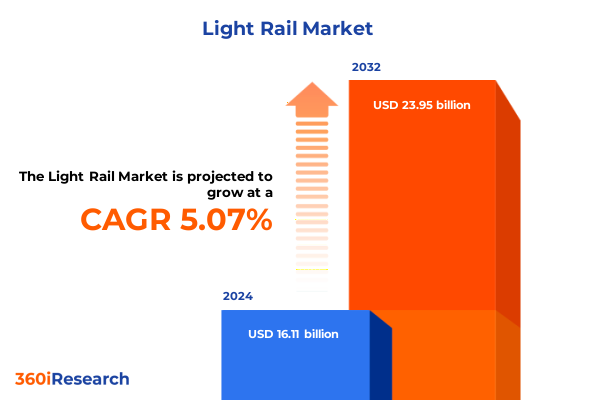

The Light Rail Market size was estimated at USD 16.84 billion in 2025 and expected to reach USD 17.61 billion in 2026, at a CAGR of 5.15% to reach USD 23.95 billion by 2032.

Setting the Stage for Transformative Urban Mobility through Light Rail Innovations Responding to Growing Demand for Sustainable Connectivity

The evolution of urban environments and increasing demand for sustainable transportation have elevated light rail systems to the forefront of mobility solutions. This report delves into the industry’s contemporary context, examining how demographic shifts, environmental imperatives, and technological advancements converge to redefine public transit. By focusing on the intersection of urban development priorities and evolving passenger expectations, it sets a holistic framework for understanding why light rail has emerged as a critical vector for future mobility.

Building upon this foundation, the introduction outlines the scope and objectives of the executive summary, providing decision-makers with a structured overview of transformative trends, segmentation insights, regional perspectives, and actionable guidance. It articulates how such an integrated approach can inform policy formulation, capital investment, and operational optimization, thereby laying the groundwork for sustained performance improvements in light rail networks.

Exploring Paradigm Shifts Shaping the Light Rail Ecosystem through Digital Automation Electrification and Evolving Passenger Expectations Driving Industry Evolution

In recent years, the light rail sector has undergone a profound metamorphosis driven by digitalization, automation, and heightened focus on passenger experience. Advances in IoT-enabled asset management and predictive maintenance platforms have reshaped maintenance paradigms, minimizing downtime while extending the useful life of rolling stock. Meanwhile, the integration of contactless ticketing and real-time passenger information systems has redefined user engagement, fostering trust and encouraging modal shift away from private vehicles.

Concurrently, electrification and green energy integration are catalyzing efforts to reduce carbon footprints across networks. Innovative power storage solutions and smart grid interfaces allow operators to dynamically manage energy consumption, aligning service delivery with environmental targets. As a result, cities are not only achieving lower operating costs but are also meeting stringent sustainability benchmarks, reinforcing light rail’s role as a cornerstone of future urban transit.

Unpacking the Far-Reaching Impacts of 2025 United States Tariff Adjustments on Supply Chains Manufacturing Costs and Procurement Strategies in the Light Rail Sector

The introduction of new United States tariffs in early 2025 has introduced a series of challenges and opportunities for light rail stakeholders. By targeting key inputs such as steel components, signaling equipment, and propulsion subsystems, these measures have led to recalibrated procurement strategies and supply chain realignments. Manufacturers and operators have responded by diversifying sourcing portfolios and accelerating local content strategies to mitigate cost pressures and tariff exposure.

As a cumulative outcome, the industry is witnessing a resurgence in domestic supplier development and reshoring initiatives, aiming to bolster resilience against external trade fluctuations. Moreover, long-term contracts are being renegotiated to include flexible pricing mechanisms, while project timelines and capital budgets are being reassessed to maintain financial viability. These adaptive measures underscore the sector’s agility in navigating complex regulatory landscapes and repositioning itself for sustained growth.

Unveiling Critical Market Segmentation Insights Grounded in Component Composition Vehicle Configurations Propulsion Variants Service Models Application Scenarios and End Users

A comprehensive look at light rail market segmentation reveals a multifaceted structure that informs both strategic planning and resource allocation. When dissected by component, the landscape spans infrastructure elements encompassing depot and workshop facilities, station design, and track and platform configurations; maintenance services characterized by corrective and preventive approaches; rolling stock varieties ranging from articulated formations to double-deck and single-unit vehicles; and systems divisions including control and safety frameworks alongside signaling and communication networks.

Examining the market through the lens of vehicle type further accentuates the nuanced requirements of articulated, double-deck, and single-unit designs, each presenting unique implications for capacity, route integration, and passenger flow management. Propulsion type segmentation differentiates between diesel-electric hybrid and fully electric models, underscoring the ongoing transition toward cleaner energy sources. Service type analysis contrasts new installation projects with replacement and refurbishment efforts, while application-based insights distinguish airport transit corridors from interurban, tourist and heritage, and urban transit services. Finally, the market’s operation category and end-user dimensions bifurcate along private and public transit operations as well as private sector and public sector stakeholders, illuminating distinct investment rationales and operational objectives.

This comprehensive research report categorizes the Light Rail market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vehicle Type

- Propulsion Type

- Service Type

- Operation Category

- Application

- End User

Illuminating Regional Perspectives Uncovering How Diverse Market Dynamics across the Americas Europe Middle East and Africa and Asia Pacific Drive Light Rail Deployment Strategies

Regional dynamics exert a profound influence on light rail development, reflecting a tapestry of economic priorities, funding structures, and policy frameworks. In the Americas, a strong emphasis on urban revitalization and public-private partnerships has accelerated network expansions, particularly in metropolitan corridors seeking to alleviate congestion and reduce emissions. Emerging markets in Latin America are exploring turnkey light rail solutions as cost-effective mechanisms to modernize transport infrastructure.

Across Europe, Middle East and Africa, regulatory commitments to decarbonization and modal integration continue to spur investments in electrified transit and digital control systems. European cities are pioneering wallet-less ticketing and network interoperability, while the Middle East is leveraging light rail as an enabler of sustainable urban growth in newly developed economic zones. Africa’s nascent projects are increasingly supported by international development agencies focusing on capacity building and technical training.

In the Asia Pacific, rapid urbanization and high-density population centers have driven robust demand for scalable light rail solutions. Nations are deploying advanced signaling technologies to manage complex multimodal nodes, while leading manufacturers in the region are strengthening local partnerships to deliver turnkey projects that meet strict performance and safety standards.

This comprehensive research report examines key regions that drive the evolution of the Light Rail market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Highlighting Strategic Collaborations Technological Differentiators and Competitive Positioning within the Global Light Rail Marketplace

Global light rail market leadership is shaped by a cadre of companies distinguished by technological prowess, strategic alliances, and localized presence. Major OEMs have forged collaborative ventures with software and energy providers to integrate digital asset management platforms, offering operators end-to-end visibility into fleet performance. At the same time, established rail constructors are diversifying their portfolios through acquisitions of niche technology firms specializing in autonomous operations and predictive analytics.

Moreover, partnerships between rolling stock manufacturers and infrastructure conglomerates are becoming increasingly common, enabling the delivery of comprehensive design-build-operate packages. These alliances not only streamline project execution but also foster innovation in areas such as modular station construction and energy-efficient propulsion. Additionally, smaller specialized firms are carving out competitive niches by developing lightweight materials and next-generation signaling solutions tailored for high-density urban corridors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Light Rail market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ALSTOM Group

- Brookville Equipment Corporation

- BYD Motors Inc.

- CRRC Corporation Limited

- HANNING & KAHL GmbH & Co. KG

- Hitachi, Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kinki Sharyo Co., Ltd.

- Larsen & Toubro Limited

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- NJ TRANSIT Services

- OBRASCON HUARTE LAIN S.A.

- Progress Rail Services UK Ltd.

- Siemens AG

- SINARA GROUP

- SMART Railway Technology GmbH

- Stadler Rail AG

- Wabtec Corporation

Strategic Recommendations for Industry Leaders to Navigate Regulatory Complexities Embrace Technological Advancements and Foster Sustainable Growth in Light Rail Operations

Industry leaders looking to maintain a competitive edge in the evolving light rail domain must prioritize regulatory engagement and coalition-based advocacy to shape favorable policy outcomes. Investing in digital infrastructure, such as predictive maintenance and traffic optimization platforms, can yield significant reductions in lifecycle costs while improving service reliability. Concurrently, diversifying supply chains through partnership with regional manufacturers and dual-sourcing strategies strengthens resilience against geopolitical and tariff-induced disruptions.

To foster sustainable growth, executives should champion workforce development initiatives that align technical training programs with emerging automation and safety standards. Public-private partnership models, when underpinned by transparent governance frameworks, can unlock new funding avenues while ensuring accountability. Finally, embracing data-driven decision-making-including scenario analysis for capital planning-will enable organizations to proactively adapt to shifting demand patterns and policy landscapes.

Articulating a Rigorous Research Methodology Emphasizing Data Triangulation Industry Interviews and Quantitative Analysis to Ensure Robust Insights in Light Rail Studies

The research methodology underpinning this analysis is grounded in rigorous data triangulation, combining primary and secondary sources to ensure validity and comprehensiveness. Primary inputs were garnered through in-depth interviews with executives from transit agencies, equipment suppliers, and regulatory bodies, supplemented by qualitative insights from technical workshops and targeted stakeholder surveys.

Secondary research involved systematic review of industry publications, patent filings, standards documentation, and academic studies to contextualize technological and policy developments. Quantitative data was analyzed using advanced statistical techniques to identify usage patterns and cost drivers across regions. Validation sessions with subject matter experts further refined key findings and reinforced the robustness of the segmentation framework, ensuring that insights are both actionable and aligned with real-world dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Light Rail market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Light Rail Market, by Component

- Light Rail Market, by Vehicle Type

- Light Rail Market, by Propulsion Type

- Light Rail Market, by Service Type

- Light Rail Market, by Operation Category

- Light Rail Market, by Application

- Light Rail Market, by End User

- Light Rail Market, by Region

- Light Rail Market, by Group

- Light Rail Market, by Country

- United States Light Rail Market

- China Light Rail Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing Key Takeaways Highlighting the Convergence of Technological Innovation Regulatory Evolution and Market Dynamics Shaping the Future of Light Rail Mobility

The convergence of digital automation, sustainable propulsion, and shifting regulatory landscapes is redefining the light rail sector’s trajectory. By integrating IoT-enabled maintenance with green energy solutions, operators can elevate service reliability while advancing environmental goals. The implementation of strategic sourcing and local supplier development in response to new tariffs demonstrates the industry’s capacity for adaptive resilience.

Segmentation analysis highlights the importance of tailoring solutions across component categories, vehicle types, and service models, while regional examinations underscore diverse deployment approaches shaped by economic and policy contexts. Competitive profiling reveals that success will hinge on collaborative ecosystems combining technological differentiation with flexible delivery models. Collectively, these insights point toward a future where data-driven, customer-centric, and sustainability-oriented strategies will define the next era of light rail mobility.

Engage Directly with Ketan Rohom to Discuss Tailored Reporting Solutions Optimizing Strategic Planning and Propelling Light Rail Initiatives Forward in Your Organization

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure tailored insights that align with your strategic objectives and accelerate your light rail initiatives. By partnering directly, you gain exclusive access to in-depth analyses that illuminate competitive landscapes, regulatory shifts, and technological breakthroughs critical to your decision-making processes. This comprehensive research report offers actionable intelligence on segmentation trends, regional dynamics, and the implications of recent policy changes, empowering you to build resilient supply chains and optimize procurement strategies. Reach out today to unlock the full potential of these insights and drive your organization’s next phase of growth in the evolving light rail domain.

- How big is the Light Rail Market?

- What is the Light Rail Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?