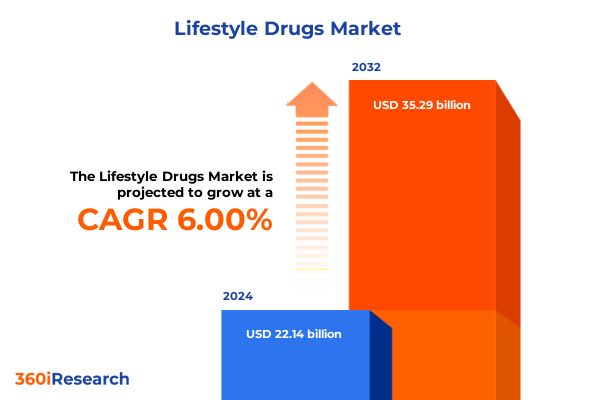

The Lifestyle Drugs Market size was estimated at USD 23.09 billion in 2025 and expected to reach USD 24.09 billion in 2026, at a CAGR of 6.24% to reach USD 35.29 billion by 2032.

Unveiling the Surge of Lifestyle Pharmaceutical Solutions Revolutionizing Preventive Health and Wellness Across Diverse Therapeutic Applications

The uptake of prescription drugs tailored to address non-life-threatening conditions has risen dramatically, transforming the broader pharmaceutical ecosystem. Once niche therapies reserved for specific patient cohorts, lifestyle drugs now span an expanding spectrum of applications from cosmetic dermatology to metabolic wellness. This shift reflects evolving consumer priorities, where the quest for sustained vitality and enhanced quality of life intersects with the mainstreaming of medical interventions that were previously confined to acute or chronic disease management.

Fueled by an increasingly health-conscious population, robust advancements in drug delivery technologies, and a surge in direct-to-consumer marketing, the lifestyle drug segment has ascended to a strategic focal point for industry stakeholders. Patients are embracing therapies that not only ameliorate symptoms but also proactively optimize day-to-day functioning, and this change is mirrored by payers and providers seeking cost-effective, outcome-based solutions. Moreover, the convergence of regulatory flexibility and accelerated approval pathways has reduced barriers to market entry, catalyzing a wave of innovation.

Digital health platforms, telemedicine services, and data-driven patient support models have further accelerated adoption, enabling clinicians to personalize regimens and monitor real-world outcomes remotely. As healthcare delivery becomes more consumer-centric, lifestyle drugs have emerged as a bridge between traditional pharmacotherapy and wellness-enhancing interventions, underscoring the need for integrated strategies that blend clinical efficacy with patient experience design. This executive summary delves into the pivotal shifts shaping the market, examines the impact of recent trade policies, and offers actionable insights that will help stakeholders navigate the complex dynamics of this rapidly evolving domain.

Mapping the Transformational Forces Reshaping Lifestyle Drug Development Through Digitalization, Personalized Care, and Regulatory Innovations

An array of transformative forces have converged to redefine how lifestyle drugs are developed, regulated, and delivered. Digitalization has ushered in AI-driven drug discovery platforms, significantly shortening lead times and enabling precision targeting of molecular pathways tied to aesthetic, metabolic, or behavioral health outcomes. Meanwhile, personalized medicine paradigms, bolstered by advanced diagnostic assays and pharmacogenomic profiling, are challenging one-size-fits-all dosing models, driving demand for individualized regimens that align with each patient’s genetic and lifestyle context.

Regulatory frameworks are also adapting, with agencies worldwide adopting more flexible evidentiary standards for products addressing quality-of-life improvements rather than life-saving endpoints. Expedited review pathways and conditional approvals for therapies demonstrating favorable benefit-risk profiles have incentivized innovation, particularly in areas such as GLP-1 receptor agonists, topical retinoids, and novel nicotine receptor modulators. This evolving oversight landscape has lowered entry barriers, enabling emerging biotech firms to compete alongside established pharmaceutical players.

Simultaneously, supply chain and distribution networks are undergoing a paradigm shift, propelled by direct-to-consumer channels and telepharmacy models. Enhanced cold-chain logistics, track-and-trace technologies, and digital patient support tools are optimizing treatment adherence and accelerating time-to-patient. The integration of outcome-based contracting arrangements and real-world evidence platforms further amplifies these shifts, facilitating closer collaboration among manufacturers, payers, and healthcare providers. Together, these transformative currents are orchestrating a fundamental reorientation of the lifestyle drug landscape.

Evaluating the Consequences of 2025 United States Tariff Measures on Lifestyle Drug Supply Chains, Cost Structures, and Strategic Sourcing

In 2025, the United States implemented a series of tariff policies targeting the import of active pharmaceutical ingredients and key excipients used in lifestyle drug formulations. These measures, designed to bolster domestic manufacturing capabilities and shield critical supply chains from geopolitical disruptions, have introduced new cost dynamics across the sector. Import duties on select chemical intermediates have increased the landed cost of traditionally low-priced raw materials, prompting manufacturers to reassess procurement strategies and renegotiate terms with international suppliers.

Consequently, the downstream effect on dosage form producers and contract manufacturing organizations has been significant. Many specialty ingredient suppliers have passed through higher costs, squeezing margins for drug developers and compelling end-to-end supply chain optimization. Formulation partners are increasingly seeking dual sourcing arrangements and establishing regional hubs to mitigate tariff exposure. At the same time, the threat of further trade policy volatility has led companies to re-evaluate inventory buffers and diversify their portfolio of certified manufacturing sites to ensure uninterrupted production of popular lifestyle therapeutics, including erectile dysfunction treatments, weight management injectables, and topical retinoid creams.

Despite short-term margin pressures and logistical complexities, the tariff environment has also catalyzed innovation in sourcing and process efficiency. Some stakeholders are exploring onshore synthesis projects, partnering with domestic chemical manufacturers to localize API production and reduce foreign dependency. Others are investing in advanced continuous manufacturing systems that deliver greater yield and flexibility while offsetting increased raw material costs. As the industry adapts, organizations that adopt agile supply chain frameworks and strategic sourcing partnerships will be well positioned to thrive amidst evolving trade dynamics and maintain competitiveness in the lifestyle drug market

Revealing Critical Insights Across Indication, Dosage Forms, Administration Routes, Therapeutic Classes, Distribution Channels, and End User Profiles

The lifestyle drug market exhibits a multifaceted landscape when analyzed through the lens of indication, revealing that aesthetic and performance-enhancing therapies lead adoption trends. Cosmetic skin treatments leveraging retinoids and other topicals remain a mainstay for consumers seeking non-invasive complexion enhancement, while targeted interventions for erectile dysfunction continue to command significant attention due to demographic and psychosocial factors. Hair loss solutions, smoking cessation aids, and weight management therapeutics, including GLP-1 receptor agonists, further diversify the portfolio of available options, demonstrating a robust demand for treatments that address both appearance and lifestyle optimization.

When considering the dosage form dimension, capsules and tablets persist as the predominant formats, with hard and soft capsules offering flexibility in delivering complex molecules. Immediate release tablets cater to rapid onset requirements, whereas sustained release formulations support patient adherence through extended dosing intervals. Meanwhile, injectables have emerged as a high-growth category, especially for metabolic health applications, benefiting from precision dosing and controlled bioavailability. Topical creams and gels continue to be favored in dermatological indications, and emerging spray technologies are gaining traction for their convenience and user-centric design.

Route of administration insights underscore the primacy of oral delivery, yet inhalation-based smoking cessation products and parenteral metabolic therapies are reshaping patient preferences. Distribution channels reflect an omnichannel approach: traditional drug stores and retail pharmacies coexist with digitally enabled online pharmacies offering both over-the-counter and prescription services. Hospital pharmacies, segmented between private and public institutions, serve as critical access points for specialized treatments, while chain and independent retail outlets maintain broad reach. End user profiles further illuminate market dynamics, with clinics and hospitals facilitating professional administration of injectable therapies, home healthcare settings accommodating self-administered regimens, and retail environments driving mass-market accessibility.

This comprehensive research report categorizes the Lifestyle Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Dosage Form

- Route Of Administration

- Therapeutic Class

- Distribution Channel

- End User

Analyzing Regional Dynamics and Emerging Demand Drivers Impacting Lifestyle Drug Markets Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Within the Americas, the United States and Canada represent mature markets characterized by high consumer spending on lifestyle therapies and progressive reimbursement frameworks that increasingly recognize quality-of-life enhancements. In particular, weight management injectables and erectile dysfunction products command significant uptake, underpinned by comprehensive patient support programs and direct-to-consumer marketing campaigns. Latin American markets, by contrast, exhibit a more cost-sensitive profile, prompting manufacturers to tailor pricing strategies and distribution partnerships to align with regional purchasing power while navigating localized regulatory requirements.

Europe, the Middle East, and Africa present a heterogeneous landscape wherein Western European nations maintain stringent regulatory oversight that favors established retinoid and PDE5 inhibitor offerings, often requiring robust clinical evidence to secure market entry. In parts of the Middle East, private clinics have catalyzed demand for cosmetic skin treatments, leveraging affluent demographics and medical tourism infrastructure. Meanwhile, Africa’s nascent ecosystem is marked by emerging public-private collaborations aimed at expanding access to smoking cessation therapies and affordable generic alternatives, signaling an uptick in public health initiatives targeting lifestyle-related risk factors.

In the Asia-Pacific region, rapid urbanization and evolving consumer attitudes have accelerated the adoption of lifestyle drugs, particularly in metropolitan hubs across East and Southeast Asia. Markets such as Japan and South Korea demonstrate high penetration of topical and oral formulations, supported by advanced distribution networks and telehealth integration. India and China, as major producers of generic APIs, are concurrently evolving into significant consumer bases, with weight loss and hair loss treatments gaining traction amid rising disposable incomes. Across the region, the proliferation of digital pharmacy platforms and home healthcare services is reshaping traditional access models and unlocking new growth corridors for lifestyle therapeutics.

This comprehensive research report examines key regions that drive the evolution of the Lifestyle Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Initiatives and Competitive Positioning of Leading Biopharmaceutical Companies in the Lifestyle Drug Segment

Leading pharmaceutical and biotech firms have adopted multifaceted strategies to consolidate their positions within the competitive lifestyle drug segment. Collaborations and licensing agreements have become commonplace, enabling established players to augment their pipelines with niche, high-potential assets. Strategic acquisitions have also served as a rapid means to enter adjacent markets; companies with core oncology or metabolic portfolios are diversifying into obesity and skin health, leveraging their existing R&D infrastructure to accelerate development timelines.

Research and development focus has intensified around novel mechanisms with superior safety and efficacy profiles. For instance, GLP-1 receptor agonist innovators continue to explore next-generation analogs that offer improved tolerability and dosing convenience. Similarly, advancements in transdermal delivery technologies have drawn interest from firms aiming to differentiate topical retinoid formulations. In the realm of erectile dysfunction, companies are investing in next-wave PDE5 inhibitors with tailored pharmacokinetic characteristics to minimize adverse events and enhance spontaneity.

On the commercial front, leading organizations are optimizing omnichannel marketing models to engage digitally savvy consumers. Partnerships with telemedicine providers and pharmacy fulfillment networks underpin streamlined patient journeys, from virtual consultations to doorstep delivery. Additionally, manufacturers are experimenting with outcome-based contracting frameworks, aligning pricing with real-world effectiveness metrics. Finally, sustainability commitments have emerged as a differentiator, with several companies integrating green chemistry principles and carbon-neutral packaging to resonate with environmentally conscious stakeholders. This holistic approach to value creation underscores the importance of corporate responsibility alongside commercial performance in the lifestyle drug domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lifestyle Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Bayer AG

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Novo Nordisk A/S

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd

Defining Clear and Actionable Recommendations to Drive Growth, Optimize Portfolios, and Enhance Competitive Agility in the Lifestyle Drug Market

To navigate the complex terrain of lifestyle drug markets, industry leaders should prioritize supply chain resilience by diversifying sourcing and expediting nearshoring initiatives for critical raw materials. Establishing strategic partnerships with multiple API manufacturers and contract development organizations can mitigate tariff-related disruptions while fostering collaborative innovation. Continuous manufacturing solutions should be deployed to enhance production agility and reduce per-unit costs, laying the groundwork for scalable growth.

Investment in digital health ecosystems remains paramount. Organizations must deepen integration with telemedicine platforms, patient engagement applications, and remote monitoring tools to deliver personalized therapy experiences. Data-driven insights gathered from real-world evidence frameworks can inform product enhancements and support outcome-based pricing discussions with payers. Tailoring communication strategies across channels, from social media to clinician portals, will further enrich the customer journey and strengthen brand loyalty.

A proactive approach to regulatory engagement will yield long-term advantages. Companies should cultivate transparent dialogues with health authorities to anticipate evolving compliance requirements, while aligning clinical development programs with emerging guidelines for quality-of-life indications. Regional market entry strategies must be adapted to local policy landscapes, leveraging public-private collaborations where appropriate. Finally, embedding sustainability and corporate responsibility into product development and supply chain operations will not only satisfy stakeholder expectations but also unlock operational efficiencies and reputational benefits.

Outlining a Rigorous Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Robust Validation Approaches for Credible Insights

This report’s findings are underpinned by a rigorous research framework that combines qualitative and quantitative methodologies. Primary research was conducted through in-depth interviews with key opinion leaders, including dermatologists, endocrinologists, urologists, and clinical pharmacists, who provided strategic perspectives on therapeutic trends and patient behavior. Supplemental insights were collected from senior executives at leading contract manufacturing organizations, distribution partners, and regulatory experts to triangulate commercial and operational considerations.

A comprehensive secondary research component incorporated the systematic review of publicly available sources, such as regulatory agency guidelines, peer-reviewed journals, corporate press releases, and patent filings. Industry conference proceedings and white papers were analyzed to capture the latest scientific advancements and competitive developments. All data points underwent validation through cross-comparison of multiple sources, ensuring consistency and reliability.

Analytical rigor was further enhanced by leveraging statistical tools for trend analysis, cluster mapping across segmentation dimensions, and scenario modeling to assess potential market impacts of trade policy changes. The methodology also integrated feedback loops with subject matter experts at various stages of the research cycle, facilitating iterative refinement and enhancing the overall credibility of the conclusions presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lifestyle Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lifestyle Drugs Market, by Indication

- Lifestyle Drugs Market, by Dosage Form

- Lifestyle Drugs Market, by Route Of Administration

- Lifestyle Drugs Market, by Therapeutic Class

- Lifestyle Drugs Market, by Distribution Channel

- Lifestyle Drugs Market, by End User

- Lifestyle Drugs Market, by Region

- Lifestyle Drugs Market, by Group

- Lifestyle Drugs Market, by Country

- United States Lifestyle Drugs Market

- China Lifestyle Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Key Findings and Strategic Imperatives That Define the Future Trajectory of the Lifestyle Drug Landscape for Informed Decision-Making

The landscape of lifestyle drugs is undergoing a profound metamorphosis, driven by converging factors such as digital innovation, regulatory evolution, and shifting consumer preferences. As therapies extend beyond traditional disease treatment into realms of wellness, aesthetics, and behavioral health, stakeholders must adapt their strategic playbooks to stay ahead of market trends and competitive pressures. The 2025 tariff environment has introduced new operational complexities, yet also presents opportunities to strengthen domestic capabilities and invest in next-generation manufacturing technologies.

Segmentation analysis reveals that indications from cosmetic skin treatments to weight management are experiencing differentiated growth trajectories, while dosage forms and routes of administration are becoming more sophisticated to meet nuanced patient needs. Regional insights underscore the necessity of tailored strategies that reflect local regulatory landscapes, infrastructure maturity, and consumer behavior. Finally, competitive benchmarking highlights the importance of collaborative R&D, flexible supply chains, and outcome-based commercial models. By embracing an integrated approach that balances innovation with operational excellence, industry leaders can position themselves to unlock new growth pathways and enhance patient outcomes in the evolving world of lifestyle pharmaceuticals.

Empower Your Strategic Planning by Connecting with Associate Director Sales & Marketing to Secure Exclusive Lifestyle Drugs Market Research Insights Today

To gain a comprehensive, data-driven understanding of these market dynamics and secure a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for personalized guidance and access to the full market research report. Our team is ready to collaborate with you to tailor insights to your strategic priorities and support your decision-making processes with meticulous analysis and actionable intelligence

- How big is the Lifestyle Drugs Market?

- What is the Lifestyle Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?