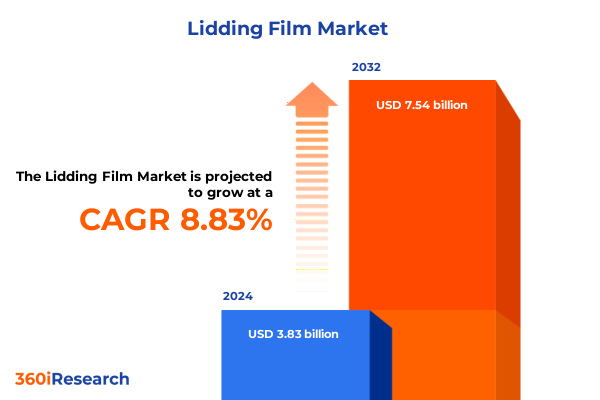

The Lidding Film Market size was estimated at USD 4.11 billion in 2025 and expected to reach USD 4.41 billion in 2026, at a CAGR of 9.04% to reach USD 7.54 billion by 2032.

Unveiling the Critical Role of Lidding Films in Modern Packaging Ecosystems Driven by Consumer Demand and Sustainability Imperatives

The rapidly evolving packaging landscape has elevated lidding films from functional facings to strategic assets that safeguard product integrity while enhancing consumer appeal. As critical barriers to oxygen, moisture, and contaminants, these films underpin the preservation of food, pharmaceutical, and personal care products during processing, transportation, and retail display. Beyond protective performance, lidding films also serve as canvases for branding narratives, enabling companies to differentiate offerings through high-definition printing and innovative die-cut designs. With consumers demanding transparency on provenance and sustainability, lidding films play a dual role in preserving quality and conveying environmental credentials.

Amid rising concerns over food waste, lidding films contribute significantly to shelf-life extension, thereby aligning with broader corporate sustainability goals. Concurrently, the shift towards single-serve and on-the-go consumption formats amplifies the need for robust seals and ease-of-use features such as peelable and resealable options. In parallel, legislative frameworks worldwide are tightening requirements for recyclability and recycled content, compelling film producers to innovate materials and processes. As a result, the lidding film sector is experiencing a convergence of material science breakthroughs, regulatory compliance imperatives, and consumer-centric design, positioning it at the nexus of protection, performance, and purpose within modern packaging ecosystems.

Navigating Transformative Shifts in Lidding Film Production Fuelled by Sustainability Regulations Digital Innovations and Evolving Consumer Expectations

The lidding film industry is undergoing transformative shifts fueled by an imperative to reconcile performance with environmental stewardship and by the infusion of advanced digital capabilities. One of the most defining trends is the widespread adoption of eco-friendly mono-material structures, particularly polyethylene and polypropylene monolayers, which facilitate closed-loop recycling streams without compromising barrier or clarity attributes. Complementing this materials revolution, brands are investing in variable-data printing enabled by digital inkjet technology to deliver personalized packaging experiences at scale, thereby forging deeper consumer engagement and reinforcing loyalty.

On the regulatory front, mandates like the European Union’s Packaging and Packaging Waste Regulation, which requires 65 percent recyclability of all packaging by 2025, are accelerating R&D into recyclable and bio-based films. These policies coincide with consumer preference data indicating strong willingness to pay premiums for transparently labeled, sustainable packaging solutions. At the same time, the integration of QR codes and smart labeling has redefined the value proposition of lidding films, enabling real-time access to product provenance, nutritional data, and end-of-life instructions. Taken together, these dynamics are reshaping competitive landscapes, compelling stakeholders to recalibrate strategies around circularity, digital interactivity, and resilient supply chains.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Lidding Film Supply Chains Costs and Strategic Sourcing Decisions

The reinstatement and expansion of U.S. tariffs in early 2025 have exerted a pronounced influence on lidding film supply chains, driving cost escalations and strategic realignments. A blanket 10 percent tariff on all imported poly films was introduced, with reciprocal duties targeting nations like China peaking at over 125 percent before a temporary pause adjusted rates to around 30 percent for select products. Concurrently, a 25 percent duty was levied on flexible packaging imports that do not meet USMCA compliance, affecting aluminum foil–based lidding, induction seals, and related compounds. These measures have reverberated across resin procurement and converting operations, leading to pronounced volatility in LDPE, HDPE, and PET resin pricing as well as in additive and machinery imports.

In response, industry leaders have recalibrated sourcing portfolios to prioritize USMCA-compliant North American suppliers, thereby circumventing punitive duties and securing greater supply chain predictability. Some manufacturers have instituted buffer-stock strategies to hedge against future tariff fluctuations, while others have accelerated investments in domestic extrusion capacities. On a broader scale, the tariff environment has sharpened focus on cost-optimization and supply chain resilience, prompting companies to reassess nearshoring and diversify supplier ecosystems to mitigate geopolitical risk and input-cost pressures.

Unlocking Segment-Specific Opportunities in Lidding Films by Analyzing Material Composition End-Use Applications Packaging Formats and Technological Capabilities

Deep-diving into the lidding film market reveals distinct nuances across materials, end-use sectors, packaging formats, and sealing technologies that inform targeted growth strategies. Films based on aluminum foil deliver superior barrier protection in high-moisture and oxygen-sensitive applications, whereas polyethylene variants-particularly low-density and high-density PE-balance cost and performance for mass-market dairy and bakery products. Polyethylene terephthalate and polypropylene lidding films provide clarity and heat-resistance, suiting dual-ovenable trays and on-tray reheating scenarios. Polyvinyl chloride films, though less prevalent, retain niche roles in specialty packaging where rigidity and clarity are paramount.

End-use insights highlight that electronics and healthcare applications demand stringent purity standards and tamper-evidence, driving the adoption of peelable and resealable sealants molded to precise opening-force requirements. In food and beverage segments, thermosealable trays and vacuum pouches are engineered to preserve freshness across bakery, dairy, fruit and vegetable, meat, seafood, and pet food categories. Personal care and cosmetics leverage high-definition printing on film surfaces to elevate brand visibility and support limited-edition or seasonal releases.

The choice of packaging type-be it blister pack lidding for portioned pharmaceuticals, cup lidding for yogurt and portion cups, skin packaging for produce, tray lidding in rigid or thermoformed configurations, or bulk and retail vacuum pouches-dictates specific converting technologies and equipment line speeds. Finally, sealing-technology segmentation reveals that cold-sealable films optimize energy usage in highly temperature-sensitive fill operations, while heat-sealable films dominate high-speed flow-wrapping and thermoforming lines. The peelable category-spanning easy-peel, film-peel, and paper-peel variants-caters to diverse user convenience requirements, and resealable options reinforce repositionable functionality for multi-serve packaging.

This comprehensive research report categorizes the Lidding Film market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material

- Technology

- End Use

Mapping Regional Dynamics Shaping Lidding Film Adoption Across the Americas Europe Middle East Africa and the Asia-Pacific Growth Markets

Regional dynamics continue to dictate lidding film adoption patterns and innovation priorities across the globe. In the Americas, the convenience-driven U.S. and Canada markets anchor demand for on-the-go meal kits, ready-to-eat snacks, and premium meal trays, underpinned by state-level recycled content and labeling laws that incentivize mono-polymer solutions. Latin America’s burgeoning food processing sector, notably in Brazil and Argentina, is increasingly integrating high-clarity anti-fog films to serve meat and produce exports, despite fragmented recycling infrastructure challenges.

In Europe, Middle East, and Africa, stringent circular-economy regulations such as the EU’s Single-Use Plastics Directive and Extended Producer Responsibility (EPR) frameworks have propelled mono-material PE and PET lidding films to the forefront. Countries like France and Germany are leading the transition toward dual-ovenable films for microwaveable ready meals and leak-resistant tray applications. Meanwhile, Middle East markets, driven by hospitality and tourism, demonstrate growing appetite for premium, recyclable sealing films tailored to single-serve condiments and in-flight meal packaging.

Asia-Pacific remains the fastest-growing regional market, fueled by rapid urbanization, rising disposable incomes, and the expansion of e-grocery platforms. China’s mandatory bans on certain single-use plastics and India’s thriving processed-foods sector have accelerated local investments in high-barrier, recyclable lidding films. Southeast Asian economies are investing in modernized waste management systems, nudging manufacturers toward bio-based and compostable film alternatives, even as domestic capacity gains outpace infrastructure enhancements.

This comprehensive research report examines key regions that drive the evolution of the Lidding Film market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Lidding Film Producers and Innovators Driving Market Growth Through Strategic Collaborations Technological Advances and Sustainability Focus

The competitive landscape of lidding films is defined by global and regional players committed to performance innovation, sustainability, and operational excellence. Amcor, a leading supplier, has diversified its portfolio to include mono-material PE and PP film offerings that align with curbside recycling programs, while securing strategic partnerships to develop high-barrier coatings that eliminate the need for aluminum substrates. Berry Global leverages its expertise in advanced extrusion technologies to produce ultra-thin lidding films-often below 60 microns-that maintain puncture resistance and reduce carbon footprints through material-lightweighting strategies.

Sealed Air has introduced bio-based and compostable lidding films derived from polylactic acid, targeting premium dairy and confectionery segments. Winpak focuses on machinery-integrated solutions, offering turnkey packaging lines that optimize seal integrity and reduce energy consumption via cold-seal and heat-seal process controls. Aupac Industries has carved a niche in specialized healthcare applications, incorporating tamper-evident peelable films with precise opening-force calibration. Emerging innovators are forming consortia with resin producers and recycling organizations to pilot chemical recycling of PE-based lidding films, aiming to close the loop on post-consumer film streams and convert end-of-life waste into food-contact-grade resins.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lidding Film market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALPAGRO Packaging

- Amcor Limited

- Berry Global Group, Inc.

- Bryson Packaging

- Constantia Flexibles Group GmbH

- Coveris Holdings S.A.

- Flexopack S.A.

- Golden Eagle Extrusions, Inc.

- Huhtamaki PPL Ltd.

- Huhtamäki Oyj

- Jiangsu Qianrun New Material Technology Co., Ltd.

- KM Packaging

- Lietpak UAB

- LMI Packaging

- Mondi plc

- Papsco Pvt Ltd.

- RTG Films

- Sealed Air Corporation

- Sonoco Products Company

- Uflex Limited

- Wipak Group

- Zhongsu New Materials Technology (Hangzhou) Co., Ltd.

Actionable Strategic Recommendations for Industry Leaders to Enhance Competitiveness Through Supply Chain Resilience Innovation and Sustainable Packaging Solutions

To navigate the complexities of the lidding film market and secure competitive advantage, leaders should prioritize a blend of sustainability-driven innovation and supply chain resilience. First, invest in flexible mono-material film platforms that streamline recyclability and comply with evolving packaging mandates. Pairing these materials with advanced barrier coatings and flame-retardant additives will ensure performance parity with traditional multilayer solutions while meeting environmental targets.

Next, diversify sourcing strategies by building strategic alliances with USMCA-compliant resin suppliers and regional converters to mitigate tariff exposures and logistics disruptions. Scenario planning for fluctuating remittance rates and geopolitical tensions should inform buffer-stock levels and nearshoring initiatives. Concurrently, adopt digital printing capabilities that enable small-batch customization and rapid SKU rollouts, catering to localized consumer preferences without incurring large minimum-order requirements.

Finally, foster cross–value-chain collaborations with recycling entities and material innovators to pilot closed-loop initiatives, such as mechanical and chemical recycling of film waste. Embedding traceability via QR codes or blockchain integration on lidding films can demonstrate transparency and build brand trust, particularly in health and wellness segments. By aligning product design, supply chain architecture, and circularity goals, industry leaders can drive growth, reduce regulatory risk, and exceed consumer expectations.

Insights into Rigorous Research Methodology Underpinning the Lidding Film Market Analysis Incorporating Primary Interviews Secondary Data and Strategic Validation

This analysis synthesizes insights drawn from a rigorous, multi-stage research framework ensuring comprehensive coverage of the lidding film market. Secondary research encompassed a review of regulatory filings, industry whitepapers, patent databases, and technical standards, providing a foundational understanding of material innovations, regulatory mandates, and technology roadmaps. Concurrently, a blend of quantitative and qualitative primary research was conducted, featuring in-depth interviews with executives from leading film manufacturers, converters, packaging engineers, and sustainability officers.

We implemented a data-triangulation approach by cross-referencing trade data, customs filings, and import-export statistics to validate supply chain patterns and cost drivers. Supplementary market-sizing inputs were corroborated with publicly available financial reports from top packaging players and industrial associations. Strategic validation workshops involving subject-matter experts in polymer science, packaging design, and recycling infrastructure were held to refine segmentation schemas and ensure that emergent trends were accurately represented.

This methodology reinforces the credibility of findings and equips decision-makers with actionable insights grounded in empirical evidence and industry expertise. By combining robust secondary analysis with targeted primary engagements and expert validation, the research delivers a holistic view of the lidding film landscape and equips stakeholders to make informed, strategic choices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lidding Film market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lidding Film Market, by Packaging Type

- Lidding Film Market, by Material

- Lidding Film Market, by Technology

- Lidding Film Market, by End Use

- Lidding Film Market, by Region

- Lidding Film Market, by Group

- Lidding Film Market, by Country

- United States Lidding Film Market

- China Lidding Film Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Perspective on the Future Trajectory of the Lidding Film Industry Highlighting Key Trends Challenges and Strategic Imperatives for Stakeholders

In summary, the lidding film sector stands at a strategic inflection point where material science breakthroughs, stringent sustainability regulations, and shifting consumer behaviors converge. The imperative to reduce plastic waste, extend product shelf life, and support transparent supply chains has galvanized innovation around mono-material films, bio-based polymers, and interactive labeling technologies. Simultaneously, evolving tariff landscapes and geopolitical dynamics have underscored the importance of diversified sourcing and supply chain agility.

Successful players will be those who integrate circularity principles early in product development, harness digital capabilities for customized packaging experiences, and forge collaborative ecosystems across resin production, converting operations, and end-of-life recycling. As regional markets mature at varying paces, nuanced approaches-tailored to local regulatory contexts and consumer expectations-will drive growth and competitive differentiation. The insights presented herein equip stakeholders to navigate these multifaceted shifts and capitalize on emerging opportunities within the dynamic lidding film market.

Empowering Informed Decisions with Expertly Curated Lidding Film Market Intelligence Contact the Associate Director of Sales Marketing to Secure Your Comprehensive Report

Leverage the intelligence distilled in this comprehensive market research to fortify your strategic planning and operational execution in the dynamic lidding film arena. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how tailored insights can empower your organization’s growth trajectory. Engage directly to secure exclusive access to in-depth analysis, detailed segmentation breakdowns, and expert-driven recommendations that will position your enterprise at the forefront of innovation and sustainability. Don’t miss the opportunity to deepen your market understanding and drive actionable outcomes; contact Ketan Rohom today to obtain your full market research report and catalyze informed decision-making.

- How big is the Lidding Film Market?

- What is the Lidding Film Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?