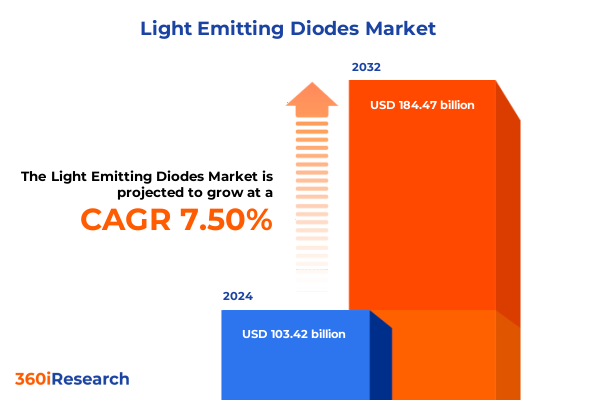

The Light Emitting Diodes Market size was estimated at USD 111.05 billion in 2025 and expected to reach USD 118.58 billion in 2026, at a CAGR of 7.51% to reach USD 184.47 billion by 2032.

Illuminating the Future Landscape of Light Emitting Diodes Through Cutting-Edge Innovations and Evolving Global Market Dynamics

The world of light emitting diodes has evolved dramatically from its infancy as simple indicator lights in consumer electronics to an all-encompassing illumination solution embraced across industries. At its core, the LED market is propelled by the relentless pursuit of energy efficiency and environmental sustainability, as decision-makers seek to curtail carbon footprints while enhancing operational cost structures. Simultaneously, pressure from regulatory bodies has spurred manufacturers to innovate rapidly, integrating advanced materials and novel semiconductor architectures that promise higher luminous efficacy and longer operational lifespans. Moreover, the convergence of lighting and digital ecosystems has unlocked fresh avenues for growth, with smart lighting platforms now acting as nodes within the broader Internet of Things fabric and offering unprecedented levels of flexibility and control.

Amid these technical strides, consumer preferences have shifted toward solutions that not only provide illumination but also support human wellness by offering tunable white spectra and high fidelity color rendering. The proliferation of connected lighting solutions in commercial and residential spaces underscores a fundamental transformation in how light is conceived: no longer a passive utility, it has become an active element of experience design. These dynamics collectively lay the groundwork for a market defined by convergence, where form factor miniaturization, aesthetic integration, and advanced control interfaces are just as critical as raw performance metrics. As a result, stakeholders across the value chain-from chip fabricators to luminaire assemblers-face intense pressure to innovate, collaborate, and differentiate in an environment characterized by surging demand for smarter, greener, and more versatile lighting.

Unveiling Revolutionary Transformations in LED Technology Adoption, Supply Chain Adaptation, and Consumer Demand Patterns Worldwide

In recent years, the LED arena has witnessed seismic shifts that have redefined both its supply chains and end-user applications. Foremost among these has been the rapid rise of micro and mini LED technologies, which deliver unprecedented brightness, contrast, and form factor flexibility. These advances have triggered a domino effect, compelling traditional LED makers to reassess manufacturing capacities and invest heavily in advanced wafer processing equipment to remain competitive. Concomitantly, the dramatic expansion of display applications-spanning from large-scale video walls to immersive automotive dashboards-has turbocharged demand for Quantum Dot LEDs and organic LEDs, which offer richer color gamuts and more uniform light distributions.

Meanwhile, digital connectivity has blurred the boundaries between lighting and data services, positioning luminaries as integral components of smart building infrastructures. This has prompted lighting OEMs to partner with platform providers and system integrators, embedding sensors and communication modules within fixtures to enable real-time monitoring, predictive maintenance, and energy management. On the procurement side, purchasers have pivoted toward suppliers capable of delivering holistic lighting-as-a-service contracts that span installation, performance tracking, and end-of-life recycling. Through these transformative trends, the LED ecosystem is rapidly coalescing around a future defined by modularity, interoperability, and sustainability, heralding a new era in which lighting does far more than simply illuminate.

Assessing the Far-Reaching Consequences of New United States Tariff Measures on LED Production, Supply Chains, and Competitive Positioning

Beginning in early 2025, the introduction of heightened tariff measures on imported LED components and finished luminaires by the United States government has had a profound impact on global trade flows. These levies, targeting key manufacturing hubs in East Asia, have inflated costs for downstream assemblers, forcing them to either absorb increased expenditures or pass them on to end users. As a direct consequence, some distributors have sought alternative sources in regions with favorable trade agreements or have accelerated nearshoring initiatives to mitigate exposure, fostering a more geographically diverse supply network. At the same time, U.S.-based producers have experienced a temporary uptick in competitiveness, buoyed by the relative price advantages afforded by import restrictions.

However, this short-term benefit has been counterbalanced by collateral challenges. The abrupt reshaping of sourcing strategies has strained relationships with long-standing suppliers and amplified lead time volatility, especially for specialty diodes and advanced substrates that remain concentrated in certain Asian clusters. Procurement managers have had to renegotiate long-term contracts and invest in dual-sourcing architectures to safeguard continuity of supply. Moreover, the ripple effects of price hikes have been felt across downstream verticals, with project developers in commercial and outdoor lighting reporting deferred rollouts and budgetary constraints. Over the longer term, these tariff-driven dynamics are likely to encourage manufacturers to deepen vertical integration, expand local assembly footprints, and pursue strategic partnerships, thereby reconfiguring the competitive landscape in profound and lasting ways.

Exploring Critical Market Segmentation Dimensions Shaping LED Industry Opportunities Across Technology, Performance, and End-User Channels

A nuanced understanding of market segmentation reveals where both challenges and opportunities lie within the LED space. When viewed through the prism of technology, offerings range from time-tested conventional LEDs to state-of-the-art micro LEDs, mini LEDs, OLEDs, and Quantum Dot LEDs, each presenting its own set of performance attributes, thermal management considerations, and cost profiles. The conventional variant retains appeal in cost-sensitive scenarios, while micro and mini LEDs have gained traction for premium display and automotive lighting applications. At the same time, OLED modules, characterized by their thin form factors and diffuse emission characteristics, have carved out niches in architectural and residential design. Quantum Dot systems, meanwhile, offer superior color fidelity, making them popular in high-end consumer electronics and broadcast studio installations.

Equally important is the lens of color rendering index, which divides the market into high CRI solutions prized for applications demanding precise color discrimination and standard CRI products that balance performance with affordability. This performance dimension often dictates suitability for end uses spanning from healthcare examination rooms to industrial inspection lines. Addressing usage patterns further, the spectrum of end users extends across automotive lighting systems, commercial venues-embracing hospitality venues, office infrastructures, and retail environments-healthcare facilities, industrial plants, outdoor installations, and residential interiors. Understanding these verticals is critical, as each calls for tailored luminaire designs, regulatory compliance checks, and service level agreements. Finally, distribution channels bifurcate into offline and online pathways, with offline sales occurring through both modern trade outlets and traditional trade pathways; meanwhile, online platforms have emerged as powerful enablers of rapid quoting, custom configuration, and direct factory-to-door logistics. Taken together, these four segmentation pillars form the structural framework for any rigorous go-to-market or product development strategy.

This comprehensive research report categorizes the Light Emitting Diodes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Color Rendering Index

- End User

- Distribution Channel

Analyzing Strategic Regional Dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific Illuminating Unique Growth Drivers

Regional dynamics exert a profound influence on the LED market’s evolution, driven by distinct regulatory landscapes, economic priorities, and infrastructure imperatives. In the Americas, there is an ever-increasing focus on energy codes and incentive programs that reward high-efficiency lighting retrofits, particularly in the United States and Canada. Government-backed funding mechanisms and utility rebates have accelerated adoption in commercial buildings and municipal projects, while the automotive sector in North America continues to innovate with adaptive driving beam and vehicle cabin illumination technologies.

Across Europe, the Middle East & Africa, ambitious sustainability targets and stringent energy efficiency regulations have spurred public and private investment in LED upgrades for legacy lighting systems. European Union directives on product ecodesign have heightened the emphasis on circularity and recyclability, prompting OEMs and distributors to develop take-back schemes and modular designs. In the Middle East, rapid infrastructure development and hospitality-driven construction have driven demand for architecturally integrated lighting, while in Africa, off-grid solar installations increasingly utilize LED luminaires to support rural electrification.

In Asia-Pacific, the region remains a critical axis both for LED manufacturing and adoption. China maintains leadership in production capacity and continues to subsidize next-generation micro LED and Quantum Dot R&D. Japan and South Korea push the envelope in high-CRI applications for medical and broadcasting uses, while India’s urbanization and smart city initiatives have generated substantial opportunities for outdoor and street lighting upgrades. Together, these regional patterns underscore how localized policy frameworks, industrial strengths, and capital flows shape divergent approaches to LED integration and innovation.

This comprehensive research report examines key regions that drive the evolution of the Light Emitting Diodes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Manufacturers and Emerging Innovators Driving Technological Advancements and Competitive Strategies in the LED Sector

The competitive panorama of the LED market features both established titans and agile newcomers, each vying to set benchmarks in efficiency, quality, and application-specific functionality. Nichia, renowned for its trailblazing work on blue LED substrates and phosphor formulations, continues to maintain a strong foothold in high-power and automotive segments. Osram has doubled down on smart lighting platforms, leveraging its expertise in sensor integration to differentiate solutions for building automation and horticultural applications. Lumileds, with its legacy rooted in high CRI modules, has intensified its focus on medical lighting and color-critical broadcast environments.

Meanwhile, Cree has solidified its reputation in industrial and outdoor lighting through robust thermal management innovations and comprehensive fixture-level offerings. Samsung Display and its affiliates are pushing the boundaries of Quantum Dot and micro LED displays, supported by expansive panel fabrication facilities and deep integration with consumer electronics OEMs. Emerging innovators in Asia are also capturing attention, introducing novel semiconductor alloys and scalable mass-transfer techniques for next-generation micro scale emitters. These companies routinely form strategic alliances with materials suppliers, system integrators, and software platform providers to deliver differentiated offerings that align with customer expectations for performance, reliability, and intelligent control.

This comprehensive research report delivers an in-depth overview of the principal market players in the Light Emitting Diodes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams-OSRAM AG

- Broadcom Inc.

- Citizen Electronics Co., Ltd.

- Cree LED, Inc. (part of SMTC Corporation)

- Everlight Electronics Co., Ltd.

- Harvatek Corporation

- Kingbright Electronic Co., Ltd.

- LG Innotek Co., Ltd.

- Lite-On Technology Corporation

- Lumileds Holding B.V.

- Nichia Corporation

- Opto Tech Corporation

- Osram Licht AG

- Rohm Co., Ltd.

- Samsung Electronics Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Sharp Corporation

- Stanley Electric Co., Ltd.

- Toyoda Gosei Co., Ltd.

- Vishay Intertechnology, Inc.

Empowering Industry Leaders with Strategic Recommendations to Optimize Supply Chains, Innovate Product Portfolios, and Capture Emerging Market Segments

Industry leaders seeking to maintain or enhance their market standing must adopt strategic imperatives that align operational agility with technological foresight. First, diversifying supply chains through a combination of nearshore assembly sites and multi-sourcing agreements will mitigate disruptions from policy shifts and geopolitical tensions. Complementing this, targeted investments in micro LED and Quantum Dot R&D can position companies at the forefront of next-generation displays and specialty lighting segments. At the product level, embedding human-centric lighting features-such as circadian rhythm tuning and dynamic color control-will help capture emerging demand in healthcare, hospitality, and residential wellness applications.

Furthermore, forging partnerships across the digital ecosystem, including building management system integrators and cloud service providers, can unlock new revenue streams via lighting-as-a-service models. From a go-to-market perspective, stakeholders should expand direct-to-consumer channels and leverage advanced analytics to anticipate purchasing trends and personalize configurations. Finally, embracing modular fixture architectures that facilitate easy maintenance and end-of-life recycling will resonate with increasingly eco-conscious buyers and meet tightening regulatory requirements, thereby strengthening brand reputation and fostering long-term customer loyalty.

Detailing Rigorous Research Frameworks and Methodological Approaches Underpinning the Comprehensive Analysis of the LED Market Landscape

This analysis is built upon a multi-faceted research framework designed to ensure depth, accuracy, and relevance. Initially, comprehensive secondary research was conducted, drawing upon a curated selection of industry publications, corporate disclosures, trade association reports, and regulatory filings. These sources provided foundational data on market trends, technology roadmaps, and policy developments. To enrich this understanding, primary interviews were carried out with executives and technical experts spanning LED chip manufacturers, luminaire assemblers, system integrators, and end-user organizations in automotive, commercial, and industrial segments.

Quantitative insights were then triangulated using both bottom-up and top-down approaches. The bottom-up method involved validating company-level shipment and revenue data against publicly disclosed financials, while the top-down perspective incorporated macroeconomic indicators and industry benchmarks to ensure consistency. Segmentation analyses were performed by mapping technology, performance, end-user, and channel metrics to real-world case studies. Rigorous data validation procedures-encompassing cross-source verification and logical consistency checks-were applied throughout to guarantee the robustness of findings and underpin the strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Light Emitting Diodes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Light Emitting Diodes Market, by Technology

- Light Emitting Diodes Market, by Color Rendering Index

- Light Emitting Diodes Market, by End User

- Light Emitting Diodes Market, by Distribution Channel

- Light Emitting Diodes Market, by Region

- Light Emitting Diodes Market, by Group

- Light Emitting Diodes Market, by Country

- United States Light Emitting Diodes Market

- China Light Emitting Diodes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Essential Insights and Strategic Implications Derived from the In-Depth Exploration of the Global LED Market Trajectory

Through an in-depth exploration of technological evolutions, tariff-induced market realignments, segmentation dynamics, and regional nuances, this report illuminates the pivotal forces shaping the global LED landscape. The acceleration of innovations such as micro LED and Quantum Dot LEDs underscores how performance demands continue to propel the industry forward, while the advent of tariffs in 2025 has magnified the importance of supply chain resilience and strategic sourcing. Segmentation insights reveal that a one-size-fits-all approach no longer suffices, as buyers require tailored solutions across conventional and next-generation technologies, high-CRI and standard-CRI applications, a breadth of end-user environments, and diverse distribution channels.

Regional analysis highlights that regional policy frameworks and market maturity levels create differentiated growth trajectories, compelling stakeholders to adopt localized strategies. Key players are distinguishing themselves through vertical integration, cross-industry partnerships, and a sharp focus on human-centric lighting features. In synthesizing these findings, the report underscores that success in the coming years will depend on the ability to balance cost optimization with value-driven innovation, while simultaneously embracing sustainability imperatives and digitalization opportunities. Ultimately, this integrated perspective sets the stage for stakeholders to make informed strategic choices and maintain a competitive advantage in an increasingly complex market.

Take Decisive Action Today to Secure Comprehensive Market Intelligence and Outpace Competitors with Expert Guidance from Our Associate Director of Sales & Marketing

To take the next step toward unlocking unparalleled insights into market dynamics, decision-makers are invited to reach out to Ketan Rohom, who serves as Associate Director of Sales & Marketing and possesses deep expertise in guiding organizations toward data-driven strategies. Engaging directly with Ketan will enable your team to gain tailored advice on how to leverage the comprehensive analysis contained within the full report and apply those findings to your own strategic roadmap. By speaking with him, you will receive a detailed overview of additional sections, custom market breakouts, and bespoke consulting options that align with your unique priorities. Act now to secure your copy of this indispensable resource and fortify your competitive edge, as in today’s rapidly evolving LED ecosystem, timely intelligence can make the difference between leading the curve and playing catch-up

- How big is the Light Emitting Diodes Market?

- What is the Light Emitting Diodes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?