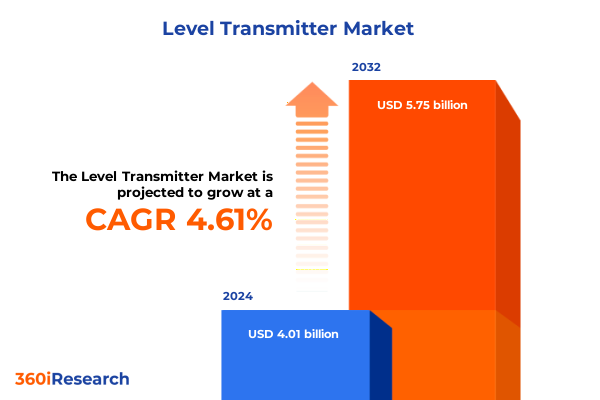

The Level Transmitter Market size was estimated at USD 4.19 billion in 2025 and expected to reach USD 4.39 billion in 2026, at a CAGR of 4.61% to reach USD 5.75 billion by 2032.

Redefining Operational Accuracy and Safety with Advanced Level Transmitters That Elevate Industrial Efficiency and Asset Management Across Sectors

Modern industrial processes increasingly hinge on precise, reliable instrumentation to maintain operational integrity, optimize resource utilization, and ensure safety across critical applications. Level transmitters serve as the foundational sensors for monitoring fluid and bulk solids interfaces, directly impacting decision-making in sectors such as oil and gas, chemical processing, water treatment, and power generation. In high-stakes environments where a single mismeasurement can trigger costly shutdowns, equipment damage, or safety incidents, the imperative for robust level measurement solutions has never been more pronounced.

With the rise of smart manufacturing initiatives and the Industry 4.0 paradigm, level transmitters have transcended their traditional role as standalone instruments. They now act as key nodes within interconnected ecosystems, transmitting real-time data via digital protocols and enabling predictive maintenance algorithms. This shift underscores a broader industry imperative: moving beyond reactive maintenance schedules to data-driven strategies that anticipate potential failures, optimize production cycles, and extend asset lifecycles. As markets evolve under the twin pressures of economic volatility and regulatory scrutiny, organizations are re-evaluating their instrumentation portfolios to align with long-term resilience and sustainability goals.

Seismic Evolution in Level Sensor Technologies Fueled by Digital Transformation Edge Computing and IIoT Integration Shaping the Future of Industrial Monitoring

The landscape of level transmitter technology is undergoing a profound metamorphosis driven by the convergence of digital transformation, edge computing, and artificial intelligence. Traditional analog signal architectures are progressively giving way to integrated digital platforms that provide enhanced diagnostics, automated calibration, and seamless remote connectivity. Consequently, organizations are able to reduce manual intervention, minimize calibration errors, and accelerate response times to critical threshold breaches.

Edge-enabled level transmitters, once considered niche, are now mainstream in modern plants. These devices process raw sensor outputs locally, filter noise, and transmit only the most relevant insights to centralized control systems. This localized intelligence minimizes network bandwidth consumption while empowering on-site technicians with immediate alerts via mobile interfaces. Paired with advanced analytics dashboards, these innovations catalyze proactive fault detection and root cause analysis, propelling the move from time-based maintenance to truly condition-based regimes. As a result, downtime is curtailed, and operational expenditures are driven down, marking a significant departure from legacy operational frameworks.

Assessing the Far Reaching Consequences of the United States’ 2025 Tariff Regime on Level Transmitter Supply Chains Components and Overall Industry Economics

The introduction of elevated tariffs on select instrumentation and electronic components under the United States’ 2025 trade framework has created ripple effects throughout the level transmitter value chain. Import duties on precision machined parts and bespoke semiconductor elements have increased acquisition costs, compelling manufacturers and end users to reassess procurement strategies. In some cases, buyers have postponed capital projects pending clarity on tariff renewals or potential exemptions, creating lag in equipment deployments.

However, the tariff landscape has also stimulated regional diversification of manufacturing footprints. To counteract rising import costs, several transmitter OEMs have expanded production in tariff-exempt jurisdictions or leveraged free trade agreements to secure duty-free passage of critical subassemblies. While these measures mitigate cost escalation, they necessitate more complex supply chain orchestration and demand greater agility in vendor management. Consequently, organizations that prioritize supply chain transparency, dual-sourcing arrangements, and strategic inventory buffers are better positioned to navigate the uncertainty introduced by the 2025 tariff shifts.

Uncovering Distinct Market Dynamics Across Type Technology End User and Mounting Dimensions to Reveal Critical Insights Informing Strategic Deployment of Transmitters

Type delineation remains a critical axis for evaluating level transmitter applicability. Absolute transmitters deliver direct measurements referenced to a fixed datum, with differential variants offering the flexibility to compare pressure differences across two ports. Within differential devices, remote seal renditions accommodate corrosive or high-temperature media by using capillary-linked diaphragms, while standard configurations excel in general-purpose environments. These distinctions guide technology selection based on process conditions, safety requirements, and maintenance profiles.

Technological segmentation also dictates performance characteristics and cost models. Guided Wave Radar, encompassing both Frequency Modulated Continuous Wave and Time Domain Reflectometry approaches, excels in complex interfaces and vapor-laden atmospheres. Hydrostatic transmitters leverage fluid head measurements for straightforward level determination in tanks and open vessels. Magnetostrictive options, available in non-probe and probe designs, combine high accuracy with robust durability, making them well suited for harsh settings. Ultrasonic devices, whether contact or non-contact, provide non-intrusive monitoring of liquids and slurries, balancing ease of installation with susceptibility to environmental noise.

End users span critical verticals where adherence to stringent quality and safety standards is paramount. Chemical and petrochemical operators demand corrosion-resistant designs and SIL-certified electronics, while the food and beverage segment emphasizes hygienic construction and CIP compatibility. Oil and gas facilities require explosion-proof housings and high-temperature tolerance, whereas pharmaceutical applications focus on pharmaceutical-grade materials and minimal dead volume. Power generation entities prioritize integration with distributed control systems, and water and wastewater managers seek cost-effective, low-maintenance solutions for remote pumping stations.

Mounting options further refine the deployment strategy, with flange connections offering high-integrity seals for pressurized vessels and manifold assemblies enabling compact interfacing with control valves. Remote transmitters decouple electronics from process conditions, enhancing longevity in extreme environments, while sanitary configurations facilitate stringent cleaning protocols in life sciences. Threaded units provide economical solutions for low-pressure tanks and auxiliary vessels, underscoring the importance of mechanical compatibility in installation planning.

This comprehensive research report categorizes the Level Transmitter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Mounting

- End-User

Diverse Regional Dynamics and Growth Catalysts in the Americas Europe Middle East Africa and Asia Pacific Illuminating Global Footprints of Level Transmitter Technologies

In the Americas, the push toward digital water and wastewater infrastructure upgrades continues to drive demand for smart level measurement, especially within municipal projects seeking to reduce non-revenue water losses. Concurrently, North American refining and petrochemical expansions stimulate demand for intrinsically safe and high-precision differential transmitters. Latin American markets, while more price-sensitive, are increasingly adopting ultrasonic and hydrostatic technologies to modernize aging utilities under tight budget constraints.

Europe, the Middle East, and Africa present a tapestry of opportunity underpinned by regulatory rigor and diversity of industrial end users. European initiatives around carbon neutrality and energy optimization are accelerating adoption of predictive maintenance platforms incorporating guided wave radar and magnetostrictive transmitters. In the Gulf and North African regions, rapid infrastructure investments in desalination and petrochemical complexes elevate demand for remote seal assemblies capable of withstanding corrosive brine environments. Across Sub-Saharan Africa, distributed renewable energy projects are creating niche applications for low-power, non-contact ultrasonic devices.

Asia Pacific remains the fastest-growing region, fueled by rapid urbanization, manufacturing reboot, and large-scale infrastructure programs. China’s ongoing refinery capacity expansions and Southeast Asia’s proliferation of chemical parks are driving investments in high-accuracy process control instrumentation. India’s water resource management initiatives under national smart city frameworks are spurring widespread deployment of hydrostatic level probes. Meanwhile, Australia’s stringent mining regulations have heightened requirements for explosion-proof and SIL-certified transmitters in coal and mineral processing facilities.

This comprehensive research report examines key regions that drive the evolution of the Level Transmitter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leading Manufacturers and Innovative New Entrants Driving Competition Collaboration and Advancements in Level Transmitter Performance and Integration

Leading industrial instrumentation providers are advancing level transmitter portfolios through a combination of technology licensing, partnerships, and in-house R&D. One global OEM recently unveiled an edge-enabled ultrasonic transmitter featuring built-in AI algorithms for anomaly detection, highlighting the push toward self-learning field devices. Another industry stalwart expanded its radar line to include intrinsically safe models certified to the latest IEC standards, reinforcing its position in hazardous processing plants.

Simultaneously, mid-tier manufacturers are carving niches by offering modular platforms that streamline customization for vertical markets, such as sanitary process applications or offshore platforms. Innovative start-ups have also emerged, introducing 3D-printed sensor housings that reduce lead times and material waste, exemplifying how additive manufacturing can transform supply chain resilience. Collaboration between established vendors and technology pioneers is fostering cross-pollination of expertise, accelerating the integration of wireless HF communication modules and energy-harvesting power supplies.

Competitive dynamics are further influenced by strategic acquisitions designed to augment complementary capabilities. Recent merger activity has consolidated expertise in guided wave radar and magnetostrictive technologies, creating end-to-end solution providers capable of addressing the full spectrum of level measurement challenges. These transactions underscore a broader trend toward portfolio diversification, enabling companies to offer bundled instrumentation, analytics platforms, and lifecycle services under unified commercial agreements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Level Transmitter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Banner Engineering Corporation

- Easy-Laser AB

- Emerson Electric Co.

- Endress+Hauser AG

- Fluke Corporation

- Focuslight Technologies Inc.

- Garner Industries Inc.

- Hawk Measurement Systems

- HiTech Technologies, Inc.

- Honeywell International Inc.

- Krohne Messtechnik GmbH

- Magnetrol International, Inc.

- Pinpoint Laser Systems

- Robert Bosch GmbH

- RPMC Lasers

- S3 Technics

- Schneider Electric SE

- Siemens AG

- Stabila GmbH

- VEGA Grieshaber KG

- Yokogawa Electric Corporation

Action Oriented Strategies for Industry Stakeholders to Capitalize on Emerging Technologies Optimized Sourcing and Regulatory Adaptation in the Level Transmitter Ecosystem

Industry leaders should prioritize the development of interoperable platforms that support both legacy protocols and emerging digital standards, ensuring seamless integration across diverse control architectures. By adopting open communication frameworks, organizations can foster multi-vendor ecosystems that accelerate innovation, reduce vendor lock-in, and simplify maintenance workflows.

Moreover, establishing dual-sourcing strategies with geographically dispersed suppliers can mitigate the impact of trade policy fluctuations and supply chain disruptions. Leaders are advised to cultivate strategic partnerships with regional manufacturers to secure localized production capabilities and expedite after-sales support. In parallel, investing in modular product architectures enables rapid reconfiguration of transmitters to meet evolving regulatory and process requirements, minimizing capital expenditure risks.

To harness the full potential of data, enterprises must embed analytics capabilities within field devices and leverage cloud-based platforms for holistic asset performance management. By deploying machine learning models trained on historical process data, organizations can forecast maintenance needs, optimize calibration cycles, and reduce unplanned downtime. Additionally, dedicating resources to workforce upskilling-particularly in digital diagnostics, cybersecurity, and data visualization-will empower technicians to extract maximum value from next-generation level measurement solutions.

Comprehensive Multimethod Approach Leveraging Primary Interviews Secondary Data Vendor Benchmarking and Industry Analysis for Robust Level Transmitter Research

This research study employs a hybrid methodology combining rigorous primary and secondary data collection to deliver comprehensive insights. In the primary phase, in-depth interviews were conducted with senior instrumentation engineers, procurement heads, and industry consultants across the Americas, Europe, and Asia Pacific. These discussions focused on pain points in transmitter deployment, evolving technology preferences, and adaptive strategies in response to geopolitical shifts.

Secondary research drew upon technical white papers, regulatory filings, and benchmark industry reports to corroborate interview findings and ensure factual accuracy. Our analysis included systematic review of patent filings to track innovation trajectories, as well as cross-referencing manufacturer catalogs to validate feature comparisons. A vendor scorecard framework was utilized to assess competitive positioning based on criteria such as technology breadth, service ecosystem, and global support network.

Quantitative modeling integrated tariff schedules, supply chain lead times, and typical procurement cycles to simulate the cost implications of the 2025 United States trade measures. Validation workshops with industry experts further refined our interpretations, ensuring that conclusions align with real-world operational constraints. This robust multi-method approach underpins the strategic recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Level Transmitter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Level Transmitter Market, by Type

- Level Transmitter Market, by Technology

- Level Transmitter Market, by Mounting

- Level Transmitter Market, by End-User

- Level Transmitter Market, by Region

- Level Transmitter Market, by Group

- Level Transmitter Market, by Country

- United States Level Transmitter Market

- China Level Transmitter Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of Key Discoveries Emphasizing Technological Innovations Geopolitical Impacts and Market Drivers Shaping the Trajectory of Level Transmitter Adoption

In synthesizing the investigation’s findings, it is evident that technological convergence, supply chain agility, and regional specialization are the key pillars driving market evolution. Digital transformation initiatives have elevated level transmitters from passive data sources to active participants in predictive maintenance and process optimization frameworks. Meanwhile, the 2025 tariff environment has underscored the necessity of supply chain diversification, prompting a reevaluation of procurement and manufacturing strategies.

Segmentation insights reveal that no single transmitter type or technology reigns supreme; instead, application-specific considerations dictate optimal configurations. Organizations that align type, technology, end-user requirements, and mounting preferences with broader operational objectives achieve superior reliability and cost efficiency. Regionally, the fastest growth is observed where infrastructure investment and regulatory rigor intersect, driving adoption of smart measurement solutions.

Looking ahead, industry stakeholders who embrace interoperable platforms, data-driven decision-making, and localized manufacturing partnerships will secure competitive advantages. As the market continues to recalibrate under geopolitical and technological influences, maintaining an adaptive posture-anchored by robust research and continuous innovation-will be critical to capturing long-term value in the level transmitter domain.

Connect with Ketan Rohom Associate Director Sales and Marketing to Access Tailored Insights Secure Your Comprehensive Level Transmitter Market Analysis Today

To explore how precision measurement strategies can unlock untapped value and mitigate supply chain challenges in your operations, reach out to Ketan Rohom, Associate Director, Sales and Marketing. You will receive a personalized overview of key findings and actionable insights tailored to your unique needs. Engage now to secure your full level transmitter market research report and gain a competitive edge in optimizing asset performance, ensuring compliance, and accelerating digital transformation initiatives.

- How big is the Level Transmitter Market?

- What is the Level Transmitter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?