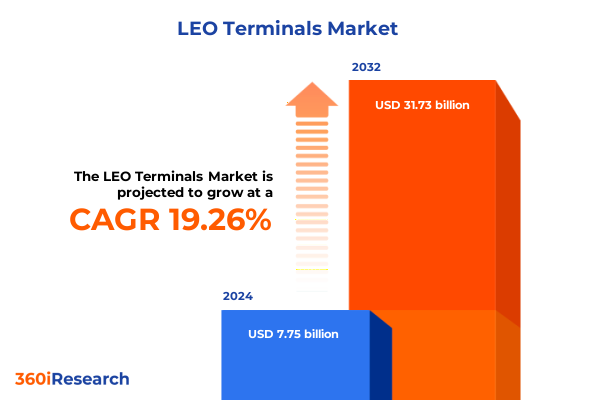

The LEO Terminals Market size was estimated at USD 9.20 billion in 2025 and expected to reach USD 10.94 billion in 2026, at a CAGR of 19.33% to reach USD 31.73 billion by 2032.

Catalyzing the Next Connectivity Revolution Through Advanced Low Earth Orbit Terminals and Innovative Deployment Strategies

Across the connectivity landscape, low Earth orbit terminals have emerged as a crucial enabler for bridging global digital divides by delivering high-speed, low-latency broadband to regions beyond the reach of traditional terrestrial networks. As traditional infrastructure encounters barriers such as remote terrain and prohibitive build-out costs, these advanced satellite terminals offer a versatile solution capable of supporting consumer broadband applications as well as specialized enterprise and government use cases. This dynamic has catalyzed unprecedented demand for compact, resilient hardware capable of operating seamlessly across diverse environments, from maritime vessels to emergency response vehicles.

Emerging Technologies and Geopolitical Forces Driving a Paradigm Shift in the Low Earth Orbit Terminal Ecosystem Landscape and Competitive Dynamics

The low Earth orbit terminal market is undergoing a paradigm shift driven by rapid technological advancements and evolving geopolitical imperatives. Innovations in phased array beamforming have yielded flatter, lighter antennas that dramatically reduce power consumption while maintaining high throughput, enabling integration onto mobility platforms and urban infrastructure alike. Meanwhile, multi-constellation architectures are setting new expectations for seamless handovers between orbital layers, prompting terminal manufacturers to embrace open standards and modular designs that support dynamic network interoperability.

Simultaneously, public and private stakeholders are forging strategic alliances to accelerate constellation deployments and shared ground infrastructure. These partnerships range from telescope-style cooperative launch manifest programs to policy collaborations aimed at refining spectrum allocation and space traffic management. As national governments seek sovereign control over communications infrastructures, regional players in Europe and Asia are prioritizing local alternatives to mitigate reliance on U.S. providers. This interplay between innovation and policy is reshaping competitive dynamics, placing a premium on ecosystem orchestrators who can deliver turnkey connectivity solutions across hardware, network services, and managed operations.

Assessing the Consequential Role of 2025 United States Tariff Measures on the Import and Deployment of LEO Satellite Terminals

U.S. trade policies enacted in 2025 have introduced new tariff measures targeting imported electronics, structural materials, and precision components crucial to LEO terminal manufacturing. These levies have incrementally raised production costs by an estimated 10 to 15 percent for many domestic satellite equipment providers, as higher input prices cascade through the supply chain. Component manufacturers, particularly those reliant on Asian-sourced raw materials and semiconductors, are reporting extended lead times and supply uncertainties, eroding the economies of scale that underpin affordable consumer-grade terminal offerings.

In response to these pressures, industry stakeholders are pivoting toward domestic sourcing strategies, establishing joint ventures for in-house production of mission-critical subsystems, and actively lobbying for tariff exemptions on aerospace-specific trade policies. Concurrently, some international competitors based in regions with fewer trade barriers are intensifying their market entry efforts, leveraging cost advantages to secure enterprise and government contracts. This evolving tariff environment underscores the importance of adaptive supply chain resilience and strategic policy engagement for sustaining long-term competitiveness in the U.S. market.

Uncovering Critical Insights from Diverse Segmentation Perspectives to Decode Patterns in Low Earth Orbit Terminal Deployment and Usage

Evaluating the market through the lens of terminal type reveals a clear stratification: handheld devices address mission-critical portability needs, while large and medium terminals-further sub-classified by physical dimensions-cater to sectors requiring sustained power and bandwidth, such as maritime and fixed enterprise sites. These size-based distinctions influence not only deployment scenarios but also cost structures and end-user value propositions, with the largest terminals offering the highest throughput at a premium. Application segmentation underscores broadband connectivity as the primary driver, subdivided into consumer and enterprise streams that reflect divergent performance and service guarantees; meanwhile, M2M and IoT deployments, organized into consumer and industrial verticals, highlight the growing role of automated, low-data-rate communication in remote asset management and environmental monitoring. Emergency services and video-centric mission profiles further diversify demand, demanding rapid-deploy, high-resolution data pipelines in critical scenarios.

End-user segmentation spans commercial, government, and military domains. Commercial applications in aviation, maritime, and telecom operations drive volume throughput and service innovation, while government deployments by research institutes and space agencies prioritize scientific and regulatory objectives. Military use cases, defined by air force, army, and naval requirements, exert influence on terminal durability standards and encryption capabilities. Frequency band segmentation-spanning S, X, Ku, and Ka bands with high and low Ka subdivisions-shapes antenna design and spectrum management strategies, while technology type differentiation among hybrid, phased array, and reflector systems reflects a continuum of performance, cost, and adaptability.

This comprehensive research report categorizes the LEO Terminals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Terminal Type

- Frequency Band

- Technology Type

- Application

- End User

Examining Regional Dynamics and Growth Drivers Shaping Low Earth Orbit Terminal Adoption Across Americas, Europe Middle East & Africa, and Asia-Pacific

In the Americas, the advanced economies of the United States and Canada are fueling robust demand for LEO terminals through policy-driven funding initiatives such as the FCC’s Rural Digital Opportunity Fund, which incentivizes operators to extend broadband into underserved areas. North American manufacturers are leveraging these incentives to scale production of electronically steered antennas and modular ground kits designed for rapid deployment, establishing the region as both a leading market and innovation hotspot. Enterprise uptake spans sectors from remote oil and gas operations to aviation connectivity, reflecting a broad appetite for resilient, high-capacity communications solutions in both consumer and institutional contexts.

Europe, Middle East and Africa are characterized by strategic investments in sovereign satellite capacity and multi-orbit architectures, with the European Commission backing projects like Iris² to reduce reliance on non-EU providers. National programs in the Gulf states are similarly channeling public-private capital into constellation participation and terminal R&D, driving a fragmented yet rapidly maturing market. In Asia-Pacific, high-growth trajectories are led by China’s ambitious launch cadence-accounting for the majority of projected LEO satellite deployments-alongside accelerated digital inclusion efforts in India and Australia. These markets prioritize versatile, low-cost terminal solutions to bridge digital divides and support burgeoning IoT ecosystems across agriculture, logistics, and smart city initiatives.

This comprehensive research report examines key regions that drive the evolution of the LEO Terminals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Strategic Roles and Competitive Advantages of Leading Enterprises Innovating in the Low Earth Orbit Terminal Market

SpaceX’s Starlink terminal portfolio remains the benchmark for high-volume consumer and enterprise deployments, with continuous hardware iterations that balance cost, performance, and ease of installation. Its vertically integrated manufacturing and launch model has enabled rapid global expansion and frequent feature rollouts, from reduced dish form factors to enhanced network handoff capabilities. Amazon’s Project Kuiper, armed with deep logistical and capital resources, faces initial production hurdles yet is positioned to compete vigorously in the enterprise and government arenas as its first wave of user terminals enters service.

OneWeb has carved out a niche in government and commercial backup connectivity, leveraging partnerships with established satellite operators to gain market traction. Collaborations with maritime terminal developers and telecom infrastructure providers underscore its focus on specialized high-margin verticals. Telesat’s Lightspeed initiative, underpinned by strategic alliances with Viasat and niche integrators, is targeting the aviation and defense sectors with terminals designed for avionics-grade resilience and certified security protocols.

Emerging players such as Isotropic Systems, Kymeta, and key Chinese state-supported consortia are accelerating the pace of innovation in terminal design, integrating flat-panel phased arrays, software-defined payload management, and cross-constellation handoff algorithms. These entrants are forging strategic alliances with mobile network operators and defense contractors to ensure interoperability and secure market footholds, challenging incumbents to continually enhance modularity, efficiency, and cost competitiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the LEO Terminals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AvL Technologies

- Cobham Limited

- DataPath, Inc.

- EchoStar Corporation

- Hughes Network Systems, LLC

- Hytera Communications Corporation Limited

- Intellian Technologies, Inc.

- Iridium Communications Inc.

- Kymeta Corporation

- L3Harris Technologies, Inc.

- ND SatCom GmbH

- Satixfy UK Limited

- STMicroelectronics N.V.

- TE Connectivity

- Thales Group

- The Boeing Company

- Viasat, Inc.

Implementing Actionable Strategies for Industry Leaders to Enhance Resilience, Drive Innovation and Maximize Opportunities in the Evolving LEO Terminal Sector

Industry leaders are advised to embed interoperability standards within terminal development roadmaps, ensuring seamless multi-constellation handovers and reducing integration risk for end users. Investing in domestically shielded supply chains can mitigate tariff exposure while fostering local partnerships to secure critical raw materials and subsystems. Moreover, adopting modular hardware architectures and software-centric upgrades will extend product lifecycles and accommodate evolving bandwidth and encryption requirements without necessitating full hardware replacement.

Forward‐looking organizations should also cultivate strategic alliances across the ecosystem-linking satellite operators, network service providers, and vertical industry integrators. Co-development agreements for next‐generation electronically steered antennas, combined with bundled service contracts, will strengthen value propositions and streamline procurement. Finally, maintaining an agile R&D pipeline with dedicated resources for emerging use cases-such as 5G NTN integration and AI-driven network optimization-will be critical for capturing growth in specialized segments like autonomous mobility and real-time remote sensing.

Detailing the Rigorous Research Methodology and Analytical Framework That Underpins the Quality and Reliability of This Low Earth Orbit Terminal Market Study

This study was developed through a comprehensive research framework combining primary interviews with industry executives and technical experts alongside extensive secondary analysis of regulatory filings, company white papers, and patent databases. Expert insights were validated through a multi‐stage review process, incorporating feedback from a global panel of satellite communications specialists.

Data triangulation techniques were applied to cross‐verify quantitative and qualitative inputs, ensuring alignment between market signals, technology roadmaps, and user requirements. The research methodology emphasizes transparency and reproducibility, with clearly defined inclusion criteria for data sources and an audit trail for all analytical assumptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our LEO Terminals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- LEO Terminals Market, by Terminal Type

- LEO Terminals Market, by Frequency Band

- LEO Terminals Market, by Technology Type

- LEO Terminals Market, by Application

- LEO Terminals Market, by End User

- LEO Terminals Market, by Region

- LEO Terminals Market, by Group

- LEO Terminals Market, by Country

- United States LEO Terminals Market

- China LEO Terminals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Discoveries and Future Outlook to Illuminate the Strategic Imperatives for Low Earth Orbit Terminal Stakeholders

The confluence of technological miniaturization, flexible constellation architectures, and supportive policy initiatives has positioned low Earth orbit terminals at the frontier of global connectivity solutions. Industry momentum is clearly shifting toward open‐standard ecosystems, capable of delivering integrated hardware‐software offerings that meet the diverse needs of consumer, enterprise, and defense end users. In parallel, the strategic implications of trade policies and tariff regimes underscore the importance of supply chain resilience and proactive policy engagement for sustaining competitive advantage.

Looking ahead, the terminal market is poised to evolve through tighter integration with terrestrial 5G networks, broader adoption of AI‐enabled network management, and deepening collaboration between satellite operators and vertical industry stakeholders. Success will hinge on the ability to harmonize these trends into compelling value propositions that deliver affordable, high‐performance connectivity at scale, driving the next chapter in the global digital transformation journey.

Empower Your Organization with Expert Insights and Connect Directly with Ketan Rohom to Access the Comprehensive Low Earth Orbit Terminal Market Research Report

Every leader grappling with the complexities of the modern satellite communications landscape requires access to comprehensive, expertly curated market intelligence. By reaching out to Ketan Rohom, Associate Director of Sales & Marketing, you will receive personalized guidance on how this report’s depth of analysis can inform strategic decisions, optimize procurement cycles, and unlock new partnership opportunities. Engage directly with Ketan to discuss tailored research packages, licensing options, and executive briefings designed to meet your organization’s unique objectives. Don’t navigate the evolving low Earth orbit terminal market alone-take the first step toward securing the insights that will drive your growth and innovation agenda.

- How big is the LEO Terminals Market?

- What is the LEO Terminals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?