workflow customization. Law firms in this region often seek modular solutions that can be rapidly deployed to address evolving legal frameworks, while enterprise clients demand seamless integration with enterprise resource planning systems and vertical-specific compliance modules.

This comprehensive research report examines key regions that drive the evolution of the Legal Practice Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Companies Driving Innovation through Comprehensive Ecosystems Strategic Alliances and Customer-Centric Excellence

Leading companies in the legal practice management software domain are distinguished by their comprehensive product roadmaps, strategic alliances, and relentless focus on user adoption. Market frontrunners have forged partnerships with cloud infrastructure providers, cybersecurity firms, and artificial intelligence innovators to deliver integrated ecosystems that address end-to-end operational and analytical needs. By leveraging open APIs and fostering a partner network, these organizations enable a rich marketplace of third-party extensions while maintaining strict compliance standards.

Meanwhile, established players continue to invest in customer success frameworks, providing tailored onboarding, ongoing training, and industry-specific best practices to maximize return on investment for clients. Their global delivery models combine centralized development teams with regional support centers, ensuring rapid response to localization demands and regulatory changes. In parallel, agile newcomers have captured attention by offering lean, modular suites that cater to niche workflows such as litigation management or corporate compliance, compelling incumbents to innovate and accelerate feature releases.

Collectively, this competitive dynamic has elevated the market’s sophistication, prompting a shift from one-size-fits-all solutions to curated offerings that blend core capabilities with specialized modules. As firms evaluate vendors, considerations around scalability, partner ecosystems, and the depth of AI-enabled services increasingly inform procurement strategies, setting the stage for continued industry consolidation and collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Legal Practice Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actionstep

- Aderant Holdings, Inc.

- Adobe Inc

- Athenahealth, Inc.

- BHL Software Pty. Ltd.

- Caret

- Clio by Themis Solutions Inc.

- CLOUDLEX, INC.

- CODY Computer Services, Inc.

- Fastcase, Inc. by vLex, LLC

- Greenway Health, LLC

- iManage LLC

- International Business Machines Corporation

- Intuit Inc.

- Lawmatics, Inc.

- LawPro Legal Systems Ltd.

- LexisNexis

- Matrix Pointe Software

- Microsoft Corporation

- Mitratech Holdings, Inc.

- MyCase, Inc.

- Orion Law Management Systems, Inc.

- Panther Software, LLC by Alpine SG

- PracticeSuite Inc.

- Relx PLC

- Rocket Matter, LLC

- Salesforce, Inc

- SAP SE

- Smokeball, Inc.

- SurePoint Technologies

- Tabs3 Software by Software Technology, LLC

- The Access Group

- Thomson Reuters Corporation

- Zoho Corporation Pvt. Ltd

- Zola Suite, LLC

Delivering Actionable Recommendations for Industry Leaders to Enhance Competitive Positioning through Technology Investments and Client-Focused Strategies

To secure a competitive edge in the evolving legal technology landscape, decision-makers should prioritize technology investments that align with both immediate operational needs and long-term strategic objectives. Begin by evaluating core platform capabilities against user adoption metrics, ensuring that interface design, mobile access, and collaboration features support seamless integration into daily workflows. Next, advance your practice’s AI roadmap by piloting automated document analysis, smart calendaring, and predictive insights to uncover efficiency gains and elevate service quality.

Simultaneously, technology leaders must strengthen cybersecurity and compliance postures through integrated threat-detection tools and robust data governance frameworks. Incorporate regular vulnerability assessments and leverage multi-factor authentication to safeguard client data and maintain regulatory adherence. Forge strategic partnerships with specialized providers to access niche functionalities without extensive in-house development, and foster an open-architecture stance that enables the continuous introduction of new innovations.

Finally, cultivate a culture of continuous learning by implementing structured training programs and performance dashboards that track key usage indicators. Engage stakeholders across practice groups to gather feedback and iterate on process optimizations. By embracing an agile, user-centric implementation methodology, firms can accelerate time-to-value, mitigate deployment risks, and position themselves as forward-thinking legal service providers capable of adapting to future market disruptions.

Detailing a Rigorous Research Methodology Underpinning Market Analysis with Data Triangulation Expert Interviews and Validation

The research methodology underpinning this analysis integrates multiple layers of data collection, validation, and expert insight to ensure a robust and reliable market perspective. Initial secondary research encompassed a comprehensive review of publicly available sources, including industry publications, regulatory filings, and technology vendor documentation. These findings were triangulated with proprietary repositories of market trends and usage patterns to establish a foundational dataset.

Building on this, primary research efforts engaged senior legal practitioners, technology executives, and consulting specialists through in-depth interviews and structured surveys. These interactions provided qualitative insights into purchasing criteria, deployment experiences, and feature priorities across diverse practice sizes, geographic regions, and application domains. Quantitative data points were then synthesized using statistical techniques to identify correlation between solution attributes and client satisfaction metrics.

A multi-stage validation process followed, involving peer review by the research firm’s internal subject-matter experts and external validation panels comprising law firm CIOs and compliance officers. Discrepancies were reconciled through follow-up consultations, ensuring that the final analysis reflects both market realities and projected adoption trajectories. This rigorous approach delivers confidence in the strategic recommendations and segmentation insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Legal Practice Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Legal Practice Management Software Market, by Component

- Legal Practice Management Software Market, by Organization Size

- Legal Practice Management Software Market, by Deployment Mode

- Legal Practice Management Software Market, by Application Type

- Legal Practice Management Software Market, by End User

- Legal Practice Management Software Market, by Region

- Legal Practice Management Software Market, by Group

- Legal Practice Management Software Market, by Country

- United States Legal Practice Management Software Market

- China Legal Practice Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding with Strategic Reflections on the Future of Legal Practice Management Software in a Digital and Client-Centric Era

This executive summary has outlined the pivotal trends, tariff influences, segmentation dynamics, regional variations, and competitive landscape shaping legal practice management software today. The convergence of artificial intelligence, cloud scalability, and client-centric design principles heralds a new era of operational efficiency and service differentiation in legal services. Concurrently, external factors such as trade policy shifts and cybersecurity imperatives underscore the necessity for firms to adopt resilient procurement strategies and fortified technology roadmaps.

Segmentation insights reveal that a one-size-fits-all approach is no longer sufficient; instead, law firms and solo practitioners must align solution configurations with their unique scale, domain focus, and compliance requirements. Regional nuances further highlight the importance of localized data governance, language support, and industry-specific customizations. Meanwhile, leading vendors continue to innovate through strategic partnerships, modular architectures, and comprehensive customer success programs.

As the legal sector navigates this complex landscape, informed decision-making grounded in reliable market intelligence will be the differentiator between incremental improvements and transformative leaps. By synthesizing these insights and recommendations, stakeholders are equipped to chart a course toward enhanced productivity, client engagement, and long-term growth within an increasingly digital and competitive environment.

Drive Your Strategic Advantage with a Personalized Consultation with Ketan Rohom for the Complete Legal Practice Management Software Report

If you are ready to gain a definitive competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing at our research firm. Ketan brings deep expertise in legal technology markets and can guide you through the extensive findings of this report, including bespoke insights tailored to your organization’s strategic objectives. By engaging directly with Ketan, you will secure access to detailed analyses, comparative evaluations, and actionable intelligence that can inform procurement decisions, technology roadmaps, and partnership strategies. Your discussion with Ketan will also include an exploration of implementation frameworks, risk mitigation approaches, and future trend projections to ensure your firm remains at the forefront of industry innovation. Seize this opportunity to transform your legal technology strategy with an authoritative, data-driven research asset-connect with Ketan Rohom today to purchase the complete market research report and begin charting a path toward enhanced efficiency, profitability, and client satisfaction.

- How big is the Legal Practice Management Software Market?

- What is the Legal Practice Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?