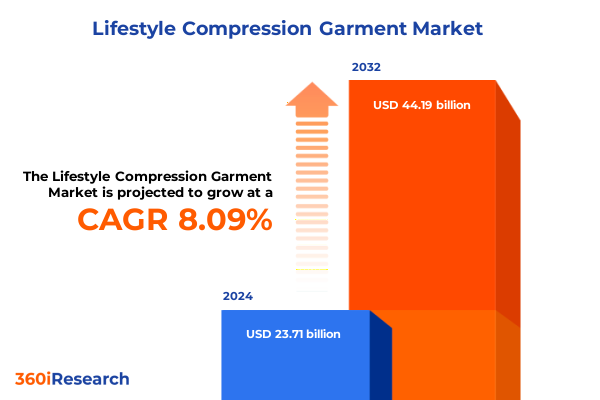

The Lifestyle Compression Garment Market size was estimated at USD 25.59 billion in 2025 and expected to reach USD 27.63 billion in 2026, at a CAGR of 8.11% to reach USD 44.19 billion by 2032.

Unlocking the Dynamics of the Lifestyle Compression Garment Market Through Health Driven Consumer Behavior and Advanced Fabric Technology

The global lifestyle compression garment sector has evolved from a niche athletic accessory into a multifaceted apparel category driven by health awareness, technological fabric innovations, and shifting consumer preferences. Once primarily prescribed within clinical and rehabilitation settings, compression garments now occupy an essential role across fitness routines, everyday wear, and high-performance sports. As wellness trends continue to emphasize holistic well-being and preventive health measures, consumers are increasingly seeking functional apparel that combines comfort, style, and scientifically proven benefits.

Over the past decade, advances in textile engineering-particularly in moisture-wicking blends and graduated compression weaves-have elevated the efficacy and appeal of compression wear. These innovations, paired with seamless knitting techniques and ergonomic tailoring, help enhance circulation, reduce muscle fatigue, and accelerate recovery. Consequently, mainstream brands and emerging specialists alike have introduced fashionable compression collections that cater not only to athletes but also to commuters, office workers, and lifestyle-focused individuals.

Today’s landscape is characterized by a convergence of medical-grade performance standards with lifestyle-driven aesthetics. Consumers expect garments that seamlessly transition from post-workout recovery to casual daily activities, while also supporting long-term musculoskeletal health during sedentary tasks. This dynamic intersection of health and fashion underscores the strategic significance of compression garments as both a functional and aspirational product category.

This executive summary offers a comprehensive exploration of the market’s transformative shifts, the impact of recent policy changes, segmentation insights, regional variations, leading corporate strategies, and actionable recommendations for industry leaders.

Analyzing the Fundamental Shifts Shaping the Compression Apparel Sector from Athletic Performance to Everyday Wellness Integration

In recent years, the compression garment landscape has undergone fundamental transformations propelled by rising health consciousness, digital fitness ecosystems, and sustainability imperatives. The proliferation of wearable health monitoring devices and mobile training platforms has heightened consumer awareness of muscle recovery and circulatory improvements, creating new touchpoints for compression apparel adoption. As a result, leading manufacturers have integrated sensor-ready fabrics and smart textiles to deliver data-driven performance feedback, effectively bridging the gap between apparel and digital wellness solutions.

Simultaneously, the athleisure movement has propelled compression garments into everyday wardrobes, prompting a shift from purely functional designs to fashion-forward collections. This blend of style and performance has attracted strategic partnerships with influencers, fitness studios, and sports franchises, reinforcing brand relevance across diverse demographics. Moreover, the rise of e-commerce and direct-to-consumer channels has democratized access, enabling niche brands to scale rapidly and challenge traditional retail models.

Environmental considerations have further reshaped the market, with a growing emphasis on recyclable fibers, waterless dye techniques, and reduced carbon footprints. Pioneering developers are experimenting with bio-based elastomers and closed-loop manufacturing processes to meet consumer demand for eco-friendly products. These shifts underscore a broader transformation: compression wear is no longer a static medical or athletic aid but rather a dynamic, interconnected ecosystem integrating technology, fashion, and sustainability.

Collectively, these developments signal a new era in which innovation, consumer engagement, and environmental stewardship converge, redefining competitive imperatives and unlocking fresh opportunities for brand differentiation.

Evaluating the Extensive Impact of 2025 United States Tariffs on Sourcing Costs Distribution Channels and Profit Margins in Compression Apparel

The imposition of new tariff measures by the United States in 2025 has created significant reverberations across the compression garment value chain, influencing sourcing decisions, distributor margins, and end-consumer pricing. Tariffs targeting textile and knitwear imports from key manufacturing hubs, particularly China and select Southeast Asian countries, have increased landed costs by approximately 10 to 20 percent, prompting brands to reevaluate their global procurement strategies.

In response, several market players have accelerated nearshoring initiatives, establishing production facilities in Mexico and Central America to mitigate tariff exposure and reduce lead times. This realignment has yielded improved control over quality and logistics, albeit with initial capital outlays and workforce training requirements. Concurrently, select brands have pursued tariff engineering tactics, such as sourcing intermediary materials from non‐tariffed regions or incorporating tariff-free components to maintain competitive pricing structures.

Distribution channels have also been affected, as wholesalers and brick‐and‐mortar retailers face compressed margins. To preserve profitability, some channel partners have adjusted inventory mixes, emphasizing higher‐margin premium lines and private‐label compression offerings. Meanwhile, direct‐to‐consumer segments have leveraged digital channels to pass through cost increases transparently and reinforce value propositions through enhanced customer service and loyalty programs.

Moving forward, the cumulative impact of these tariff measures continues to reshape cost structures and supply chain resilience, underscoring the imperative for industry participants to adopt agile sourcing frameworks and tariff‐mitigation strategies.

Deriving Strategic Insights from Segmenting the Compression Apparel Market by Application Product Type Material End User and Distribution Channels

Segment analysis reveals a richly layered compression garment landscape that demands tailored strategies for each application category. In daily wear, consumers prioritize seamless integration, comfort, and subtle aesthetics, driving demand for lightweight leggings and shirts that support everyday circulation without overt performance cues. Fitness training applications, conversely, emphasize graduated compression and targeted muscle support for high‐intensity workouts, steering manufacturers toward differentiated sleeve and shorts designs that optimize recovery and proprioceptive feedback.

Product type variations further shape market approaches, as leggings continue to dominate due to their versatility, while shirts and shorts capture niche segments like upper‐body compression and cross‐training. Compression sleeves and socks, meanwhile, serve both athletic and medical rehabilitation audiences, offering precise anatomical support for injury prevention and venous health. Each product family benefits from specialized knit constructions and variable compression gradients that align with user biomechanics.

The choice of material underpins functional performance across segments, with nylon spandex blends delivering superior stretch recovery and durability, and polyester elastane blends offering enhanced moisture management and abrasion resistance. These distinct fiber compositions allow brands to calibrate garments for specific use cases, balancing compression efficacy with wearer comfort across temperature and activity profiles.

End user segmentation underscores gender‐based design preferences and fit nuances, as men’s compression wear often features more structured silhouettes and subdued color palettes, whereas women’s lines emphasize adjustable support zones and fashion-driven prints. Distribution channels complete the segmentation tapestry: offline outlets like department stores, pharmacies, and specialty running shops retain importance for tactile fit consultations, while online channels-comprising both company‐owned websites and third‐party platforms-offer convenience, broader selection, and data‐driven personalization tools that refine product recommendations based on individual needs.

This comprehensive research report categorizes the Lifestyle Compression Garment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- End User

- Distribution Channel

Exploring Regional Dynamics across Americas EMEA and Asia Pacific Uncovering Distinct Drivers Challenges and Growth Opportunities for Compression Wear

Geography plays a crucial role in shaping demand patterns, regulatory environments, and distribution infrastructures across the compression garment market. In the Americas, robust fitness culture and healthcare initiatives bolster both athletic and medical applications. The United States, in particular, benefits from well‐established professional sports markets and widespread adoption of preventive health practices, driving consumer willingness to invest in premium compression solutions. Canada and Brazil demonstrate growing interest in compression technology for both endurance sports and rehabilitation therapies, supported by expanding physio‐clinic networks.

Across Europe, Middle East & Africa, regulatory diversity and economic heterogeneity create both challenges and opportunities. Western European countries exhibit stringent medical device classifications for compression hosiery and sleeves, compelling manufacturers to secure CE markings and invest in clinical validation studies. The Gulf region’s affinity for high‐performance sports and climate‐driven cooling fabric innovations encourages lighter compression lines, while South Africa’s emerging sports infrastructure underpins demand for affordable athletic compression gear.

In Asia Pacific, rapid urbanization and rising disposable incomes catalyze market expansion. China leads through a broad e‐commerce ecosystem and government‐sponsored health campaigns, making digital direct‐to‐consumer channels a critical growth vector. Japan’s advanced textile R&D landscape fosters innovative smart fabrics, including biofeedback‐enabled compression wear, whereas Australia and India exhibit increasing acceptance of compression garments in everyday wellness routines and medical rehabilitation contexts.

This regional mosaic underscores the importance of adaptive product portfolios, compliance strategies, and go‐to‐market models that align with local consumer behaviors, trade regulations, and distribution infrastructures across the Americas, EMEA, and Asia Pacific.

This comprehensive research report examines key regions that drive the evolution of the Lifestyle Compression Garment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Compression Garment Manufacturers and Brands Innovating Through Technology Partnerships and Sustainable Production Practices

Leading corporations within the compression garment domain differentiate through a blend of technological innovation, strategic partnerships, and sustainability commitments. Under Armour has expanded its product lines to include sensor‐embedded sleeves that track muscle activity and integrate with proprietary training apps, solidifying its position among performance‐driven athletes and digital fitness enthusiasts. Similarly, Nike continues to refine its compression fabrics by collaborating with top sports teams and research institutes, applying biomechanical data to enhance garment ergonomics.

Specialist brands such as 2XU and SKINS focus on rigorous scientific validation, commissioning peer‐reviewed studies to substantiate compression benefits in recovery and circulatory health. These credentials enable premium pricing and foster trust among professional athletes and medical practitioners alike. At the same time, medical hosiery experts like Sigvaris and CEP concentrate on clinical partnerships and distribution through pharmacy networks, ensuring compliance with medical device regulations and positioning their products as trusted therapeutic solutions.

Smaller disruptors are carving niches through sustainable manufacturing and customization platforms. Start‐ups leveraging recycled elastane and waterless dye processes appeal to eco-conscious consumers seeking high‐performance, low‐impact options. Other innovators offer made‐to‐measure compression collections enabled by AI‐driven sizing tools, delivering precise fit and personalized support to address individual anatomical needs.

Across this competitive landscape, the most successful players blend evidence‐based performance claims, robust distribution channel strategies, and continuous product innovation to maintain relevance and capture evolving consumer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lifestyle Compression Garment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2XU Pty Ltd

- Adidas AG

- Comfort Plus Corporation

- Design Veronique, LLC

- Hanesbrands Inc.

- Leonisa S.A.

- Lululemon Athletica, Inc.

- Lymphedivas, LLC

- Marena Group, LLC

- McDavid, LLC

- Nike, Inc.

- Puma SE

- Skims HQ LLC

- Spanx, Inc.

- Therafirm, LLC

- Tommie Copper, Inc.

- Triumph International AG

- Under Armour, Inc.

- VIM & VIGR, LLC

- Össur hf.

Implementing Actionable Strategies for Industry Leaders to Navigate Regulatory Challenges Optimize Supply Chains and Enhance Consumer Engagement in Compression Apparel

Industry participants must adopt a multifaceted approach to navigate evolving regulatory frameworks, supply chain complexities, and consumer expectations. First, diversifying sourcing geographies and leveraging tariff engineering techniques can mitigate import duties while preserving access to high-quality raw materials. Establishing agile supplier networks-combining nearshore manufacturers with strategic partnerships in lower‐tariff regions-enhances resilience against policy fluctuations and logistical disruptions.

Second, integrating digital innovation across product development and customer engagement will be critical. By embedding sensors and leveraging mobile applications for real‐time performance tracking, brands can deepen consumer loyalty and differentiate their value propositions. Concurrently, investing in AI‐driven fit analysis reduces return rates and elevates the online shopping experience, driving conversion and lifetime value in direct‐to‐consumer channels.

Third, sustainability must permeate every facet of the business, from material selection to end‐of‐life recycling programs. Companies that pioneer bio‐based elastomers, closed‐loop manufacturing, and transparent supply chain reporting will resonate with eco‐aware consumers and comply with increasingly rigorous environmental regulations. Collaborations with certification bodies and non‐profits can further reinforce brand legitimacy.

Finally, cultivating strategic collaborations with healthcare providers, sports teams, and wellness influencers can amplify market penetration and validate performance claims. By co‐creating research initiatives and educational campaigns, industry leaders can elevate market credibility, accelerate adoption, and foster an ecosystem that bridges medical therapy, athletic performance, and lifestyle wellness.

Outlining a Comprehensive Research Methodology Combining Primary Interviews Secondary Data Analysis and Expert Validation to Ensure Market Intelligence Accuracy

Our research framework combined extensive primary interviews with industry executives, product designers, and distribution channel partners, alongside a comprehensive review of company filings, trade publications, and regulatory databases. Primary data collection involved structured discussions with key stakeholders to capture real‐time perspectives on tariff impacts, material innovations, and channel dynamics. These insights provided granular visibility into decision‐making processes and emerging strategic priorities.

Secondary research sources included technical journals, patent databases, and competitive intelligence reports to trace the evolution of compression textile technologies and performance claims. Regulatory information was sourced from government publications and international standards organizations to map medical device classifications and import duty schedules in target markets. This multi‐source approach enabled robust cross‐validation of findings.

Quantitative analysis focused on synthesizing cost factors, channel mix trends, and consumer sentiment indicators without extrapolating market size or projections. Data triangulation techniques ensured consistency across disparate inputs, while an expert validation workshop involving independent analysts and domain specialists ratified the conclusions. Any discrepancies were addressed through iterative review cycles until consensus was achieved.

This methodology ensures that our insights reflect the most current industry realities, underpin strategic recommendations with empirical evidence, and deliver actionable intelligence for stakeholders seeking to navigate the complexities of the compression garment market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lifestyle Compression Garment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lifestyle Compression Garment Market, by Product Type

- Lifestyle Compression Garment Market, by Material

- Lifestyle Compression Garment Market, by Application

- Lifestyle Compression Garment Market, by End User

- Lifestyle Compression Garment Market, by Distribution Channel

- Lifestyle Compression Garment Market, by Region

- Lifestyle Compression Garment Market, by Group

- Lifestyle Compression Garment Market, by Country

- United States Lifestyle Compression Garment Market

- China Lifestyle Compression Garment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Strategic Implications from Market Trends Technological Advances and Policy Influences in the Compression Garment Landscape

The compression garment sector stands at the confluence of health science, textile innovation, and lifestyle consumerism. Our analysis reveals that dynamic shifts-including digital fitness integration, sustainable material adoption, and tariff‐driven supply chain realignments-are collectively redefining competitive battlegrounds. Segmentation insights underscore the necessity for nuanced product strategies across daily wear, fitness, medical rehabilitation, and sports niches, while regional variations highlight the importance of localized compliance and distribution models.

Key corporate players distinguish themselves through a blend of evidence‐backed performance claims, advanced fabric development, and strategic alliances with healthcare and athletic institutions. Meanwhile, emerging brands focusing on customization, eco‐friendly materials, and digital personalization are challenging incumbents and expanding market frontiers. These parallel trajectories underscore a broader industry imperative: to harmonize technological innovation with consumer expectations and regulatory demands.

Looking ahead, industry leaders must embrace adaptive sourcing frameworks, digital‐first engagement tactics, and sustainability commitments to maintain relevance. The cumulative impact of new tariff regimes and evolving trade policies further amplifies the need for agile operations and proactive risk management. By synthesizing these insights, stakeholders can chart a strategic course that capitalizes on emerging opportunities and mitigates structural challenges.

Through this executive summary, decision‐makers are equipped with a cohesive understanding of market drivers, segmentation dynamics, regional particularities, and actionable strategies essential for navigating the rapidly evolving compression garment landscape.

Engage with Ketan Rohom for Exclusive Insights and Secure Your Definitive Market Research Report to Unlock Competitive Advantage in Compression Apparel

To deepen your strategic understanding of the compression garment market and secure a competitive edge, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you’ll gain exclusive access to tailored insights drawn from our rigorous analysis of industry dynamics, supply chain transformations, and consumer behavior. This conversation will illuminate critical opportunities for differentiating your brand, optimizing your distribution channels, and mitigating regulatory risks in 2025 and beyond.

Seize this opportunity to equip your organization with the definitive market research report that underpins data-driven decision making. Ketan Rohom is ready to guide you through the key findings, evaluate bespoke recommendations aligned to your strategic objectives, and outline the next steps for commissioning a customized research engagement. Reach out today to ensure your team stays ahead of evolving trends in lifestyle compression garments and capitalizes on emerging avenues for innovation and growth.

- How big is the Lifestyle Compression Garment Market?

- What is the Lifestyle Compression Garment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?