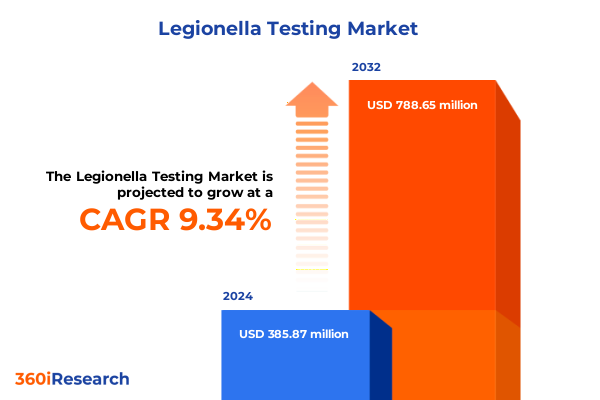

The Legionella Testing Market size was estimated at USD 421.31 million in 2025 and expected to reach USD 463.08 million in 2026, at a CAGR of 9.36% to reach USD 788.64 million by 2032.

Exploring the Fundamentals of Legionella Testing and Its Critical Role in Safeguarding Water Quality and Public Health

Legionella bacteria pose a significant threat to public health when they proliferate unchecked in water systems, demanding rigorous testing regimes to safeguard communities and infrastructure. The introduction of advanced diagnostic techniques over recent decades has transformed the detection landscape from labor-intensive culture methods to rapid molecular and biosensing platforms. These innovations have not only accelerated time-to-result but also improved sensitivity, thereby enabling more proactive water management strategies. At the same time, tightening regulatory frameworks have elevated the importance of standardized testing protocols, aligning scientific rigor with public safety imperatives.

Against this backdrop, industry stakeholders-from laboratory service providers to water utilities-have converged on a shared imperative: to deploy robust testing solutions that balance operational efficiency with stringent quality control. Water treatment facilities, commercial real estate managers, and healthcare institutions alike are recalibrating their monitoring practices in light of emerging evidence on Legionella’s resilience. In parallel, research institutions are advancing the knowledge base, refining assay parameters and exploring novel materials that can expedite on-site analysis. As a result, the Legionella testing domain sits at the intersection of technological innovation, regulatory compliance, and strategic risk mitigation.

This executive summary distills the essential trends and insights driving the current market environment. It synthesizes shifts in testing paradigms, assesses the impact of policy changes such as the 2025 United States tariffs, and unpacks complex segmentation dynamics spanning test methods, product classifications, and end-user demands. By laying out comprehensive regional and company-level intelligence, the summary aims to equip decision-makers with a nuanced understanding of opportunities and challenges inherent to the Legionella testing sector.

Unveiling the Technological Breakthroughs Operational Innovations Regulatory Overhauls and Global Standards Driving Transformation in Legionella Testing Safety

The Legionella testing industry has undergone a profound transformation driven by converging technological breakthroughs and regulatory evolutions. Automated biosensor platforms now offer in situ analysis with near real-time reporting, enabling facility managers to preempt outbreaks before they escalate. Concurrently, the integration of digital water monitoring systems with cloud-based analytics has ushered in a new era of predictive maintenance, effectively minimizing sampling blind spots and enhancing traceability across complex distribution networks.

Regulatory bodies worldwide have responded to rising public health concerns by revising guidelines to mandate more frequent surveillance and lower detection thresholds. In North America and Europe, these directives have catalyzed adoption of rapid immunoassays and polymerase chain reaction approaches that vastly outperform traditional agar culture in both speed and specificity. Moreover, industry alliances have formed to harmonize testing standards, fostering interoperability among instrument manufacturers, service providers, and compliance officers. This collaborative ethos is accelerating the validation of innovative methodologies, such as next-generation sequencing and microfluidic assays, which promise to redefine benchmarks for sensitivity and turnaround time.

Consequently, the competitive landscape is shifting away from legacy culture-based offerings toward end-to-end solutions that combine automated sample processing, multiplex detection, and data visualization. Companies that integrate supply chain resilience-particularly in the wake of tariff adjustments-and partner with regulatory agencies are emerging as preferred providers. As such, the sector is poised for an inflection point where agility in technology deployment and strategic regulatory engagement will determine market leadership.

Analyzing How 2025 United States Tariffs Are Reshaping Supply Chains Pricing Dynamics and Competitive Positioning in the Legionella Testing Market

The introduction of targeted tariffs by the United States in early 2025 has reshaped the economics of importing critical Legionella testing components, including high-precision biosensor modules and reagent-grade antibodies. Suppliers traditionally reliant on global manufacturing hubs have reevaluated their production footprints, with many opting to nearshore assembly operations or diversify their vendor base to mitigate cost pressures. This strategic realignment has yielded both short-term price volatility and long-term benefits, as domestic capacity investments reduce dependency on prolonged logistics cycles.

In parallel, testing laboratories and service providers have absorbed a portion of these additional costs, prompting negotiations for longer-term procurement agreements and volume-based discounts. Some industry leaders have leveraged tariff-induced supply chain disruptions as impetus for vertical integration, acquiring reagent manufacturers to secure direct access to critical consumables. Meanwhile, major equipment producers have introduced subscription-based models to offset upfront capital expenditures, effectively smoothing pricing impact for end users.

Looking ahead, the cumulative effect of these trade measures is fostering greater resilience within the Legionella testing ecosystem. By catalyzing local manufacturing capabilities and driving contract innovation, the tariff environment is shaping a more robust supply landscape. However, sustained stakeholder collaboration and transparent cost-sharing mechanisms will be essential to ensure that public health objectives remain fully aligned with economic realities.

Deciphering Critical Market Segmentation Dynamics Across Test Methods Product Types Applications End Users and Distribution Channels in Legionella Testing

Analyzing market segmentation reveals nuanced preferences and technological adoption patterns across diagnostic approaches, product categories, usage contexts and purchase pathways. In terms of test methods, traditional culture techniques coexist with membrane filtration culture, yielding proven reliability for regulatory compliance, while agar culture assays continue to serve as key reference standards. At the same time, immunoassays-such as enzyme-linked immunosorbent assays and lateral flow devices-have gained prominence for their speed and ease of use, particularly in decentralized settings where rapid decision-making is critical. Meanwhile, polymerase chain reaction methods have bifurcated into real-time quantitative assays for high-throughput laboratories and conventional PCR platforms that prioritize broader accessibility.

Turning to product type, the landscape spans automated and manual equipment designed to streamline workflows, complemented by kits, reagents and consumables that include high-affinity antibodies, optimized culture media, and next-generation DNA polymerases engineered for enhanced fidelity. Specialized service offerings-ranging from on-site sampling to laboratory-based confirmatory testing-cater to entities lacking in-house diagnostic capabilities. When considering applications, environmental monitoring remains the primary use case, often integrated into broader water safety management systems, while facility management teams rely on periodic testing to uphold building compliance standards. Water treatment operators also employ Legionella diagnostics to validate disinfection efficacy and support process optimization efforts.

End-user segments illustrate divergent needs: commercial building operators demand cost-efficient, rapid-turnaround solutions that minimize operational disruption, whereas healthcare facilities prioritize the highest sensitivity assays to safeguard vulnerable populations. Research institutes focus on method development and validation protocols, leveraging advanced platforms for investigative studies, and water utilities integrate Legionella testing into comprehensive network management strategies. Finally, distribution channels span direct sales relationships for tailored service arrangements, distributor partnerships that provide local support, and online platforms offering off-the-shelf kits for quick procurement, each enabling distinct routes to market and influencing adoption velocity across customer cohorts.

This comprehensive research report categorizes the Legionella Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Test Method

- Application

- End User

- Distribution Channel

Highlighting Regional Variations in Legislative Frameworks Technology Adoption Rates and Market Drivers Across Americas EMEA and Asia-Pacific for Legionella Testing

Regional dynamics in the Legionella testing sector reflect varying regulatory landscapes, infrastructure maturity and investment priorities. In the Americas, stringent federal and state-level guidelines mandate routine water system surveillance, driving demand for both rapid molecular assays and validated culture-based methods. Large-scale utilities and commercial property owners have accelerated adoption of integrated digital monitoring platforms, aligning test data with facility management systems to achieve real-time visibility and bolster public health compliance.

Europe, the Middle East and Africa present a mosaic of regulatory protocols shaped by EU directives, national statutes and localized guidelines. Western European countries have pioneered mandatory risk assessments and are increasingly embracing biosensor-enabled devices for point-of-use testing. In contrast, several markets across the Middle East and Africa are in earlier stages of standards development, prioritizing capacity building and training initiatives to uplift laboratory networks. Multinational equipment and reagent suppliers often collaborate with regional partners to tailor solutions that navigate diverse approval pathways and logistical considerations.

In the Asia-Pacific region, rapid urbanization and infrastructure expansion have spurred demand for cost-effective, scalable testing solutions. Water utilities and large-scale residential complexes increasingly incorporate Legionella diagnostics into broader environmental monitoring programs. Government-led initiatives to modernize public health laboratories have stimulated procurement of automated PCR systems and multiplex platforms, with online channels emerging as a vital conduit for distributing standardized test kits across remote geographies. Consequently, the region is witnessing accelerated uptake of hybrid models that blend centralized laboratory expertise with on-site rapid assay capabilities.

This comprehensive research report examines key regions that drive the evolution of the Legionella Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Strategic Initiatives Product Portfolios and Collaborations Shaping the Competitive Terrain of Legionella Testing

Leading stakeholders in the Legionella testing market are distinguished by their innovation pipelines, strategic alliances, and breadth of portfolio offerings. Global diagnostics companies have expanded their presence through acquisitions of specialized reagent manufacturers, enabling end-to-end solutions ranging from sample preparation to data analytics. Some pioneers in biosensor technology have forged partnerships with water utility conglomerates to pilot real-time monitoring networks, thereby generating critical case studies that validate performance under operational conditions.

Equipment manufacturers are differentiating through modular platforms that support both traditional culture assays and advanced molecular techniques, catering to laboratories with variable throughput needs. By introducing subscription-based service agreements, these companies are aligning their revenue models with long-term user requirements, fostering closer collaboration on instrument maintenance and software updates. Reagent and consumable suppliers continue to innovate with high-affinity antibody formulations and next-generation DNA polymerases that improve assay sensitivity and reduce false-positive rates.

Service providers specializing in on-site testing have scaled their operations via regional hubs, leveraging trained field technicians and standardized protocols to ensure consistency. In parallel, several firms have invested in digital portals that allow customers to track sample status, review historical data, and generate compliance reports. This emphasis on user experience, combined with a robust global footprint, is underpinning market share gains and influencing competitive positioning across key territories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Legionella Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Aquacert Ltd.

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- bioMérieux SA

- Bio‑Rad Laboratories, Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- Eiken Chemical Co., Ltd.

- Eurofins Scientific SE

- Hologic, Inc.

- Hydrosense Ltd.

- IDEXX Laboratories, Inc.

- Luminex Corporation

- Merck KGaA

- Neogen Corporation

- PerkinElmer, Inc.

- Pro‑Lab Diagnostics, Inc.

- Qiagen N.V.

- Quidel Corporation

- Roche Diagnostics

- Spartan Bioscience Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Formulating Strategic Imperatives for Stakeholders to Leverage Technological Advances Regulatory Compliance and Partnership Models in Legionella Testing

Industry leaders should prioritize the integration of automated and real-time diagnostic platforms to meet escalating regulatory requirements while optimizing operational efficiency. Adopting a hybrid testing strategy that balances rapid immunoassays with confirmatory molecular or culture-based methods can provide both speed and reliability, ensuring that critical water safety decisions are grounded in comprehensive data. Additionally, forging strategic partnerships with local service providers and regulatory bodies will facilitate smoother workflows and enhance compliance outcomes.

Furthermore, investing in supply chain resilience is imperative in light of recent tariff fluctuations, and organizations should explore nearshoring components or establishing dual-source agreements to mitigate cost volatility. From a product development perspective, emphasizing interoperability between testing instruments and digital water management systems can differentiate offerings and drive user adoption. Equally important is the training of facility management personnel and laboratory technicians on new methodologies to ensure accurate implementation and sustained quality control.

Lastly, companies should consider flexible commercial models-such as subscription services and performance-based contracts-that align incentives with end-user success metrics. By coupling technology innovation with customer-centric engagement strategies, stakeholders can reinforce their market position and foster long-term relationships in an increasingly dynamic Legionella testing environment.

Detailing the Robust Multi-Phased Research Framework Incorporating Primary Interviews Secondary Data Analytics and Validation Protocols for Market Insight Generation

This research adheres to a comprehensive, multi-phased methodology designed to generate robust and actionable market insights. The process commenced with an extensive secondary data review, encompassing regulatory guidelines, scientific literature, manufacturer catalogs, and industry whitepapers to establish a foundational understanding of testing modalities and market structures. Concurrently, patent analyses and product registries were examined to identify innovation trajectories and competitive benchmarks.

In the primary research phase, in-depth interviews were conducted with a diverse panel of stakeholders, including senior laboratory directors, water utility executives, regulatory agency representatives, and technology innovators. These dialogues probed market pain points, adoption drivers, and future technological ambitions. The qualitative insights were subsequently triangulated with quantitative data drawn from anonymized customer surveys and historical procurement trends, ensuring that findings were validated across multiple sources.

To reinforce the credibility of the analysis, the study employed a rigorous validation protocol involving expert workshops and peer reviews. Drafted insights were subjected to critical appraisal by independent consultants and industry veterans, leading to iterative refinements. Finally, data modeling techniques were applied to integrate segmentation, regional, and competitive intelligence, yielding a cohesive narrative that aligns with observed market dynamics and stakeholder expectations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Legionella Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Legionella Testing Market, by Product Type

- Legionella Testing Market, by Test Method

- Legionella Testing Market, by Application

- Legionella Testing Market, by End User

- Legionella Testing Market, by Distribution Channel

- Legionella Testing Market, by Region

- Legionella Testing Market, by Group

- Legionella Testing Market, by Country

- United States Legionella Testing Market

- China Legionella Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Industry Implications to Provide a Cohesive Perspective on the Future Direction of the Legionella Testing Landscape

The examination of current and emerging trends in Legionella testing underscores a pivotal shift toward rapid, automated and digitally integrated solutions. Technological advancements in biosensors, real-time polymerase chain reaction, and immunoassays are converging to deliver enhanced sensitivity and reduced turnaround times, thereby enabling proactive water safety management. Concurrently, evolving regulatory frameworks-accentuated by 2025 United States tariffs-are reshaping supply chain strategies and encouraging the localization of critical components to bolster resilience.

Segmentation analysis reveals that laboratories and service providers must navigate a diverse array of test methods, product types, applications, end-user requirements and distribution channels. Adopting flexible, hybrid diagnostic strategies will be key to addressing the distinct demands of commercial buildings, hospitals, research institutes and water utilities. Regionally, the Americas, EMEA and Asia-Pacific each present unique regulatory landscapes and infrastructure capabilities, necessitating tailored approaches to product deployment and customer engagement.

Competitive dynamics are informed by leading companies’ emphasis on portfolio breadth, digital integration and collaborative ventures. To capitalize on these insights, industry stakeholders should pursue strategic imperatives that balance innovation investment, regulatory alignment and supply chain optimization. Ultimately, organizations that proactively adapt to technological, policy and market shifts will be best positioned to advance water safety objectives and secure a leadership role in the Legionella testing domain.

Engage with Ketan Rohom to access specialized Legionella testing insights empower informed decision-making and secure your comprehensive market research report today

Engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to unlock unrivaled insight into the complexities of the Legionella testing arena. Collaborating with Ketan ensures that your organization gains bespoke guidance on navigating technological innovations, regulatory imperatives, and competitive strategies tailored to your unique operational needs. By securing this comprehensive market research report, stakeholders will benefit from data-driven clarity, facilitating investments in cutting-edge testing solutions and enhancing risk mitigation frameworks.

Ketan’s expertise spans both sales and marketing dimensions, enabling him to bridge the gap between strategic objectives and actionable market intelligence. His leadership in delivering targeted analyses empowers decision-makers to accelerate product development roadmaps, optimize supply chains in light of evolving tariffs, and refine segmentation approaches across test methods, product categories, and distribution channels. Initiating a conversation with Ketan today positions your organization at the forefront of Legionella testing innovation, ensuring that you not only meet current compliance standards but also anticipate future shifts in water safety protocols.

To proceed, reach out through the dedicated inquiry portal and request immediate access to the full market research dossier. Elevate your risk management, align your investment priorities with real-world adoption patterns, and partner with an authoritative resource committed to your success in the dynamic Legionella testing landscape.

- How big is the Legionella Testing Market?

- What is the Legionella Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?