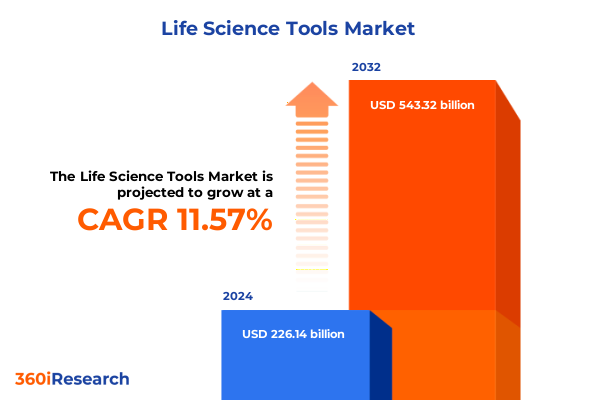

The Life Science Tools Market size was estimated at USD 252.39 billion in 2025 and expected to reach USD 281.70 billion in 2026, at a CAGR of 11.57% to reach USD 543.32 billion by 2032.

Navigating the Evolving Life Science Tools Ecosystem Through Strategic Insights and Technological Milestones Driving Future Growth

The life science tools market stands at the forefront of scientific discovery and medical advancement, driven by rapid technological breakthroughs and evolving research priorities. In recent years, the convergence of automation, digitalization, and high-throughput analytics has redefined laboratory operations, enabling researchers to accelerate timelines and enhance reproducibility. As global health challenges demand more agile and precise methodologies, organizations are compelled to adapt their toolsets to address complex biological questions and large-scale data integration.

This executive summary synthesizes the critical trends, strategic shifts, and decision-critical insights shaping the life science tools landscape. It provides a concise yet thorough overview of market segmentation, regional dynamics, and the repercussions of newly implemented US tariffs in 2025. Additionally, it highlights the competitive intelligence on key industry players and outlines actionable recommendations to empower leaders in charting a course toward sustainable growth. By distilling these multifaceted elements into a coherent narrative, stakeholders can align their investments and innovation strategies with emerging opportunities and regulatory imperatives.

Unveiling the Pivotal Transformative Forces Rapidly Reshaping Innovation and Market Dynamics in the Life Science Tools Landscape

The life science tools market is undergoing a transformative phase marked by digital integration, automation, and the democratization of advanced methodologies. Artificial intelligence and machine learning platforms now seamlessly integrate with sophisticated instrumentation, enabling predictive analytics for complex datasets. Concurrently, robotics and high-throughput systems have revolutionized sample processing workflows, reducing manual intervention and enhancing reproducibility. These technological accelerators, in turn, have fostered a culture of real-time data sharing and collaboration across research institutions and biomanufacturing facilities.

In parallel, the rise of cloud-native bioinformatics infrastructure has enabled laboratories to transcend physical limitations, scaling their computational capabilities on demand. This shift has unlocked new avenues for multi-omics research, accelerating discoveries in areas such as personalized medicine and synthetic biology. Furthermore, strategic partnerships between instrument manufacturers and software developers are streamlining end-to-end workflows, closing the gap between data generation and actionable insights. As life science organizations confront growing complexities, these transformative forces are redefining value creation and competitive advantage within the market.

Assessing the Comprehensive Impact of 2025 US Tariffs on Life Science Tools Including Supply Chains and Complex Cost Structures

The imposition of targeted US tariffs in 2025 on critical laboratory equipment and consumables has introduced new cost pressures across the life science tools sector. These measures have elevated import expenses for high-precision instruments and specialty reagents, prompting procurement teams to reassess supplier portfolios and seek alternative sourcing strategies. As a result, some organizations have accelerated initiatives to localize manufacturing and diversify their supply chains, aiming to mitigate tariff-related volatility.

Moreover, the cumulative impact of these tariffs has influenced budgeting cycles and capital expenditure priorities, compelling stakeholders to balance immediate operational needs against long-term innovation roadmaps. In response, several vendors have absorbed portions of the increased costs through price adjustments and promotional incentives to maintain customer retention and market share. Nonetheless, the ripple effects of these policy shifts have underscored the importance of flexible supply chain architectures, risk assessment frameworks, and collaborative partnerships to sustain continuity in research and development endeavors.

Illuminating Key Market Segmentation Insights Revealing the Nuances of Product, Technology, Application, and Workflow Dynamics

A comprehensive understanding of market segmentation unveils the intricate architecture of the life science tools ecosystem. Based on product type, the landscape encompasses major categories such as instruments, reagents and consumables, and software and services, each serving distinct laboratory workflows. Instruments span a broad spectrum-from centrifuges and chromatography systems to electrophoresis equipment, flow cytometers, mass spectrometers, microscopes, PCR machines, robotics and automation systems, sequencing instruments, and spectrophotometers-forming the backbone of experimental capabilities. Reagents and consumables, ranging from antibodies and proteins to cell culture reagents, media, buffers, and stains, as well as nucleic acid reagents, constitute the consumptive lifeblood of biological assays. Meanwhile, software and services, including bioinformatics software, cloud platforms, consulting and technical support, data analysis tools, and laboratory information management systems, deliver critical insights and streamline operations.

From a technology standpoint, the market extends across analytical chemistry, cell biology, genomics, high-throughput screening, metabolomics, microbiology, molecular biology, proteomics, synthetic biology, and transcriptomics. Each technological domain drives unique research applications and demands specialized instrumentation and data pipelines. In application segmentation, core areas include agricultural biotechnology, basic research, bioprocessing and biomanufacturing, clinical diagnostics, drug discovery and development, environmental testing, epidemiology and public health, forensic science, and personalized medicine. These end-use scenarios underscore the versatility and breadth of life science tools in addressing global challenges.

In addition, a workflow stage perspective illuminates the phases of experimental work, from sample preparation through amplification, separation and detection, data acquisition, analysis and interpretation, to storage and archiving. This lens enables stakeholders to pinpoint bottlenecks and opportunities for optimization at each step of the scientific process, guiding investments in complementary technologies and services that enhance throughput and data fidelity.

This comprehensive research report categorizes the Life Science Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- Workflow Stage

Discerning Critical Regional Insights Unveiling Unique Drivers and Opportunities Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics reveal distinct growth drivers and operational considerations across the Americas, Europe Middle East and Africa, and Asia-Pacific zones. In the Americas, a robust emphasis on translational research and the presence of leading pharmaceutical and biotech hubs have cultivated advanced laboratory infrastructure and early adoption of next-generation technologies. Moreover, supportive funding mechanisms and regulatory frameworks encourage innovation in personalized medicine and advanced therapeutics.

Across Europe, the Middle East, and Africa, heterogeneous markets present both challenges and opportunities. Western Europe continues to lead in precision diagnostics and high-throughput screening investments, while emerging economies in Eastern Europe and the Middle East are scaling up their research capacities through government-backed initiatives. In Africa, public health testing and environmental monitoring drive demand for cost-optimized tools, fostering a dual focus on affordability and reliability.

The Asia-Pacific region demonstrates the fastest pace of expansion, fueled by significant investments in genomics, biomanufacturing, and a growing base of contract research organizations. China’s strategic emphasis on domestic manufacturing has spurred local innovation, while Japan and South Korea maintain leadership in precision instrumentation. Concurrently, India’s research ecosystem is diversifying, with rising interest in bioinformatics and synthetic biology solutions. Collectively, these regional insights underscore the importance of tailored go-to-market strategies that account for regulatory landscapes, funding paradigms, and infrastructure maturity.

This comprehensive research report examines key regions that drive the evolution of the Life Science Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exposing Strategic Moves and Competitive Positioning of Leading Organizations Driving Innovation in the Life Science Tools Sphere

Leading organizations in the life science tools arena are deploying multifaceted strategies to secure competitive advantage and foster sustainable innovation. Prominent players have intensified research and development pipelines through strategic alliances with academic institutions and technology startups, accelerating product launches and expanding their portfolio breadth. Concurrently, several firms have pursued targeted acquisitions to integrate complementary capabilities, such as data analytics platforms or next-generation sequencing technologies, thus enhancing end-to-end workflow solutions.

In addition, agile companies are investing in service ecosystems, offering subscription-based software licenses and outcome-oriented service agreements that align vendor incentives with customer success. This shift toward managed services and cloud-enabled platforms has enabled deeper customer engagement and recurring revenue streams. Meanwhile, ongoing collaborations between instrument manufacturers and reagent providers are optimizing compatibility and performance, reducing technical barriers to adoption.

Furthermore, a subset of emerging challengers is leveraging open-source frameworks and collaborative consortia to democratize access to cutting-edge methodologies. By adopting modular design principles and fostering user communities, these innovators are driving accelerated iteration cycles and lowering entry barriers for resource-constrained labs. Collectively, these corporate maneuvers reflect a dynamic, competitive landscape where value creation extends beyond product features to encompass integrated solutions and service excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Life Science Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- AliveCor, Inc.

- Apple Inc.

- Bardy Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- Biobeat Technologies Ltd.

- BioIntelliSense, Inc.

- Current Health Limited

- Danaher Corporation

- Dexcom, Inc.

- Eko Health, Inc.

- Empatica Inc.

- F. Hoffmann-La Roche Ltd.

- Garmin Ltd.

- GE HealthCare

- GENTAG, Inc.

- Illumina, Inc.

- iRhythm Inc.

- Koninklijke Philips N.V.

- Masimo Corp.

- Medtronic PLC

- Merck KGaA

- OMRON Healthcare, Inc.

- PerkinElmer, Inc.

- Qardio, Inc.

- Qiagen N.V.

- Samsung Electronics Co., Ltd

- Sartorius AG

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- VitalConnect

- VivaLNK, Inc.

- Wellinks

- WHOOP

- Withings Inc.

- ZOLL Medical Corporation

Actionable Strategic Recommendations Empowering Industry Leaders to Drive Growth, Resilience, and Innovation in Life Science Tools Markets

Industry leaders are encouraged to adopt a multifaceted approach that balances operational efficiency with strategic innovation. First, organizations should optimize their supply chain architectures by diversifying manufacturing sites and implementing advanced risk analytics, thereby mitigating the impact of geopolitical shifts and tariff fluctuations. Concurrently, investing in digital transformation initiatives-such as integrating laboratory automation with cloud-based data management-will unlock new levels of agility and scalability.

Moreover, forging cross-sector partnerships with technology providers and academic consortia can accelerate product development and foster knowledge exchange. By embedding customer feedback loops into product roadmaps, companies will ensure their offerings remain aligned with evolving research needs. Talent management is equally critical; cultivating a workforce with interdisciplinary expertise in artificial intelligence, bioinformatics, and regulatory affairs will position organizations to navigate complex scientific and compliance landscapes.

Finally, a proactive engagement with regulatory agencies and standard-setting bodies will streamline approvals and reinforce market trust. By championing sustainability initiatives-such as reducing plastic waste in consumables and enhancing energy efficiency in instrumentation-companies can meet stakeholder expectations and future-proof their operations against emerging environmental regulations. Together, these recommendations provide a roadmap for industry leaders to bolster resilience, drive growth, and maintain a competitive edge.

Defining the Comprehensive Research Methodology Underpinning Data Collection, Analysis, and Validation in the Life Science Tools Study

This study integrates a rigorous mix of secondary and primary research methodologies to ensure robust, validated insights. Initial phases involved extensive secondary research, including analysis of scientific publications, patent filings, regulatory guidelines, and industry white papers. These sources provided foundational understanding of technological trends and market drivers. Concurrently, proprietary databases and open-source data repositories were mined to extract quantitative information on equipment installations, reagent consumption, and technology adoption rates.

The primary research phase involved in-depth interviews with over 50 subject matter experts spanning academic research institutions, pharmaceutical and biotechnology companies, contract research organizations, and regulatory agencies. These conversations yielded nuanced perspectives on adoption barriers, emerging applications, and regional regulatory nuances. Additionally, structured surveys were deployed across key user segments-ranging from bench scientists to procurement executives-to capture decision-making criteria and investment priorities.

Data triangulation was achieved through cross-validation of secondary intelligence with primary feedback, ensuring consistency and accuracy. Furthermore, an external panel of industry advisors reviewed interim findings to identify potential blind spots and validate strategic interpretations. The entire process adhered to a transparent audit trail, with documented assumptions and methodological parameters clearly defined. This comprehensive approach delivers a high-fidelity view of the life science tools market, empowering stakeholders to make informed, evidence-based decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Life Science Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Life Science Tools Market, by Product Type

- Life Science Tools Market, by Technology

- Life Science Tools Market, by Application

- Life Science Tools Market, by Workflow Stage

- Life Science Tools Market, by Region

- Life Science Tools Market, by Group

- Life Science Tools Market, by Country

- United States Life Science Tools Market

- China Life Science Tools Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Conclusions Highlighting Strategic Imperatives and Growth Trajectories in the Life Science Tools Domain

The analysis confirms that life science tools are at an inflection point, driven by converging trends in automation, data analytics, and modular workflow integration. As tariffs reshape supplier dynamics, organizations that proactively adapt their sourcing strategies and foster resilient supply chains will emerge stronger. Market segmentation insights highlight the need for holistic solutions that span instruments, reagents, software, and services, ensuring seamless interoperability across diverse applications and technological domains.

Regional disparities underscore the importance of localized strategies, with high-maturity markets favoring advanced automation and cloud-native platforms, while emerging economies prioritize cost-effective, robust solutions for public health and environmental testing. Competitive intelligence reveals that leading entities are augmenting their portfolios through strategic alliances, acquisitions, and service-oriented business models, indicating a shift from transactional sales toward long-term customer partnerships.

Ultimately, this report underscores a set of strategic imperatives: embrace digital transformation, cultivate collaborative ecosystems, optimize risk-managed supply chains, and engage proactively with regulatory and sustainability frameworks. By aligning organizational capabilities with these imperatives, stakeholders can capitalize on disruptive innovations and secure a commanding position in the evolving life science tools market.

Take the Next Step to Unlock Critical Market Insights by Strategically Securing Your Comprehensive Life Science Tools Report Today

Embarking on a journey to unlock unparalleled insights begins with an invitation to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who stands ready to guide you in harnessing the full potential of this comprehensive report. Through his strategic counsel, you will access tailored recommendations, exclusive data sets, and a roadmap to outpace competitors in an increasingly complex landscape. By securing your copy today, you will ensure your team is equipped with the knowledge to navigate regulatory changes, technological disruptions, and evolving customer expectations.

Engaging with Ketan Rohom allows you to customize your research experience, aligning it precisely with your organization’s objectives. His expertise in life science market dynamics ensures you receive actionable insights that translate directly into tactical and strategic decisions. Don’t miss this opportunity to transform data into decisive action. Reach out now to secure your comprehensive Life Science Tools market research report and take the next step toward market leadership.

- How big is the Life Science Tools Market?

- What is the Life Science Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?