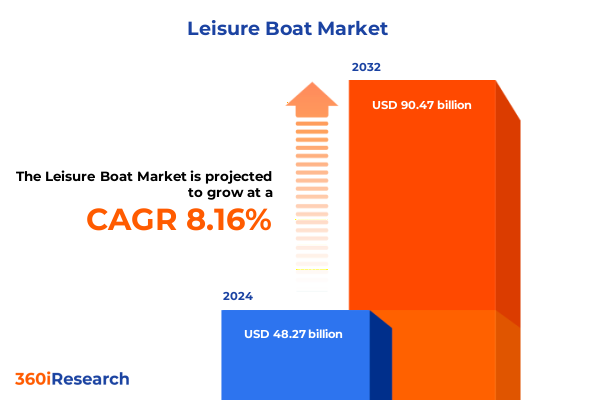

The Leisure Boat Market size was estimated at USD 52.01 billion in 2025 and expected to reach USD 56.05 billion in 2026, at a CAGR of 8.22% to reach USD 90.47 billion by 2032.

Exploring the Current Landscape of Leisure Boating Through Emerging Trends and Consumer Preferences That Are Shaping Industry Dynamics

The leisure boat market has undergone dynamic evolution, fueled by rising disposable incomes and an expanding demographic of consumers seeking premium recreational experiences on water. Recent years have seen advents in user-friendly digital platforms for boat rental and charter services, enabling spontaneous excursions and access to a wider range of vessels. Meanwhile, a generational shift has directed preferences toward sustainability, as eco-conscious boaters demand powertrains that minimize environmental impact and hull materials that offer durability without compromising recyclability. This multichannel confluence of technological innovation and evolving consumer habits highlights the need for market participants to remain nimble and responsive to swiftly changing expectations.

At the same time, strategic collaborations between traditional manufacturers and emerging technology firms have accelerated the introduction of electric and hybrid propulsion systems. Industry stakeholders are increasingly focused on forging partnerships that can blend marine expertise with battery management, charging infrastructure, and software integration. Consequently, boat builders are rethinking core product design to integrate digital dashboards, connectivity solutions, and modular components that enhance customization. As the market moves beyond conventional gasoline-powered craft, companies must balance legacy operational models with investments in next-generation platforms to capture new segments and stay ahead of competitive pressures.

Understanding the Transformative Technological, Regulatory, and Consumer Shifts Redefining the Future of Leisure Boats Around the World

Technological advancements in battery chemistry and electric motors have heralded a profound transformation in vessel propulsion, spurring a surge of interest in silent cruising and zero-emission excursions. Simultaneously, tightening global emissions standards have compelled legacy boat manufacturers to expedite the development of low-emission engines and adopt alternative fuel options. These regulatory shifts, together with evolving consumer attitudes toward environmental stewardship, have reset the competitive playing field and driven innovation in hull design and powertrain optimization.

Moreover, digitalization is revolutionizing how boats are marketed, sold, and serviced. Online marketplaces equipped with virtual showrooms and 3D simulators allow prospective buyers to explore layouts and trim levels remotely. Cloud-based maintenance platforms enable remote diagnostics and predictive servicing, reducing downtime and extending vessel lifecycles. Transitioning from traditional dealership models to omnichannel strategies, companies are leveraging data analytics to tailor offerings and engage directly with end users throughout the ownership journey.

Analyzing the Cumulative Impact of United States Tariffs on Import Costs, Supplier Strategies, and Price Structures in 2025

In 2025, the imposition of increased tariffs on imported steel, aluminum, and composite materials by the United States government has exerted pressure across the entire leisure boat value chain. Boat manufacturing costs have risen as producers adjust sourcing strategies and negotiate with multiple suppliers to mitigate duty-related surcharges. Although some builders have pursued nearshoring to North American suppliers, others have absorbed higher input costs, weighing the trade-off between maintaining price competitiveness and preserving design integrity.

These tariffs have also impacted aftermarket supply networks, where elevated costs for spare parts and accessory components have challenged service providers to engineer cost-efficient repair solutions. In response, several original equipment manufacturers have renegotiated long-term procurement contracts and instituted tiered pricing models for different customer segments. Looking ahead, continuous dialogue between industry associations and policymakers will be critical to achieving a stable duty regime that balances domestic industry protection with the need for affordable leisure boating experiences.

Revealing Key Segmentation Insights That Drive Customization of Leisure Boat Offerings Across Types, Propulsion, Materials, Sizes, and End Use

Insight into leisure boat segmentation reveals how diverse consumer needs and operational use cases shape product development and go-to-market approaches. Based on boat type, manufacturers are tailoring lines across personal watercraft, sailboats, and yachts. Sit-down and stand-up personal watercraft models are being enhanced for adrenaline-seeking users, while monohull and multihull sailboats receive upgrades in rigging efficiency and onboard comfort to appeal to cruising enthusiasts. Motor yachts and sailing yachts alike are integrating smart control systems to deliver seamless navigation and energy management.

Examining propulsion, the market’s shift toward diesel-powered and gasoline-powered boats remains significant for long-range applications, yet electric-boat adoption is gaining momentum in marinas and inland waterways due to zero-emission advantages. Hybrid-powered vessels, meanwhile, are emerging as an attractive compromise for boaters seeking extended range without sacrificing environmental performance. When it comes to hull material, aluminum continues to dominate segments requiring robustness and corrosion resistance, but fiberglass retains its leadership in cost-effective production for recreational craft. Inflatable materials have carved a niche in compact tender boats, while steel and wood find enduring appeal in custom and heritage builds.

Size-based differentiation also drives purchasing behavior, from nimble boats under sixteen feet ideal for day trips to offshore-capable vessels between sixteen and forty feet prized by coastal cruisers, and over-forty-foot yachts serving luxury charter and private-owner markets. End user segmentation spans commercial operations in fishing and tourism through government agencies such as coast guard and law enforcement, and private owners who divide their time between high-performance racing and leisurely recreational use. By aligning product roadmaps with specific profiles, manufacturers can optimize investment in research, production, and targeted sales initiatives to capture the unique value propositions of each segment.

This comprehensive research report categorizes the Leisure Boat market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Boat Type

- Propulsion

- Material

- Size

- End User

Uncovering Critical Regional Insights Across the Americas, Europe Middle East and Africa, and Asia Pacific Leisure Boat Markets Under Evolving Dynamics

Geographic dynamics remain a defining force in shaping regional market trajectories. In the Americas, well-established boating cultures in North America coexist with expanding recreational industries across South America. Manufacturers in these markets are prioritizing adaptability, launching modular models that can be configured to meet diverse coastal and inland waterway requirements. This region’s mature dealer networks and vibrant charter ecosystems underpin demand for both entry-level craft and high-end yachts.

Within Europe, the Middle East, and Africa, stringent environmental regulations and advanced marina infrastructure in Western Europe contrast with rapidly developing leisure boating sectors in the Gulf region and parts of sub-Saharan Africa. For example, luxury yacht builders are intensifying efforts to integrate waste management systems and shore-power compatibility to comply with regional directives. Across Asia Pacific, the confluence of rising incomes, improved port facilities, and government incentives for tourism is driving swift uptake of recreational vessels. Local manufacturers are increasingly collaborating with international designers to create boats tailored to the unique sea conditions and cultural preferences of these markets.

This comprehensive research report examines key regions that drive the evolution of the Leisure Boat market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Innovative Strategies Shaping the Competitive Leisure Boat Landscape

Leading companies are differentiating themselves through product innovation, strategic partnerships, and expanded service portfolios. Global manufacturers have introduced high-performance electric motor yachts, collaborating with battery specialists to address range limitations and safety standards. At the same time, traditional builders are leveraging their heritage craftsmanship to launch bespoke yacht lines, combining artisanal woodwork and advanced composites to satisfy discerning private owners.

On the supply side, component producers are forging alliances with testing laboratories to accelerate regulatory compliance for new propulsion systems and encourage international standardization. Distribution channels have become increasingly digital, with market leaders deploying integrated e-commerce platforms for spare parts and accessory sales. Aftermarket service firms are also elevating their capabilities by establishing regional centers of excellence for rapid-response maintenance and parts provisioning. Collectively, these competitive maneuvers demonstrate a commitment to end-to-end customer engagement and underscore the importance of continuous innovation in preserving market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Leisure Boat market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- Apache Powerboats

- Axopar Boats Oy

- Azimut Benetti S.p.A.

- Bavaria Yachtbau GmbH

- Bertram Yachts LLC

- Better Boats, Inc.

- Bombardier Recreational Products Inc.

- BPS Direct, L.L.C.

- Brisbane Boating & Leisure

- Brunswick Corporation

- Catalina Yachts

- Chaparral Boats, Inc.

- Farr Yacht Design Ltd.

- Ferretti S.p.A.

- Fincantieri S.p.A.

- Fleming Yachts

- Fulcrum Speedworks

- Grady-White Boats, Inc.

- Groupe Beneteau

- Iconic Marine Group

- Leonardo S.p.A.

- Lyman-Morse Boatbuilding, Inc.

- Malibu Boats, Inc.

- Marine Products Corporation

- MarineMax, Inc.

- MasterCraft Boat Holdings, Inc.

- Polaris Inc.

- Raymarine by Teledyne FLIR LLC

- Sabre Corporation

- Sunseeker International Ltd

- Tiara Yachts, Inc.

- Tige Boats, Inc.

- Viking Yacht Company

- Winnebago Industries, Inc.

- X Shore AB

- Yamaha Motor Co., Ltd.

- Yanmar Co., Ltd.

- Zodiac Nautic

Formulating Actionable Recommendations for Industry Leaders to Navigate Challenges and Capitalize on Emerging Opportunities in Leisure Boating

Industry leaders should prioritize investment in electrification initiatives to capture emerging segments demanding zero-emission performance. By establishing partnerships with energy providers and marina operators, they can facilitate charging infrastructure rollout and vehicle-to-grid experimentation, positioning their brands at the forefront of sustainable boating.

Simultaneously, diversifying procurement networks to include local and nearshore suppliers will mitigate the risks posed by fluctuating tariffs and logistical bottlenecks. Manufacturers can further streamline operations through modular design frameworks, enabling cost-effective customization without sacrificing economies of scale. In parallel, strengthening aftermarket service capabilities by deploying predictive maintenance solutions will enhance operational uptime and drive recurring revenue streams.

Finally, a targeted marketing approach that leverages data analytics to segment audiences by usage patterns and regional preferences will optimize promotional spend and improve conversion rates. Companies should also invest in training programs for dealer networks and service technicians to ensure consistent brand experiences across geographic markets. These combined actions will empower industry participants to navigate uncertainty and unlock sustainable growth pathways.

Detailing a Rigorous Research Methodology That Ensures Accuracy, Validity, and Depth in Leisure Boat Market Analysis

This report is grounded in a mixed-method research framework, combining extensive primary interviews with manufacturers, distributors, and end users, alongside rigorous secondary research across trade journals, regulatory filings, and proprietary databases. Primary engagement involved structured discussions with senior executives to understand strategic priorities, as well as in-depth surveys with boat owners to capture firsthand usage insights and satisfaction metrics.

Secondary research included analysis of tariff schedules, material cost indices, and docking infrastructure developments to contextualize market drivers. Quantitative data was triangulated through cross-validation techniques, ensuring that findings are robust and reflective of multiple perspectives. Regional specialists provided on-the-ground intelligence, while technology consultants contributed expertise on emerging propulsion systems and digital solutions.

A multilevel segmentation approach was applied to dissect the market by vessel type, powertrain, material, size, end user, and geography. This rigorous methodology ensures a comprehensive understanding of competitive dynamics and emerging trends, equipping decision-makers with reliable insights to inform strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Leisure Boat market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Leisure Boat Market, by Boat Type

- Leisure Boat Market, by Propulsion

- Leisure Boat Market, by Material

- Leisure Boat Market, by Size

- Leisure Boat Market, by End User

- Leisure Boat Market, by Region

- Leisure Boat Market, by Group

- Leisure Boat Market, by Country

- United States Leisure Boat Market

- China Leisure Boat Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Drawing Conclusive Insights on the Evolving Leisure Boat Market to Inform Strategic Decision Making and Investment Priorities

The leisure boat market is at a pivotal juncture, shaped by converging forces of environmental regulation, consumer demand for experiential recreation, and ongoing technological innovation. As electric and hybrid powertrains transition from niche to mainstream, the landscape will reward organizations that can balance sustainability imperatives with compelling performance and design.

Tariff fluctuations underscore the importance of supply chain resilience and strategic sourcing, while regional market variances highlight tailored approaches as essential for success. Segmentation insights confirm that the ability to cater to distinct user profiles-from commercial fishing operations to private racing enthusiasts-remains central to sustained differentiation. Ultimately, companies that integrate advanced analytics, agile manufacturing, and customer-centric service models will chart the most successful course and secure leadership positions in the rapidly evolving leisure boat arena.

Engage with Our Associate Director to Secure Comprehensive Market Intelligence and Drive Business Growth in Leisure Boating Today

If you are ready to transform your understanding of the leisure boat market and position your organization for success, reach out today to explore how this report can empower your next strategic move. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the report’s insights, explain the depth of analysis, and outline customized packages tailored to your specific needs. His expertise will ensure you extract maximum value, whether you are evaluating entry into a new regional market, refining product portfolios, or optimizing supply chain partnerships. By engaging with a dedicated expert, you will gain clarity on critical market drivers and recommended approaches to deliver tangible returns on investment. Secure your access to the definitive leisure boat market research report and chart a course toward sustained competitive advantage.

- How big is the Leisure Boat Market?

- What is the Leisure Boat Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?