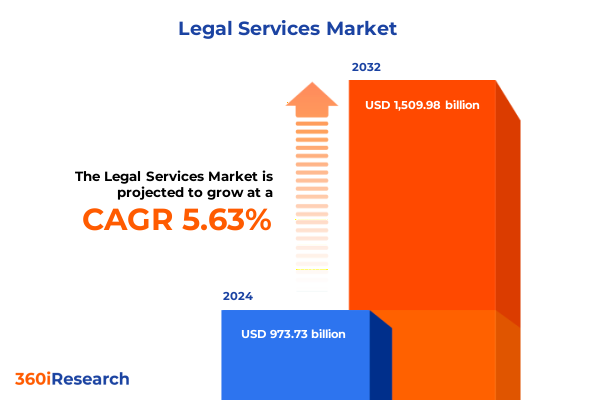

The Legal Services Market size was estimated at USD 1.02 trillion in 2025 and expected to reach USD 1.08 trillion in 2026, at a CAGR of 5.67% to reach USD 1.50 trillion by 2032.

Unveiling the Strategic Underpinnings and Core Imperatives of the Legal Services Market Amid Evolving Client Needs and Regulatory Complexities

The legal services landscape confronts an unprecedented convergence of client expectations, technological innovation, and regulatory evolution. As firms strive to align their offerings with evolving requirements, they must also navigate increasing cost pressures and demands for enhanced efficiency. In this context, an insightful executive summary illuminates the critical forces reshaping the market, establishes a clear understanding of stakeholder priorities, and sets the stage for strategic responses that drive both short-term resilience and long-term differentiation.

The executive summary synthesizes core themes such as the digitization of service delivery, the rise of alternative and hybrid provider models, and the imperative of agile compliance frameworks. It underscores how legal practitioners and departments are redefining collaboration models, leveraging data analytics for proactive counsel, and forging partnerships that transcend traditional firm–client dynamics. By articulating these foundational observations, the introduction primes decision-makers to engage deeply with the subsequent analysis and embrace the transformative shifts that characterize today’s market.

Exploring the Transformational Trends Reshaping Legal Service Delivery Models and Driving Operational Reinvention in Advisory Litigation and Transactional Practices

Over the past several years, the legal services market has undergone profound shifts in how value is delivered. Embracing digital platforms and cloud-based ecosystems, firms have adopted remote models to offer seamless access and real-time collaboration for clients scattered across geographies. Meanwhile, entrenched traditional models have been revitalized through strategic investments in proprietary technology, enabling on-premises teams to integrate advanced analytics and workflow automation into core processes. As a result, the industry is witnessing an iterative interplay between centralized operational hubs and distributed delivery nodes, each driving efficiency and client responsiveness in distinct yet complementary ways.

Simultaneously, the competitive landscape is evolving beyond legacy law firms. Alternative providers, including managed legal services and specialized niche consultancies, are leveraging their agility to capture segments of advisory, litigation, and transactional work that were once the exclusive domain of full-service practices. This shift demands that established firms reimagine their operating models, forging alliances, pursuing carve-out strategies, and embedding value-added capabilities such as flexible pricing, integrated technology platforms, and multidisciplinary teams. Collectively, these transformative trends are redefining the parameters of client engagement and operational reinvention across the legal spectrum.

Assessing the Influence of the 2025 United States Tariff Measures on the Strategic Direction and Operational Dynamics of Law Firms and Legal Departments

The imposition of new tariff measures by the United States in 2025 has exerted a multifaceted influence on the legal services sector, extending beyond trade and supply-chain counsel to ripple through corporate finance, transactional negotiations, and regulatory compliance functions. Law firms and in-house teams have expedited the development of specialized practices to interpret evolving tariff schedules, align client strategies with shifting cost structures, and mitigate exposure stemming from cross-border disputes. As a result, advisory services focusing on corporate restructuring and mergers & acquisitions have intensified, prioritizing resilience in the face of tariff-driven volatility in global markets.

In parallel, litigation specialists are navigating a surge in contract dispute cases, where force majeure clauses and tariff-related breach claims have become central. Firms versed in drug violations and white collar crimes are similarly experiencing heightened demand as enforcement agencies scrutinize tariff circumvention and fraud allegations. On the transactional front, real estate and joint venture teams are reevaluating deal structures, embedding enhanced tariff-impact analyses into lease agreements, partnership contracts, and corporate joint ventures. Collectively, these developments have catalyzed a strategic pivot toward more integrated, multidisciplinary service offerings that anticipate and address the full spectrum of tariff-induced risks.

Distilling Key Insights from Service Type Delivery Model Provider Firm Size Client Type and End-User Segmentation to Inform Strategic Positioning

A nuanced understanding of the legal services market emerges when mapping client needs against diverse segmentation lenses. Service type delineations reveal that advisory engagements are bifurcating into corporate advisory mandates-centering on restructuring and deal-making guidance-and tax advisory undertakings, which now combine compliance assurance with forward-looking planning strategies. Meanwhile, civil litigation practices continue to specialize in contract dispute resolution and personal injury claims, even as criminal litigation teams intensify focus on drug violation defenses and white collar crime mitigation. Transactional services have likewise split into business transactions and real estate transactions, with teams dedicated to joint ventures, partnership agreements, commercial property sales, and lease negotiations.

Complementing these functional breakdowns, the delivery model segmentation highlights a clear tension between traditional in-office frameworks and remote delivery architectures. Firms are calibrating hybrid approaches to balance face-to-face counsel with virtual efficiency. Provider classifications signal that government departments, established business firms, and private practitioners each occupy distinct niches, influencing service scope and pricing structures. Firm size elucidations-from global powerhouses to mid-tier and boutique practices-demonstrate divergent investment priorities in technology and talent. Client type analysis bifurcates demand between corporate enterprises seeking enterprise-grade solutions and individual consumers valuing personalized counsel. Finally, end-user segmentation across sectors including consumer goods, financial institutions, healthcare and life sciences, infrastructure and mining, manufacturing and transport, private equity, real estate, and technology underscores industry-specific legal imperatives that drive differentiated service design.

This comprehensive research report categorizes the Legal Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Model

- Provider

- Firm Size

- Client Type

- End-User

Unveiling Regional Demand Variations and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Legal Services Landscapes

The legal services market exhibits pronounced regional nuances that reflect underlying economic trajectories and regulatory frameworks. In the Americas, demand is buoyed by robust transactional deal flow and a growing emphasis on tax planning amid shifting federal and state compliance requirements. North American and Latin American jurisdictions alike present opportunities for litigation specialists, particularly in sectors such as energy and consumer goods, where contract disputes and environmental claims are prevalent.

Across Europe Middle East and Africa, firms are adapting to a mosaic of legal regimes, from single-market directives in the European Union to bespoke regulatory environments in Middle Eastern and African markets. Political shifts and trade agreements have compelled businesses to align governance practices regionally, elevating the role of cross-border counsel. As a result, multinational firms and alliance networks have deepened their presence, offering integrated advisory, compliance, and dispute resolution services tailored to the EMEA context.

In the Asia-Pacific region, rapid urbanization and infrastructure investment are driving demand for real estate transaction expertise, joint venture frameworks, and regulatory guidance in sectors like infrastructure mining and technology. The surging volume of cross-border mergers and joint development projects has intensified requirements for firms to maintain on-ground capabilities, cultural fluency, and agile tariff-compliance advisory, making Asia-Pacific a focal point for strategic expansion and local partnership models.

This comprehensive research report examines key regions that drive the evolution of the Legal Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Law Firms Alternative Providers and Innovative New Entrants Shaping Competitive Dynamics and Strategic Alliances in Legal Services

The competitive arena of legal services is increasingly characterized by diverse player profiles vying for market share and client loyalty. Leading global and national law firms continue to invest in integrated technology platforms, knowledge-management systems, and sector-focused practice groups to maintain their reputations for comprehensive expertise. Simultaneously, alternative providers-ranging from managed service centers to specialized litigation boutiques-are challenging the status quo through value-based pricing and streamlined process workflows.

Emerging entrants, including legal tech startups and advisory boutiques, are forging strategic alliances with established firms, combining innovative platforms for contract lifecycle management, e-discovery, and AI-powered due diligence. These partnerships amplify service offerings and accelerate time-to-value for clients. Additionally, corporate legal departments are evolving into hybrid providers, insourcing certain advisory and compliance functions while outsourcing high-volume litigation and transactional tasks to external partners. Collectively, this ecosystem of traditional incumbents, nimble disruptors, and hybrid in-house models is reshaping competitive dynamics, compelling all players to differentiate based on specialized expertise, client experience, and outcome-driven pricing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Legal Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advokatfirmaet Thommessen AS

- Allen & Gledhill LLP

- Allen & Overy LLP

- Amarchand & Mangaldas & Suresh A. Shroff & Co

- Baker & McKenzie

- Castrén & Snellman Attorneys Ltd.

- Clifford Chance LLP

- Clyde & Co LLP

- Consilio LLC

- Deloitte Touche Tohmatsu Limited

- DLA Piper LLP

- Egorov Puginsky Afanasiev & Partners

- Elevate Services, Inc.

- Ernst & Young Global Limited

- Integreon, Inc.

- Kirkland & Ellis LLP

- KPMG International Limited

- Latham & Watkins LLP

- Linklaters LLP

- Morgan, Lewis & Bockius LLP

- Osler, Hoskin & Harcourt LLP

- Skadden, Arps, Slate, Meagher & Flom LLP

Outlining Strategic Recommendations for Enhancing Client Value Optimizing Operational Efficiency and Embedding Sustainable Differentiation in Legal Services

To stay ahead in this dynamic environment, legal services organizations should prioritize investments in integrated digital platforms that facilitate seamless collaboration, knowledge sharing, and data-driven decision-making. By aligning technology roadmaps with client expectations-whether in high-stakes M&A negotiations or compliance monitoring-firms can demonstrate both agility and strategic foresight. Furthermore, adopting outcome-based pricing models can reinforce value orientation, incentivizing efficiency while ensuring alignment of interests between provider and client.

Operational transformation should also encompass talent strategy. Cultivating multidisciplinary teams that combine legal expertise with analytics, technology, and sector experience will enable firms to deliver nuanced insights and anticipate emerging risks. Partnerships with specialized legal tech vendors and alliances with domain-focused consultancies can further enhance service portfolios. Additionally, embedding sustainability and diversity considerations into firm governance and client engagement frameworks will bolster reputational currency and align with broader environmental social governance mandates. Together, these strategic imperatives will empower legal service leaders to craft resilient business models, differentiate offerings, and unlock new avenues for revenue and growth.

Detailing the Research Approach Utilizing Expert Interviews Secondary Research and Multi-Level Validation to Deliver Robust Legal Market Intelligence

This study integrates primary research conducted through in-depth interviews with senior partners, general counsel, and industry experts across key jurisdictions. Insights from these engagements were triangulated with comprehensive secondary research, encompassing regulatory filings, policy directives, sector publications, and reputable legal journals. The resulting dataset underwent multi-level validation, involving peer review by in-house analysts and external subject matter authorities to ensure accuracy and relevance.

Data synthesis leveraged thematic coding to identify recurring patterns across service segments, delivery models, and regional contexts. Analytical frameworks were applied to distill the interplay between tariff developments, litigation trends, and advisory innovations. Throughout the process, rigorous quality checks, including methodology audits and consistency reviews, ensured that findings are robust, transparent, and actionable for stakeholders seeking to navigate the complexities of today’s legal services market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Legal Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Legal Services Market, by Service Type

- Legal Services Market, by Delivery Model

- Legal Services Market, by Provider

- Legal Services Market, by Firm Size

- Legal Services Market, by Client Type

- Legal Services Market, by End-User

- Legal Services Market, by Region

- Legal Services Market, by Group

- Legal Services Market, by Country

- United States Legal Services Market

- China Legal Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Summarizing Key Takeaways on Market Drivers Strategic Imperatives and Critical Insights to Reinforce Decision-Making Among Legal Services Stakeholders

As the legal services sector accelerates toward digital integration and client-centric delivery, firms and in-house functions must recalibrate their strategic priorities. Emphasizing cross-functional collaboration, investing in specialized capabilities, and forging agile partnerships will be critical to meeting rising expectations around efficiency, cost predictability, and regulatory compliance. Moreover, the ability to anticipate and respond to external shocks-such as tariff adjustments and geopolitical shifts-will distinguish market leaders.

By absorbing the key takeaways outlined herein, stakeholders can refine operational blueprints, sharpen competitive positioning, and unlock new growth trajectories. The insights presented offer a foundation for informed decision-making, enabling organizations to pivot with confidence and harness the evolving contours of the legal landscape.

Connect with Ketan Rohom to Explore How This Comprehensive Legal Services Report Can Propel Your Strategic Initiatives and Sustainable Competitive Advantage

To secure a comprehensive grasp of market dynamics and capitalize on emerging opportunities, we invite you to arrange a personalized consultation with Ketan Rohom (Associate Director, Sales & Marketing). This exclusive discussion will delve into the unique challenges and strategic objectives facing your organization, allowing Ketan to recommend targeted research solutions that align precisely with your priorities. By leveraging the depth and rigor of our findings, you can refine your competitive strategies, optimize resource allocation, and accelerate your path to value creation in the legal services domain. Reach out now to transform data-driven insights into actionable plans that drive measurable results and sustainable growth.

- How big is the Legal Services Market?

- What is the Legal Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?