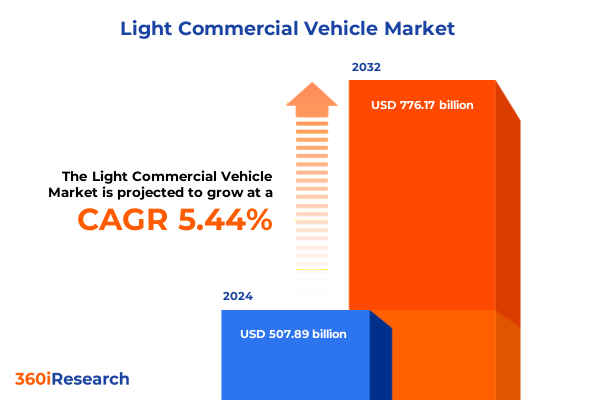

The Light Commercial Vehicle Market size was estimated at USD 535.62 billion in 2025 and expected to reach USD 566.94 billion in 2026, at a CAGR of 5.44% to reach USD 776.17 billion by 2032.

Uncover the strategic foundations and future-ready context shaping the evolving landscape of light commercial vehicles for forward-thinking decision makers

In an era defined by rapid technological breakthroughs and shifting supply chain paradigms, light commercial vehicles stand at the forefront of logistics, construction, and urban services transformation. This introduction establishes the core context by weaving together critical threads: sustainability demands, digital integration, regulatory evolution, and end-user expectations. By anchoring our narrative to tangible industry drivers, we illuminate the forces reshaping vehicle design, propulsion, and fleet management.

Transitioning from silent electric powertrains to advanced telematics platforms, stakeholders must comprehend the multifaceted nature of today’s competitive landscape. Decision-makers are tasked with balancing operational efficiency, sustainability benchmarks, total cost of ownership, and responsiveness to evolving trade policies. Against this backdrop, the executive summary provides a strategic lens through which professionals can observe key catalysts of change. The following sections unpack pivotal market shifts, dissect the cumulative impact of newly adopted U.S. tariffs for 2025, and reveal segmentation-based insights vital for tailored product and service strategies.

Explore the convergence of electrification, connectivity, and modular design forging a new era of agile, tech-enabled light commercial vehicles

The light commercial vehicle landscape has undergone transformative shifts driven by the convergence of electrification, connectivity, and modular platform design. Original equipment manufacturers are recalibrating production lines to accommodate adaptable chassis architectures that enable rapid powertrain swaps and scalable cargo modules. This modularity supports a diverse range of configurations-from cargo vans and minibuses to specialized municipal service vehicles-while reducing time to market and overall development costs.

Simultaneously, the digital thread spanning vehicle design to aftermarket service is being woven tighter through integrated software ecosystems. Advanced analytics platforms capture real-time telematics and predictive maintenance data, enabling fleet operators to optimize routing, minimize downtime, and reduce emissions. Furthermore, the acceleration of autonomous driving trials in controlled environments has laid the groundwork for next-generation driver assistance systems in urban delivery corridors. These shifts converge to redefine value propositions, compelling industry participants to pivot toward innovation-driven business models that transcend traditional vehicle manufacturing.

Analyze how 2025 United States tariff measures have reshaped supply chain strategies and cost structures within the light commercial vehicle sector

The cumulative imposition of United States tariffs in 2025 has created a complex landscape for importers and domestic producers of light commercial vehicles. These measures, aimed at safeguarding local manufacturing, have resulted in adjusted cost structures for chassis components, powertrain modules, and key electronic subsystems procured from overseas. In response, many manufacturers have undertaken supply chain reshoring initiatives, realigning procurement strategies to source critical parts from North American suppliers.

However, while reshoring helps mitigate duty exposure, it also introduces challenges such as supplier capacity constraints and initial price premiums. Market leaders are leveraging co-investment partnerships with local foundries and electronics producers to scale domestic component production and achieve price parity over the medium term. Moreover, tier-one suppliers are redesigning stamping processes and optimizing logistics footprints to absorb tariff impacts without drastic end-user price increases. This adaptive response underscores the resilience of the light commercial vehicle ecosystem and highlights the necessity of strategic supply chain agility.

Delve into the multi-dimensional segmentation insights that illuminate tailored configurations and performance drivers across diverse light commercial vehicle use cases

The light commercial vehicle market is dissected through a multi-dimensional segmentation framework that reveals nuanced performance drivers across diverse operational scenarios. Examining weight class segmentation-ranging from the nimble up to 3.5 tonnes category to the versatile midrange 3.5 to 7.5 tonnes and the heavy-duty segment above 7.5 tonnes-uncovers variations in load capacities and chassis robustness that align with specific industry applications. Parallel analysis by fuel type contrasts traditionally dominant diesel engines with expansive portfolios of CNG platforms, petrol propulsion options, and emergent electric architectures subdivided into battery electric and fuel cell electric powertrains; concurrently, hybrid powerplants are categorized into mild and full hybrid configurations that bridge combustion and electrified performance.

Furthermore, insights derived from vehicle type segmentation-spanning crew cabs engineered for personnel transport, minibuses tailored for passenger shuttles, panel vans optimized for payload protection, and pickup trucks valued for flatbed versatility-illustrate how form factors correspond to varied end-user requirements. Transmission type analysis reveals automated manual gearboxes that combine efficiency with automated controls, fully automatic units offering seamless shifts, and manual transmissions that deliver direct driver engagement. Power output segmentation-differentiating models up to 100 kW, those delivering 100 to 150 kW, and high-output variants above 150 kW-highlights performance thresholds suited to urban deliveries, regional distribution, and heavy-haul applications. Lastly, evaluating end-user industry segmentation across construction, logistics, municipal, and retail sectors clarifies the last-mile demands, regulatory compliance needs, and customization imperatives unique to each domain.

This comprehensive research report categorizes the Light Commercial Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Weight Class

- Fuel Type

- Transmission Type

- Power Output

- Vehicle Type

- End-User Industry

Examine the diverse regional dynamics shaping opportunities and challenges for light commercial vehicles in the Americas, EMEA, and Asia-Pacific landscapes

Regional dynamics exert profound influence on light commercial vehicle strategies as distinct market ecosystems evolve. In the Americas, electrified van retrofits in metropolitan centers coexist alongside robust diesel fleets in long-haul logistics corridors, reflecting diverging urban and intercity transport demands. Infrastructure incentives in major U.S. states have accelerated charging network deployments, spurring fleet electrification pilots among last-mile delivery operators.

Across the Europe, Middle East & Africa region, stringent emission regulations and low-emission zones have catalyzed widespread adoption of battery electric models, especially in congested urban centers. Concurrently, CNG adoption in certain Middle Eastern markets addresses both environmental targets and fuel cost optimization, while diesel remains integral in long-distance freight corridors. Public-private partnerships are expanding hydrogen refueling infrastructure in select European countries, creating nascent markets for fuel cell electric vehicles.

The Asia-Pacific domain presents a tapestry of rapid urbanization, cost sensitivity, and industrial diversification. Electric cargo vans dominate pilot programs in East Asian megacities, leveraged for noise reduction and emission control, whereas Southeast Asian markets continue to rely on value-oriented diesel pickups and panel vans for expansion of e-commerce last-mile logistics. Regulatory harmonization efforts and investment in localized battery and component manufacturing are laying the groundwork for scalable growth in low-emission platforms.

This comprehensive research report examines key regions that drive the evolution of the Light Commercial Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover how leading OEMs, disruptors, and supplier networks are collaborating to shape holistic value propositions across the light commercial vehicle ecosystem

Industry incumbents and emerging disruptors alike are redefining competitive benchmarks through technological differentiation, strategic alliances, and service ecosystem enhancements. Legacy manufacturers are collaborating with advanced software firms to embed predictive analytics and over-the-air update capabilities, ensuring vehicles remain at peak performance throughout their lifecycle. Simultaneously, new entrants specializing in electric and fuel cell drivetrains are capturing attention by offering turnkey fleet electrification solutions, inclusive of infrastructure installation and operational training services.

Supplier networks are also evolving, with tier-one component providers investing in localized assembly facilities for battery modules and power electronics. This not only mitigates tariff exposure but facilitates faster time to market for regionally tailored variants. Financing partners and fleet management solution providers are bundling subscription-based maintenance and telematics services, offering integrated packages that shift from traditional capex models to operational expenditure structures. Collectively, these strategies underscore the competitive imperative to deliver comprehensive value propositions that extend beyond vehicle hardware.

This comprehensive research report delivers an in-depth overview of the principal market players in the Light Commercial Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashok Leyland Limited.

- BYD Company Limited

- Ford Motor Company

- Great Wall Motor Company Limited

- Hyundai Motor Company

- Isuzu Motors Limited

- Iveco Group N.V.

- Kia Corporation

- Mahindra & Mahindra Limited

- Mercedes-Benz Group AG

- Nissan Motor Co., Ltd.

- Piaggio & C. SpA

- Renault S.A.

- Rivian Automotive, Inc.

- SAIC Motor Corporation Limited

- Stellantis N.V.

- Suzuki Motor Corporation

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen AG

Implement diversified sourcing models, modular architectures, and integrated software services to transform disruption into competitive advantage in light commercial vehicles

Industry leaders should proactively realign their strategic roadmaps around several actionable imperatives. First, fostering resilient supply chains through diversified sourcing and co-investment in regional manufacturing hubs will guard against tariff volatility and logistical disruptions. Second, prioritizing modular vehicle architectures that support swift powertrain conversions can capture emerging niches across electrified, hybrid, and conventional propulsion segments. Third, embracing software-driven service models-ranging from predictive maintenance to dynamic fleet optimization-will deepen customer engagement and create recurring revenue streams.

Furthermore, engaging in strategic partnerships with charging network operators, infrastructure developers, and local governments can accelerate the rollout of low-emission vehicles, particularly in urban centers with strict emissions regulations. Investing in talent development programs, including cross-functional training in electric powertrain diagnostics and digital systems integration, will strengthen internal capabilities. By embedding these recommendations into their operational blueprints, industry leaders can turn disruption into opportunity and secure long-term competitive advantage.

Leverage a rigorous, multi-source research approach featuring primary stakeholder interviews and comprehensive secondary analysis to validate insights

Our research methodology combines primary qualitative interviews, extensive secondary literature reviews, and rigorous data triangulation to ensure comprehensive coverage and unbiased insights. Primary research involved in-depth discussions with fleet operators, OEM product strategists, and component suppliers to capture real-world challenges and strategic priorities. These interviews were complemented by site visits to manufacturing facilities and technology showcases, where observational data enriched our understanding of production innovations and pilot programs.

Secondary research encompassed analysis of regulatory filings, patent databases, industry association reports, and peer-reviewed journals to validate technical trends and policy developments. Data points were cross-referenced to eliminate discrepancies and ensure consistency across region-specific case studies. The triangulation of qualitative perspectives, quantitative data sets, and on-site observations yields a robust framework for drawing actionable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Light Commercial Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Light Commercial Vehicle Market, by Weight Class

- Light Commercial Vehicle Market, by Fuel Type

- Light Commercial Vehicle Market, by Transmission Type

- Light Commercial Vehicle Market, by Power Output

- Light Commercial Vehicle Market, by Vehicle Type

- Light Commercial Vehicle Market, by End-User Industry

- Light Commercial Vehicle Market, by Region

- Light Commercial Vehicle Market, by Group

- Light Commercial Vehicle Market, by Country

- United States Light Commercial Vehicle Market

- China Light Commercial Vehicle Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesize the pivotal themes of innovation, policy influence, and segmentation complexity that define the future trajectory of light commercial vehicles

In summary, the light commercial vehicle sector is undergoing a period of accelerated evolution driven by electrification, connectivity, regional policy divergence, and supply chain recalibration. Organizations that embrace modular design platforms, invest in resilient and localized supply networks, and integrate software-centric service models will be best positioned to thrive. The interplay of weight-class diversity, propulsion choices, vehicle configurations, and industry-specific demands underscores the need for tailored solutions rather than one-size-fits-all approaches.

As tariff measures continue to influence procurement strategies and regional dynamics shape adoption trajectories, continuous monitoring of policy shifts and infrastructure developments will remain essential. By aligning strategic investments with the insights detailed in this executive summary, stakeholders can navigate complexity, seize emerging opportunities, and chart a sustainable growth path in the ever-changing light commercial vehicle landscape.

Connect with Ketan Rohom, Associate Director of Sales & Marketing to unlock bespoke light commercial vehicle market intelligence and drive strategic advantage

To secure your organization’s competitive edge within the dynamic light commercial vehicle arena, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly with Ketan, you will gain access to tailored consulting sessions and priority delivery of the comprehensive market intelligence report. His expertise enables swift alignment of your strategic roadmap with the latest technological evolutions, emerging tariff landscapes, and regionally nuanced opportunities. Engage now to leverage actionable insights for capitalizing on next-generation powertrain innovations, optimized fleet configurations, and regulatory foresight. Position your brand to lead industry transformation by connecting with Ketan today

- How big is the Light Commercial Vehicle Market?

- What is the Light Commercial Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?